The MetaTrader 4 trading platform remains the platform of choice for Forex and CFD traders. We researched more than 1,400 MT4 brokers globally and compiled a list of the best MT4 Forex brokers for you.

Read on to review the best MT4 brokers and make the best choice for you, plus how to choose, and review the key capabilities of the platform for better trading.

Best Metatrader 4 Brokers - Forex Trading Platforms

- AvaTrade, Highly regulated, choice of fixed or floating spreads.

- Pepperstone, Great ECN execution on MT4/5, cTader, TradingView and Pepperstone proprietary platform.

- Eightcap, 1:500 maximum leverage and cutting-edge trading tools.

- IFC Markets, 1:400 maximum Forex leverage with floating spreads from 0.4 pips.

- FXTM, Best all-around broker with high floating leverage and fast execution.

Best MT4 Brokers Comparison

|  |  |  |  | |

Regulators | ASIC, BVI, Central Bank of Ireland, FFAJ, FSCA, KNF, MiFID | ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB | ASIC, CySEC, FCA, SCB | BVI, FSCA, LFSA | CMA, FCA, FSC Mauritius, FSCA, SCA |

Year Established | 2006 | 2010 | 2009 | 2006 | 2011 |

Execution Type(s) | Market Maker | No Dealing Desk, NDD | ECN/STP, Market Maker | ECN/STP | ECN/STP, Market Maker |

Minimum Deposit | |||||

Average Trading Cost EUR/USD | 0.9 pips | 1.1 pips | 1.0 pips | $4.00 | 0.1 pips |

Average Trading Cost GBP/USD | 1.5 pips | 1.4 pips | 1.2 pips | $24.00 | 0.2 pips |

Average Trading Cost Gold | $0.29 | $0.15 | $0.12 | $45.00 | $0.18 |

Trading Platform(s) | Other, MetaTrader 4, MetaTrader 5, Proprietary platform, Web-based+ | Other, MetaTrader 4, MetaTrader 5, cTrader, Proprietary platform, Trading View+ | MetaTrader 4, MetaTrader 5, Trading View | MetaTrader 4, MetaTrader 5, Proprietary platform, NetTradeX | MetaTrader 4, MetaTrader 5, Proprietary platform |

Islamic Account | |||||

Negative Balance Protection | N/A | N/A | |||

| Visit Website | Get Started Visit Website75-95% of traders on margin lose | Visit Website | Visit Website | Visit Website |

AvaTrade

In Summary Highly regulated, choice of fixed or floating spreadsA large broker with $70 billion in monthly trading volume, AvaTrade has the capital to invest heavily in its technology and services and has earned over 30 industry awards as a result.

AvaTrade is a market maker and only charges spreads, not commissions.

AvaTrade is an MT4 Forex broker offering MT4 and MT5. Uniquely, they also make available a Mac version of MetaTrader.

Apart from MetaTrader, they offer two in-house platforms: AvaTradeGO for mobile trading and AvaOptions, designed especially for options traders.

AvaTrade is regulated in several countries, including tier 1 jurisdictions. It holds client funds in segregated accounts separate from the company’s operations.

Pros & Cons

- High quality educational offering via AvaAcademy

- Excellent choice of trading platforms catering to various trading needs

- Broad asset selection and cross-asset diversification opportunities

- Well-regulated and trusted broker with oversight from a central bank

- Trading costs competitive but nothing special

Pepperstone

In Summary Great ECN execution on MT4/5, cTader, TradingView and Pepperstone proprietary platformPepperstone upgrades MT4/MT5 platforms with the 28-plugin Smart Trader Tools package and Autochartist. It also maintains a well-balanced asset selection, including CFDs on Forex indices, cryptocurrencies, and ETFs with competitive trading fees. Forex costs in the commission-based account feature raw spreads from 0.0 pips for a commission of $7.00 per 1.0 standard round lot. A volume-based rebate program also exists. It makes Pepperstone one of the best MT4 brokers within this listing.

