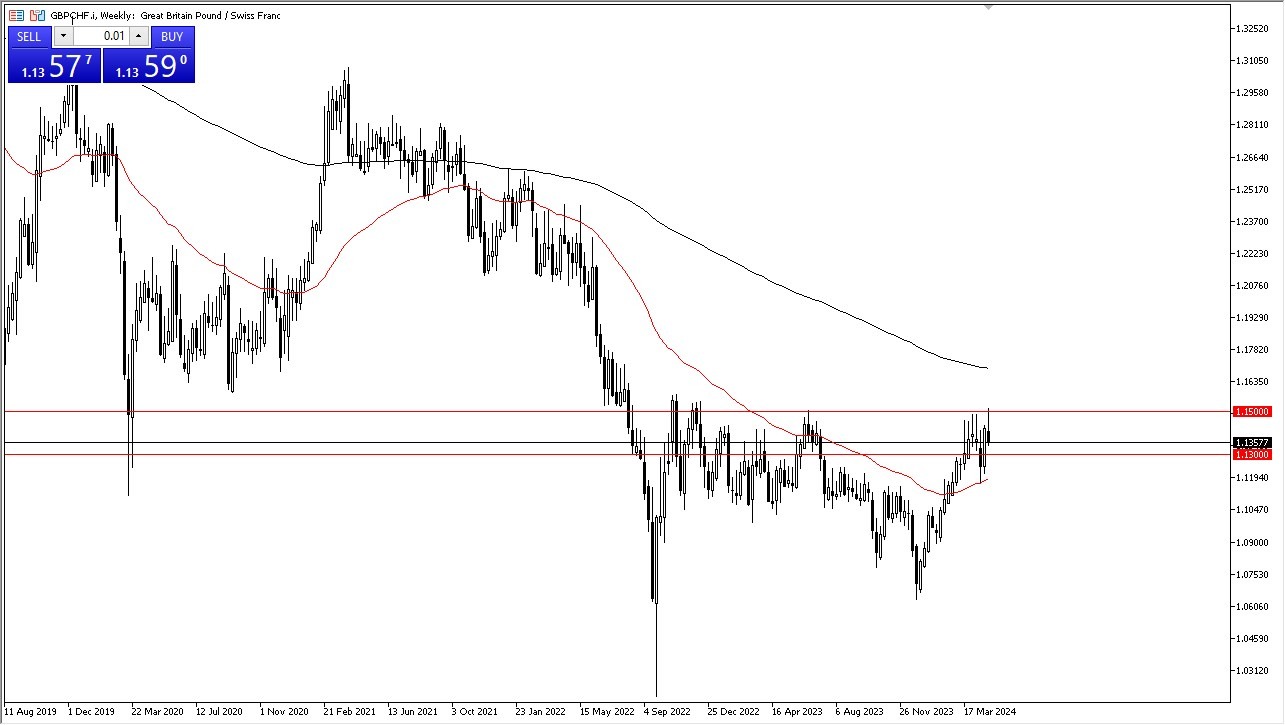

GBP/CHF

The British pound initially rallied during the course of the week against the Swiss franc but has found the 1.15 level to be like a brick wall. At this point in time, it looks like the market is going to continue to pull back a bit, perhaps reaching the 1.13 level, an area where there is a certain amount of support. After that, then we have the 1.12 level offering support. Keep in mind that the market is likely to continue to see traders preferred the British pound over the Swiss franc, for the interest rate differential alone. All things being equal, probably remains buy on the dips.

