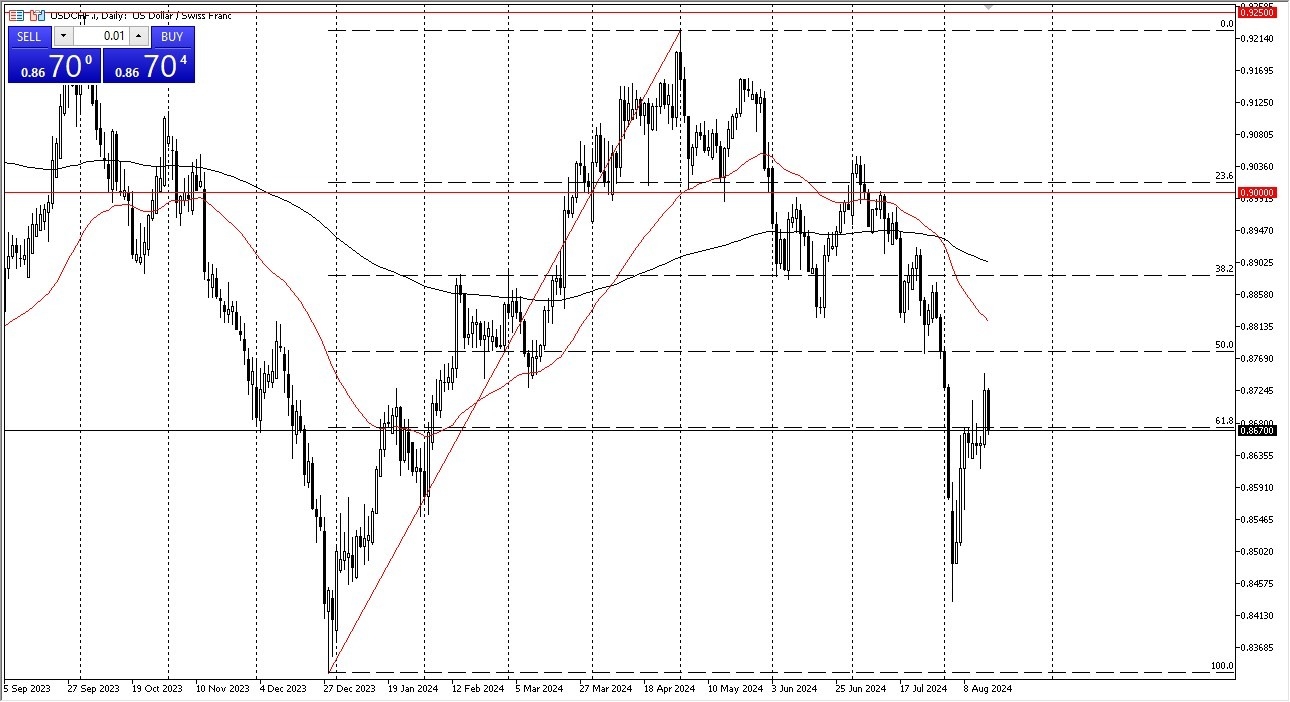

- The US dollar has fallen a bit during the trading session on Friday as we continue to see a lot of volatility in the Forex markets overall, the US dollar and the Swiss Franc, both are considered to be safety currency.

- So that does make a certain amount of sense that we would see noise.

- All things being equal. We have recently seen a massive bounce.

- I think ultimately this is a market that I think could continue to see a lot of volatility.

On a Break Higher

If we do break to the upside, the 50-day EMA is near the 0.8825 level, which is an area that previously has been important. Pullbacks at this point could open up a move to the 0.85 level, which is an area that is a large round psychologically significant figure and an area where we've seen some action previously.

Top Forex Brokers

In general, this is a market that I think continues to see a lot of questions asked about whether or not the U.S. dollar is going to continue to strengthen or weaken because there is a lot of noise around the Federal Reserve and whether or not they are going to cut rates aggressively. We already know that the Swiss National Bank has cut rates a couple of times and as per usual Switzerland is typically a carry trade destination, at least as far as borrowing is concerned.

That being said, the carry trade has been cut back on recently, so that might be part of why the franc itself appreciated in value earlier. At this point, I do think it remains a little bit of a buy on the dip market, mainly due to the fact that we are close to the bottom of the longer-term range of trading, and therefore, I think value hunters will be looking for a bit of a bounce in the US dollar that they can take advantage of from a momentum perspective.

Ready to trade our daily forex forecast? Here are the best online trading platforms in Switzerland to choose from.