Editor’s Verdict

Overview

Review

Headquarters | Cyprus |

|---|---|

Regulators | FSC Belize |

Year Established | 2010 |

Execution Type(s) | Market Maker |

Minimum Deposit | $250 |

Trading Platform(s) | MetaTrader 4 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

As of October 2021, this broker is no longer accepting new traders. To find a reliable, regulated Forex broker, check out our top Forex brokers list. Thank you!

24Option began its journey in the now-defunct binary options market. Briefly, the binary options market was notorious for fraud and scams, which prompted global regulators to clamp down on the marketing of binary options. Regulators voided operating licenses, and eventually put an end to this dubious sector. 24Option was one of the more well-established brokers on the scene and had the capital to transform into a CFD broker, adding the MT4 trading platform to its webtrader. The company has voluntarily renounced its Cypriot license, which took effect on August 20, 2020; the broker caters to international clients from Belize. It would be imprudent to state with any certainty whether or not 24Option has left the binary options industry practices in the past; however, appearances suggest that some ill-advised and questionable practices remain intact.

Regulation and Security

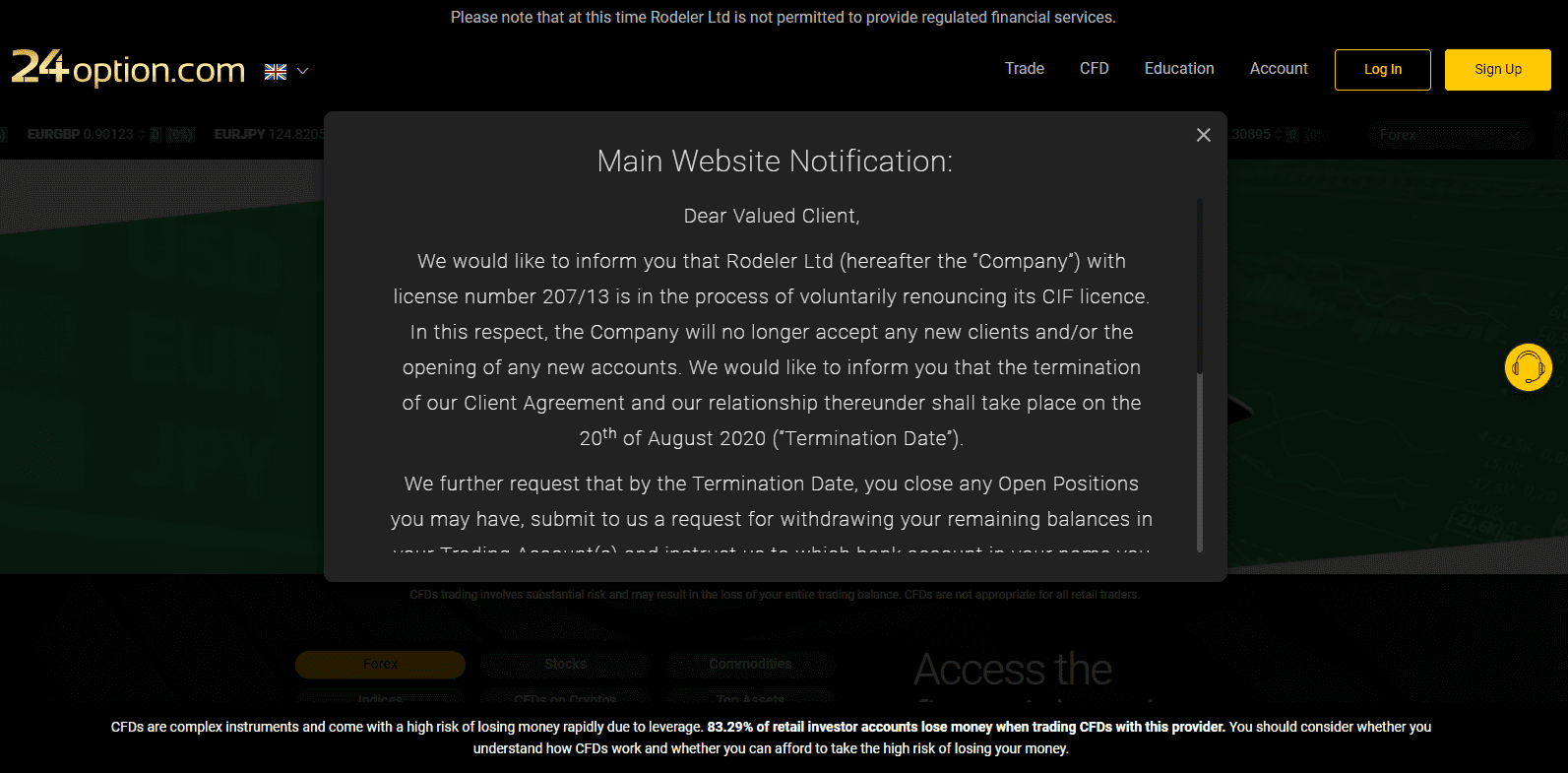

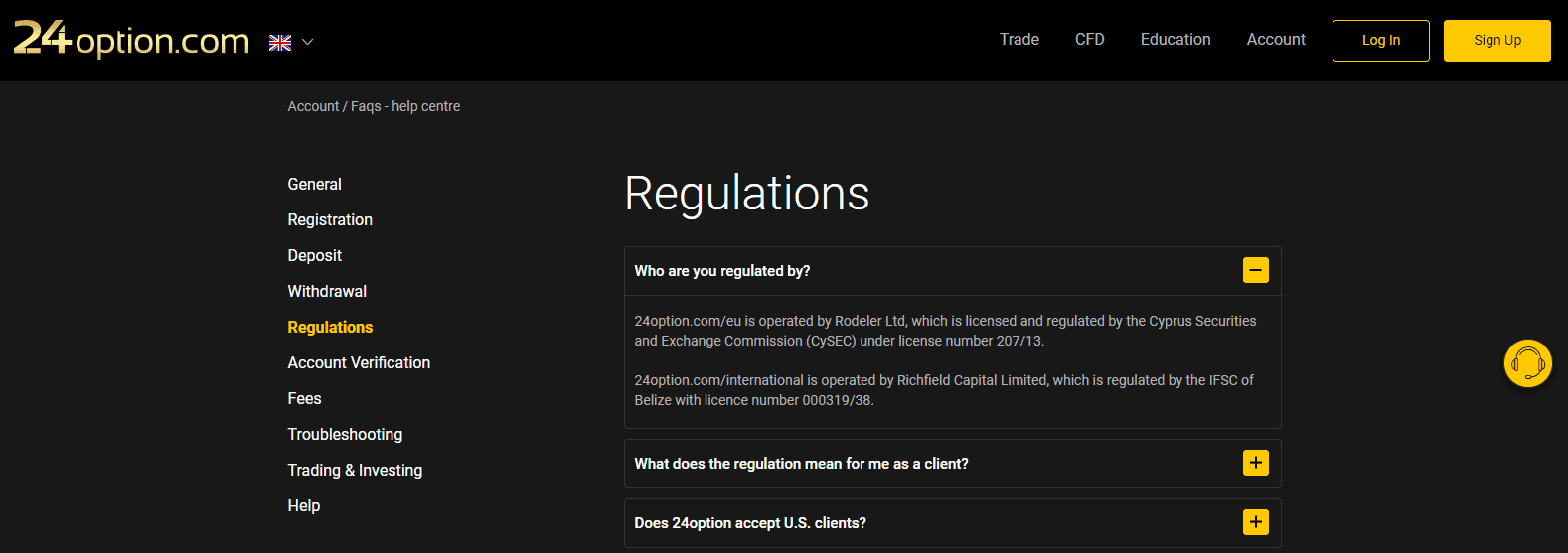

The ownership appears to be transitioning from Rodeler LTD, which was operating as a Cypriot Investment Firm (CIF), to Belize-based Richfield Capital Limited. Per the company statement, Rodeler LTD voluntarily renounced its operating license in Cyprus, primarily due to counter-productive measures taken by the European Securities and Markets Authority (ESMA), the EU financial regulator.

