BullionVault Editor’s Verdict

BullionVault, founded by Galmarley Limited in 2003 and partially-owned by the World Gold Council (11.4%) and Augmentum Capital (11.4%), is the largest online precious metals investment service in the world. It is home to over 85,000 clients from over 175 countries, with total holdings in excess of $2 billion in stored bullion across five vaults.

Overview

BullionVault was twice awarded the Queen’s Award for Enterprise honors; it is a full member of the London Bullion Market Association and the London Platinum and Palladium Market.

Headquarters | United Kingdom |

|---|---|

Year Established | 2003 |

Minimum Deposit | None |

Trading Platform(s) | Web-based |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

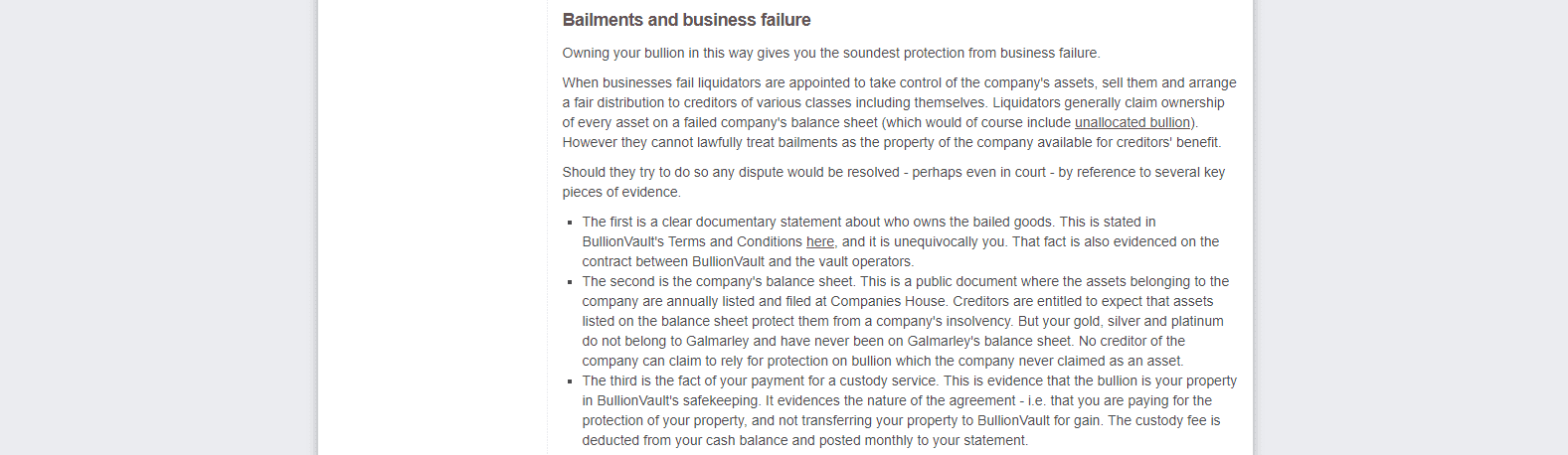

Regulation and Security

Galmarley Limited is a company registered in England and Wales. BullionVault LTD, its wholly-owned subsidiary and operator of the website, is separately registered in the same jurisdictions. An audit of all assets across vaults, along with the nicknames of clients, is published daily, which allows owners to confirm their holdings. Three independent professional bullion market vault operators and LBMA security transport companies manage the five vaults where the precious metals are stored. Extensive physical security measures and an external insurance policy ensures the safety and security of the physical assets. Should BullionVault, or any of the operators, file for bankruptcy, a liquidator will return the assets to the owners, as ownership always remains with clients.

BullionVault offers highly secure gold, silver, and platinum trading and storage services.

In the case of business failure, a liquidator will return all assets to the owners.

Fees

BullionVault derives its fees from spreads, commissions, custody fees, and interest receipts. The mark-up on gold and silver is generally higher than that charged by most other brokers, though platinum is competitively priced. Commissions commence from 0.50%, but can be as low as 0.05%, depending on volume. An annual storage and insurance fee, 0.12% for gold, and 0.48% for silver and platinum, respectively, exists.