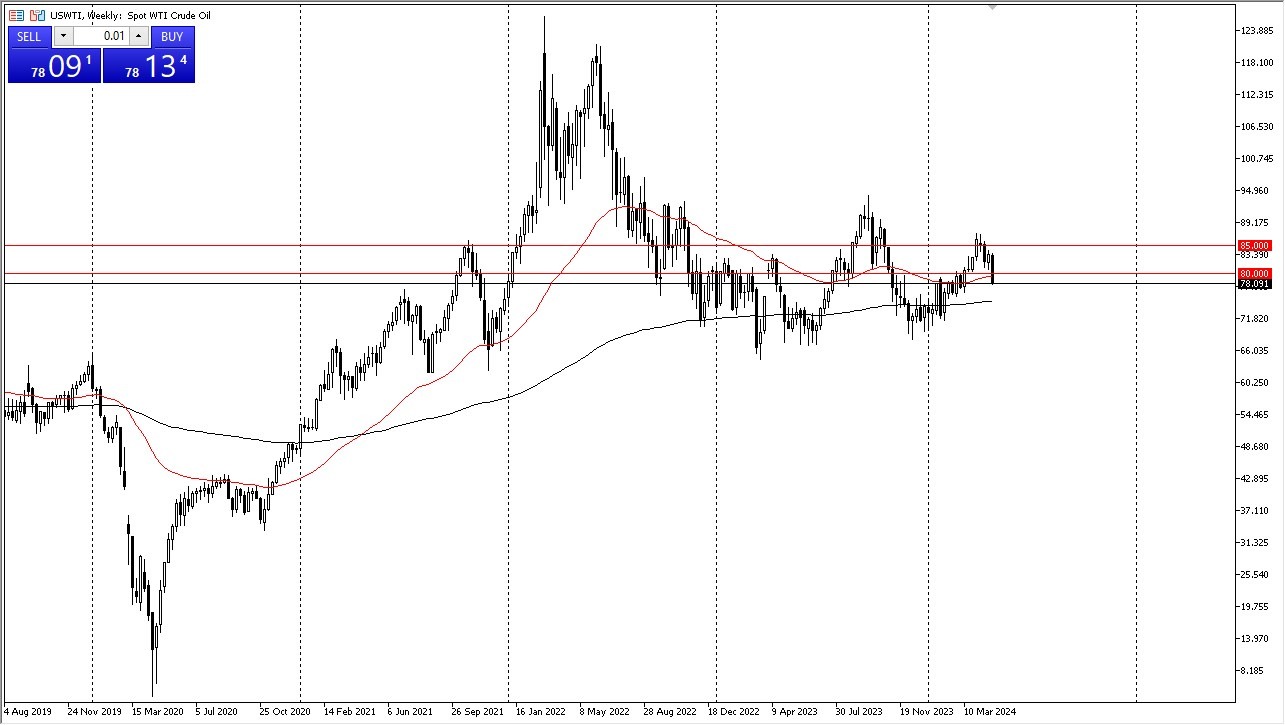

WTI Crude Oil

The West Texas Intermediate Crude Oil market has plunged during the week, as we continue to see concerns about the global economy. The fact that the jobs number in the United States came and 60,000 less than anticipated, that has even more people out there looking at it through the prism of a potential lack of demand. However, cyclically speaking this is generally a positive time of year so I do think that there are buyers underneath. At this point in time, it’s probably better to look for some type of bounce in order to get long and take off to the upside.

Top Forex Brokers

EUR/GBP

The euro has been very positive against the British pound during the week, as we continue to consolidate overall. The 0.85 level underneath continues to be a significant amount of support, but we also see a lot of resistance just above at the 50-Day EMA, which is just above the 0.86 which in and of itself is going to be a bit of a barrier. If we can break above all of that, then we could see the euro finally take off against the British pound, perhaps eventually trying to get to the 0.8750 level. In the short term though, I think this is more or less a “buy on the dips” scenario.

GBP/JPY

The British pound has plunged against the Japanese yen after initially taking off during the early part of the week. Quite frankly, this is due to the Bank of Japan intervening, which is something that can only slow down a trend, not change it. The interest rate differential still favors the British pound, and as I write this on Friday, I am giving serious thought to trying to find some type of entry point in this market. I believe that the ¥190 level is going to be crucial in this market, and I will be looking for value to take advantage of if and when it shows up.