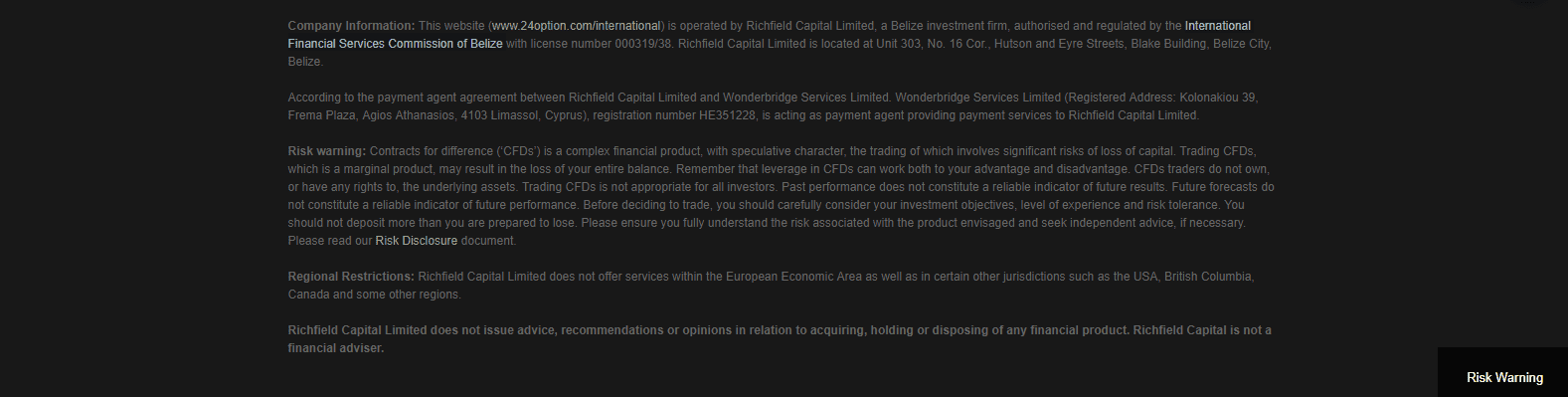

Richfield Capital Limited, and the 24Option international website, the only one operational, does not dedicate a section to security and regulation. It merely denotes oversight by the financial regulator, the International Financial Services Commission of Belize (IFSC). While the IFSC maintains a business-friendly light regulatory touch, trustworthy brokers usually combine this with a membership of the Hong Kong-based Financial Commission, which complements the existing regulation with security features for traders. 24Option fails to do so, and together with the lack of transparency over security, raises concerns at this former binary options broker.

Rodeler LTD, the operator of 24Option under CySEC regulation, renounced its license effective August 20th, 2020.

Richfield Capital Limited became the sole operator of 24Option, as noted on the 24Option website.

The website of Richfield Capital Limited confirms ownership.

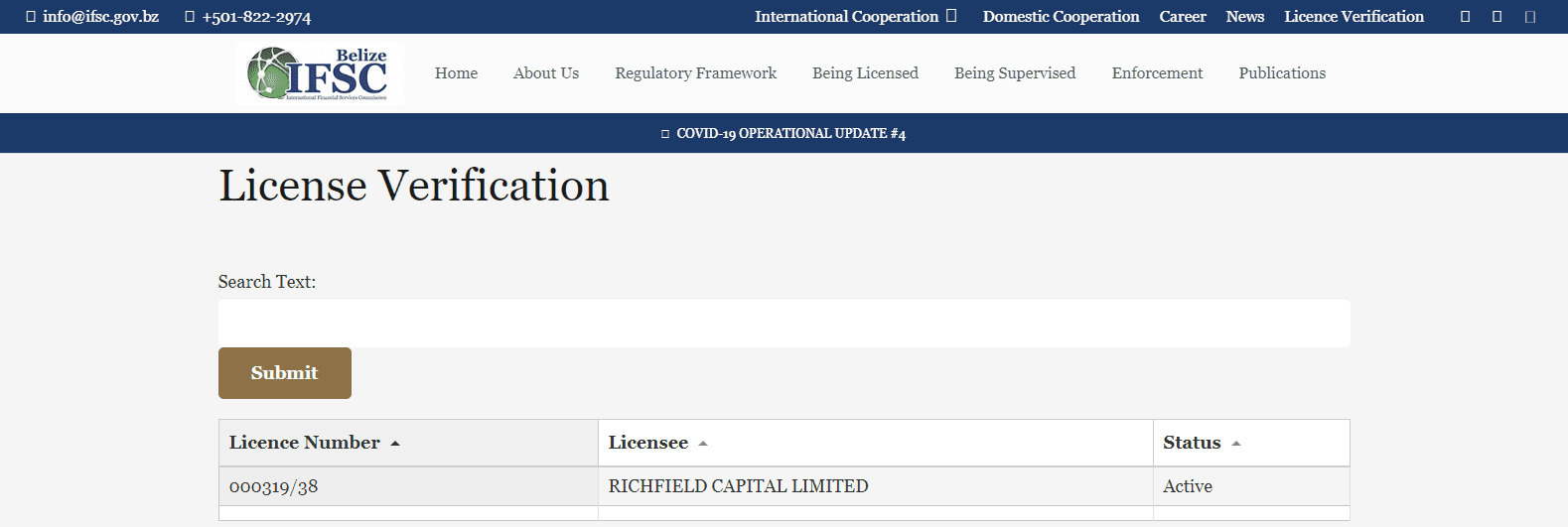

A verification check with the IFSC returned an active license for Richfield Capital Limited.

24Option shows CySEC regulation on its international website, despite confirming licensing renouncement.

