Singapore recorded its worst quarterly GDP contraction in the second quarter, down 13.2%, amid the fallout of the global COVID-19 pandemic. It prompted the Ministry of Trade and Industry (MTI) to narrow the 2020 GDP range from a contraction between 4.0% and 7.0% to 5.0% and 7.0%, noting the outlook deteriorated slightly. MTI highlighted the uncertainty of the trajectory of the recovery, both domestically and internationally. Minister Chan Chun Sing warned that Singapore will not return to a pre-COVID-19 world and that an uneven and lengthy recovery is likely. Realizing permanent changes will allow Singapore to adjust swiftly, unlike the US, where debt-funded stimuli remain the preference. The USD/SGD rejection by its short-term resistance zone favors a new breakdown sequence.

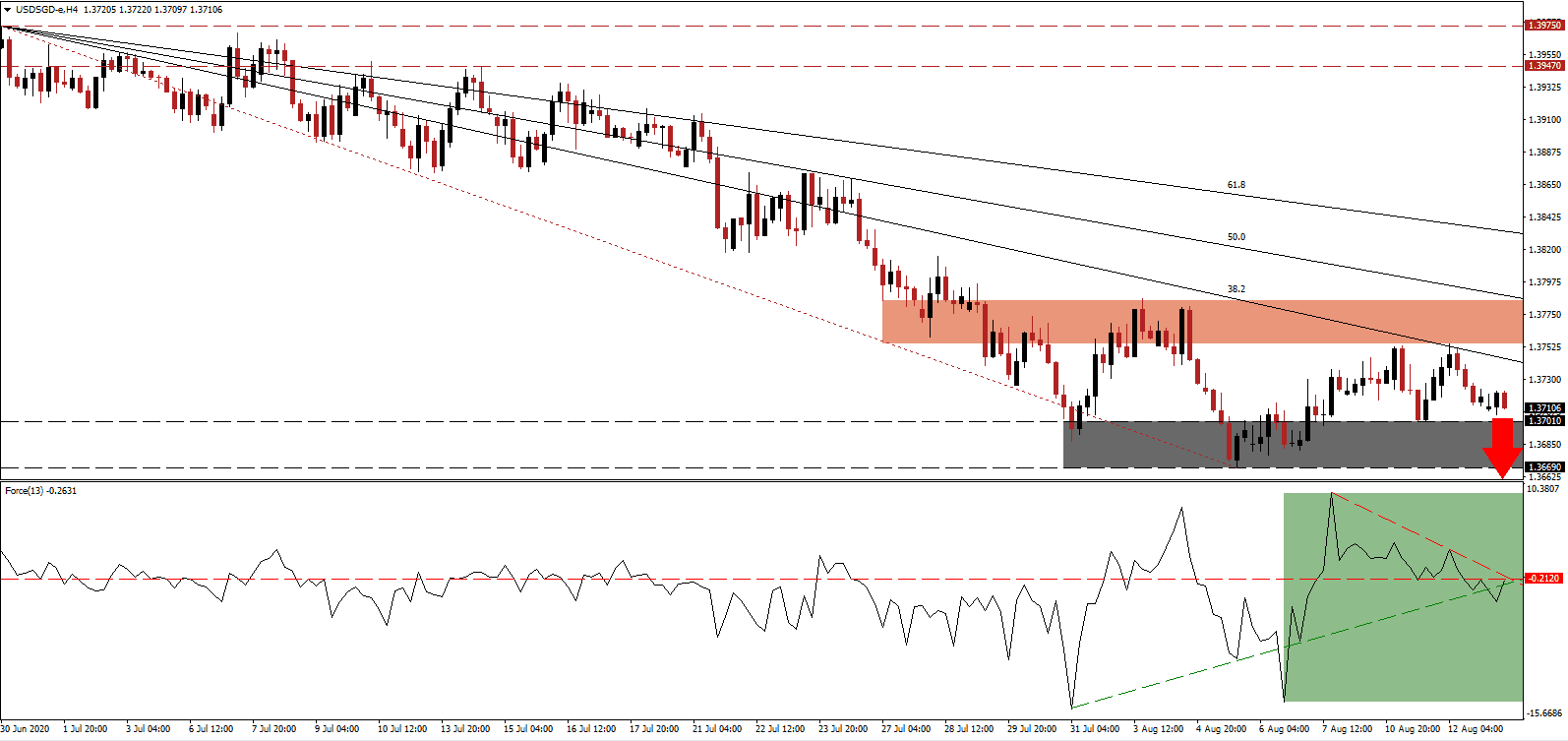

The Force Index, a next-generation technical indicator, was able to reclaim its ascending support level, but remains below its horizontal resistance level, as marked by the green rectangle. A renewed contraction is favored, driven by its descending resistance level, pushing this technical indicator deeper into negative territory. Bears will then regain complete control over the USD/SGD, seeking more downside.

While the bottom of economic contraction appears set, the labor market poses an ongoing challenge. The government confirmed that 24,000 unemployed took advantage of the employment and traineeships by the end of July. Fears are that the COVID-19 related impact will be more dominant than that of the 1997 Asian financial crisis or the 2008 global financial crisis. Singapore also faces a rapidly aging society, with over 35% of the population above the age of 50. More selling is expected after the rejection in the USD/SGD by its short-term resistance zone located between 1.3755 and 1.3785, as marked by the red rectangle.

A massive spike in economic activity against depressed levels as compared to the second quarter is forecast, but a double-dip cannot be excluded. South Korean exports, viewed as an essential indicator for global trade, recorded a double-digit contraction in the first week of August. The US is ill-prepared for an ongoing crisis, adding a distinct bearish catalyst to the USD/SGD. A breakdown below its support zone located between 1.3669 and 1.3701, as identified by the grey rectangle, is anticipated, with the descending Fibonacci Retracement Fan enforcing the well-established bearish chart pattern. Price action will challenge its next support zone between 1.3567 and 1.3597.

USD/SGD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 1.3710

Take Profit @ 1.3570

Stop Loss @ 1.3755

Downside Potential: 140 pips

Upside Risk: 45 pips

Risk/Reward Ratio: 3.11

More upside in the Force Index, enhanced by its ascending support level, could lead the USD/SGD into a temporary reversal. Given the deteriorating outlook for the US economy and the US Dollar, the upside potential is limited to its 61.8 Fibonacci Retracement Fan Resistance Level. Forex traders are recommended to take advantage of any price spike with new net sell orders.

USD/SGD Technical Trading Set-Up - Limited Reversal Scenario

Long Entry @ 1.3785

Take Profit @ 1.3830

Stop Loss @ 1.3755

Upside Potential: 45 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 1.50