- In my daily analysis of the cryptocurrency markets, Ethereum stands out as a bad sign, lease for the short term.

- After all, Ethereum is by far the biggest cryptocurrency out there, the least be on Bitcoin, so this has a bit of a “down ballot” effect on many other coins.

- Think of it this way, the Ethereum ecosystem is where most of the smaller coins operate, so that obviously has an influence on how they behave as far as markets are concerned.

Technical Analysis

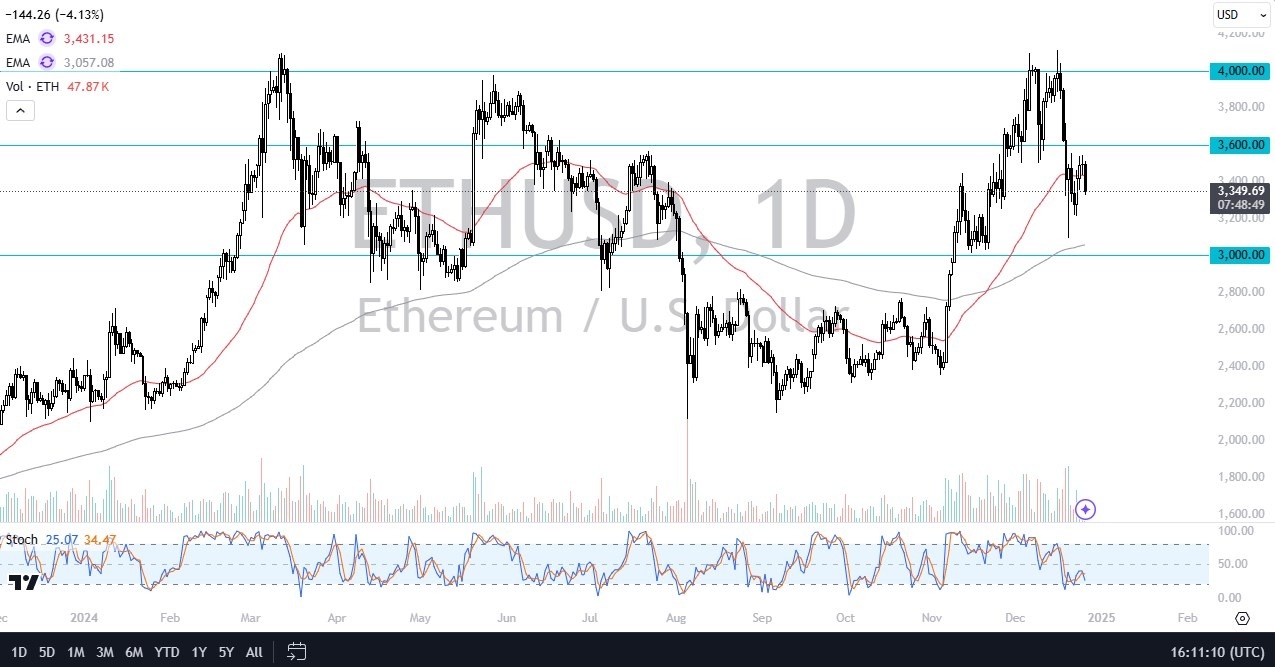

At this point, the market seems to be dancing around the 50 Day EMA more than anything else, and I think we are just simply killing time at the moment as we are in the midst of the holidays. With that being said, we have a situation where traders are going to continue to focus on other things, so we could get added around here and there. Nonetheless, I do have a couple of levels that I will be watching closely and acting on if and when they give me the appropriate signals.

Top Forex Brokers

The first level that I am watching closely as the $3600 level, as it is a large, round, psychologically significant figure, and an area where we have seen action in both directions. The fact that we continue to fail at that level does tell me that it is in fact offering quite a bit of selling pressure, but we have broken through there before, so it’s not like it is impossible. The next level I’m watching is the $3000 level underneath, because I do believe that the large, round, psychologically significant figure should come into the picture to offer support. We also have the 200 Day EMA in that same neighborhood also, and therefore would anticipate a lot of noise in general.

The most important thing to pay attention to in my estimation from a day-to-day basis is what the Bitcoin market is doing. If Bitcoin rallies convincingly, then money ends up in the Ethereum market. I understand that they are 2 different worlds, but they do have a significant correlation that people pay close attention to.

Ready to trade ETH/USD? Here’s a list of some of the best crypto brokers to check out.