Editor’s Verdict

Overview

Review

Headquarters | Switzerland |

|---|---|

Regulators | FINMA |

Year Established | 2002 |

Execution Type(s) | ECN/STP |

Minimum Deposit | $100 |

Trading Platform(s) | Other, MetaTrader 4 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Advanced Currency Markets (ACM) was founded in 2001 and is the Forex broker branch of the Swissquote Group, which it acquired in October 2010. ACM serves both individual and corporate clients. It is headquartered in Geneva with branches in Zurich, New York, Montevideo and Dubai. It is regulated by Finma and registered as a spot Forex broker in the Seychelles. Although Swissquote is a market maker broker, ACM-FX is an ECN Forex broker and is not a dealing desk.

Accounts

ACM offers a choice of account types, each of which serves as a universal trading tool for work on international financial markets. All accounts provide access to every trading symbol available when working with ACM.

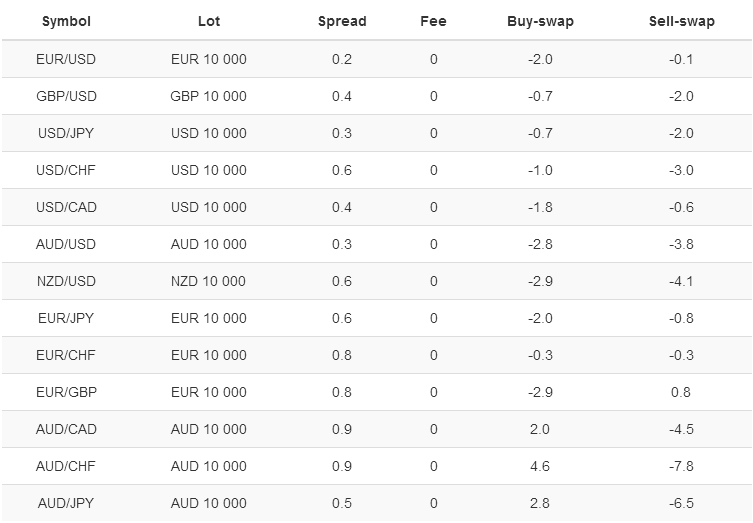

The Mini account requires a minimum deposit of $100 while $10,000 is needed to fund the Standard account. The leverage offered for both account is 100:1.There are no commissions and all fees and spreads are listed clearly on a separate page of the website.

ACM FX Spreads

Standard, Mini and Micro lots are available subject to the leverage and account size leveraged. Hedging or Expert Advisory strategies can be used to enhance trading skills.

Orders are automatically sent directly to liquidity providers using Straight-Through Processing

The demo account is highly regarded at ACM as the broker believes practicing to trade sufficiently on a demo account is the best tool for new traders before moving on to a live account where their money is at risk. Traders can open as many demo accounts as they like totally free.

ACM sets no minimum number of transactions required to maintain an account and accounts are not deactivated for inactivity. Up to 100 trades can be opened at the same time.

A PAMM Account is also offered at ACM and allows experienced traders to manage the funds of investors and receive compensation for their work. $300 is needed in the account in order to get started managing funds and each manager determines the conditions of the account and how the profit will be distributed.

Features

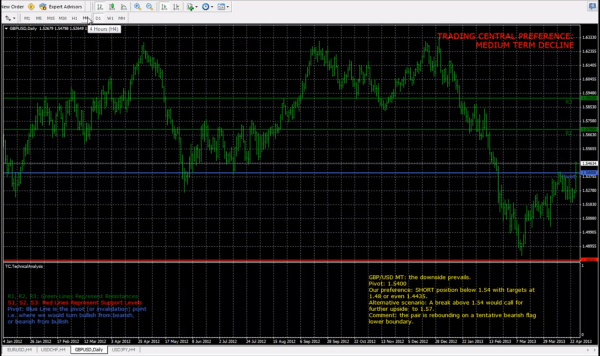

ACM offers the use of Trading Central, a certified member of three Independent Research Providers associations: Investorside Research, Euro IRP and Asia IRP. It is also a Registered Investment Adviser (RIA) with the U.S. Securities and Exchange Commission (SEC).

ACM FX Trading Central

Trading Central is a useful tool for all traders and although it doesn’t give trading signals per se, it predicts the likely direction of the market based on the current conditions. Traders can use forecasts from Trading Central to confirm their hunches, work out their own trading strategies and pick up some of the finer points of technical analysis. Trading Central incorporates a variety of analytical approaches into its forecasting methodology.

Education

ACM believes good education in Forex trading is the key to success and profits and they offer a host of educational tools for all registered account holders.

The beginners course offers basic instruction on Forex trading enhanced by a series of online videos that provide even tutorials for both beginners as well as advanced traders. There is a separate series of classes specifically on ECN and its benefits.

ACM FX Educational Videos

A list of the most important terms in Forex trading is provided and useful trading tips are given in textual lessons. There are also several classes on social trading and how it can be used by traders who wish to gain access to additional trading sources.

There are two ACM eBooks—for beginners and for traders with more experience in Forex trading-- which can be down loaded and read easily online. There is even a third eBook—specifically on how to best use the MT4 trading platform and its benefits.

ACM offers an economic calendar and several calculators—Pivot, Fibonacci, Pip and Deal Size—and there are 6 animated films with full explanations on the use and economic rules of these trading tools.