Copy trading is available via embedded MT4/MT5/cTrader services, Signal Start, Copy Trading by Pepperstone and DupliTrade depending on jurisdiction.

Pros & Cons

- Excellent choice of trading platforms consisting of MT4/MT5, cTrader, TreadingView and Pepperstone Platform

- Market-leading MT4/MT5 upgrade package, Autochartist, and API trading

- Social trading support via Signal Start, MetaTrader Signals, Copy Trading by Pepperstone, DupliTrade

- Leverage of up to 1:400 depends on jurisdiction and superb trade execution

- Demo accounts have 60-day time limits

Eightcap

In Summary 1:500 maximum leverage and cutting-edge trading toolsBased in Australia, EightCap is a leading global forex broker with a competitive MT4 platform. Founded in 2009, EightCap is considered reliable and trustworthy, based on over a decade’s worth of service and licensing through the much respected Australian Securities and Investments Commission (ASIC), with additional licensing via the Vanuatu Financial Services Commission. As a leading MT4 forex broker, EightCap offers one of the lowest forex fees out of all top Australian forex brokers. This is especially true for clients that choose the Raw account.

Pros & Cons

- Low minimum deposit and high leverage of up to 1:500

- Competitive cost structure

- Excellent technology infrastructure and seasoned management team

- Daily research and quality educational content

- Limited leverage in some areas

IFC Markets

In Summary 1:400 maximum Forex leverage with floating spreads from 0.4 pipsIFC Markets maintains a well-balanced asset selection, including synthetic assets via its patented PQM asset generation technology, integrated with its proprietary NetTradeX trading platform. Traders can also use MT4/MT5 and choose between fixed and floating spread accounts, where the latter includes lower and highly competitive trading fees for NetTradeX and MT5 accounts. Therefore, I rank IFC Markets among the best Forex brokers.

Traders get a maximum leverage of 1:200 with negative balance protection, and the minimum deposit for Standard accounts is $1,000. IFC Markets offers multiple payment processors, including cryptocurrencies, and maintains Bitcoin as an account base currency.

Pros & Cons

- Excellent regulatory track record and secure trading environment

- Outstanding asset selection and patented PQM asset generation technology

- Extremely competitive commission-free trading cost structure

- Valuable research and educational section, low minimum deposit, and high leverage

- No direct support for social trading

FXTM

In Summary Best all-around broker with high floating leverage and fast executionFXTM gives clients a choice of an account with spreads starting at 0 pips plus a commission or an account with a minimum 1.5 pip spread without a commission. Their floating leverage system means leverage can reach as high as 1000:1.

FXTM has independently audited monthly execution speed and slippage statistics published on their website. According to the published data, most FXTM clients receive improved pricing through positive slippage, and the broker offers some of the fastest execution in the industry.

FXTM is a well-licensed MT4 Forex broker offering MT4 and MT5. It also provides its own platform, FXTM Trader.

FXTM is regulated in the UK, Cyprus, and Mauritius. FXTM stores client funds in segregated accounts separate from their operations.

Pros & Cons

- Excellent commission-based Forex pricing environment and transparency

- Upgraded MT4/MT5 trading platforms plus proprietary mobile trading app

- Quality market research and educational content for beginner traders

- A highly regulated broker with a tier-1 license

- Limited choice of commodities

What is MT4?

If you want to trade Forex or any other market, such as equities, commodities, and cryptocurrencies, you will need to connect to your broker electronically.

MetaTrader 4 (MT4) is independent third-party software that connects traders to their brokers. MT4 displays charts and provides technical analysis tools. You can place trading orders directly from MT4.

Today, MT4 is the most popular platform for Forex traders.

In the early 2000s, Forex opened to retail customers, and hundreds of brokers worldwide offered Forex services, often each with their own proprietary platform. Then a company called MetaQuotes recognized the opportunity for a standardized Forex platform (much like Windows did for the personal computer). In 2005, they released MetaTrader 4 (MT4), which brokers could license for a fee. It meant brokers did not have to commit time and money developing their platforms and could focus on providing liquidity and executing trades for their clients. It also meant traders could learn to use a single standardized platform, regardless of which Forex broker they used.

