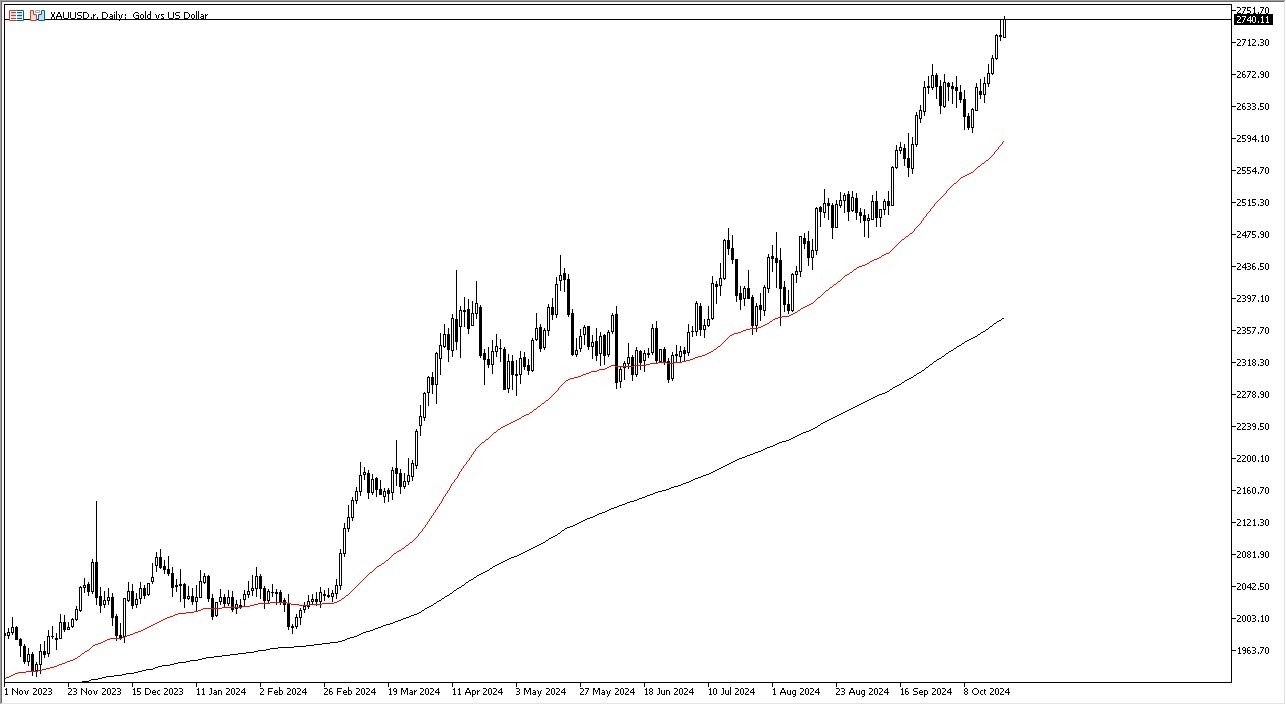

- In my daily analysis of the gold market, it’s quite easy to say that we are in a bullish trend, and I think that will continue to be the case.

- Quite frankly, during the previous session we had formed a bit of a shooting star which of course suggests that we are getting a bit stretched.

- However, the market pulling back at this point in time offers plenty of value just waiting to present itself, and I think at that point I would be more than willing to jump into the gold market as we clearly cannot be short of gold.

Top Forex Brokers

Technical Analysis

The technical analysis for this market could not be any stronger than it is at the moment. Based upon the previous “bullish flag” that we had formed, the so-called “measured move” suggest that we could go as high as $2800. I do think that we get that given enough time, but quite frankly I don’t see any reason why we don’t get to the $3000 level eventually.

Underneath, we have the 50 Day EMA near the $2600 level, which I think is an area that a lot of traders will be paying close attention to. If we were to break down below that level, that would be absolutely catastrophic for gold, and it would probably be in an environment where the US dollar is essentially swallowing everything. Do not get me wrong, it’s not like the US dollar and gold cannot rally at the same time, because quite frankly that’s exactly what happened during most of the 1980s.

At this point, gold has plenty of reasons to go higher, not the least of which would be geopolitical concerns, but we also have central banks around the world cutting rates left and right, which should continue to drive this market higher as well. While I would expect some type of pushback at the $2800 level, I think that it would be minor at best, and I do think that eventually we blow through there and go much higher.

Ready to trade today’s Gold forecast? Here are the best Gold brokers to choose from.