Fees

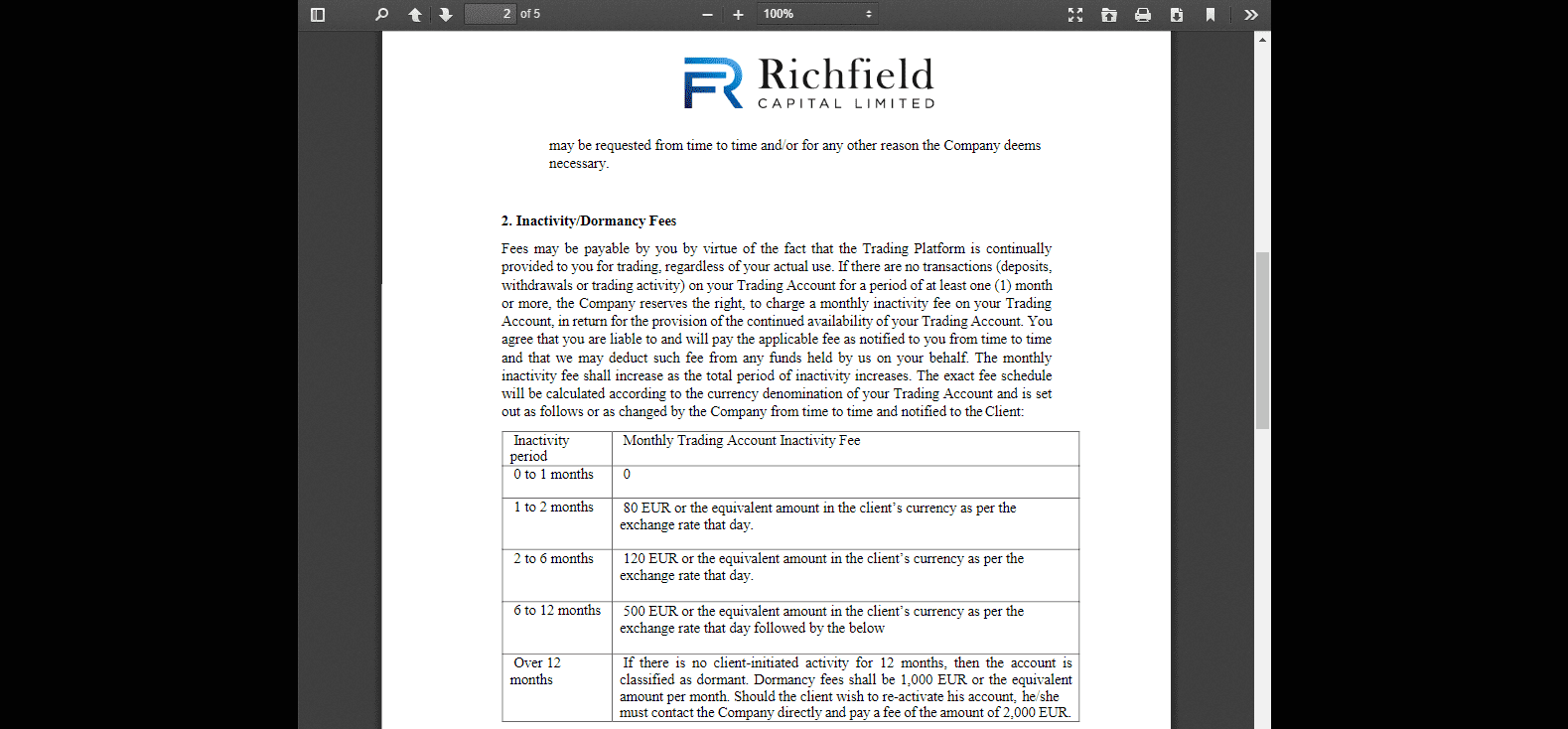

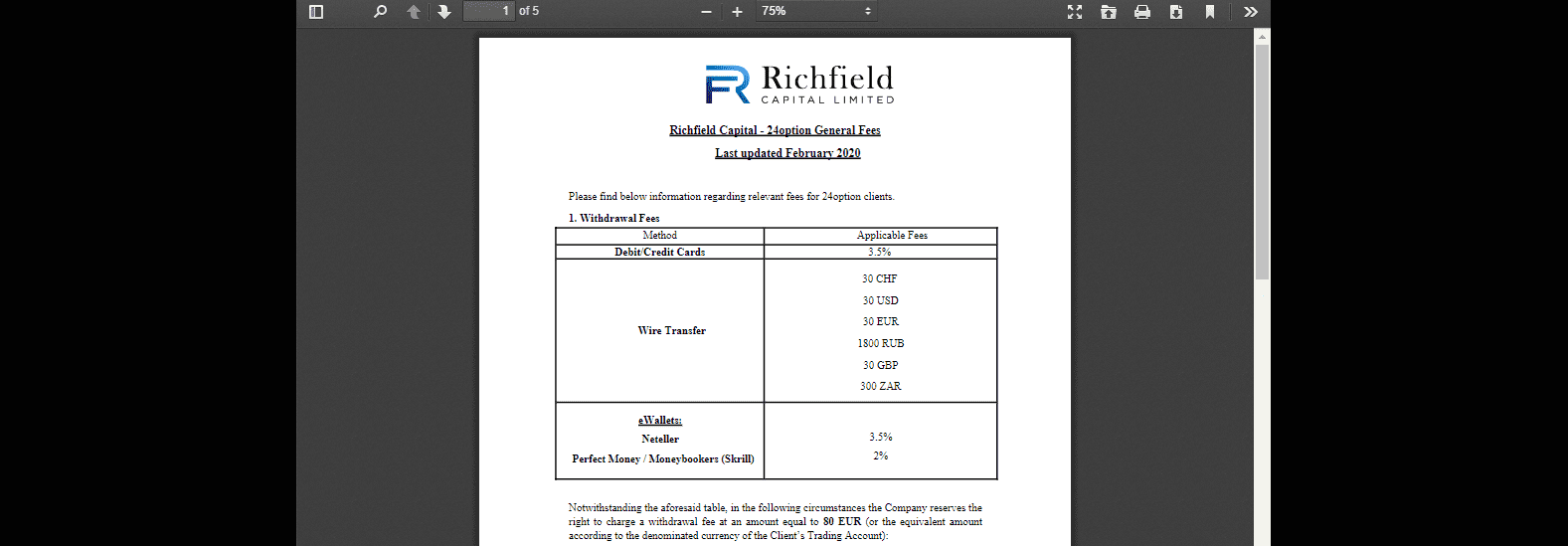

24Option is vague about trading costs and fails to outline them properly. Only high spreads are visible, while the FAQ section does make note of swap rates on overnight leveraged positioned. The terms of conditions consist of just three pages with no mention of the cost structure. The legal subsection hosts a PDF document labeled General Fees, linking away from the 24Option website and to the Richfield Capital Limited one, where this broker references an inactivity fee between €80 to €2,000, deducted after the first month of inactivity. It is a clear statement towards draining capital from traders and pressing for enhanced activity at this market maker, which profits directly from losses of its clients. The lack of complete transparency for a core trading element, and the absence of a dedicated section detailing all costs, is unacceptable.

MT4 traders can easily access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Symbols.

2. Select the desired currency and then click on Properties located on the right side.

3. Scroll down until you see Swap Long and Swap Short.

24Option deploys unacceptable inactivity fees.