Today, almost all Forex brokers offer MT4—some MetaTrader 4 Forex brokers only provide MT4, others offer a choice of trading platforms.

You can trade a demo account on MetaTrader 4 without having to open a real money account with a broker. If you want to trade with real money and make real profit, you will need to trade with a Forex broker. MT4 does not replace your broker—it is a piece of software to connect you to the broker’s liquidity. You will always need a broker behind the MT4 platform to trade a live account.

What’s the difference between MT4 and MT5?

In 2010, Metaquotes released MT4’s cousin, MT5. Contrary to popular belief, MT5 is not an upgrade of MT4 – instead, it’s a parallel platform. MT4 was designed for Forex traders and traders of other decentralized markets. In comparison, Metaquotes created MT5 to access CFDs, stocks and futures, in addition to Forex. There are other differences between MT4 vs MT5.

Does MetaTrader support copy trading?

Yes, MetaTrader supports copy trading. There is a high number of trade copying providers working with MetaTrader 4.

MetaTrader provides a dedicated website for trade copying with over 1,500 signal providers. You can rank them by historical performance and learn about each signal provider.

In addition to MetaTrader’s own site, brokers and other third-party experts also provide signals and trade copying.

How Do I Choose a MetaTrader 4 (MT4) Broker?

To help you get started in your search for an MT4 broker, here is a step-by-step guide to choosing quality MetaTrader 4 Forex brokers from the Forex brokers with the MT4 platform.

Step 1: Can the broker accept you as a client?

Check if the brokers on your list allow traders from your country. Many MT4 Forex brokers can’t take certain citizens because of countries’ financial regulations. For example, only CFTC regulated brokers can take U.S. persons as clients.

Step 2: Who regulates the broker?

Trading with a regulated and trustworthy broker is necessary, but there are tremendous differences among regulators. Tier-1 regulators, on paper, offer superior protection for less competitive trading conditions, except for brokers regulated in New Zealand.

Offshore regulators often provide the best mix of competitive regulations and trader-friendly trading conditions. The best offshore Forex brokers offer third-party insurance or an investor compensation fund.

Here is my checklist for identifying a trustworthy MT4 broker:

- Check the broker’s license number with the regulator

- Ensure the broker has a clean track record exceeding 10+ years

- Trade with an offshore Forex broker that offers an investor compensation fund or verifiable third-party insurance

Step 3: Are client funds held separately?

An essential requirement for the safety of your funds is that the broker uses segregated accounts, i.e., the broker holds client money separate from their business accounts. Segregated accounts increase the likelihood that clients can withdraw funds safely if the broker goes out of business.

Step 4: How does the broker execute trades?

There are broadly two types of execution or brokers:

- “Market Makers” that use an internal dealing desk and match trades with other clients. Sometimes the broker can take the other side of your trade.

- “ECN” or “Straight-Through-Processing” brokers that connect you directly to their liquidity providers.

There are pros and cons to using either type, for example, differences in trading costs and execution. Do your research and pick the one best suited to your trading needs.

Step 5: How is their customer service?

Traders often overlook customer service, but it can be a crucial part of your trading experience. Can you reach them by phone? Or is it only by email? Can you deposit and withdraw funds easily? Compare customer service levels between brokers to get to your best choice.

Step 6: Test their MT4 demo account

Most MT4 Forex brokers allow you to download a free MT4 demo version of the platform. That means you can practice trading with them without opening and funding a live account. Be aware though that their real money trading conditions may not be the same as what you experience in the demo account, although the platform will obviously work the same.

Why MT4 Is Ideal for Beginners?

MT4 is ideal for beginner traders, as they can access thousands of tutorials on how to trade with a MetaTrader broker. MT4 remains the industry-leading algorithmic trading platform that revolutionized online Forex trading.