A bank wire fee of $30 applies, and a monthly 0.75% holding fee for Euros applies from August 2020. Additional charges, such as a $20 phone-assisted password change and a $50 fee to change bank account information, appear unnecessary. More penalties, which include repeated small deposits of less than $100 (or currency equivalent), or the unauthorized use of a credit/debit card, are deducted from the account balance.

BullionVault is completely transparent about all involved costs.

Spreads are generally more elevated as compared to many other brokers.

What Can I Trade

BullionVault offers traders the opportunity to buy physical gold, silver, and platinum bars. All bars are continuously held in professional bullion storage facilities, maintaining the chain of integrity, and the full history of each bar is available. Bar sizes for gold can be 400 troy ounces, 100 troy ounces, or one kilogram (32.1507 troy ounces). Silver bars are 1000 troy ounces and platinum bars range between one and six kilograms. Buyers may purchase assets in US Dollars, British Pounds, Euro, or Japanese Yen.

Gold, silver, and platinum are the three precious metals available at BullionVault.

Account Types

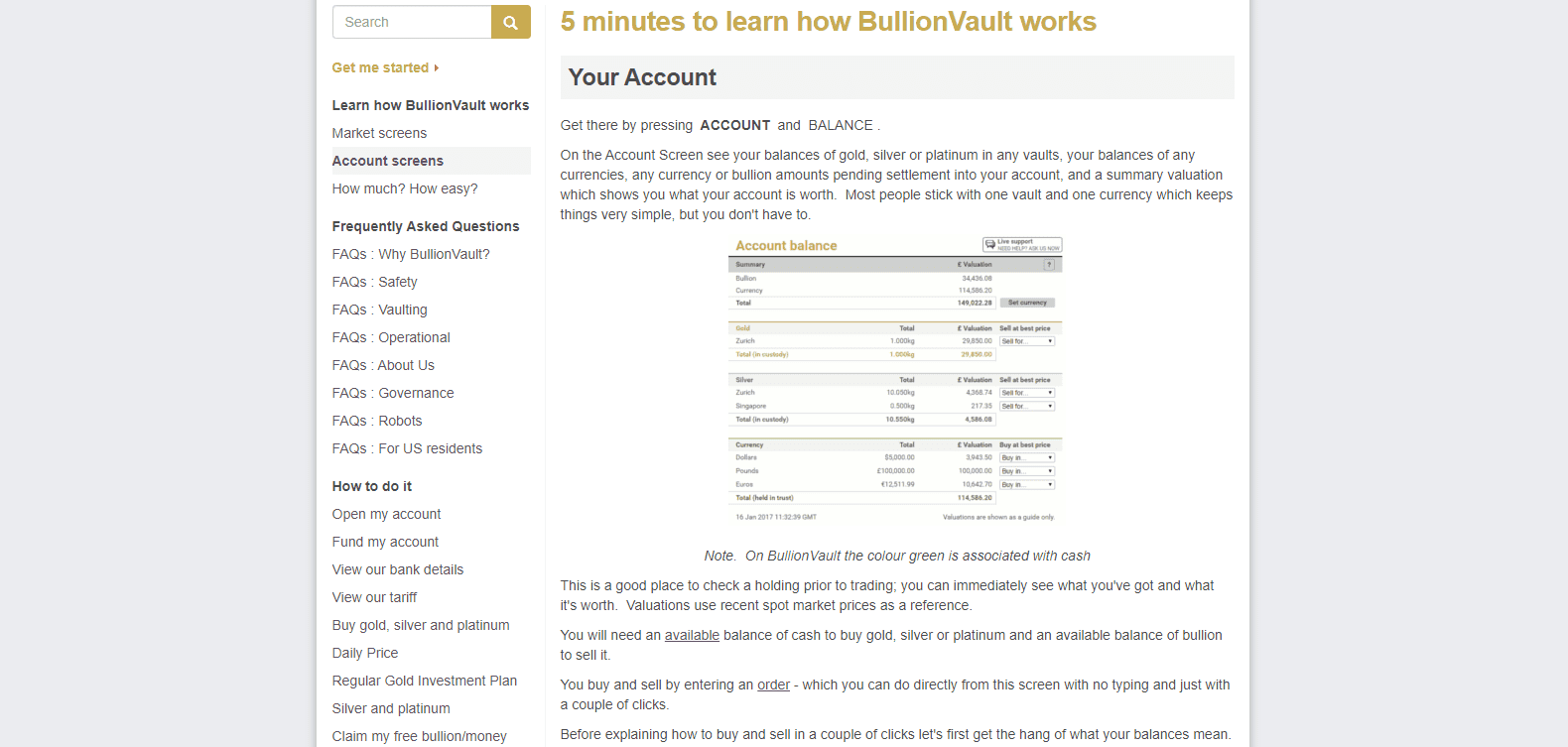

The same account type is available to all clients. While there is no minimum deposit, more than four sub-$100 deposits (or the currency equivalent of it), will be charged according to the fees incurred by BullionVault. There is no leverage, as buyers purchase physical assets stored in actual vaults. The account displays all assets and cash but resembles more of an enhanced spreadsheet than a modern user-interface.

The BullionVault account looks and functions like a spreadsheet.

Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

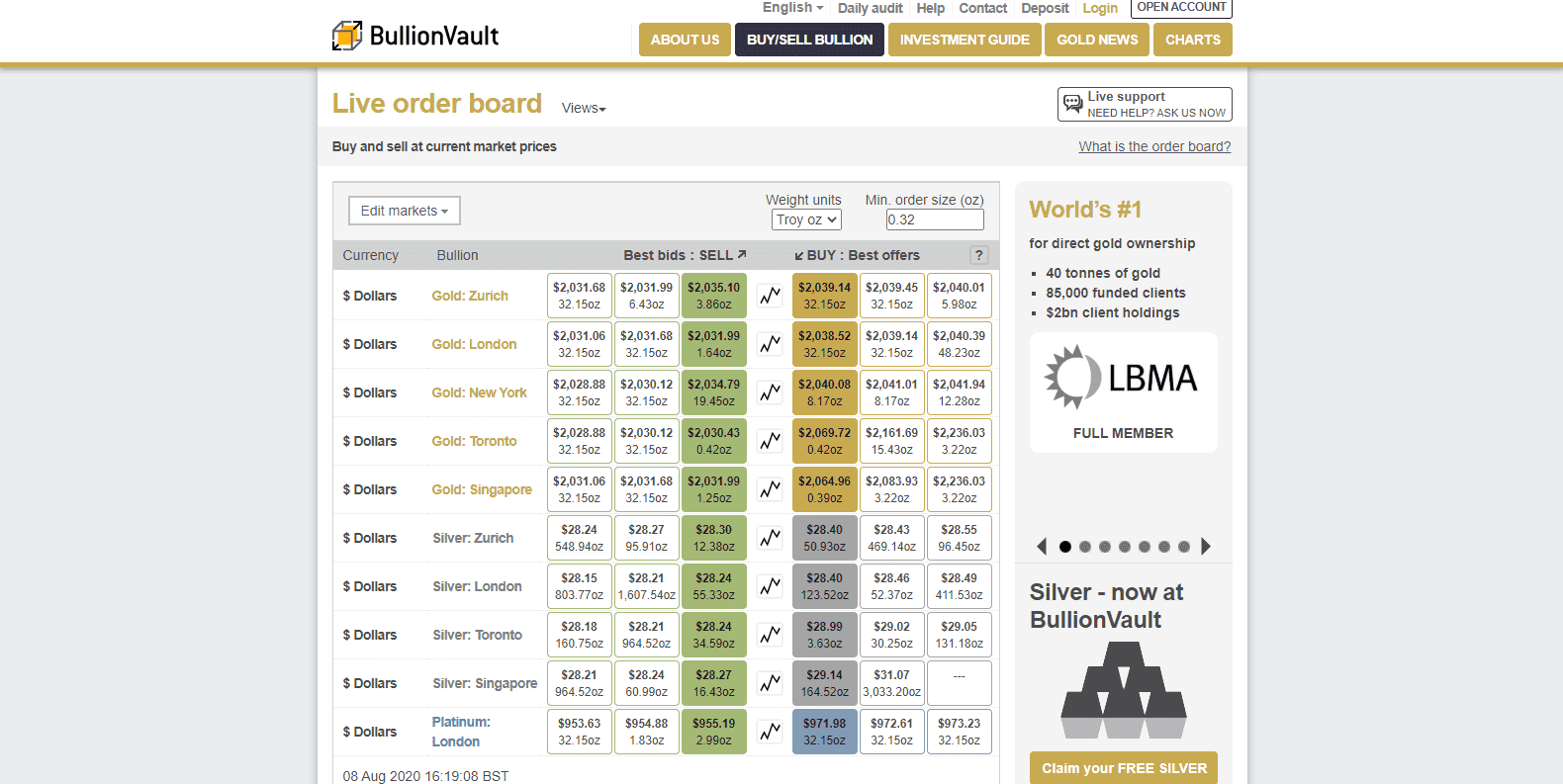

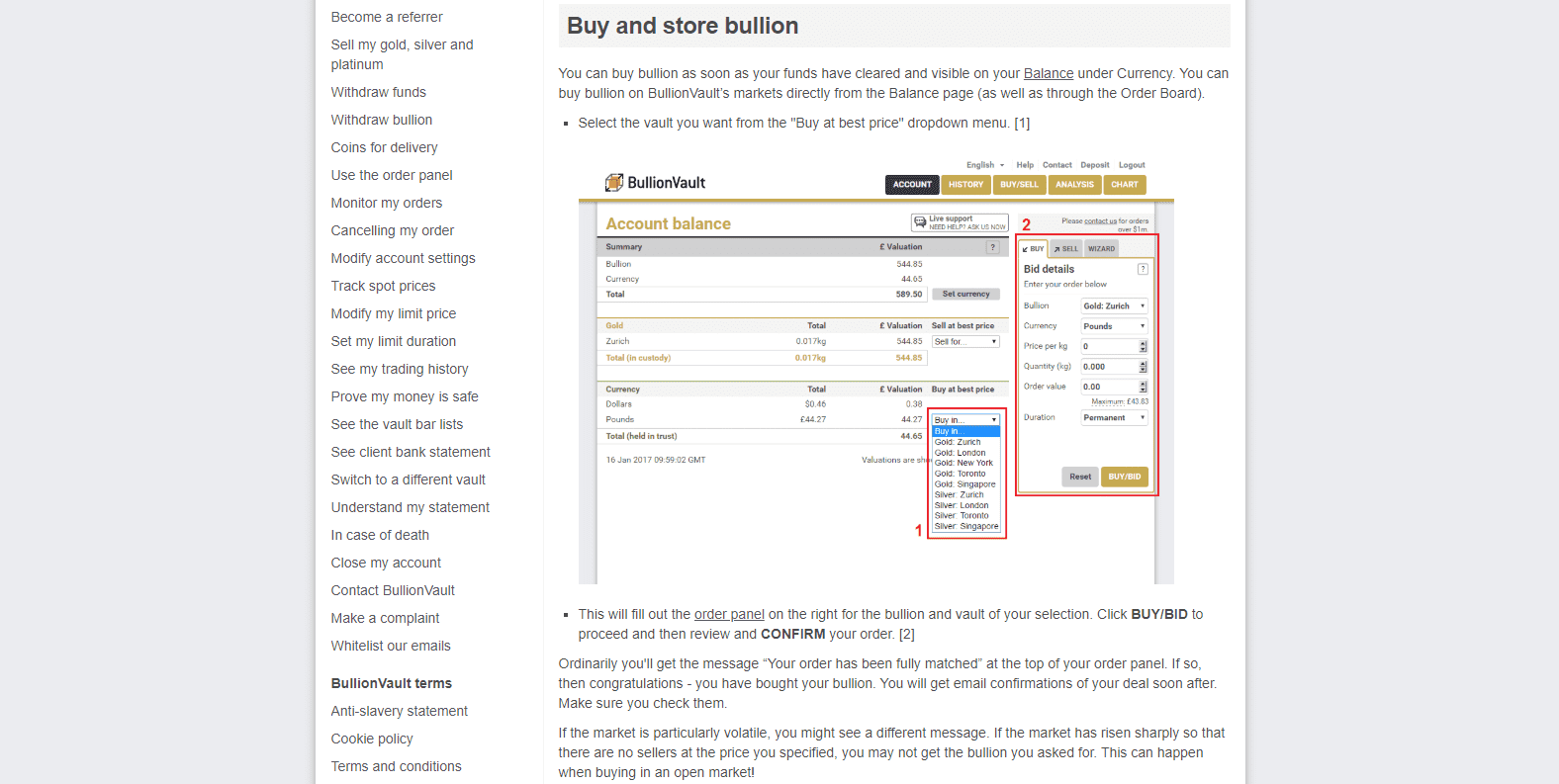

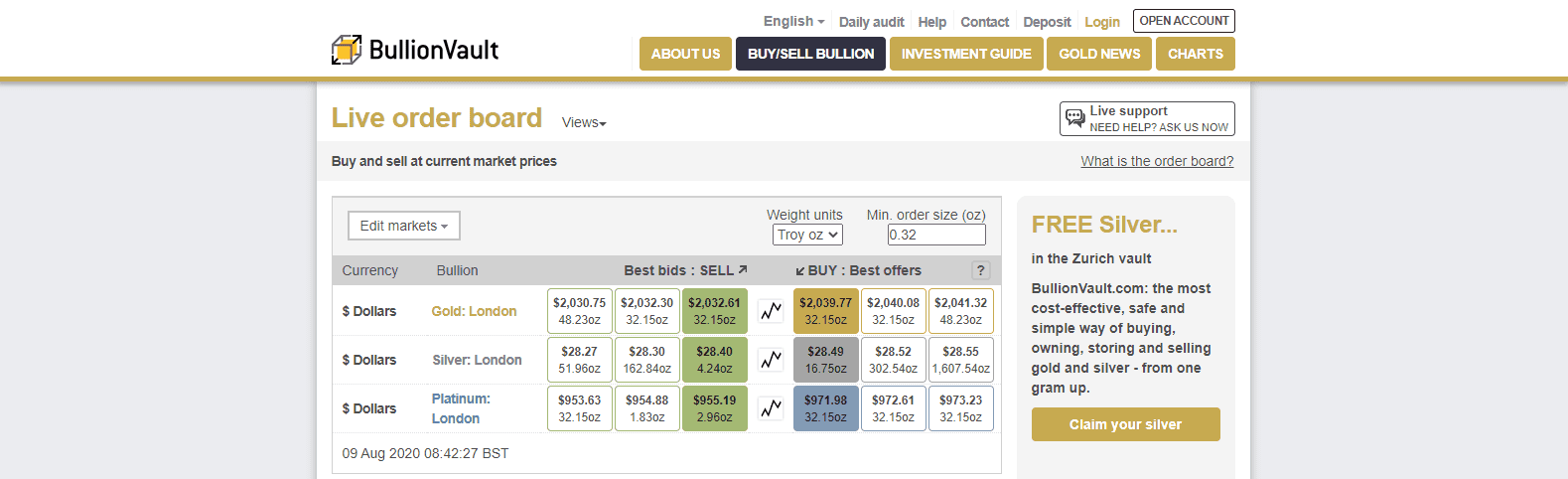

BullionVault does not feature a traditional trading platform and only has three assets available for trade. Buy and sell orders are placed from the account via a drop down menu where traders can select which asset to purchase from which market. The Live Order Board displays the current bid/ask prices without allowing order placement, and the charts lack an analytics feature. In order to trade, a client needs need to navigate to three different sections of the website, rendering the approach highly disorganized. It is solely available as a transaction-only entity to store physical assets under a bailment agreement.

A trading platform is not available, and drop down menus handle order placement.

The Live Order Board indicates price levels only.

