ActivTrades Editor’s Verdict

ActivTrades was founded in 2001 in Switzerland but relocated to the UK in 2005. From there, it grew into an international brokerage, presently catering to traders from over 140 countries. With its origin as a Forex broker, it expanded and now maintains over 1,000 CFDs across six categories. Technology fulfills a critical role at ActivTrades, as evident in intensive investment in the trading infrastructure and its development team in Bulgaria.

Overview

In April 2017, in a special supplement to the UK Sunday Times, ActivTrades was recognized as the 90th fastest growing company in the UK.

Headquarters | United Kingdom |

|---|---|

Regulators | CNMV, CONSOB, FCA, FSC Mauritius, SCB |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2001 |

Execution Type(s) | Market Maker |

Minimum Deposit | $0 |

Negative Balance Protection | |

Trading Platform(s) | Other, MetaTrader 4, MetaTrader 5, Proprietary platform, Trading View |

Average Trading Cost EUR/USD | $10.00 |

Average Trading Cost GBP/USD | $14.00 |

Average Trading Cost WTI Crude Oil | $0.06 |

Average Trading Cost Gold | $42.00 |

Average Trading Cost Bitcoin | $101.00 |

Retail Loss Rate | 83.00% |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | 0.5 pips |

Minimum Commission for Forex | Commission-free |

Funding Methods | 6 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Regulation and Security

Country of the Regulator | Brazil, The Bahamas, Italy, Mauritius, Portugal, United Kingdom |

|---|---|

Name of the Regulator | CNMV, CONSOB, FCA, FSC Mauritius, SCB |

Regulatory License Number | 434413, 199667 B, 43.050.917/0001-03, 433, 198, GB24203277 |

Regulatory Tier | 4, 1, 1, 1, 4, 2 |

ActivTrades PLC is regulated by the UK's Financial Conduct Authority (FCA), which serves as the primary authority for this broker. An office was established in Milan, Italy, and registered with the Italian Companies and Exchange Commission Commissione Nazionale per le Società e la Borsa (CONSOB). ActivTrades Corp is the broker's Bahamian subsidiary, authorized by The Securities Commission of the Bahamas. While client funds remain segregated, and UK portfolios enjoy the protection of Financial Services Compensation Scheme (FSCS) up to £85,000 (in the event of the broker's default), ActivTrades additionally maintains Excess of Loss insurance coverage with a limit of £1,000,000 for the UK subsidiary and $1,000,000 for all other accounts. Negative balance protection is equally available to all retail traders. ActivTrades is also regulated in Mauritius, Portugal, and Brazil. Registered in Mauritius with the Licence number GB24203277, authorised and regulated by The Financial Services Commission, Mauritius.

ActivTrades provides a genuinely safe and secure trading environment.

The Excess of Loss insurance coverage indicates a strong fiscal position and enforces the protection of client deposits.

Fees

Average Trading Cost EUR/USD | $10.00 |

|---|---|

Average Trading Cost GBP/USD | $14.00 |

Average Trading Cost WTI Crude Oil | $0.06 |

Average Trading Cost Gold | $42.00 |

Average Trading Cost Bitcoin | $101.00 |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | 0.5 pips |