Here are three core aspects of the trading platform to consider:

- Simple but effective and highly customizable, allowing beginners to learn the basics and upgrade MT4 to a cutting-edge trading platform as they learn how to trade

- User-friendly, despite its dated design, and it supports many keyboard shortcuts and allows traders to customize the way they wish to trade

- Highly accessible and available at almost every Forex broker industry-wide

MT4 Platforms: Essential Tips for Every Trader

The best MT4 Forex brokers offer traders a choice of a powerful desktop client, a lightweight web-based alternative, and a popular mobile app.

Here are my essential tips for every trader:

- Desktop traders should consider the 25,000+ custom technical indicators and templates and focus on using algorithmic trading solutions (EAs) developed based on their trading strategy

- Mobile app users should consider that mobile apps are ideal for monitoring portfolios, receiving breaking news and updates, and managing copy trading portfolios, but not for analyzing markets and trading

- Web platform traders should consider that the web-based version only supports manual trading

Understanding Trading Costs - Commissions, Spreads, and Fees in MT4

Trading fees are the most defining aspect of any broker, as they directly impact profitability. They determine the competitiveness of the trading environment and reveal which strategies a broker actively supports. Traders will pay frequent trading fees and less frequent non-trading fees.

Trading Fees

- Spreads (the difference between the bid and the ask price, which should not exceed 0.7 pips per lot for major currency pairs in a commission-free pricing environment or raw spreads from 0.0 pips in commission-based alternatives)

- Commissions (if applicable, charged per transaction, should not exceed $7.00 per 1.0 standard round lot for Forex or 0.10% for equities)

- Swap rates (charged on leveraged overnight positions)

- Currency conversion fees (currency conversion fees apply each time a broker exchanges one currency for another, including trading. For example, traders buy a Euro-denominated asset in a US Dollar base account)

Non-trading Fees

- Deposit fees (when traders make a deposit, competitive brokers do not charge internal deposit fees)

- Withdrawal fees (when traders request a withdrawal, competitive brokers do not charge internal withdrawal fees)

- Inactivity fees (when traders are inactive for a certain period, competitive brokers do not charge inactivity fees)

- Currency conversion fees (when the account base currency and the withdrawal currency differ)

MT4 Account Types: Choosing the Right Account for Your Trading Style

Some Forex brokers offer account types based on the execution type. The below table covers the four most common MT4 account types.

Market Maker | STP | ECN | DMA |

Clients trade with the broker’s order book, with the broker the direct counterparty | Client orders are routed directly to liquidity providers | Client orders are matched to prices from several anonymous liquidity providers | Clients trade directly with the interbank market participants |

Here is my verdict:

- Traders should avoid market makers, as they have higher fees

- STP is an execution protocol that is present at ECN and DMA brokers

- ECN is ideal for algorithmic traders

- DMA is best for high-volume traders

How to Set the Optimal Leverage In MT4 for Your Strategy

Leverage is a ratio, with the industry standard for major currency pairs at 1:500, meaning that for $1, traders can transact $500. Risk management defines your maximum loss. For example, if you have a $5,000 portfolio and set a maximum acceptable loss of 2% or $100, leverage of 1:1 or 1:unlimited does not alter the 2%.

Traders often increase the lot size without adjusting their risk management, which causes heavy losses. Therefore, traders must understand the risk management-leverage relationship, comprehend how lot sizes will impact risk management, and how to deploy appropriate risk management before using leverage assets.

The maximum available leverage is the best because a prerequisite for using leverage is understanding how leverage impacts risk management and how to use appropriate risk management. Once traders understand both concepts, they can safely trade with any leverage.

Evaluating MT4 Broker Offerings: Key Features that Make a Difference

Despite varying requirements among Forex traders, the best Forex brokers share similarities in their core trading environment to maintain a competitive edge.

Every competitive Forex broker should offer the following:

- Regulation - A clean regulatory record exceeding 10+ years.