Ethereum

Ethereum has shown itself to be very bullish on Friday, as we have a break back above the crucial $3000 level. The 50-Day EMA that sits above in could offer a little bit of resistance, but I think it’s probably only a matter of time before Ethereum breaks above there and continues to go higher. Because of this, I am bullish of this market, but I also recognize that we have a lot of noise between here and the 50-Day EMA, as well as the $3300 level. As long as we can stay above the lows of the week, I think Ethereum more likely than not will continue to go higher over the longer term.

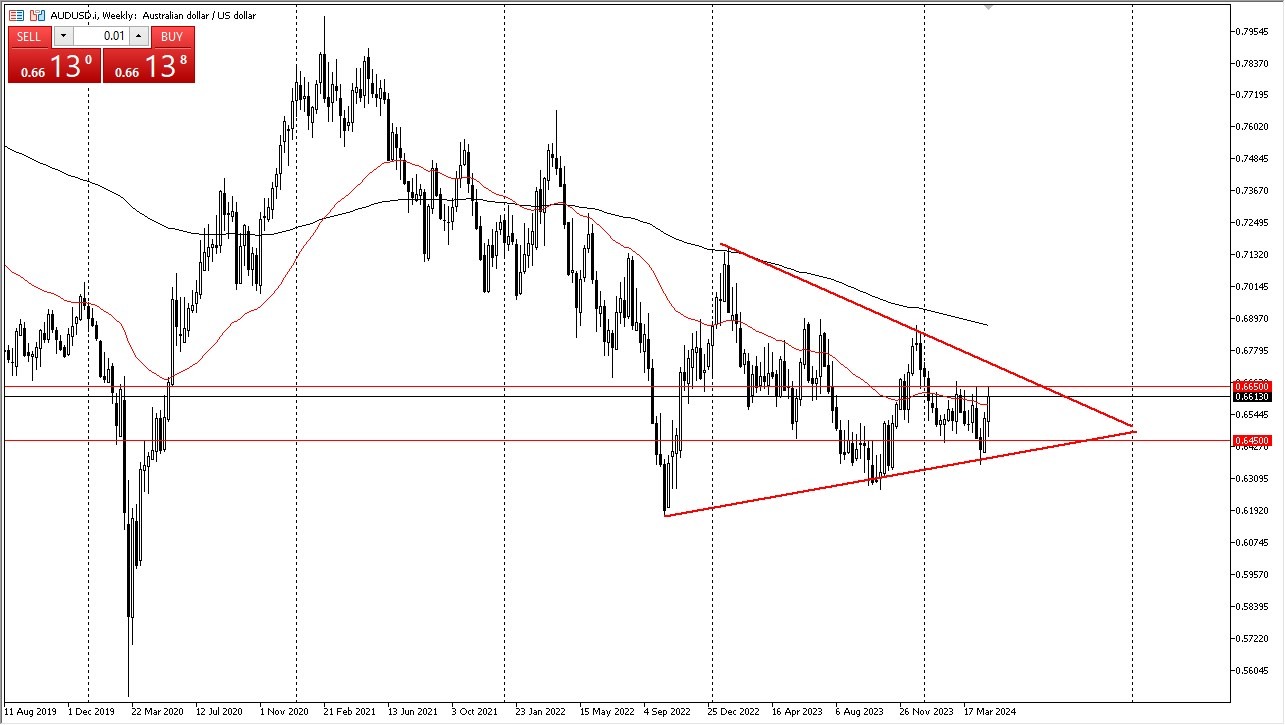

AUD/USD

The Australian dollar initially fell during the week but found enough support just above the 0.6450 level to turn things around and rally rather significantly 0.6650 level above is a major barrier, and the fact that we pull back from there on Friday tells me that we are more likely than not will continue to trade between these 2 major levels in the form of both support and resistance. I think we will continue to go sideways, and at this point in time I look at this as a fairly neutral market.