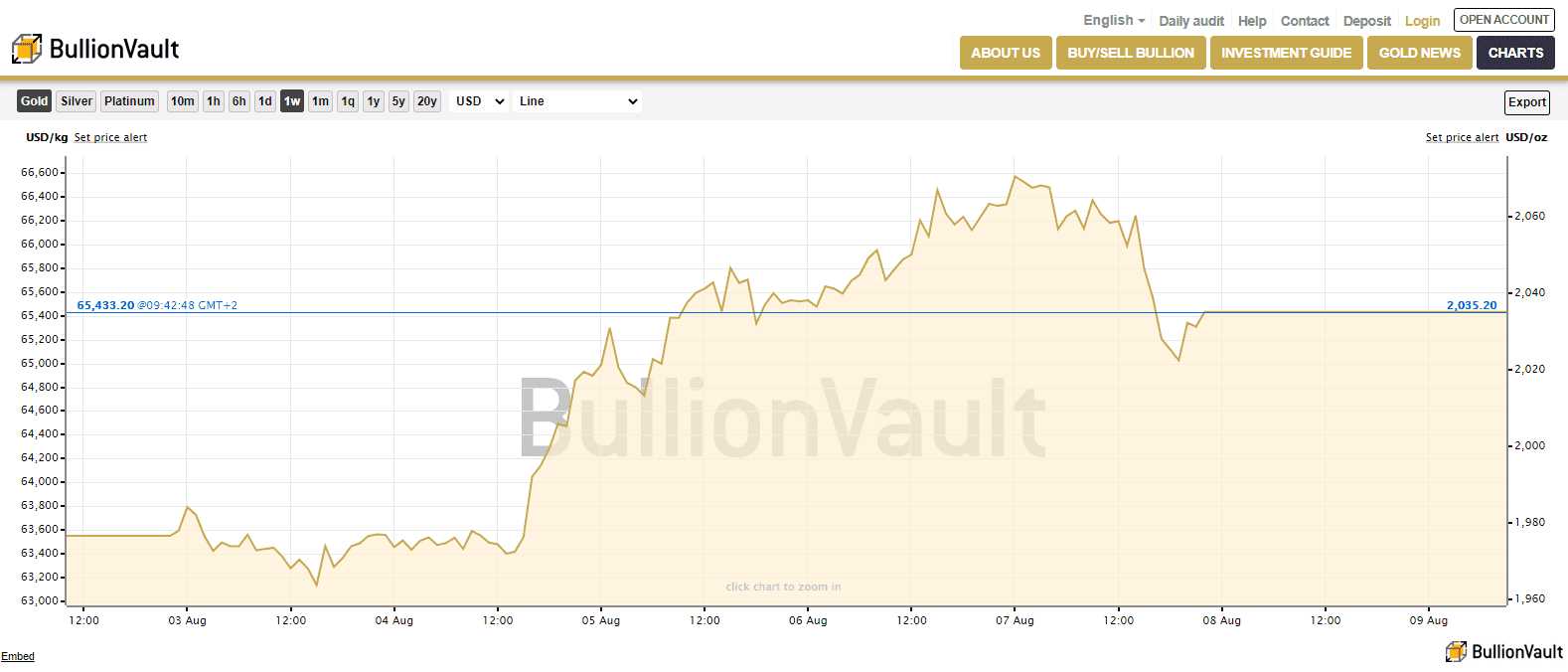

Charts, without analytic tools, exist at another location of the website.

Unique Features

The absence of the most basic analytics and account management tools, together with the disorganized approach to trading, are, regrettably, the unique features at BullionVault.

Research and Education

Market research is absent at BullionVault, which merely maintains a Gold News section, populated with relevant content and an acceptable starting point for fundamental news traders. Proper education is equally absent in a disappointing misstep. The Investment Guide is an FAQ section with a glossary, and while isolated educational content across the website exists, there is no centralized approach to delivering education.

With market research absent, traders are limited to a news feed.

BullionVault does not maintain a proper educational section.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | M-F, 9am - 8:30pm |

Website Languages |         |

An FAQ section answers the most basic questions, while support via e-mail, phone, and live chat is available. Calls and chat services are accessible during regular business hours only.

Customer Support is available only during regular business hours.

Bonuses and Promotions

BullionVault offers free gold, silver, and currencies as part of its promotional campaign.

The present promotion consists of four grams of silver from the Swiss vault, one US Dollar, one Euro, and one British Pound.