- Low trading fees - Low Forex trading fees, with the EUR/USD not exceeding costs of $7.00 per 1.0 standard round lot or 1.0 pips.

- Trading platforms - MT4 or MT5, as they support algorithmic and copy trading and include a user-friendly mobile app.

- Asset diversity - A balanced asset selection for increased trading opportunities and profit potential.

- Deposits/Withdrawals - No internal transaction fees and low minimum requirements with a choice of e-wallets and preferably cryptocurrency deposits and withdrawals.

MetaTrader 4 Pros & Cons

MT4 Pros

- Once you’ve learned how to use MT4, you can choose from a large selection of Forex brokers with the MT4 platform rather than learning different platforms for each broker.

- You can share templates that include indicators with their settings with other traders regardless of their broker.

- MetaTrader uses very little memory and processing power, meaning it can work on less powerful computers. And it’s available on desktop, iOS, and Android.

- Thousands of programmers write custom indicators and auto-trading programs (Expert Advisors) for MT4 if you want to explore different strategies.

- MetaTrader has excellent security and encryption when exchanging data between you and the broker.

MT4 cons

- Outdated user-interface

- MetaQuotes stopped MT4 support.

MetaTrader Charts

MetaTrader offers one of the most accessible charting interfaces for Forex traders. It’s easy to use and has plenty of tools and functionality.

Let’s go through some basics to get you started.

Pulling up a new chart: File > New Chart. You’ll then get a list of symbols:

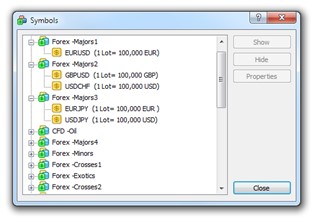

Suppose I can’t find the symbol I want? Assuming the broker offers it, go to View > Symbols or CTRL + U.

Highlight the symbol you want and click “Show.” You can also hide symbols if you feel the list is too long.

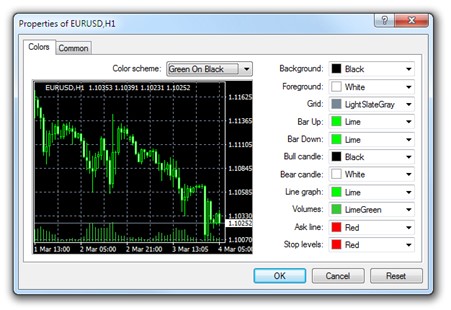

How do I change the chart’s appearance? Chart > Properties or F8.

Experiment and have fun with the chart appearance. For example, I’ve always found the standard chart colours very bright and harsh – I prefer to tone down the colours slightly.

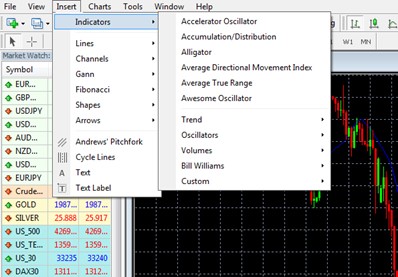

Where do I find indicators on MT4? Go to Insert in the top menu bar, and you will see sub-menus of indicators in the dropdown menu.

Adjusting indicator settings: Click on the chart and then CTRL + I for windows to change indicator settings.

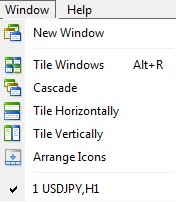

Arranging multiple charts: There are several ways to organize multiple charts, from tiling them to stacking them vertically, and so on.

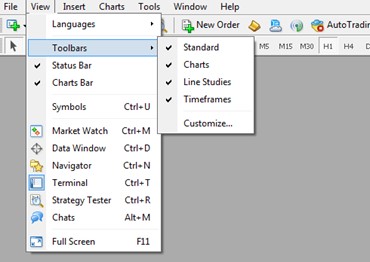

Toolbars: Rather than having to go to a dropdown menu each time you want a tool, you can keep your tools visible at the top by going to Window > Toolbars.

