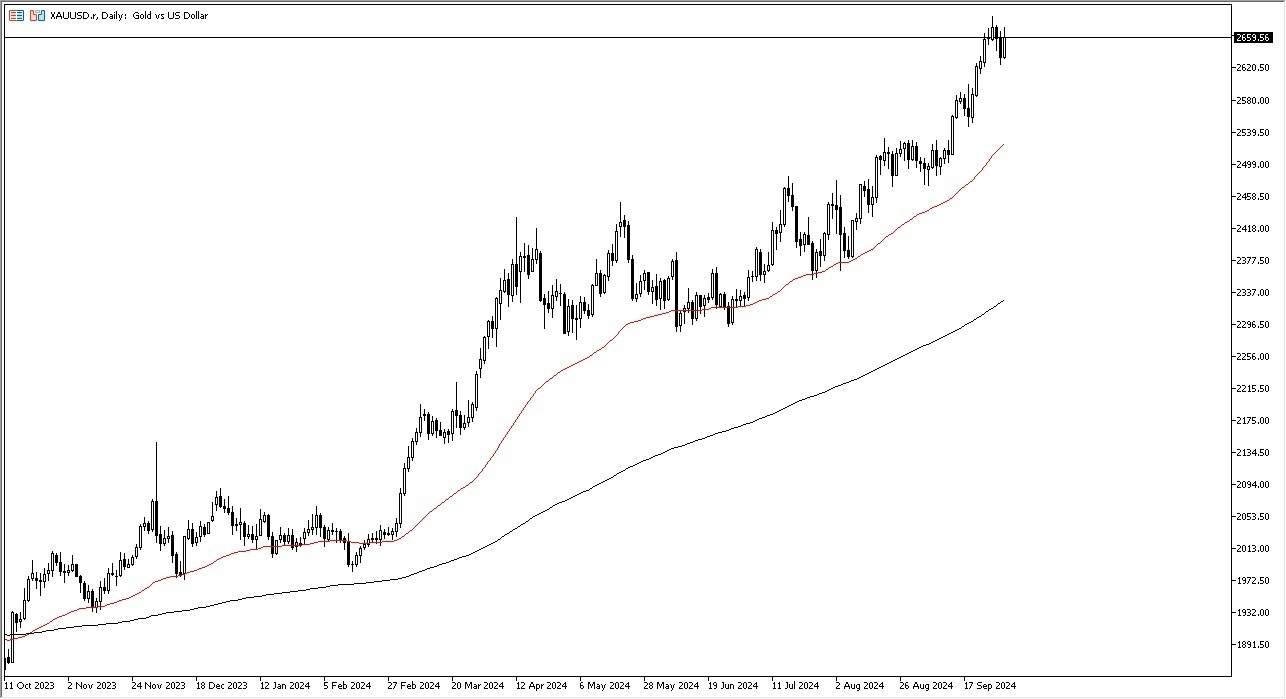

- You can see that the gold market has shown itself to be rather bullish for some time. And by turning around the way we have, it does suggest that we are going to continue going higher.

- But really, at this point, I think we are getting a little stretched. So, what I anticipate is we have a scenario where the market is probably going to remain somewhat elevated, but it's also going to be a situation where we're probably going to try to work off some of this excess froth.

- Quite frankly, that's good news. That's not a bad thing at all. The US dollar did surge higher during the day, right along with gold markets.

So, I think this just shows that a lot of what we have seen has been a run towards safety. Between the $2,600 level and the $2,700 level, I think we will continue to see a lot of noise. Looking at the world as it is, I don't have any interest in trying to get short of gold. Quite frankly, I think there's far too many things out there that would push it higher. We have geopolitical issues that obviously have been pushing traders to look for safety. And at the same time, we have central banks, in especially Asia buying massive amounts of gold in places such as China, Russia, India.

Top Forex Brokers

Downside Likely Somewhat Limited in this Market

So, with all of that being said, I think you have a situation where markets probably don't fall very far. The 50 day EMA is all the way near the $2,500 level underneath, which I think is a hard floor. I do believe that longer term, this market probably goes looking towards the $3,000 level, but it will more likely than not take a significant amount of effort to get there. I don't think it happens overnight, so therefore I would anticipate quite a bit of noise on the way higher, but also, I would anticipate that you will need to show a significant amount of patience.

Ready to trade today’s Gold forecast? Here are the best Gold brokers to choose from.