There are two separate FAQ section. The general FAQ section offers an excellent overview of Forex trading and explains the concept and benefits of it in question and answer form.

The ACM FAQ section provides information on how to trade with ACM and is also in question and answer format. Accounts can be opened directly from this page by clicking on the links provided.

It was surprising that there were no news updates s or any analysis provided. In order to receive a daily online report with technical analysis, key support levels, predictions and forecasts, traders must sign up for a monthly subscription to the ACM newsletter. A free month was offered for all new accounts and the cost of future subscriptions was not listed.

Deposits/Withdrawals

Deposits can be done by using any of the following methods: Bank wire transfer, credit card deposit, Moneybookers or by transferring funds from another existing Forex broker.

Withdrawals can be made by filling in the online withdrawal form. Withdrawals are processed within 1 business day.

Bonuses/Promotions

I was surprised to find that there ACM does not offer any bonuses or promotions. Rather, in their FAQ section, they warn traders to “be wary of “free money” and the firms that offer such incentives.”

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/7 |

Website Languages |

Traders can contact ACM via email and by calling their UK or international telephone numbers which are provided on the site 24/7. Chat is also available.

The website is available in an amazing 85 languages and is easy to navigate. It also has some excellent pictures that are appropriate and attractive.

Conclusion

ACM FX is a solid ECN Forex brokers. It has a host of educational tools and offers its traders the popular MT4 trading platform. The website is easy to navigate and has an excellent presentation.

Features

I was impressed with the ACM FX website. I found the choice of images and pictures tasteful and attractive and navigating between pages was smooth and simple. The host of educational offerings is impressive with both textual and audio lessons in many important areas of Forex trading. It was also nice to see the emphasis placed on using a demo account for a while before opening a live trading account. Most brokers give scant attention to their demo account and offer very little detail about it.

Platforms

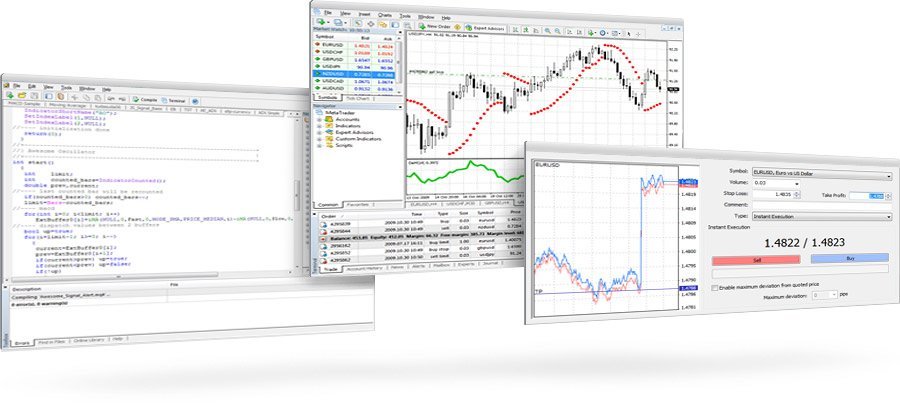

MetaTrader 4

The MetaTrader 4 terminal allows trading in the Forex, CFD and Futures markets. It provides the necessary tools and resources to analyze price dynamics of financial instruments, make the trade transactions, create and use automated trading programs (Expert Advisors).

ACM FX MT4 Terminal

The MetaTrader 4 terminal offers a number of impressive analytical tools. There are nine timeframes available for each financial instrument that provides detailed analysis of quote dynamics. More than 50 built-in indicators and tools help simplify the analysis, enabling to determine trends, define various shapes, determine entry and exit points, etc.

MetaTrader 4 supports three types of operation execution, including Instant Execution. All types of orders are available, ensuring fully-fledged and flexible trading activities. Traders use market orders, pending and stop orders, as well as the Trailing Stop.

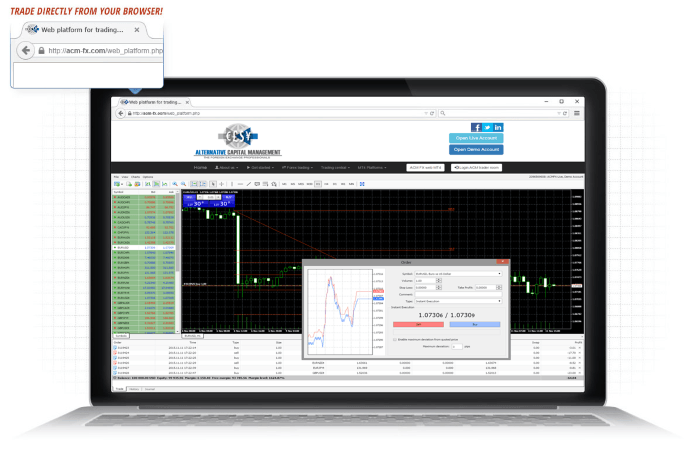

MetaTrader 4 Web

The newly released beta version of the MetaTrader 4 Web Platform allows traders to trade via any browser and operating system without any additional software. The MetaTrader 4 web platform provides trading history, graphical objects, full set of trading orders, 9 timeframes and much more

ACM FX MT4 Web Platform

Mobile

MetaTrader 4 is available for use on mobile devices including iPhones, iPads and is a fully functional Forex trading platform, offering the most critical technical analysis tools (30 technical indicators) and can be used to access financial markets from anywhere in the world, at any time for free.

Trading Platform

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |