- Gold initially pulled back just a bit during the early hours on Monday only to turn around and show signs of life again.

- All things being equal, this is a market that I think given enough time will continue to find value on holdbacks.

- The gold market has been very bullish for some time and therefore I think we will see more of the same given enough time.

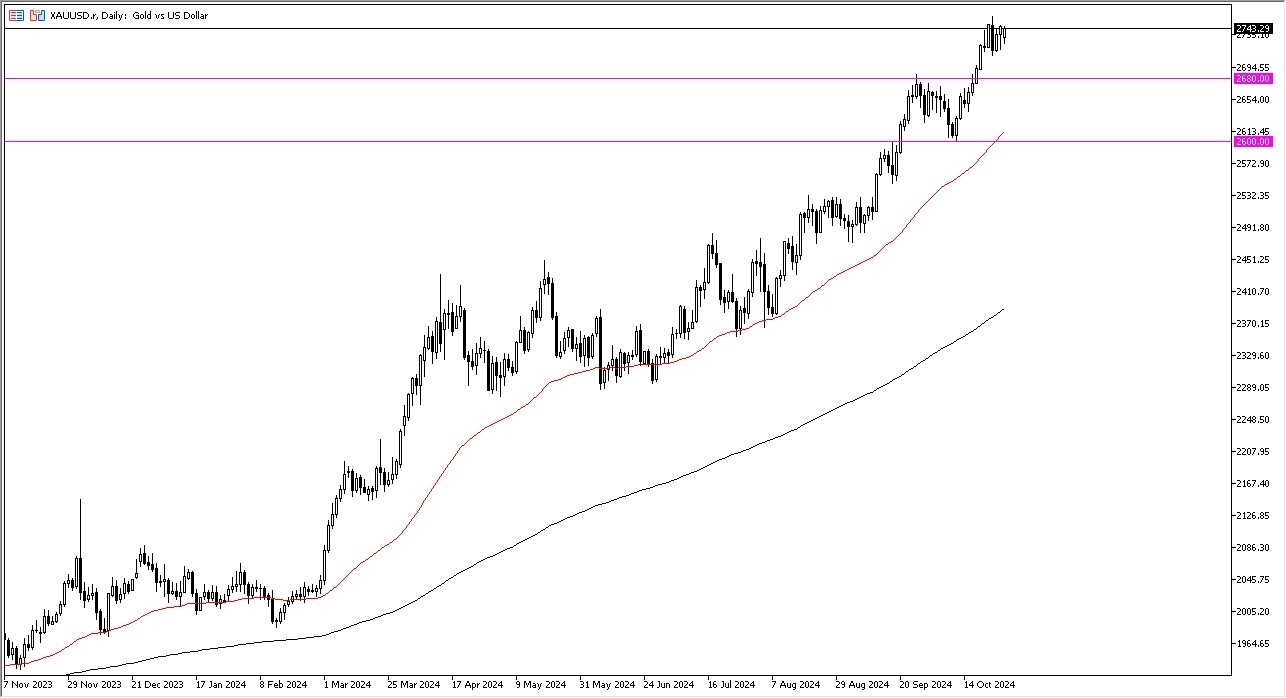

At this juncture, I believe that the $2,800 level is an area that you need to pay close attention to because it is a large, round, psychologically significant figure and an area that a lot of people would be paying close attention to. Keep in mind that we previously had formed a bit of a bullish flag and the measured move, as it were, was for a move to the $2,800 level.

Top Forex Brokers

If We Can Break Above $2800 in Gold

If we could break above there, then the market could go looking to the $3,000 level. The $3,000 level of course is a large round psychologically significant figure and therefore I think that would be difficult to overcome. Short-term pullbacks at this point in time I think have plenty of support at the $2,680 level and then again at the 50-day EMA which of course is right there by the $2,600 level.

It's not until we break down below there that I'd be a bit concerned about the pullback, but I think ultimately any pullback at this juncture probably offers value that you can take advantage of due to the geopolitical concerns around the world. And of course, the fact that central banks around the world continue to cut rates. Beyond that, there are plenty of central banks out there like Russia, Indonesia, China, India, that are all jumping in and buying physical gold anyway. So, it has a bit of a bid built into the price of gold going forward. I have no interest whatsoever in trying to short this market, as it is so overly bullish form a longer-term perspective.

Ready to trade our Gold price forecast? We’ve made a list of the best Gold trading platforms worth trading with.