Editor’s Verdict

Alpari is a well-known and trusted broker with an ultra-competitive cost structure, MT4/MT5 trading platforms, and PAMM accounts with a low minimum investment of $50. Autochartist upgrades the trading experience, while 13 payment processors ensure traders have options, including localized ones. The Nano MT4 account is ideal for beginners to learn how to trade or for seasoned traders to test new strategies. I conducted an in-depth review of Alpari and focused on the subsidiary operating from Comoros to determine if this broker provides a competitive edge. Is Alpari the best broker for your portfolio?

Overview

Ultra-low trading fees and PAMM accounts from $50 plus Autochartist for MT4/MT5.

Headquarters | Saint Vincent and the Grenadines |

|---|---|

Regulators | MWALI International Services Authority |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 1998 |

Execution Type(s) | ECN/STP, Market Maker |

Minimum Deposit | $500 |

Negative Balance Protection | |

Trading Platform(s) | MetaTrader 4, MetaTrader 5 |

Average Trading Cost EUR/USD | 1.1 pips ($11.00) |

Average Trading Cost GBP/USD | 1.2 pips ($12.00) |

Average Trading Cost WTI Crude Oil | $0.06 |

Average Trading Cost Gold | $0.27 |

Average Trading Cost Bitcoin | $56.50 |

Retail Loss Rate | Undisclosed |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 0.8 pips |

Minimum Commission for Forex | $1.60 per 1.0 standard round lot |

Funding Methods | 12 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

I like the low trading fees in the Alpari ECN accounts. The loyalty program is an excellent service for active traders and lowers trading costs further. The PAMM infrastructure is excellent, allowing traders to start with as little as $50. The 25+ years of experience is a testament to the reliability of Alpari, which established itself as a competitive Forex and equity CFD broker.

Alpari Regulation and Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders check for regulation and verify it with the regulator by checking the provided license with their database. Alpari has two regulated subsidiaries with a superb corporate owner.

Is Alpari Legit and Safe?

Alpari, founded in 1998, is one of the pioneers of online Forex trading. My review focused on the Comoros subsidiary, regulated by the Mwali International Services Authority. Another subsidiary operates with a regulatory license in Mauritius. I also want to note the superb corporate owner, Exinity Group, run by Andrey Dashin.

Alpari is a Hong Kong-based Financial Commission member, where clients get an investor compensation fund of up to €20,000 per claim, putting it on par with EU-based Tier-1 regulators. Client deposits remain segregated from corporate funds, and negative balance protection for retail traders applies.

I rate Alpari highly in areas of legitimacy due to its 25+ years of operational experience and trust amid excellent corporate ownership by Exinity Group and Andrey Dashin.

Fees

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability. Alpari has numerous account types with three distinct cost structures, ranging from competitive to ultra-competitive. Commission-free Forex fees are as low as 0.2 pips or $2.00 per 1.0 standard round lot. The commission-based alternatives come with minimum raw spreads of 0.0 pips and average ones of 0.3 pips plus a $1.60 commission for trading fees between $1.60 and $4.60 per lot. The volume-based rebate program lowers trading fees for active traders, and swap rates on leveraged overnight positions are competitive.

Average Trading Cost EUR/USD | 1.1 pips ($11.00) |

|---|---|

Average Trading Cost GBP/USD | 1.2 pips ($12.00) |

Average Trading Cost WTI Crude Oil | $0.06 |

Average Trading Cost Gold | $0.27 |

Average Trading Cost Bitcoin | $56.50 |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 0.8 pips |

Minimum Commission for Forex | $1.60 per 1.0 standard round lot |

The minimum trading costs for the EUR/USD at Alpari are:

Minimum Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

|---|---|---|

0.8 pips (Nano MT4/ Standard MT4/MT5) | $0.00 | $8.00 |

0.2 pips (ECN MT4) | $0.00 | $2.00 |

0.0 pips (Pro ECN MT4/ECN MT5) | $1.60 | $1.60 |

The most ignored trading costs are swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

MT4/MT5 traders can access swap rates from their platform by following these steps:

1. Right-click the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights in the commission-based Pro account.

Taking a 1.0 standard lot buy/sell position in the EUR/USD, at the average spread and holding it for one night in the Pro ECN MT4 account will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

|---|---|---|---|---|

0.3 pips | $1.60 | -$9.23 | X | $13.83 |

0.3 pips | $1.60 | X | $2.11 | $2.49 |

Taking a 1.0 standard lot buy/sell position in the EUR/USD, at the average spread and holding it for seven nights in the Pro ECN MT4 account will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

|---|---|---|---|---|

0.3 pips | $1.60 | -$64.61 | X | $69.21 |

0.3 pips | $1.60 | X | $14.77 | -$10.17 |

Noteworthy:

- Alpari offers positive swap rates on qualifying assets, allowing traders to earn money, like in the example above.