Minimum Commission for Forex | Commission-free |

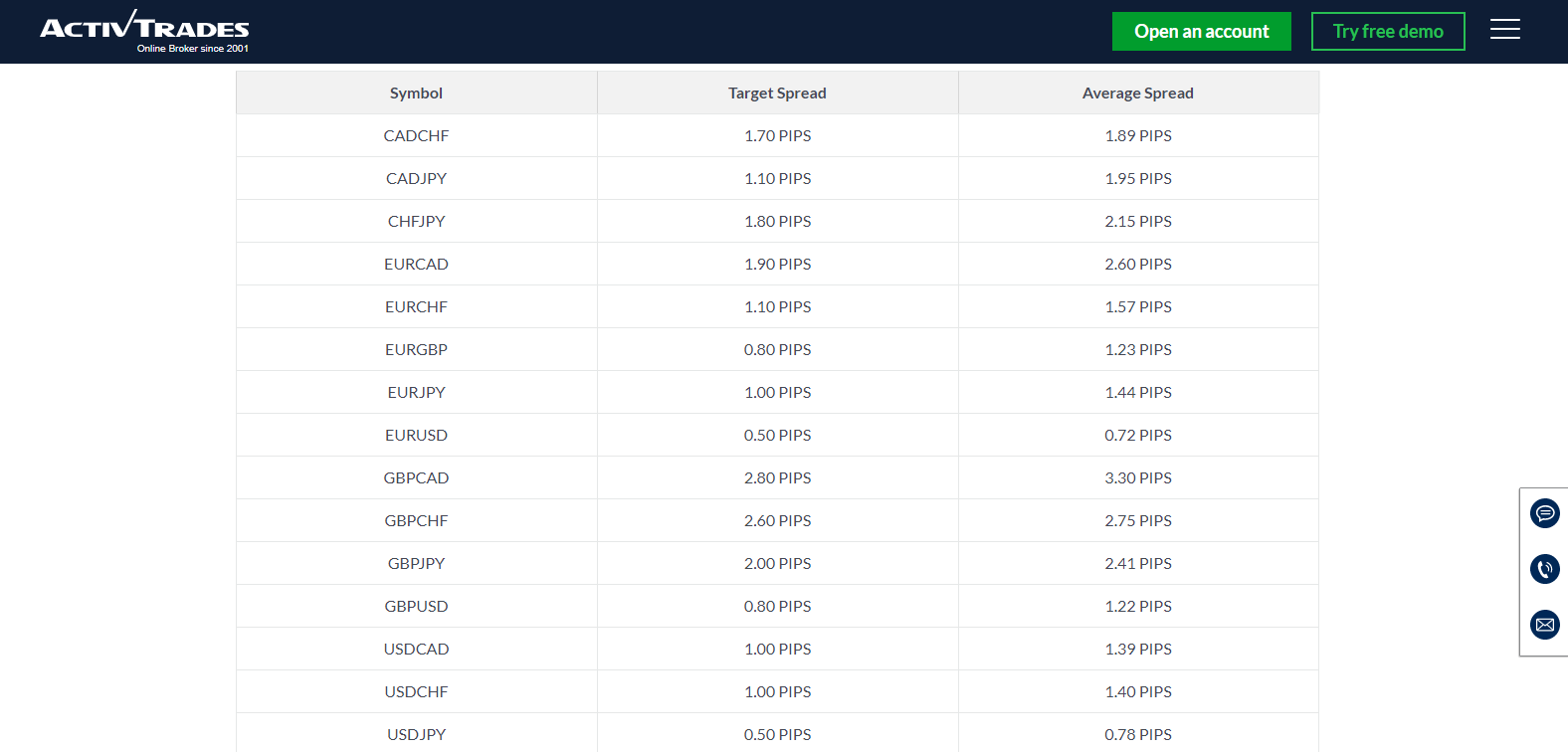

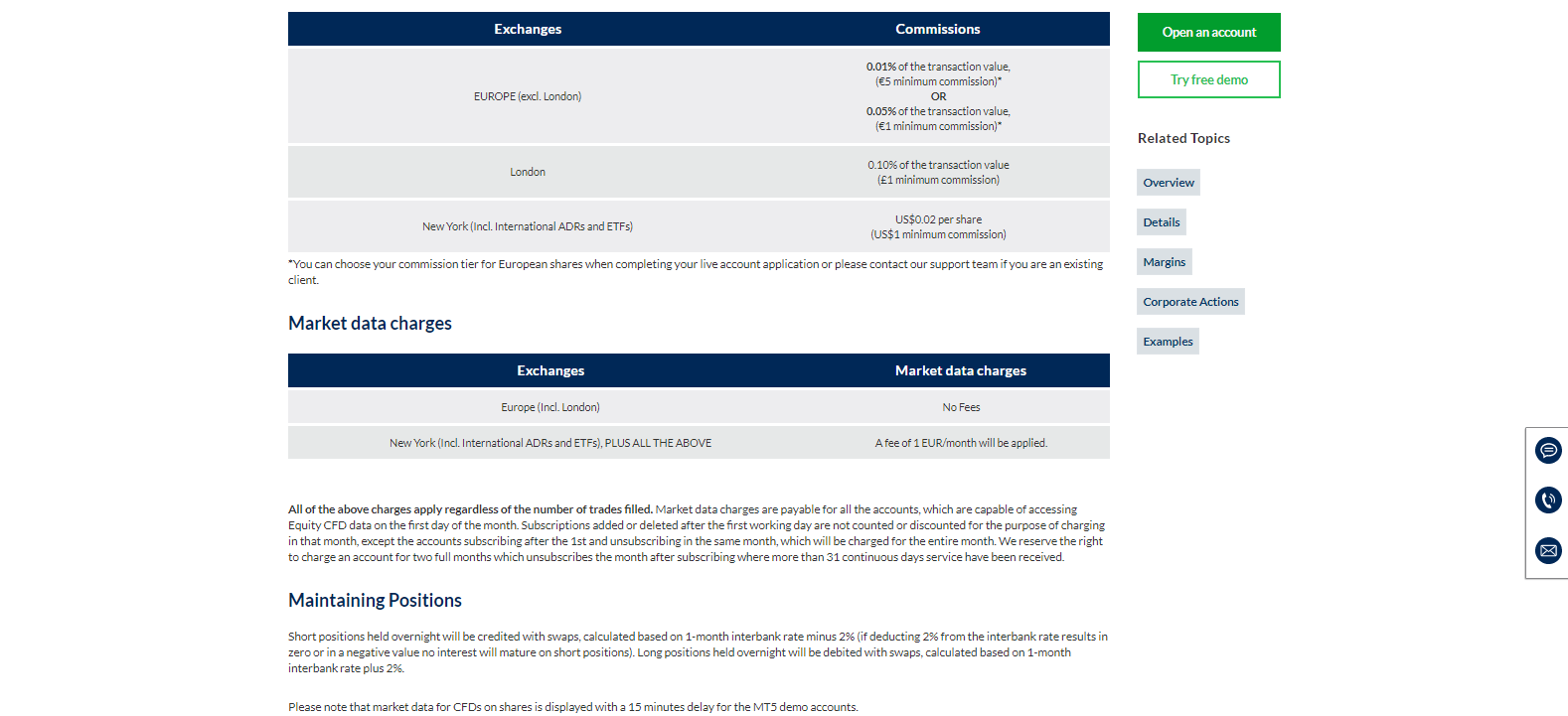

Currency pairs are commission-free, where the EUR/USD carries an average spread of 0.72 pips, representing a competitive offer. US equity CFDs carry a minimum commission of $1 or $0.02 per share, UK CFDs carry a commission of £1 or 0.1%, and European shares carry a commission of €1 or 0.01%. It should be noted that this broker also charges its clients €1 per month for market data, which is not a significant charge. Swap charges on leveraged overnight positions apply, and can be obtained directly from the trading platforms. Equity and index CFDs are exposed to corporate actions, suitably described on the website. Third-party charges for deposits and withdrawals exist.

Currency pairs are acceptably priced and remain free of commissions.

Equity CFDs commissions exist; traders should familiarize themselves with additional costs.

What Can I Trade

Pure Forex traders will find the 48 currency pairs, representing only entry-level exposure, rather disappointing. Cross-asset diversification is possible through 15 commodities, while over 450 equity CFDs are maintained. Complementing them are eight cash index CFDs, 16 forward indices, and seven bond CFDs. Completing the asset selection are 24 ETFs. Most retail traders will find the overall choice suitable, while advanced and professional traders, as well as fund managers, will swiftly encounter limitations.

ActivTrades maintains an acceptable asset selection, suitable for most retail traders.

Account Types

All clients are treated equally from an identical CFD account without a minimum deposit. UK traders are provided with a tax-free spread betting account, while an upgrade to professional status is listed under the FCA regulated brokerage. Trading conditions from the Bahamas subsidiary are equal to that of the UK professional account. A free demo account is maintained, and an Islamic account is available upon request for a minimum deposit.

All traders receive access to the same CFD account and trading conditions.

The FCA regulated entity offers a professional account upgrade.

Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

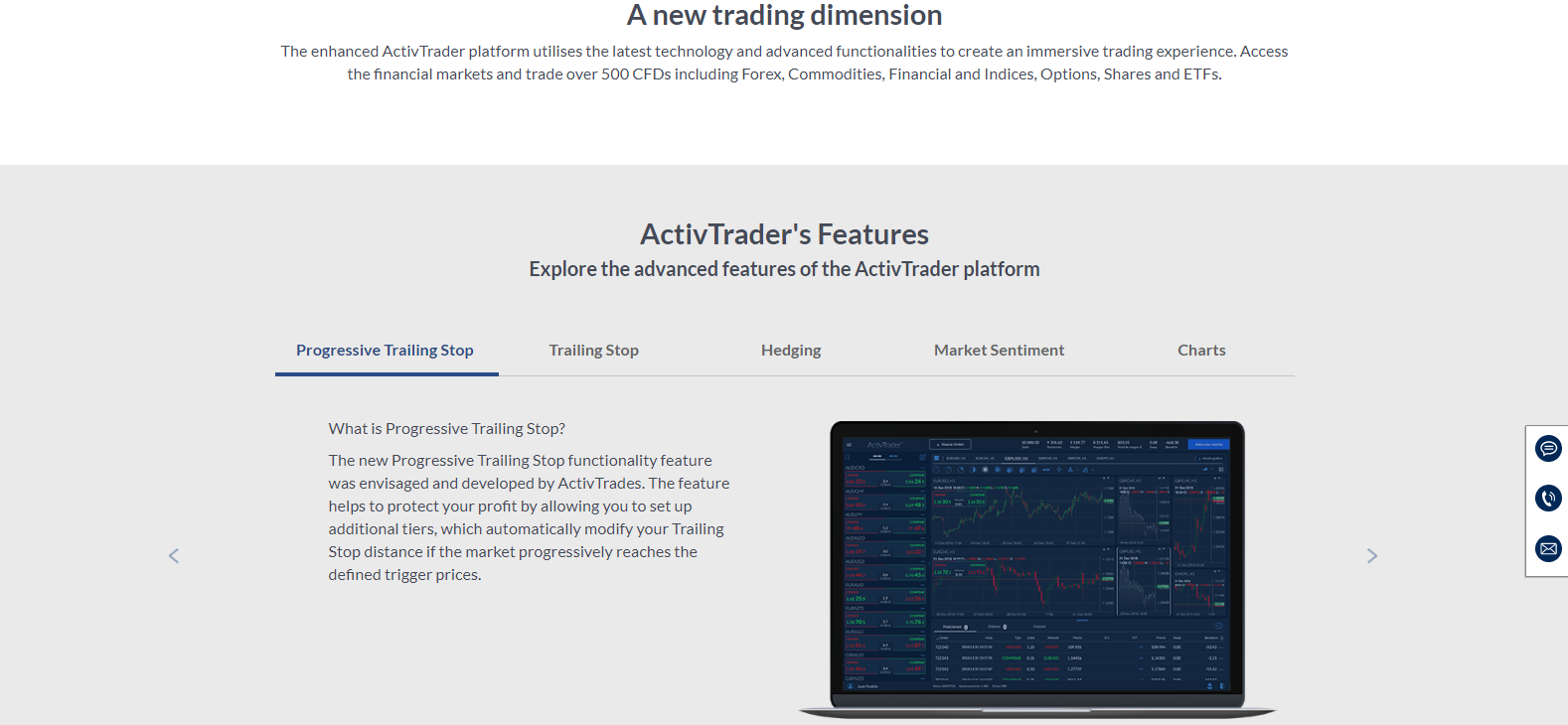

Traders without existing trading solutions developed in the MT4 infrastructure may find ActivTrader, the proprietary trading platform offered by this broker, visually appealing. While it allows for the most inclusive trading environment it is available only as a webtrader. Moreover, the ActivTrader platform lacks support for automated trading solutions, rendering it an acceptable choice only for manual traders. ActivTrades does feature the MT4 trading platform, together with its failed successor, the MT5.