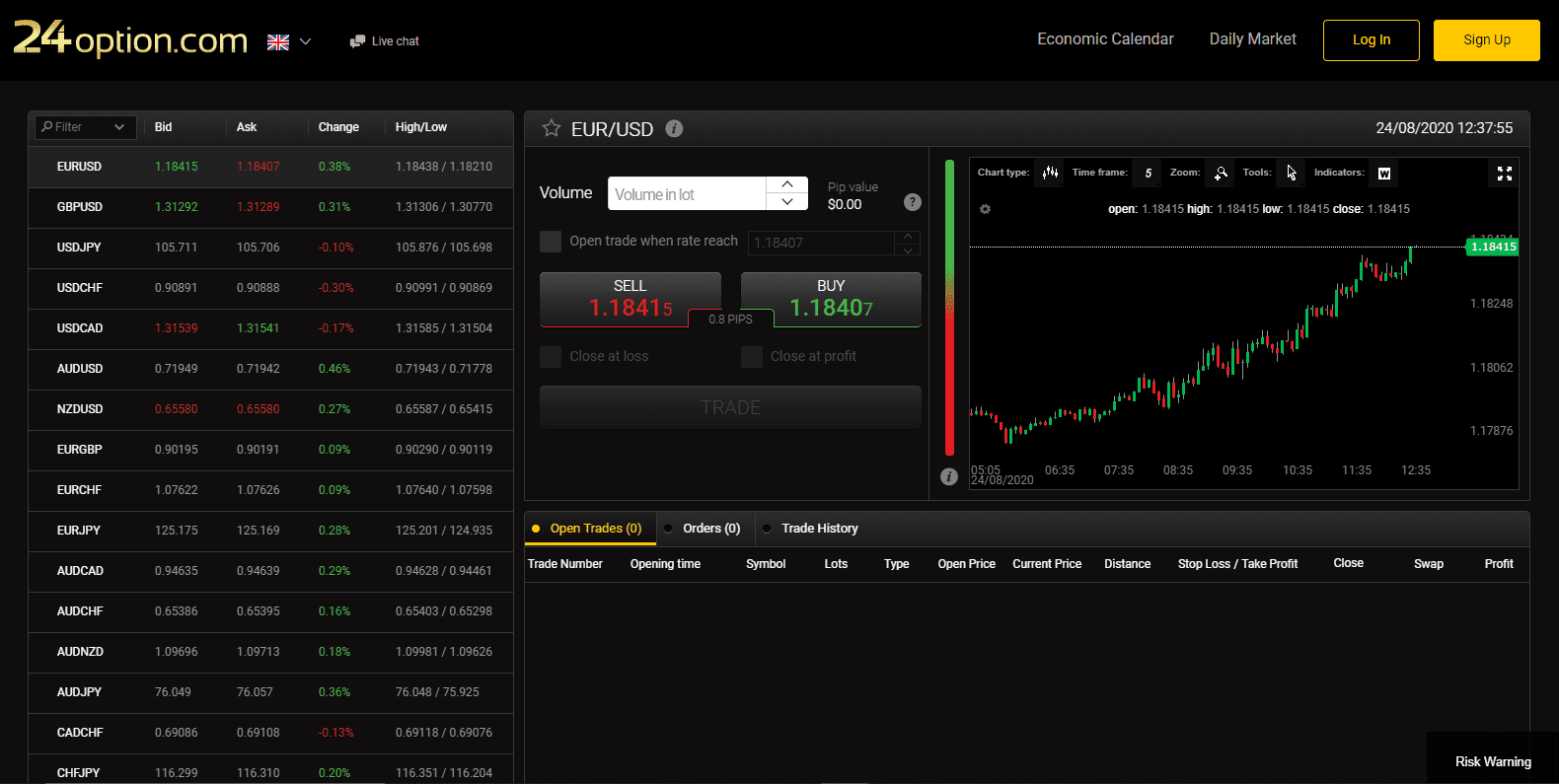

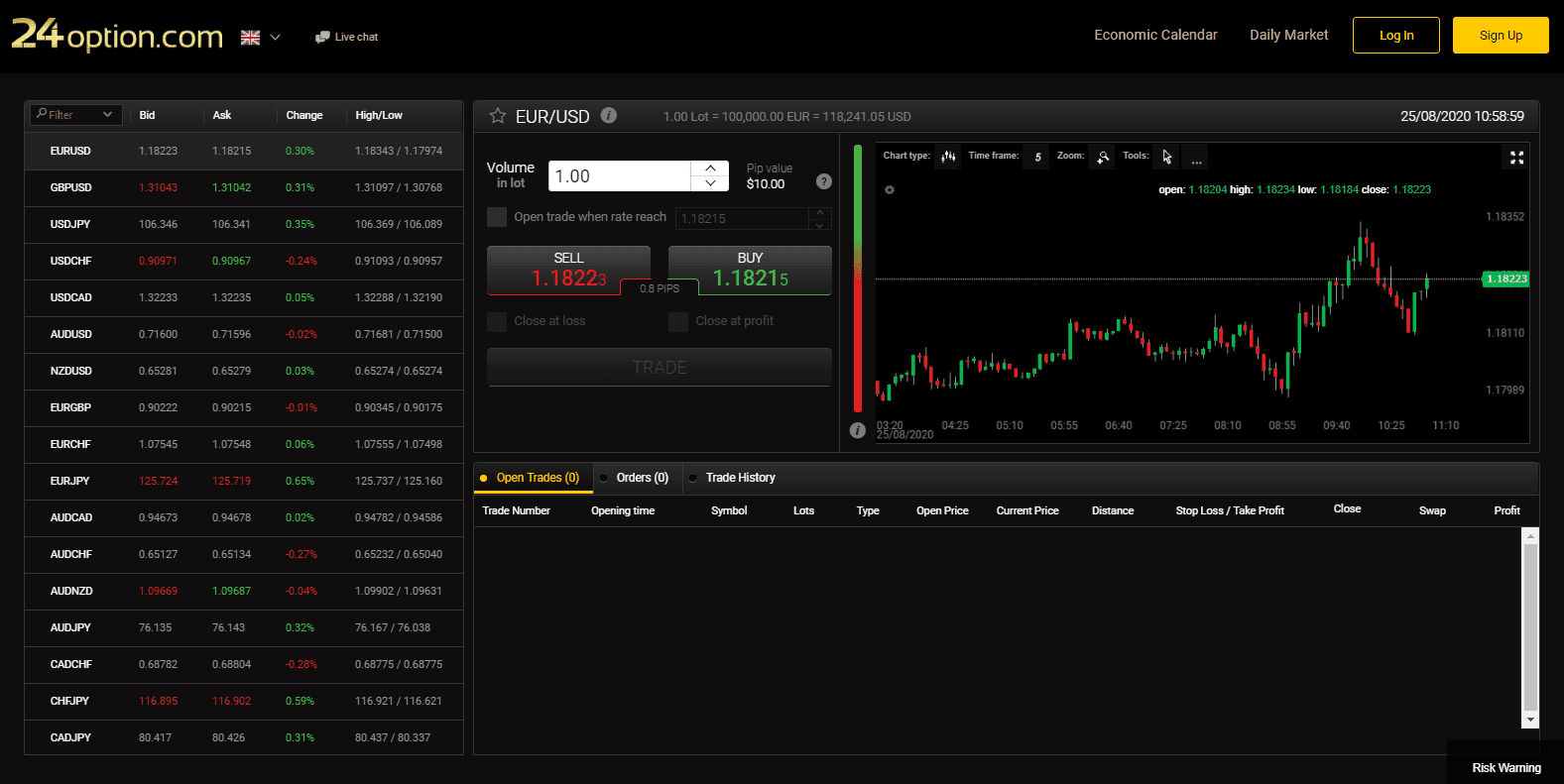

At the time of this review, the 24Option webtrader reversed the Bid/Ask prices in a fatal operational error.