Here is a snapshot of Alpari’s trading fees:

Range of Assets

Alpari offers 46 currency pairs, 28 cryptocurrencies, 5 commodities, and 20 indices. It also advertises 600+ equity CFDs, all listed in the US. The overall range of assets is above average for all sectors except Forex and commodity CFDs. I wish Alpari would provide ETFs, especially given its focus on PAMM accounts. I like the asset selection for scalpers, as Alpari offers many highly liquid trading instruments with deep liquidity and tight spreads.

Commodities | |

|---|---|

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

ETFs | |

Futures | |

Synthetics |

Alpari Leverage

Maximum Retail Leverage | 1:3000 |

|---|---|

Maximum Pro Leverage | 1:3000 |

Alpari offers maximum Forex leverage of 1:3000 in its ECN accounts, 1:1000 in the Standard alternatives, and 1:500 for its Nano option. I like that Alpari has a tiered structure, increasing the margin requirement and lowering the maximum leverage based on total position volume and asset liquidity. Cryptocurrency and equity CFD traders max out at 1:5, but select commodity and index CFDs get maximum leverage up to 1:500.

Negative balance protection ensures traders cannot lose more than their deposits. Traders must always use appropriate risk management with leveraged trading to avoid magnified trading losses.

Account Types

Alpari lists six account types plus associated PAMM options, and the most notable differences are trading fees, asset availability, minimum deposit requirements, and maximum leverage tiers. The Nano MT4 account is ideal for beginners to learn to trade in a live trading environment. The Standard MT4 and MT5 options add equity CFD trading and standard lot sizes. However, MT5 has a minimum deposit requirement of $100 versus $20 for MT4.

Trading costs improve in the ECN MT4 account, which requires a $300 minimum deposit. I recommend the commission-based Pro ECN MT4 alternative for Forex traders and the Pro ECN MT5 for equity CFD traders, as they feature the lowest trading costs, and the minimum deposit requirement is a reasonable $500. They are also competitive choices for scalpers and algorithmic traders.

Swap-free Islamic accounts are available, and all account types except for Nano MT4 are eligible for PAMM accounts. Account base currencies are USD and EUR.

Alpari Demo Account

Alpari offers demo accounts for MT4 and MT5, which require a quick application and verification of an e-mail or phone number. There is no expiry on the Alpari demo account, and traders can customize settings like account balance and leverage. I advise traders to select parameters similar to planned live portfolios for a more realistic demo trading experience. Alpari added functions to its demo account to simulate live conditions, including virtual deposits, leverage changes, and deletion of old accounts. It confirms that Alpari understands the requirement of demo traders for beginners and seasoned traders.

I want to caution beginner traders when using demo trading as an educational tool, and they should consider the limitations. Demo trading does not grant exposure to trading psychology and can create unrealistic trading expectations.

Trading Platforms

Traders at Alpari get the core MT4/MT5 trading platforms upgraded via the Autochartist plugin, which offers actionable trading signals. MT4 is the industry leader in algorithmic trading, while MT5 emerged as the dominant choice for equity CFD traders. Traders can upgrade MT4 via 25,000+ custom indicators, plugins, and EAs, but quality upgrades are not free. Both trading platforms are available as customizable desktop clients. At the same time, Alpari opted against the web-based alternative and developed its proprietary mobile app in favour of the MT4/MT5 solution. The Alpari mobile app offers a user-friendly solution for Android and iOS devices. It is an ideal option for copy traders and PAMM investors. Alpari also offers a secondary mobile app, Alpari Invest, a custom solution for PAMM investors and copy traders, featuring one-click investments.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Unique Features

Among the unique features of Alpari, besides its low commission-based trading fees, are the PAMM accounts. Alpari notes 4,000 PAMM accounts with 60,000+ active investors, making it an industry leader in this category. I also like the Alpari loyalty program and cashback rebates. It improves the competitiveness for active, high-volume traders and lowers low trading fees further. One of the best things about the four-tier loyalty program is that it depends on cumulative account balances across all accounts rather than deposits, which creates one of the fairest programs I have ever reviewed.