The Smart Tool suite upgrades the basic version of the MT4 platform and transforms it into a powerful trading portal. It can be further modified with thousands of third-party plugins, which fully supports automated trading solutions, and represents an overall superior choice. Unfortunately, not all assets may be available in MT4. Traders may opt to split their portfolio and utilize ActivTrader together with MT4 for an optimized approach, which unlocks the full potential available.

ActivTrader, the proprietary trading platform, provides a sound choice for manual traders.

The MT4 trading platform fully supports automated trading solutions.

MT5, the failed successor version of MT5, is equally available.

Unique Features

Despite having developed a proprietary trading platform, ActivTrades demonstrates their commitment to the MT4/MT5 trading platforms with seven unique add-ons available for all live accounts. The upgraded MT4 allows traders access to a more superior gateway than that which is provided in the proprietary ActivTrader. The add-ons, labeled Smart Tools, include automated chart pattern recognition, which is a tremendous tool, especially for retail traders who may lack resources and access to a proper trading team. Smart Tools represents the most valuable asset this broker provides.

Smart Tools, consisting of seven add-ons, transform the MT4 trading platform into a powerful gateway to financial markets.

Research and Education

In-house research is generated by three analysts who provide brief trading ideas daily. While the content is acceptable, it remains far below the quality of competing brokerages. The Smart Tools suite provides clients with more valuable research than the published content of the analytics team. Education is available via one-to-one training, which represents an excellent service to new traders. A video library covers MT4 introductory topics, and manuals covering all trading platforms are available. Webinars discuss more advanced topics and may be accessed from the website. ActivTrades additionally hosts events in key financial centers, and the overall educational division provides outstanding service.

The published research is acceptable but inferior to competing brokerages.

One-to-one training sessions provide exceptional value for new traders.

The video library covers MT4 related topics.

Webinars cover more advanced content.

ActivTrades also hosts events in Europe and Asia.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |            |

Customer support is provided 24/5 and easily accessible via live chat. Traders may also e-mail, call, or request a free callback. An FAQ section attempts to answer basic questions, while a glossary covers fundamental terminology. The legal section hosts all required documents.

