Fundamental Analysis & Market Sentiment

I wrote on 1st December that the best trade opportunities for the week were likely to be:

- Long of Bitcoin in USD terms following a daily (New York) close above $100,000. This set up at the end of the week, so there is no result.

- Short of the EUR/USD currency pair following a strong bearish reversal below $1.0620. This set up at the end of the week, so there is no result.

- Long of the S&P 500 Index. This resulted in a profit of 0.83%.

The weekly gain of 0.83% equals 0.28% per asset.

Last week’s key takeaways were:

- US Average Hourly Earnings –higher than expected, showing a month-on-month increase of 0.4% compared to the forecasted 0.3%, showing the US economy is still going strong, giving a fundamental boost to the US Dollar.

- US Non-Farm Employment Change – a little higher than expected (see above).

- US Unemployment Rate – a fraction higher than expected at 4.2%.

- US JOLTS Job Openings – considerably higher than expected, at 7.74 million compared to the forecasted 7.51 million, reinforcing the point made in 1.

- US ISM Services PMI –worse than expected.

- US ISM Manufacturing PMI –better than expected.

- Swiss CPI (inflation) – a month-on-month deflation by 0.1%, as expected.

- Australian GDP – this was very disappointing, with a quarterly increase of only 0.3% when 0.5% was widely expected, giving a tailwind to the Aussie’s decline over the week.

- US Unemployment Claims – very slightly higher than expected.

- Canadian Unemployment Rate – this rose much more strongly than expected, from 6.5% to 6.8%, when only 6.6% was expected, suggesting the Canadian economy is experiencing a chilly wind.

What has been the most interesting to the market over the past week was the strong US data, continuing the theme of American economic growth and other economic metrics making the USA the envy of the world right now. We saw also the Australian Dollar get hit and this is due to a faltering Australian economy that makes further rate cuts likelier over the near term. Markets are more interested right now in global growth and the likely appointments of the upcoming Trump administration, which will take power in January. We saw US and European stock markets gaining again last week as risk sentiment in parts of the world improved, with the broad US S&P 500 Index, the NASDAQ 100 Index, and the German DAX all reaching record highs.

The Week Ahead: 9th – 13th December

The coming week’s schedule is packed with key US economic data, and four central bank policy meetings, with three of them expected to produce rate cuts. This means it will likely be an important week, and we will probably see a strong increase in price movements in the Forex and stock markets.

- US CPI (inflation) – the annualized rate is expected to rise from 2.6% to 2.7%. Any surprises could cause volatility in the US Dollar and US stock markets.

- US PPI

- European Central Bank Main Refinancing Rate & Monetary Policy Statement - a rate cut of 0.25% is expected.

- Reserve Bank of Australia Cash Rate & Rate Statement – the Bank is expected to hold the Cash Rate steady at 4.35%, but there is an increased chance of a surprise rate cut.

- Bank of Canada Overnight Rate & Rate Statement – a rate cut of 0.50% is expected.

- Swiss National Bank Policy Rate & Monetary Policy Assessment - a rate cut of 0.25% is expected.

- UK GDP

- US Unemployment Claims

- Australian Unemployment Rate

Monthly Forecast December 2024

For the month of December, I forecasted that the EUR/USD currency pair would fall in value. The performance of my forecast so far is:

Weekly Forecast 8th December 2024

Last week, I forecasted that the AUD/JPY and CAD/JPY currency pairs would rise in value, as they fell by such unusually large amounts the previous week. Unfortunately, both currency crosses fell over the week, the AUD/JPY by 1.74% and the CAD/JPY by 0.94%.

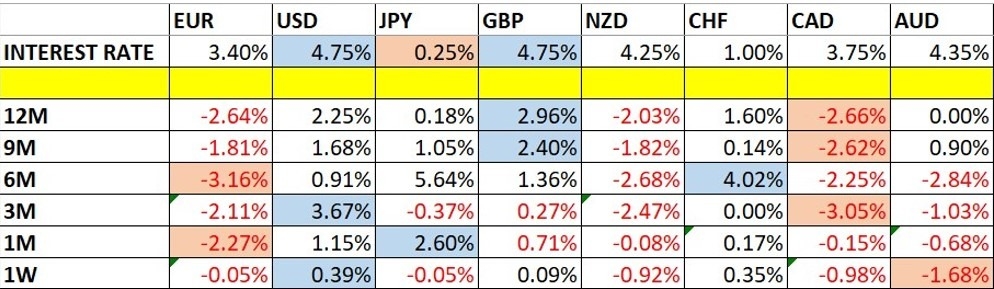

The US Dollar was the strongest major currency, while the Australian Dollar was the weakest. Volatility fell last week, with less than half of the most important Forex currency pairs and crosses changing in value by over 1%.

You can trade these forecasts in a real or demo Forex brokerage account.