Research and Education

Autochartist handles the bulk of market research and actionable trading signals. Still, Alpari complements it with high-quality in-house research, which includes trading ideas. Each analysis features a chart, and Alpari describes its analysis well while keeping it short, allowing traders to follow a recommendation. The research section remains well-structured, divided into Forex, cryptocurrencies, commodities, equities, and metals.

Beginner traders get a wide range of articles, divided into trading strategies, cryptocurrencies, investments, trading psychology, financial market analysis, and one section labelled "other." It presents a sound introduction but needs more depth. It will benefit from video content, webinars, and a classroom-style beginners course.

Therefore, beginners should consider the Alpari introduction before consulting online educational resources available for free. I recommend they begin with in-depth content covering trading psychology and the relationship between leverage and risk management while avoiding paid-for courses and mentors.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | M-F 24/5, SS 1200 - 2000 |

Website Languages |         |

Alpari offers customer support via live chat, Telegram, phone, and webform, but I need help finding support operating hours. I recommend live or phone support for urgent matters. Still, I need a direct line to the finance department, where most issues can arise. Alpari describes its products and services well, but the FAQ section answers only a few questions. Before contacting a customer services representative, I recommend browsing the forums, where clients may find their answers and engage with the Alpari community.

Bonuses and Promotions

During my review, Alpari only provided a low-paying refer-a-friend promotion and advertised that deposits are free. The loyalty program, including cashback rebates and the low trading fees in the commission-based account types, are superior long-term benefits to any bonus or promotion.

Opening an Account

Alpari has one of the fastest online applications I have encountered. It only asks for a name, e-mail, and valid mobile phone number. Alpari will send a PIN to verify the mobile phone, which grants access to the back office. I appreciate that Alpari does not engage in unnecessary data mining as part of its registration process.

Alpari fully complies with its regulator and global AML/KYC requirements, meaning account verification is mandatory. Most traders will satisfy it by uploading a copy of their government-issued ID and one proof of residency document. Alpari may ask for additional information on a case-by-case basis.

Minimum Deposit

The Alpari minimum deposit depends on the account type and ranges between $0 and $500.