Customer support is readily available and given high marks by clients

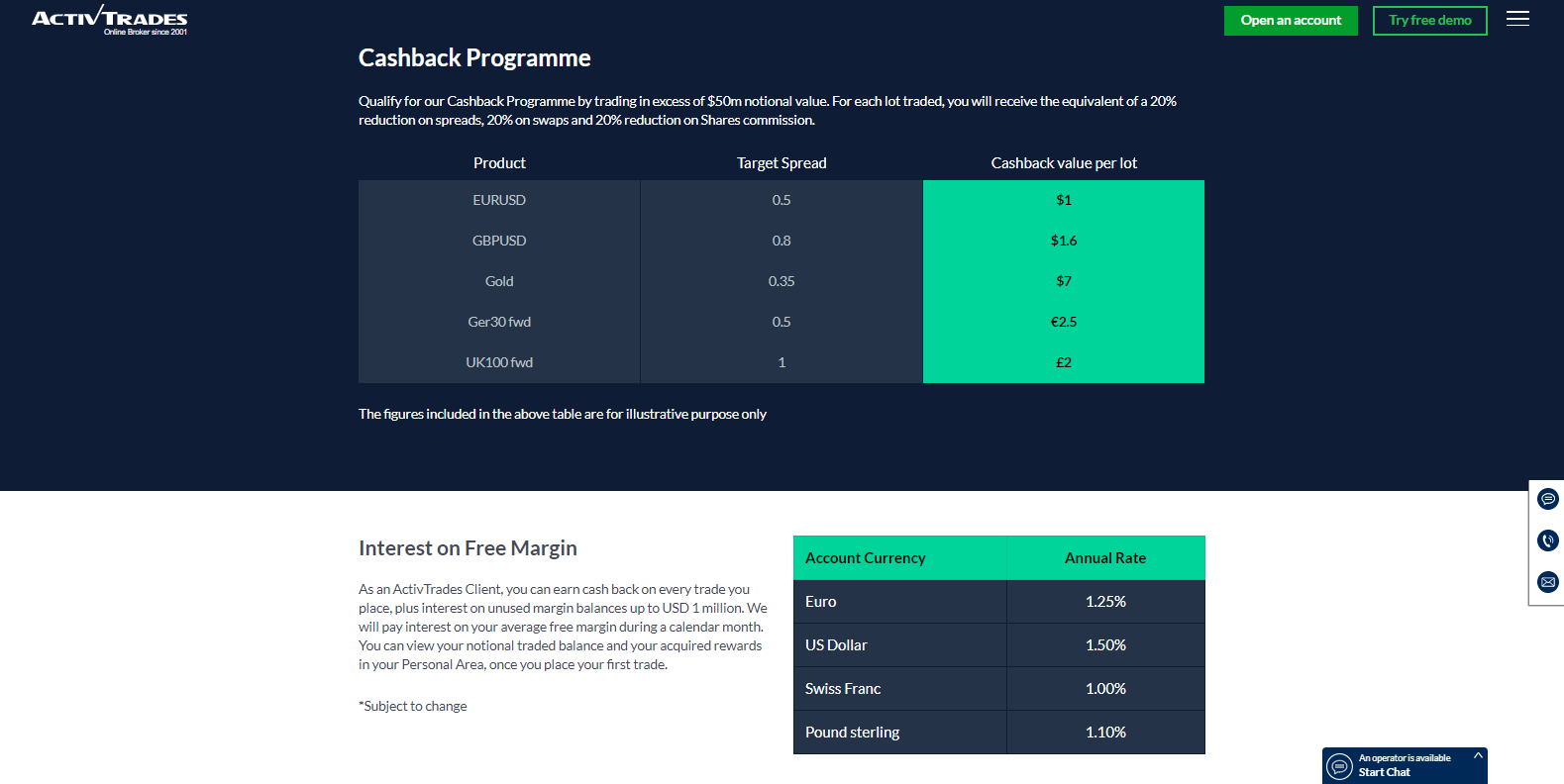

Bonuses and Promotions

ActivTrades features a cashback program for traders who exceed $50 million in notional trading value. Interest is paid on available free margin; however, both reward programs are available only for traders from the Bahamas operating subsidiary.

Cashback and free margin programs

Opening an Account

Following industry standards, new accounts are opened via an online application. After new traders obtain access to the back-office, verification is mandatory as stipulated by regulators to satisfy AML/KYC requirements. A copy of the trader's ID and one proof of residency document generally completes this step.