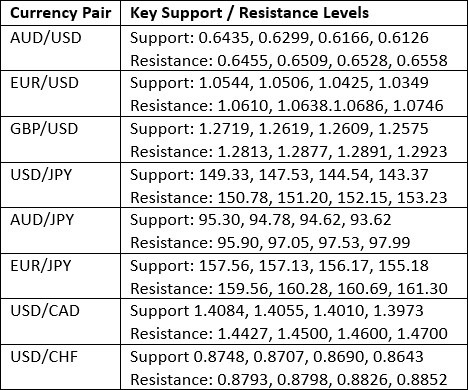

Key Support/Resistance Levels for Popular Pairs

Technical Analysis

US Dollar Index

Last week, the US Dollar Index printed a bearish doji candlestick that continued the reversal of the recent breakout to back underneath the resistance level at 105.81, as well as the upper trend line of the formerly dominant consolidating triangle chart pattern, which can be seen in the price chart below. These are bearish signs, but it should be noted that the price is above its levels from three and six months ago, suggesting a long-term bullish trend in the greenback that should be exploitable.

I have plenty of fundamental reasons to be bullish on the US Dollar. However, the upside over the coming week might be limited, so long-term trades long of the USD might be more successful than short-term trades.

We will be getting highly important US CPI (inflation) and PPI (purchasing power index) data on the US economy this week, so technical factors might not be very important, with price action over the second half of this week likely to be more data-driven.

Top Forex Brokers

Bitcoin

Bitcoin finally broke above the psychologically important $100,000 level last week, reaching a new record high above that, and even made a daily close above this level. However, there are signs that the momentum has stalled or slowed, and the price does not really seem to be respecting $100,000 anymore, as the price is chopping above and beyond it.

The strong long-term bullish trend is something worth paying attention to, and it has been given a tailwind by the Republican victory in the recent US elections. The price chart below shows a spectacular long-term bullish trend which has been ongoing for the past two years.

As we got a daily close above $100,000 on Friday, I am comfortable being long. I am not confident we are going to immediately see a further strong rise, but there is no reason to be bearish. The weekly price action still looks bullish.

EUR/USD

Last week, the EUR/USD currency pair printed a doji candlestick, with the candlestick having a higher high and higher low than the previous week’s candlestick. These are potentially bullish signs. However, the price is still below its levels from both 3 and 6 months ago, which is my preferred metric for calling a long-term bearish trend. The US Dollar Index is also in a long-term bearish trend. A final bearish filter is that the 50-day moving average is below the 100-day moving average, which validates the trend.

Although there are reasons to be short here, I am a bit concerned about the strength of the bullish inflection from the recent multi-year low. On the other hand, this currency pair tends to make deep retracements within even its strongest trends.

Friday saw the price strongly reject the resistance level at $1.0610 although it is also possible this was simply a reaction to the strong average hourly earnings and non-farm payrolls data which was released in the USA that day.

I am not very optimistic about this trade but based on historical precedents in technical analysis and trend, it makes sense to be short of this currency pair.

A rate cut by the ECB is expected this week, so if there is any surprise there, we might see a move in the Euro which could push the price around here. The same holds for US CPI (inflation) data which is also coming this week.

NASDAQ 100 Index

Last week saw the NASDAQ 100 Index print a powerful bullish candlestick reach and close at a new record high for the first time in three weeks, and the price closed very near the top of its range, which is a bullish sign. There is nothing more bullish than the fact that the price is trading bullishly in blue sky.

The price is nicely contained within a linear regression analysis channel, which can be seen in the price below, giving added reliability to the continuation of this trend.

US stock markets are leading global equities, which is nothing unusual, boosted by President Trump’s reputation as doing anything to generate economic growth and stock market growth, as well as his announcement of his intention to put strong tariffs on imports from Mexico and China.

Maybe more importantly, the US stock market has been in a strong bullish trend for over one year now, so there is plenty of momentum supporting last week’s bullish move.

I see the NASDAQ 100 Index as a buy.

S&P 500 Index

Last week saw the S&P 500 Index rise again to reach a new record high, and it closed the week quite near the high, which is a bullish sign. There is no sign more bullish than the fact that the price is trading bullishly in blue sky.

Everything I wrote above about the NASDAQ 100 applies to the S&P 500 Index too, the only difference is that while the NASDAQ 100 was dipping previously, the S&P 500 was still rising. Both indices have performed almost exactly the same over 2024 in terms of percentage gain.

I see the S&P 500 Index as a buy.

DAX Index

Last week saw the DAX Index rise unusually strongly to reach a new record high, and it closed the week right on its high, which is a bullish sign. There is no sign more bullish than the fact that the price is trading bullishly in blue sky.

Recent weeks have been dominated by the USA having a successful economy and soaring stock market compared to the rest of the world, with the German DAX one of the very few other major equity indices that is also breaking to new all-time highs. This is seen as a bit of a mystery as the German economy is not doing especially well, with most analysts seeing it as due to the strength of the German industries which the index represents (technology, financials, industrials) rather than Germany as a whole.

It is worth noting that the DAX performed almost as well as the major US equity indices over 2024. The DAX is up by 19% while the major US indices are up by 26%.

After a bullish candlestick with such strength, I see the DAX Index as a buy.

Bottom Line

I see the best trading opportunities this week as

- Long Bitcoin in USD terms.

- Short of the EUR/USD currency pair.

- Long of the NASDAQ 100 Index.

- Long of the S&P 500 Index.

- Long of the DAX Index.

Ready to trade our Forex weekly forecast? Check out our list of the top 10 Forex brokers in the world worth checking out.