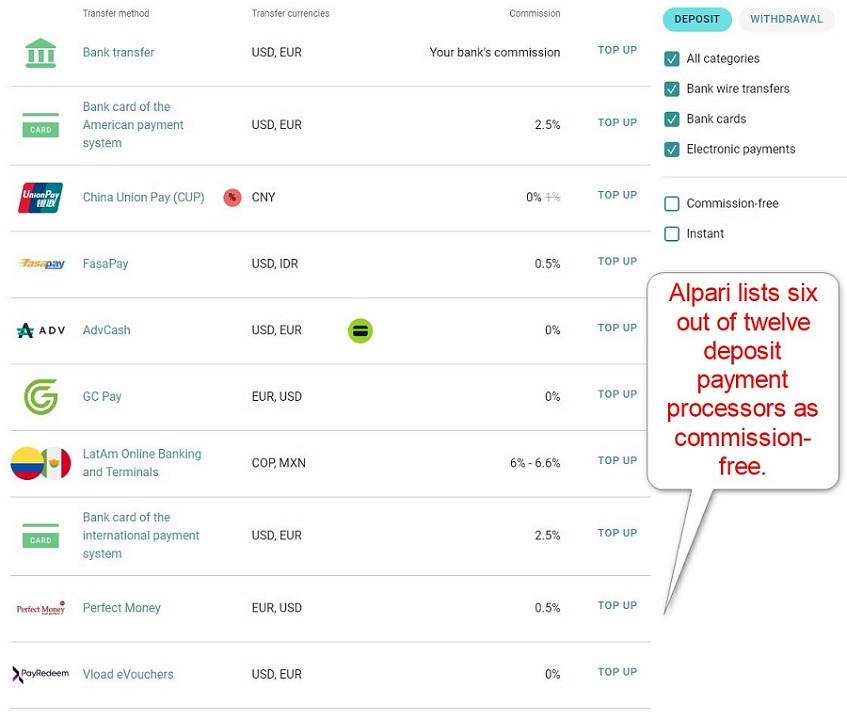

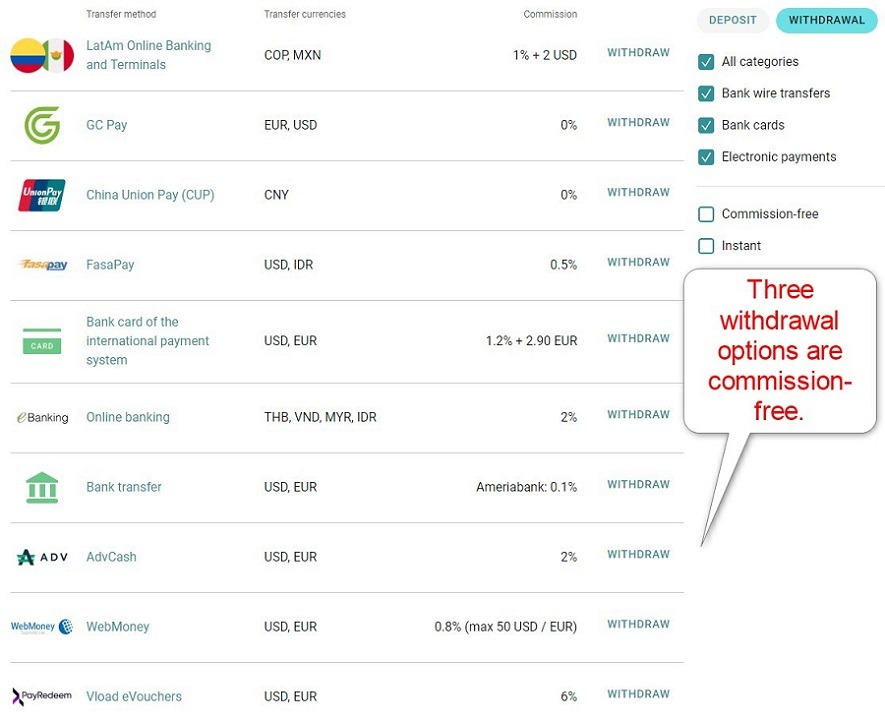

Payment Methods

Alpari payment methods consist of bank wires, credit/debit cards, China Union Pay, FasaPay, AdvCash, GC Pay, local LatAM online banking and terminals, Perfect Money, V Load e-vouchers, Asian online banking solutions, WebMoney, and TC Wallet.

Accepted Countries

Alpari accepts clients resident in most countries except the USA, Japan, Canada, Australia, the Democratic Republic of Korea, the European Union, the United Kingdom, Iran, Syria, Sudan and Cuba.

Deposits and Withdrawals

The secure Alpari back office handles all financial transactions for verified clients.

Alpari offers twelve payment processors, including localized methods for many of its core markets, ensuring traders can conduct hassle-free deposits and withdrawals. During my review, six deposit methods and three withdrawal options remained free of internal fees. Traders should consider potential third-party payment processing fees, currency conversion charges, and follow-on transaction costs. Alpari supports nine deposit and withdrawal currencies, easing financial transactions for several markets across Asia and Latin America. I am only missing cryptocurrency support.

Withdrawal processing times are within one business day for e-wallets, while Alpari credits most e-wallet deposits instantly. The name on the payment processor and Alpari trading account must match in compliance with AML regulations. Overall, deposits and withdrawals at Alpari are fast and convenient.

Is Alpari a good broker?

I like the Alpari trading environment for its low trading fees in its commission-based trading accounts, the loyalty program and cashback rebate program, the PAMM investment infrastructure, including its dedicated mobile app, and the choice of payment options. Alpari also upgrades the MT4/MT5 trading platforms with the Autochartist plugin. With 25+ years of operational experience and 2M+ clients, Alpari established itself as a trusted broker and partner. I highly recommend it to active traders, US equities-focused investors, and PAMM account managers.

FAQs

How does Alpari (Comoros) LTD work?

Like every broker, Alpari provides products and services to traders and derives its revenues from spreads and commissions.

How do I withdraw money from Alpari (Comoros) LTD?

The back office of Alpari (Comoros) LTD includes a section for deposits and withdrawals. The account name on the payment processor and the Alpari (Comoros) LTD account must be identical.

Does Alpari (Comoros) LTD accept US clients?

No, Alpari does not accept US clients.

How do I deposit to Alpari (Comoros) LTD?

Alpari’s payment methods consist of bank wires, credit/debit cards, China Union Pay, FasaPay, AdvCash, GC Pay, local LatAM online banking and terminals, Perfect Money, V Load e-vouchers, Asian online banking solutions, WebMoney, and TC Wallet.

Is Alpari (Comoros) LTD regulated?

Yes, Alpari Comoros has a regulatory license issued by the Mwali International Services Authority.