What Can I Trade

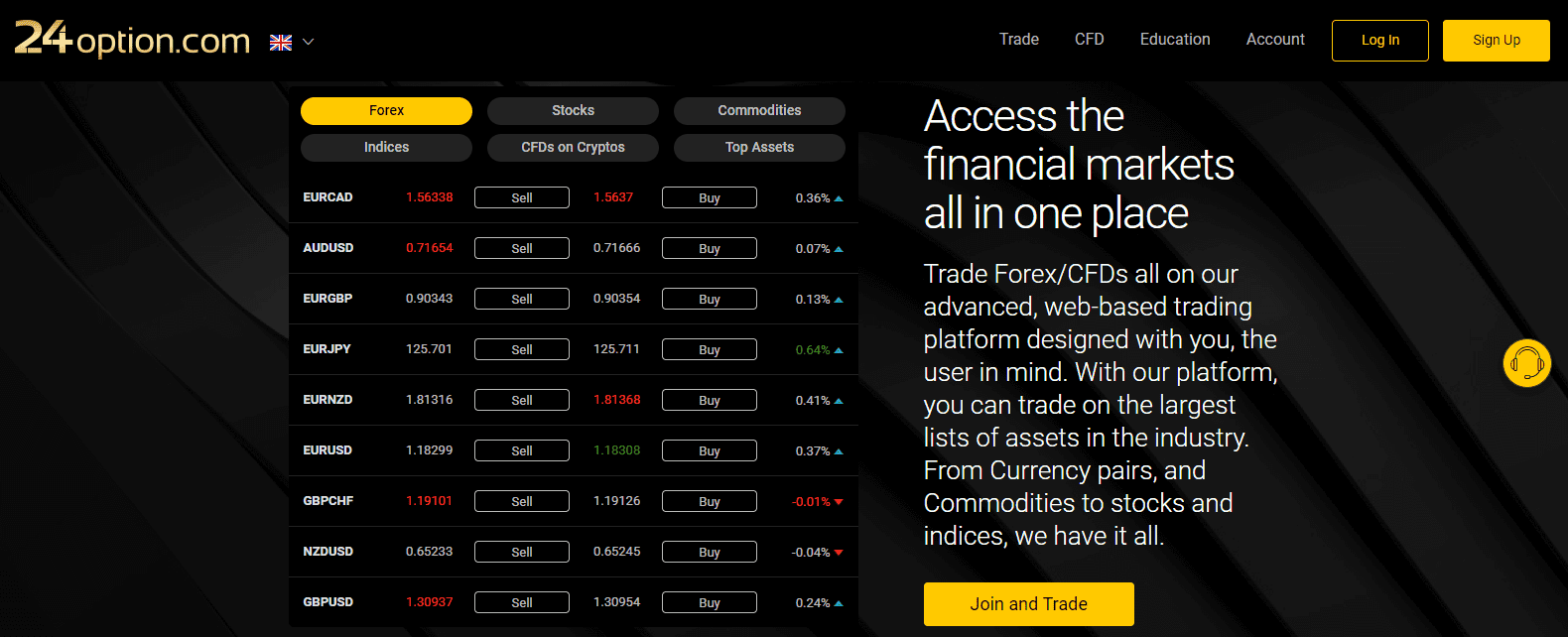

The lack of transparency and proper introduction to core elements of the trading environment continues with asset selection. 24Option offer Forex, commodity, cryptocurrency, equity, and index CFDs, as visible in a brief section on the homepage. The number of tradable assets is not displayed, but the webtrader is accessible without a login, where the complete asset list is available. This approach adds to the unacceptable presentation dominant throughout 24Option. It is regrettable, as the overall asset selection is adequate for retail traders with good cross-asset diversification possibilities.

While 24Option has a competitive asset selection, it fails to introduce it accurately.

Account Types

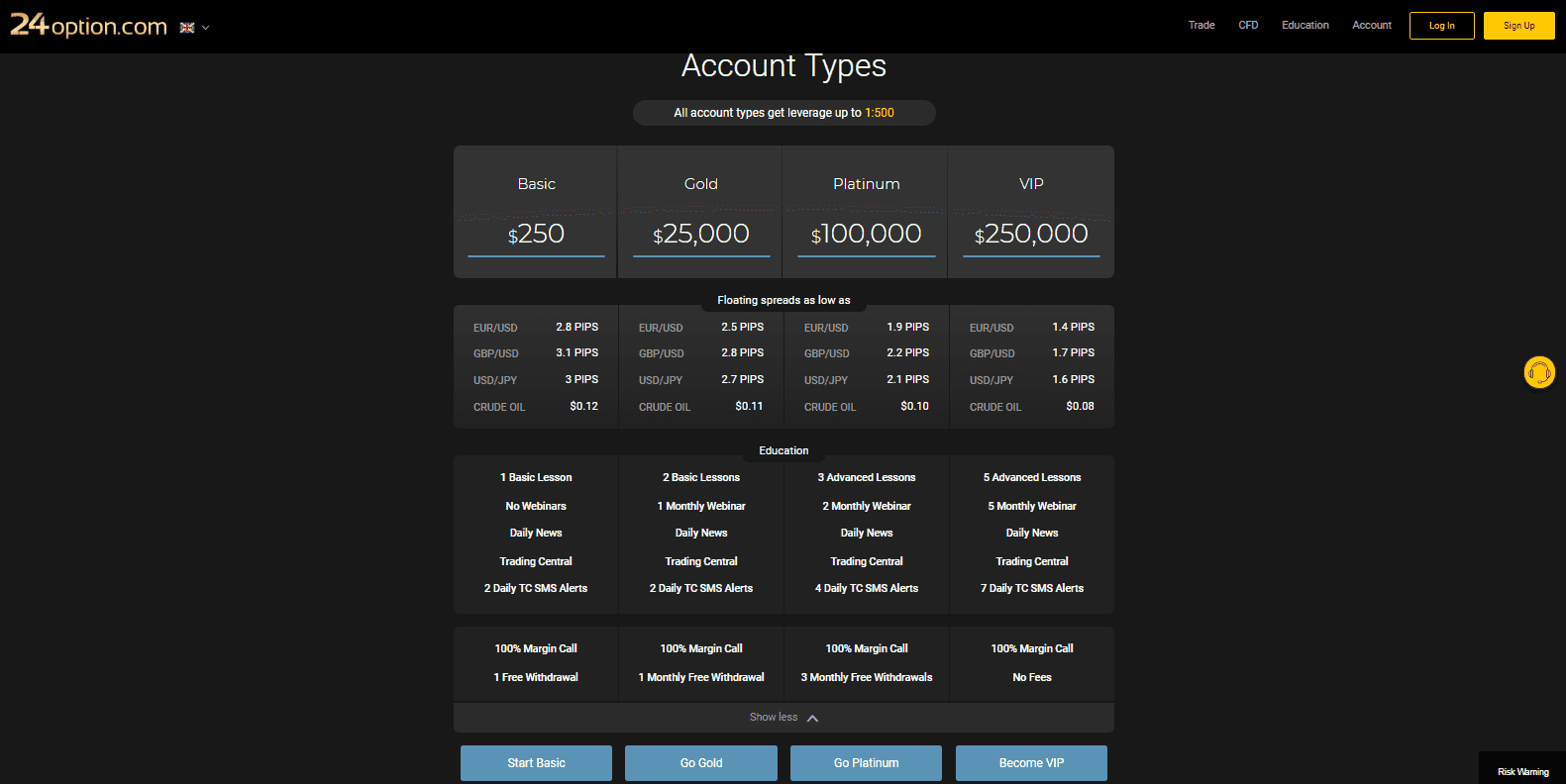

The account structure at 24Option is a reminder of the binary options industry and is indicative of this broker's failure to understand the needs of traders at different levels. New retail traders with insignificant deposits have access to limited educational content, while a deposit of $250,000 affords traders access to the full program. 24Option denies proper education to those who need it, while those who do not require it may opt to receive it. The minimum deposit is $250, and the only one where clients will trade at 24Option. The next three tiers are $25,000, $100,000, and $250,000. Due to unacceptable trading conditions, this broker lacks the capabilities to serve portfolios of those sizes properly, rendering the overall current account structure ineffectual.

24Option offers all traders unacceptable trading conditions.