USD/CAD

The US dollar has rallied rather significantly against the Canadian dollar during the early part of the week, only to turn around to show signs of weakness. In fact, the US dollar got absolutely crushed after the jobs report came out, but it’s worth noting that by the end of the week, there were buyers in this market again and we ended up forming a bit of a hammer during the Friday candlestick. This suggests that perhaps the market is going to look at the 1.36 level as support.

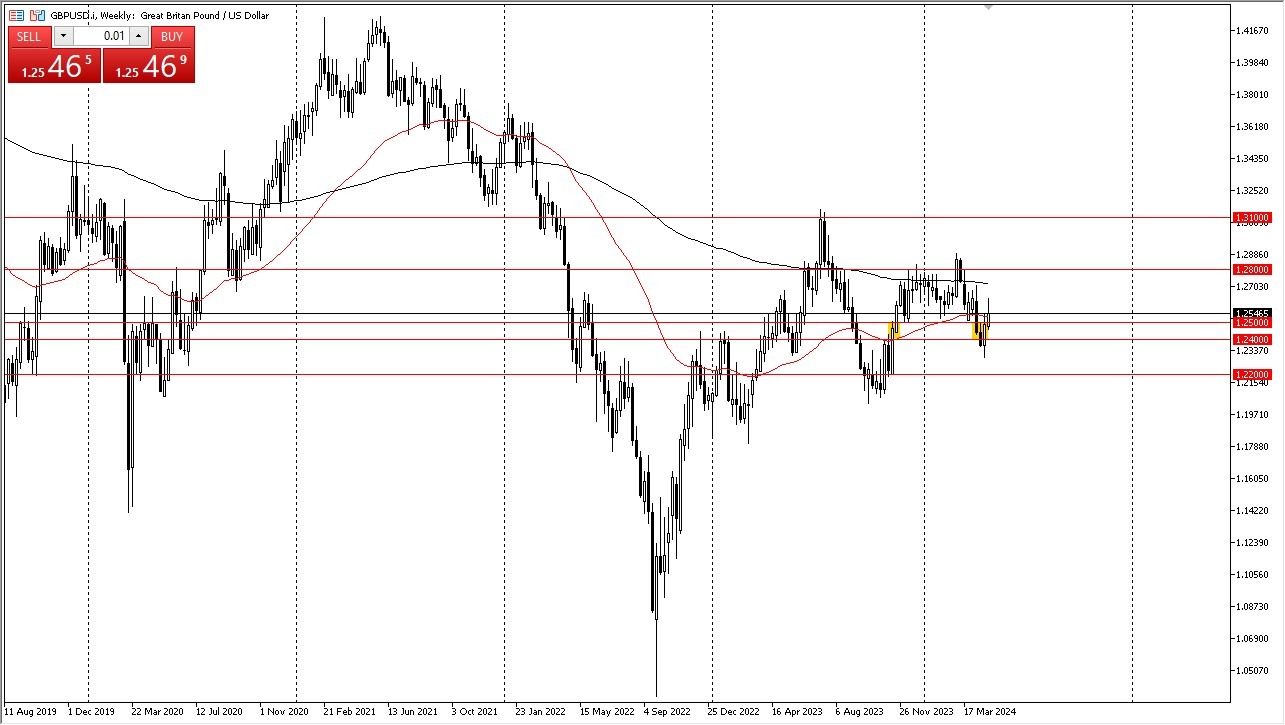

GBP/USD

The British pound has rallied initially during the course of the trading week but gave back quite a bit of the gains on Friday despite the fact that the US dollar was decimated right after the jobs number. That being said, it looks like we are going to continue to see a lot of downward pressure and therefore it would not surprise me at all to see the British pound drop below the 1.25 level during the week, perhaps going down to the 1.24 level before it’s all said and done.

Ready to trade our Forex weekly forecast? We’ve shortlisted the best forex trading accounts to choose from.