- I think we still have plenty of buying pressure out there that people will be looking to take advantage of.

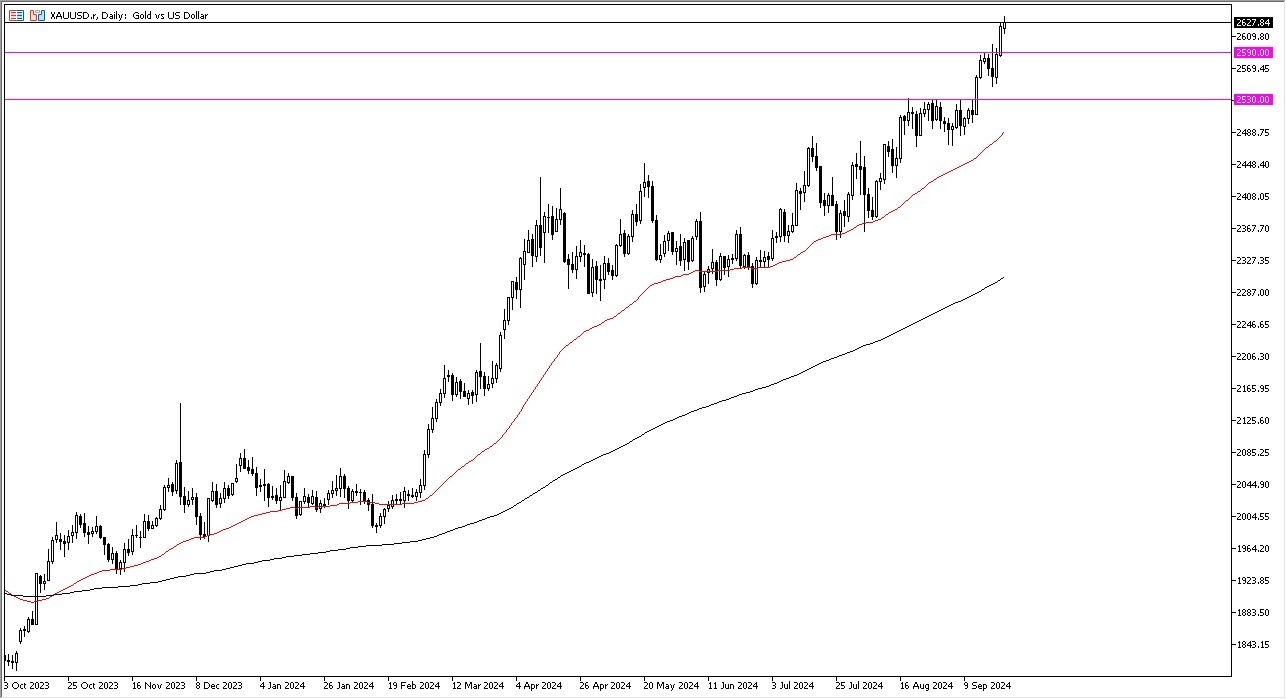

- We did dip a little bit in the early hours of Monday, only to turn around and see a few buyers jump in and push the gold market to a new all-time high.

- I think this will continue to be the theme going forward for the gold market, and as a result I am looking at this through the prism of trying to get long sooner or later.

Underneath, the $2590 level is an area that previously had been short term resistance, and therefore I think there should be a bit of “market memory” in this region, therefore I think it’s a scenario where any time we get close to that region, there will be buyers willing to come in and take advantage of “cheap gold.” That being said, we could break down below there and then I think you start to look at massive support near the $2530 level, which had been fairly resistant for several weeks. Again, I see a lot of “market memory” in that general vicinity, and therefore I think you got a situation where it’s essentially going to be the “floor in the market.”

Top Forex Brokers

Gold Continues to Watch Central Banks

Gold markets continue to watch Central banks around the world, as the markets have been paying close attention to interest rate cuts coming from the Federal Reserve, the European Central Bank, and of course many others. With this being the case, I think you have to understand that gold will continue to rise against almost everything, but there is an argument to be made that sooner or later we could see some type of major “risk off attitude” that would initially have gold selling off, only to turn around and bounce. This is because traders will have to sell profitable positions to cover the very poor and losing position. If I see anything like a shock to the gold market, I’m more than willing to take a bit of a risk on buying any drop in price here. I believe before it’s all said and done, the market is likely to go looking to the $2000.

Ready to trade our Forex daily analysis and predictions? We’ve made a list of the best Gold trading platforms worth trading with.