I like to keep all the options checked to see all the tools at a glance, such as timeframes, key technical analysis tools, etc.

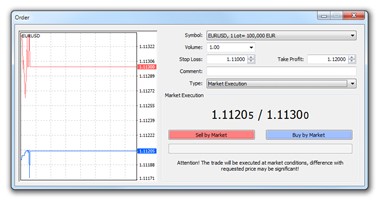

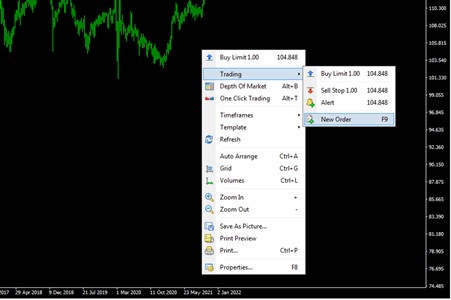

Placing an order: Right-click anywhere on the chart, and go to “New order,” or you can use F9 as the keyboard shortcut.

Is Automated Trading Risky with MetaTrader?

Automated trading is attractive for obvious reasons: you can tap into someone else’s expertise, and it can save you time if you can’t be at the screen for extended periods. But just like everything else related to trading, it can be risky.

Let’s look at the two types of automated trading: expert advisors and trade copying.

What’s an Expert Advisor (EA)?

Expert Advisors are computer programs that run on MT4 and trade according to set rules. That means expert advisors are algorithmic, systematic trading programs.

Custom Indicators & Expert Advisors (EAs)

Traders can upgrade MT4 via 25,000+ custom indicators, templates, and EAs, while MT5 features 10,000+. MT4 remains the industry-leading algorithmic trading platform and offers the most versatile trading infrastructure, including API trading.

Traders can develop custom indicators and use novel trading strategies, creating a competitive edge. Using EAs is one of the core benefits of MT4, but traders should avoid existing EAs, as they usually fail to provide consistent profits. The best way forward is for traders to code their strategy into an EA.

Pros of Expert Advisors | Cons of Expert Advisors |

|---|---|

Easy to backtest. | Rigid rules can sometimes stop working if underlying market conditions change, for example, during an economic shock or unexpected news announcement. |

Entirely systematic and therefore free from bias | To help manage risk, many expert advisors will allow you to change settings, such as adjusting underlying indicator settings and switching the program off for specific Forex pairs if you’re expecting news announcements. |

They can trade around the clock |

To help manage risk, many expert advisors will allow you to change settings, such as adjusting underlying indicator settings and switching the program off for specific Forex pairs if you’re expecting news announcements.

What can you do to help control Expert Advisors’ risks?

- Understand how the EA works. For example, is it better suited to ranging markets? That may help you decide to switch off the program if a specific Forex pair breaks out into a strong trend.

- Always forward test the EA on a demo account first. Keep in mind the trade fills on a demo account may be different from a live account because of slippage – this will matter more for short-term or scalping type expert advisors. To help save time, you can try several expert advisors at once.

- Is the seller’s published track record on a live or demo account? Preferably, you want it to be on a live trading account for two reasons. Firstly, a demo account will have perfect fills with no execution slippage. Secondly, someone could easily test dozens of different settings on their Expert Advisor and then advertise the most profitable, which may not work in the future. This process is known as “curve fitting” – it’s less likely to happen with a live account because the programmer has to fund each account with real cash.

Bottom Line

The MetaTrader 4 trading platform is available at almost every Forex broker and remains by far the most popular retail Forex trading platform. This is good news for every trader wanting to use MetaTrader 4 because there is such a wide choice of suitable brokers. The chances are that any broker you choose to trade with for other reasons will be able to offer you MetaTrader 4.

If you’re still unsure whether you want to trade Forex through the MetaTrader 4 trading platform, it is easy to test whether it is suitable for you by opening a demo account with a MetaTrader 4 Forex broker.