Account opening procedures are in line with the industry

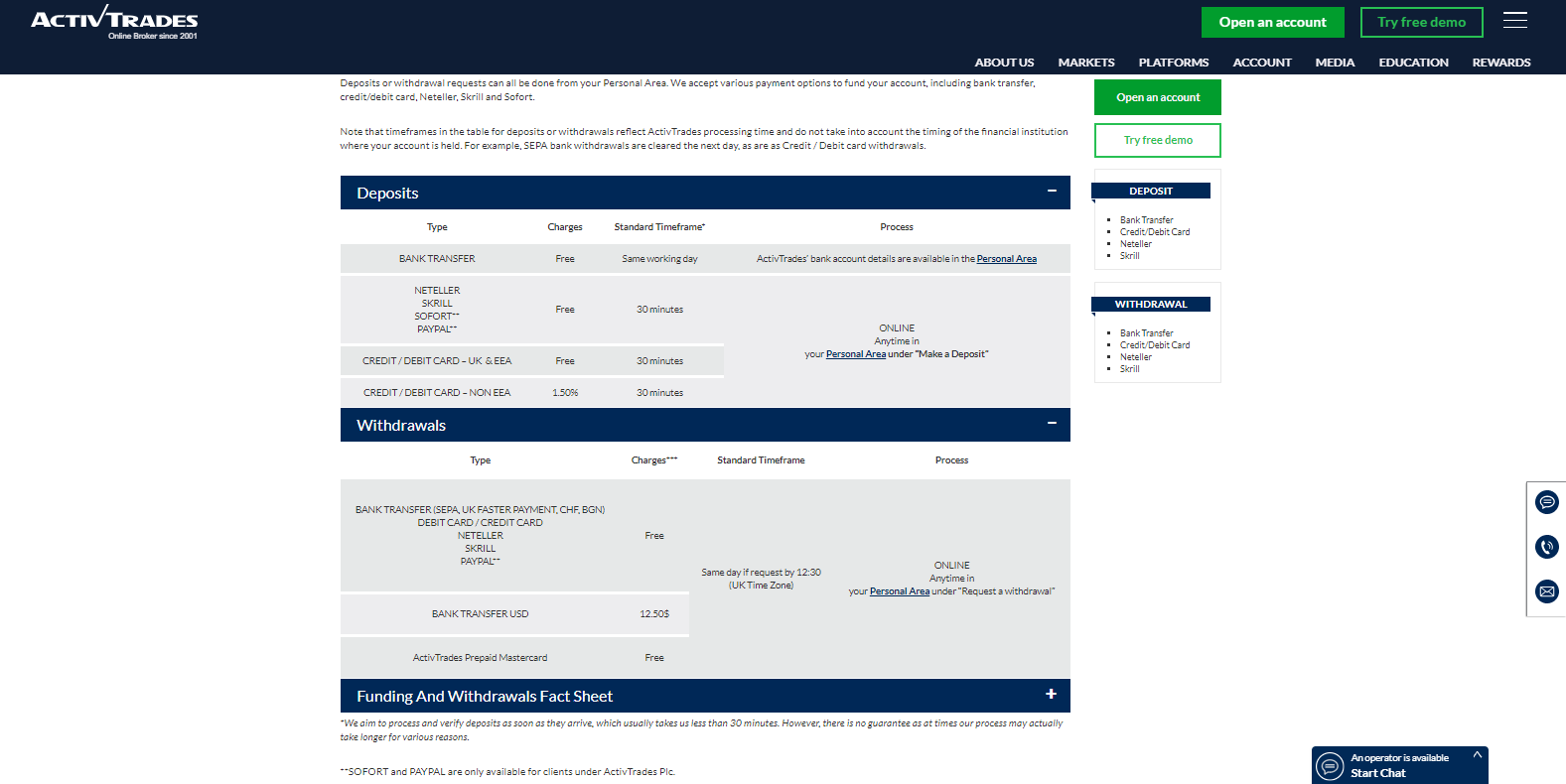

Deposits and Withdrawals

Traders may choose between bank wires, credit/debit cards, Skrill, Neteller, Sofort, and PayPal. ActivTrades differentiates between UK and EEA traders, and traders from other jurisdictions. The availability of options is dependent on geographic location, as are fees associated with deposits and withdrawals. An ActivTrades Prepaid MasterCard is listed under withdrawal options, but no further details are provided. The name on the trading account and payment processor must be identical to comply with AML regulations.

Deposit and withdrawal options

Summary

ActivTrades has been in operation since 2001 and provides superior protection of its client funds up to £/$1,000,000. The pricing structure and asset selection are acceptable, though the Bahamas subsidiary provides a far superior trading environment than the UK one. New traders are provided with an outstanding educational division, while in-house research is below average. A proprietary trading platform is available, but the MT4 platform, together with the Smart Tools upgrade, provides traders with greater value. Overall, ActivTrades represents a genuine choice for portfolios managed under the Bahamas subsidiary. The untapped potential makes this broker one to monitor for future developments, while it deserves to be part of a well-diversified brokerage selection.

FAQs

Is ActivTrades a scam?

This broker is regulated in and compliant with two regulators and, therefore, a legit broker.

What is the maximum leverage granted by ActivTrades?

Leverage is dependent on various factors, but the Bahamas based subsidiary grants leverage up to 1:1000.

What is the minimum deposit required at ActivTrades?

Accounts may be opened with as little as $10 or a currency equivalent.

What is the ActivTrades commission?

US equity CFDs carry a minimum commission of $1 or $0.02 per share, UK CFDs carry a minimum commission of £1 or 0.1% and European CFDs carry a minimum commission of €1 or 0.01%.

What is the minimum ActivTrades spread?

The EUR/USD carries an average spread of 0.72 pips, which is the lowest available.