Trading Platforms

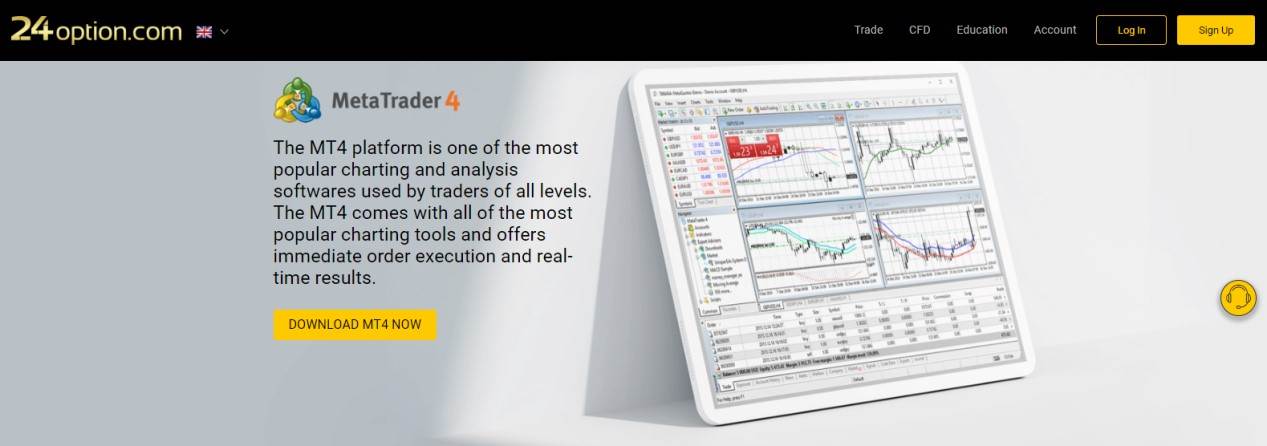

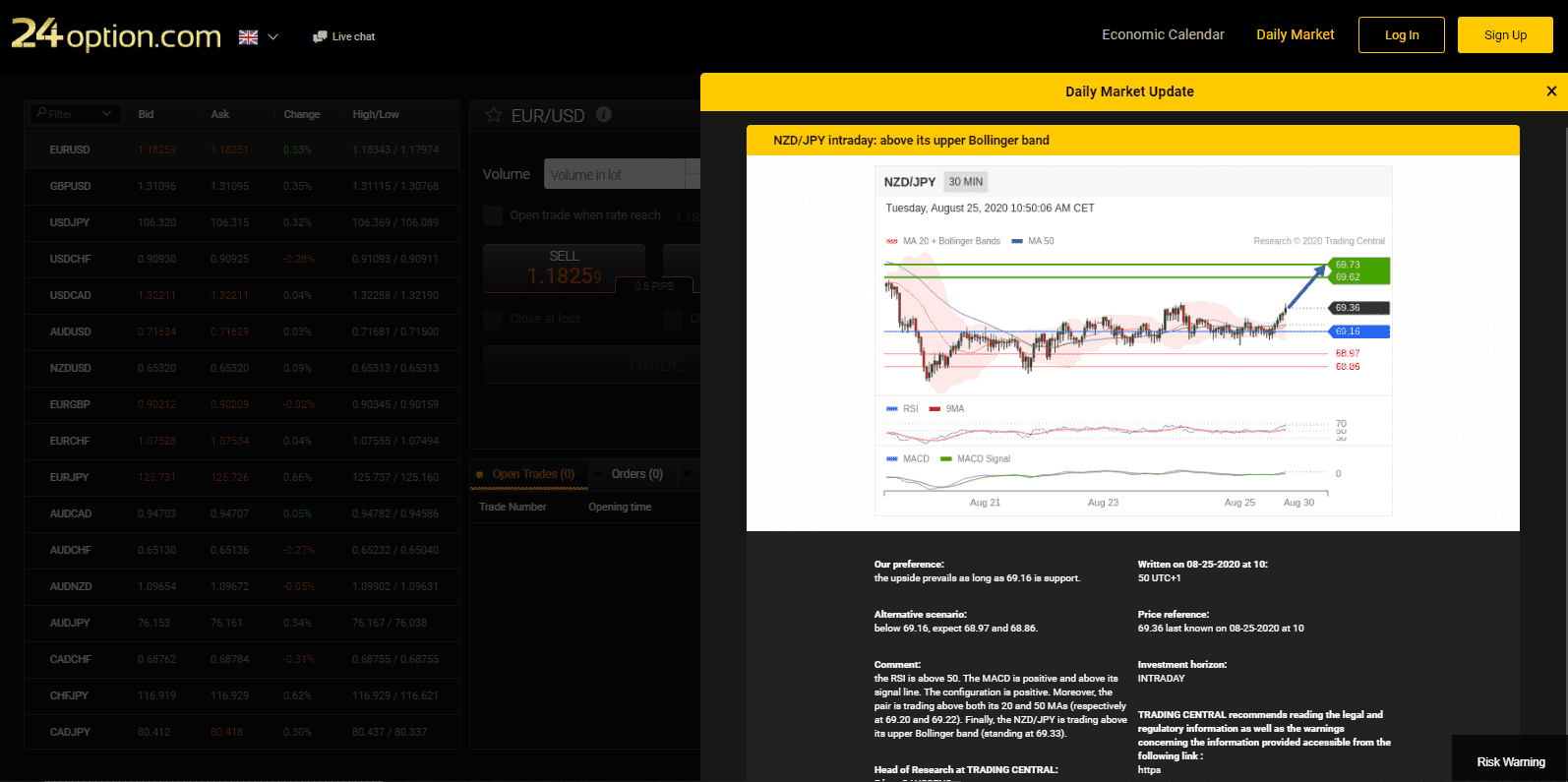

Traders may select between the core MT4 trading platform or the 24Option webtrader, which is the same one this broker used for binary options trading. This broker fails to properly introduce MT4, which is reduced to a single paragraph on the homepage, and there is no introduction for the webtrader at all. MT4 supports automated trading, but 24Option fails to provide any of the required third-party add-ons needed to unlock its full potential. The webtrader serves manual traders only, but navigation through the chart options is not user-friendly. It features a sentiment indicator and an enhanced order ticker as compared to MT4. A Daily Market Update by Trading Central exists for clients inside the webtrader. Neither trading platform, as offered by 24Option, grants access to a competitive solution.

24Option added the MT4 trading platform as part of its transformation from binary options broker to CFD broker.

This broker fails to introduce its webtrader, on which it built its now-defunct binary options business.

Unique Features

24Option maintains no unique features, but the consistent lack of transparency and missing introduction of core trading elements are noteworthy.

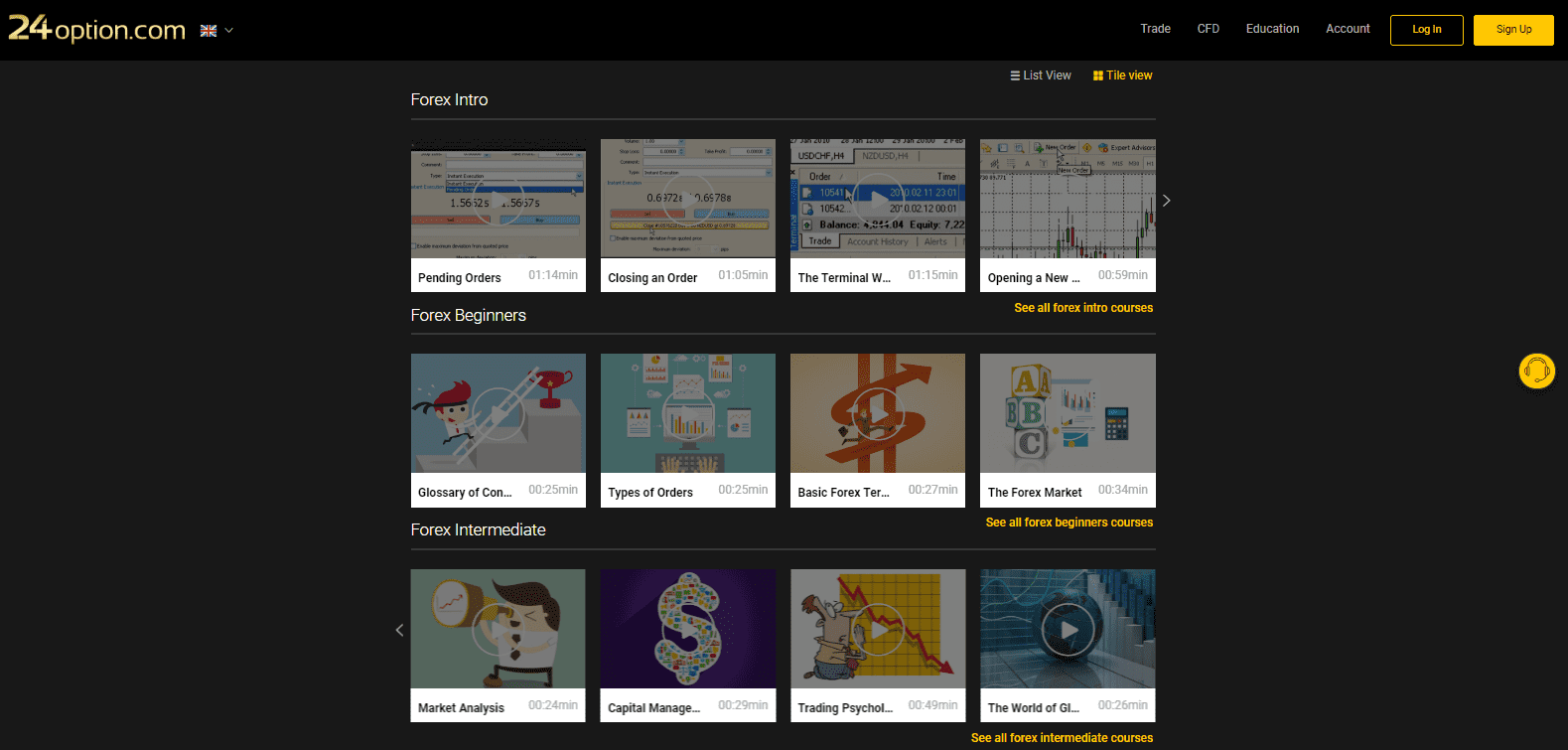

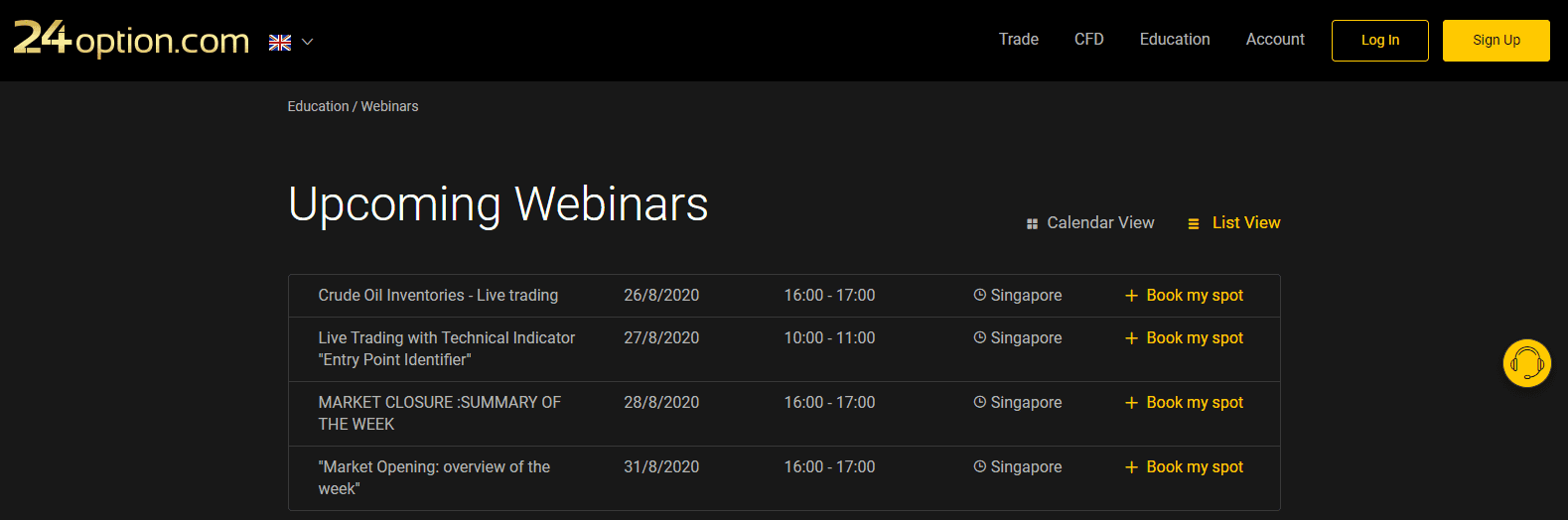

Research and Education

24Option does not generate in-house research but delivers them via a partnership with Trading Central, accessible from the webtrader. It is an acceptable solution to grant traders brief trading ideas from an established source. Education consists primarily of short videos, where quantity trumps quality, and a series of eBooks, which can be read by clients only. Live webinars, hosted daily, require an account, and so does the market news section. Requiring registration to access the research and educational contents is a misguided marketing tactic and failed opportunity. 24Option is more concerned with data acquisition than granting a genuine service to traders, as evident through its approach.

Trading Central substitutes for the missing in-house research at 24Option.

Short educational videos focus on quantity rather than quality.

eBooks likely follow the same pattern as videos.

Existing clients may register for live webinars.

Everything at 24Option requires registration, an ill-advised marketing approach.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | Unspecified |

Website Languages |      |

A dedicated customer support section is missing, together with operating hours. Pressing Contact US, located at the bottom of the homepage, merely opens a live chat client. The call button results in no action, and the FAQ section offers only brief and often opaque answers. This broker's approach to customer service joins a growing list of unacceptable practices by 24Option.

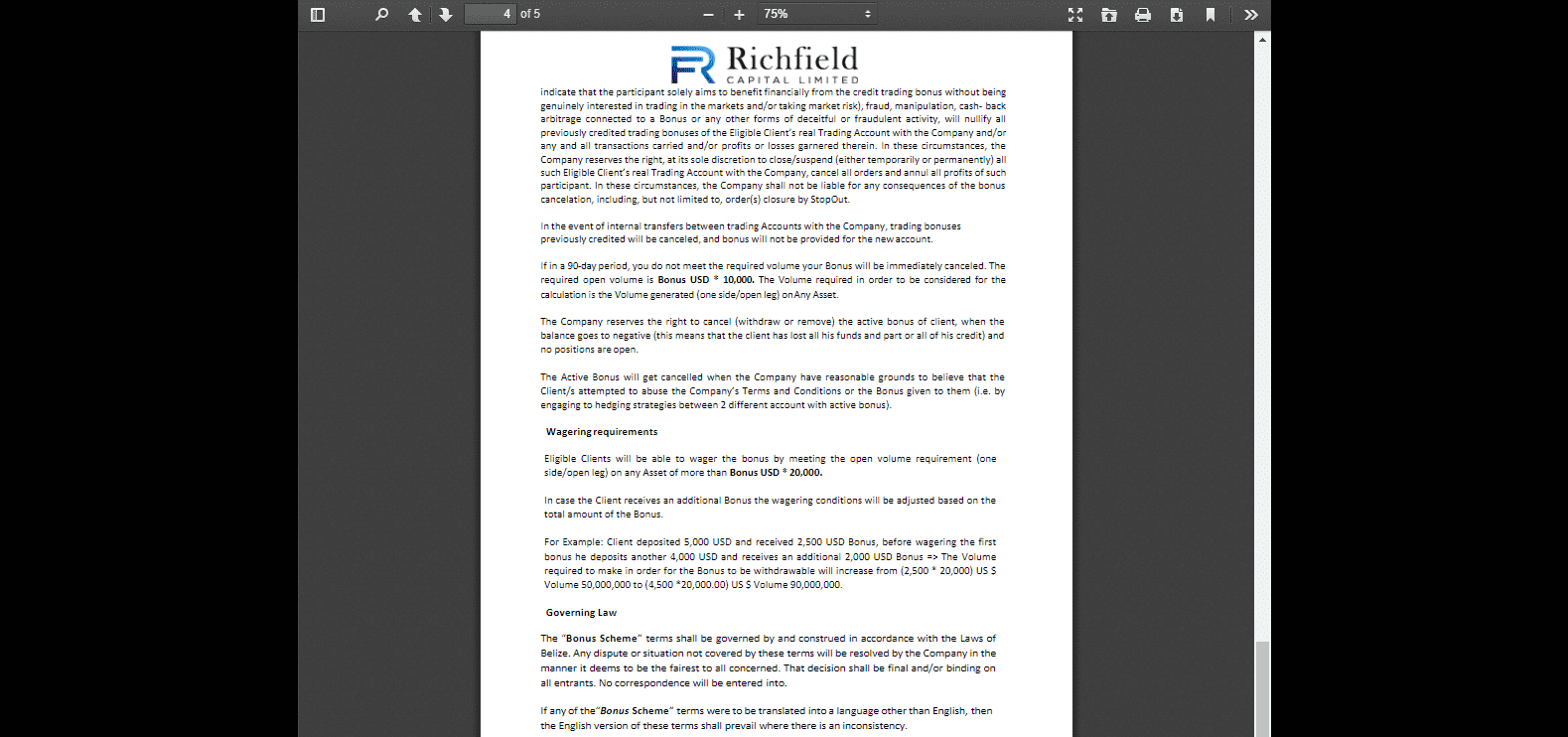

Bonuses and Promotions

24Option offers a deposit bonus of up to 50%, but the terms and conditions remain excessive. Asking clients to trade 20,000 times the bonus amount within 90 days before unlocking it as a withdrawal incentive is another binary options leftover, pressuring more trading activity. After 90 days, 24Option cancels the bonus. It is best to avoid this trap set by this broker and dismiss it as another counter-productive service.

Terms and Conditions of the current deposit promotion.

Opening an Account

The online application asks only for a full name, e-mail address, and phone number. Given its stated IFSC regulation, verification is a mandatory step to satisfy AML/KYC requirements. Traders generally complete this step by submitting a copy of their ID and one proof of residency document. Given the lack of transparency by 24Option, potential clients should approach this broker with caution.

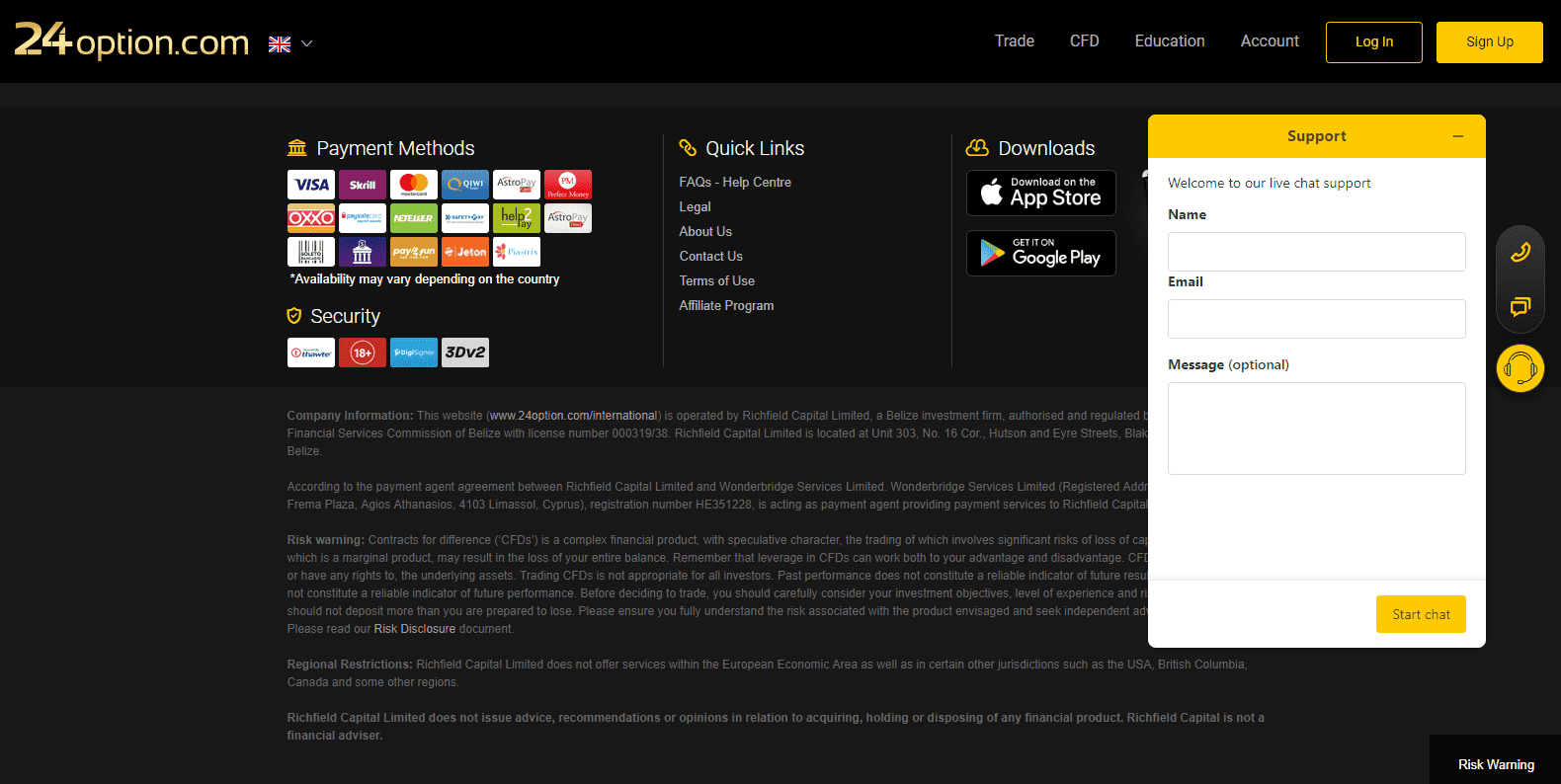

Deposits and Withdrawals

24Option extends its opaque presentation to deposits and withdrawals. In order to obtain fees associated with a financial transaction, traders first need to navigate to the legal section, then follow a link to Richfield Capital Limited. The FAQ section does not provide relevant information, and a dedicated category is missing. The document reveals bank wires, credit/debit cards, Neteller, Skrill, and Perfect Money as options. The home page lists icons of numerous other e-wallet providers, generally restricted and based on geographical location. Withdrawal processing times are within 24 hours, but it may take up to five business days to receive funds.

While 24Option does not mention deposit fees, withdrawal fees remain elevated.

Trading Platform

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

Summary

24Option remains one of a handful of former binary options brokers that made the transition to a CFD broker. After voluntarily renouncing its CySEC license, and with a name change or corporate ownership change (which remains unclear), it now operates out of Belize under IFSC oversight. 24Option does nothing to assure traders that they are no longer the same broker active in the failed binary options market, which attained notoriety for fraud and scams. The lack of complete transparency and absence of a proper introduction to core elements of the trading platform remains unacceptable, serving as a reminder of this broker’s past. It also raises concern if any trading takes place at this market maker, or if a simulated environment exists.

While the asset selection is adequate for retail traders, 24Option fails to inform new traders about it. A backward approach to education, where those who likely need it have limited access versus full access to those who do not require it, continues a practice popular among former binary options brokers. Research provided by Trading Central is the best asset at 24Option. Four account types are maintained, of which only the Basic account represents a reasonably achievable one by retail traders. The other three exist merely for the sake of appearance, in a well-documented move made by questionable brokers which backfired—another ex-binary options leftover. Traders should approach 24Option with extreme caution, and will generally find a more suitable trading environment elsewhere.

FAQs

Is 24Option a scam?

No, this broker operates as a regulated entity out of Belize.

Is 24Option legitimate?

This broker remains compliant with its regulator, the IFSC, though transparency, and a proper introduction of the core trading environment remain a concern. 24Option established itself as a leader in the now-defunct binary options segment, and remnants of the ill-advised practices still exist. Currently, it functions as a legitimate broker, but traders should remain cautious.

How do I withdraw money from 24Option?

Withdrawal options consist primarily of bank wires, credit/debit cards, Neteller, Skrill, and Perfect Money. Icons of regional e-wallet processors noted on the homepage could not be confirmed amid the lack of full transparency.

Who are 24Option?

24Option is a former binary options broker that made the transition to a CFD broker after a global ban on binary options trading, amid fraud and scams. The operating model confirms that 24Option still executes several questionable binary options tactics even today.

Is 24Option regulated?

Yes, the IFSC out of Belize regulates this broker.