Fundamental Analysis & Market Sentiment

I wrote on 24th November that the best trade opportunities for the week were likely to be:

- Long of Bitcoin in USD terms following a daily (New York) close above $100,000. This did not set up.

- Short of the EUR/USD currency pair. The price rose by 1.53% over the past week.

- Long of the NASDAQ 100 Index following a daily (New York) close above 21,139. This did not set up.

- Long of the S&P 500 Index following a daily (New York) close above 6,002. This set up on Tuesday and gave a profit of 1.85%.

The weekly gain of 0.32% equals 0.08% per asset.

Last week’s key takeaways were:

- US Core PCE Price Index – this came in exactly as expected.

- US CB Consumer Confidence - this came in exactly as expected.

- US Preliminary GDP - this came in exactly as expected.

- US FOMC Minutes – language reflected a desire to make “gradual” rate cuts. This increased expectation is that the Fed will cut rates by another 0.25% at its meeting later this month, so it had a dovish effect which helped weaken the USD.

- German Preliminary CPI (inflation) – as expected, showing a month-on-month decrease of 0.2%.

- Australian CPI (inflation) – this was considerably lower than expected, showing an annualized rate of 2.1% when it was widely expected to rise to 2.5%. That helped make the Aussie the weakest currency last week, on the increased sentiment this would be hawkish concerning rate cuts.

- Canadian GDP – this was lower than expected, showing a month-on-month increase of only 0.1% when an increase of 0.3% was widely expected.

- Reserve Bank of New Zealand Official Cash Rate, Rate Statement, and Monetary Policy Statement – the Bank cut its rate by 0.50% as was expected.

- Chinese Manufacturing PMI – this came in as expected.

- US Unemployment Claims – this came in as expected.

Apart from the inflation data, there were no data points last week that were truly interesting to the market, and even inflation is no longer the concern it was some months ago. Markets are more interested right now in global growth and the likely appointments of the upcoming Trump administration, which will take power in January. We saw US and European stock markets gaining again last week as risk sentiment in parts of the world improved, with the broad US S&P 500 Index rising to make a fresh all-time high last Friday.

The Week Ahead: 2nd – 6th December

The coming week’s schedule is lighter than last week and will likely be dominated by US Non-Farm Payrolls data on Friday.

- US Average Hourly Earnings

- US Non-Farm Employment Change

- US Unemployment Rate

- US JOLTS Job Openings

- US ISM Services PMI

- US ISM Manufacturing PMI

- Swiss CPI (inflation)

- Australian GDP

- US Unemployment Claims

- Canadian Unemployment Rate

Monthly Forecast December 2024

I made no monthly forecast for November, as the long-term trends in the Forex market were too unclear.

For the month of December, I forecast that the EUR/USD currency pair will fall in value.

Weekly Forecast 1st December 2024

This week, I forecast that the AUD/JPY and CAD/JPY currency pairs will rise in value, as they fell by such unusually large amounts last week.

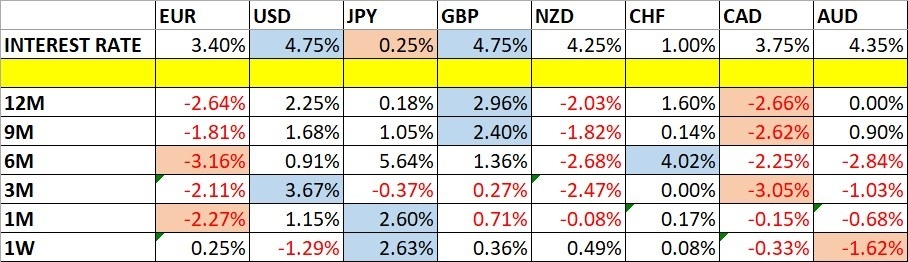

Last week, the Japanese Yen was the strongest major currency, while the Australian Dollar was the weakest. Volatility rose last week, with two-thirds of the most important Forex currency pairs and crosses changed in value by over 1%.

You can trade these forecasts in a real or demo Forex brokerage account.

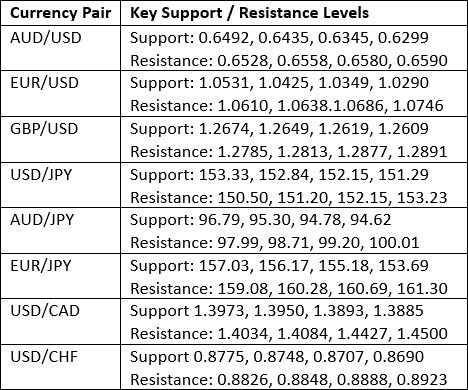

Key Support/Resistance Levels for Popular Pairs

Technical Analysis

US Dollar Index

Last week, the US Dollar Index printed a bearish candlestick that reversed the recent breakout to back underneath the resistance level at 105.81, as well as the upper trend line of the formerly dominant consolidating triangle chart pattern, which can be seen in the price chart below. The price fell sharply from the new 2-year high which was printed the previous week and closed not far from its low of the week. These are bearish signs, but it should be noted that the price is above its levels from three and six months ago, suggesting a long-term bullish trend in the greenback that should be exploitable.

I have plenty of technical and fundamental reasons to be bullish on the US Dollar. However, the upside over the coming week might be limited, so long-term trades long of the USD might be more successful than short-term trades.

Bitcoin

Bitcoin saw a week of modest gains after it hit a record high just shy of $100,000 the previous week, then made a retracement deep enough to shake out many long positions. The price now seems to have resumed its climb towards the record high and $100,00.

The strong long-term bullish trend is something worth paying attention to, and it has been given a tailwind by the Republican victory in the recent US elections. I thought that $100,000 might be hard for the price to overcome and this still looks likely to be a pivotal point over the coming days or even weeks.

I am prepared to go long again of Bitcoin, having taken in my long trade from the $75k area after the price retraced to about $91k, but I want to see a daily (New York) close above $100,000 before entering such a new trade.

EUR/USD

Last week, the EUR/USD currency pair printed a relatively strong bullish candlestick, rebounding from the lowest weekly close seen in almost two years which was made the previous week. The price is still below its levels from both 3 and 6 months ago, which is my preferred metric for calling a long-term bearish trend. The US Dollar Index is also in a long-term bearish trend. A final bearish filter is that the 50-day moving average is below the 100-day moving average, which validates the trend.

There are plenty of reasons to be short here, but I am a bit concerned about the strength of the bullish inflection from the recent multi-year low. On the other hand, this currency pair tends to make deep retracements within even its strongest trends.

I am prepared to enter new short trade from any rejection of a resistance level below $1.0620.

USD/JPY

Last week, the USD/JPY currency pair printed a very strong bearish candlestick, which was unusually large and closed right on its low.

These are bearish signs, or at least signs of bearish momentum. The Japanese Yen was the strongest of all the major currencies last week. However, this seeming bearish reversal occurred at a multi-month high price, when this pair seemed to be preparing to establish a new long-term bullish trend.

There is a lot of volatility in the Japanese Yen and there has been for many months, making Yen pairs and crosses very interesting for day traders.

I cannot predict long-term direction here, but I can predict that anyone who is good at short-term trading and who needs volatility to profit would do well to be interested in this currency pair and maybe some of the Yen crosses too.

USD/CHF

I expected that the USD/CHF currency pair would have potential support at $0.8805.

The H1 price chart below shows how the price action rejected this support level with an hourly inside bar, which followed a doji candlestick, marked by the up arrow within the price chart below. This rejection occurred right at the end of the London session last Wednesday, which can often be a great time for reversals in the US Dollar.

This trade gave a maximum profit of approximately 1.5 to 1.

This currency pair has been quite strongly positively correlated with the EUR/USD currency pair lately.

Top Forex Brokers

S&P 500 Index

Last week saw the S&P 500 Index rise again to reach a new record high, and it closed the week quite near the high, which is a bullish sign. There is no sign more bullish than the fact that the price is trading bullishly in blue sky.

US stock markets are leading global equities, which is nothing unusual, boosted by President Trump’s reputation as doing anything to generate economic growth and stock market growth, as well as his announcement of his intention to put strong tariffs on imports from Mexico and China.

Maybe more importantly, the US stock market has been in a strong bullish trend for over one year now, so there is plenty of momentum supporting last week’s bullish move.

I see the S&P 500 Index as a buy.

USD/BRL

Last week saw the USD/BRL currency pair rise strongly to make a new all-time high price, before it gave back some of its gains to close just below the previous record high made in 2020.

In other words, the Brazilian Real is in trouble and is reaching record lows.

The only note of caution for bulls here would be the fact that the price was unable to close above the 2020 high.

Many brokers do not offer the BRL to trade, and the very high overnight swap rates that come with being long of the BRL as a CFD can be a deterrent to trading this key emerging currency. However, anyone with BRL holdings might want to think about getting out or at least hedging the currency risk.

Brazil has taken quite an anti-American position in recent months, throwing its lot in fully with the BRICS countries and implying an alternative to the USD. One has to wonder what President Lula has said to President-Elect Trump in recent days, as its hard to imagine President Trump allowing such actions to go by unpunished. That may be contributing to the weakness of the Real.

USD/INR

Last week saw the USD/INR currency pair rise to make a new all-time high price, and it closed near the high of the week, painting a very bullish technical picture as it trades in blue sky. This has happened for each of the last few weeks.

The Indian Rupee is relatively weak and is reaching record lows.

Many brokers do not offer the INR to trade, and the very high overnight swap rates that come with being long of the INR as a CFD can be a deterrent to trading this key emerging currency. However, anyone with INR holdings might want to think about getting out or at least hedging the currency risk.

The relative weakness of the Indian Rupee is interesting because India’s economic metrics remain quite positive. This is likely partly due to relatively high inflation and interest rates, as well as the fear that India is so dependent upon manufacturing raw materials that it could be prone to very high levels of inflation if commodity prices spiral out of control again.

Bottom Line

I see the best trading opportunities this week as

- Long of Bitcoin in USD terms following a daily (New York) close above $100,000.

- Short of the EUR/USD currency pair following a strong bearish reversal below $1.0620.

- Long of the S&P 500 Index.

Ready to trade our weekly Forex forecast? Check out our list of the best Forex brokers worth reviewing.