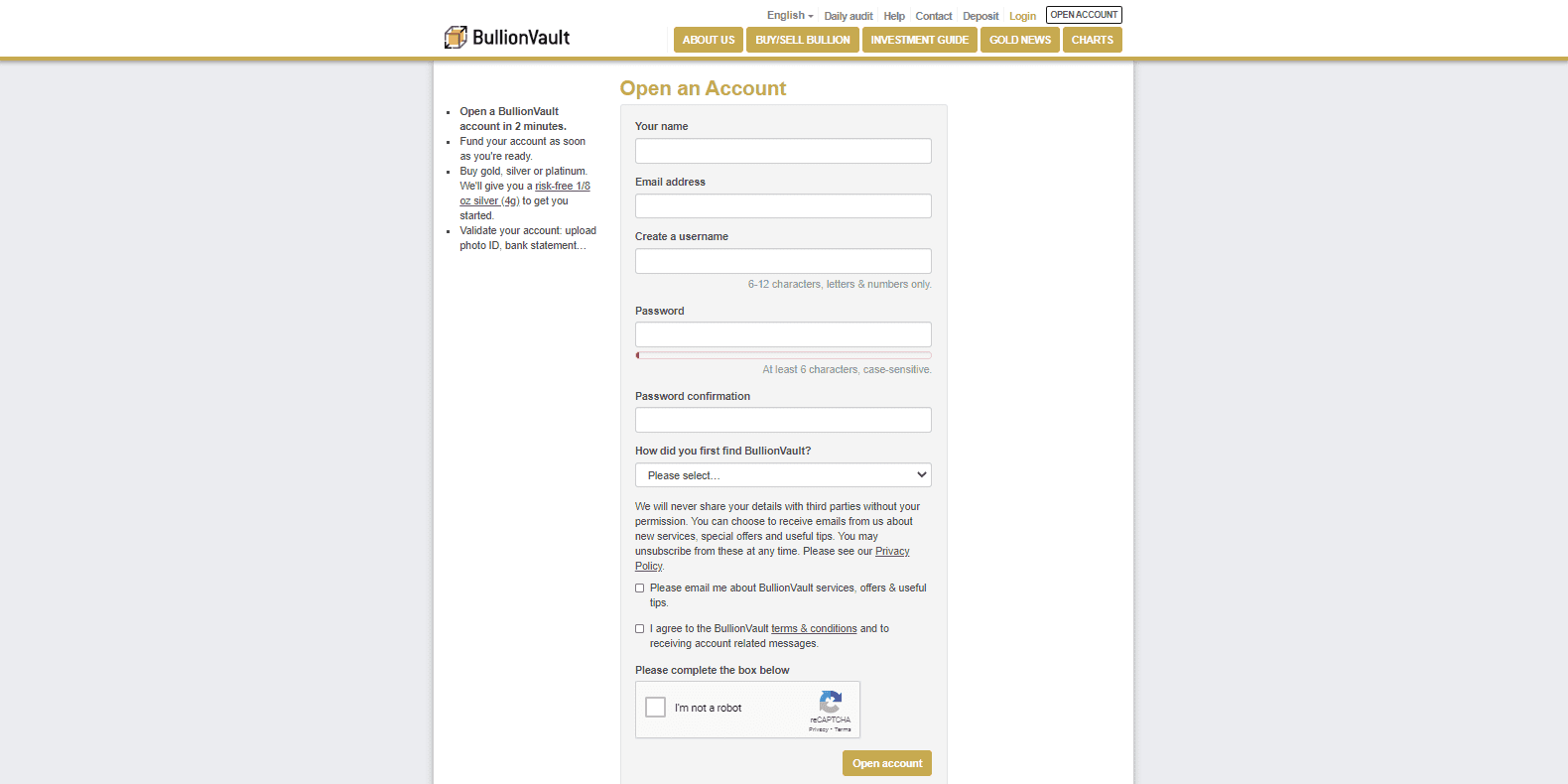

Opening an Account

An online application processes new accounts, and merely requires a name, e-mail address, username, and password. Account verification, via a copy of the client’s ID and a copy of the bank statement, is mandatory.

The Account Opening Process is standard.

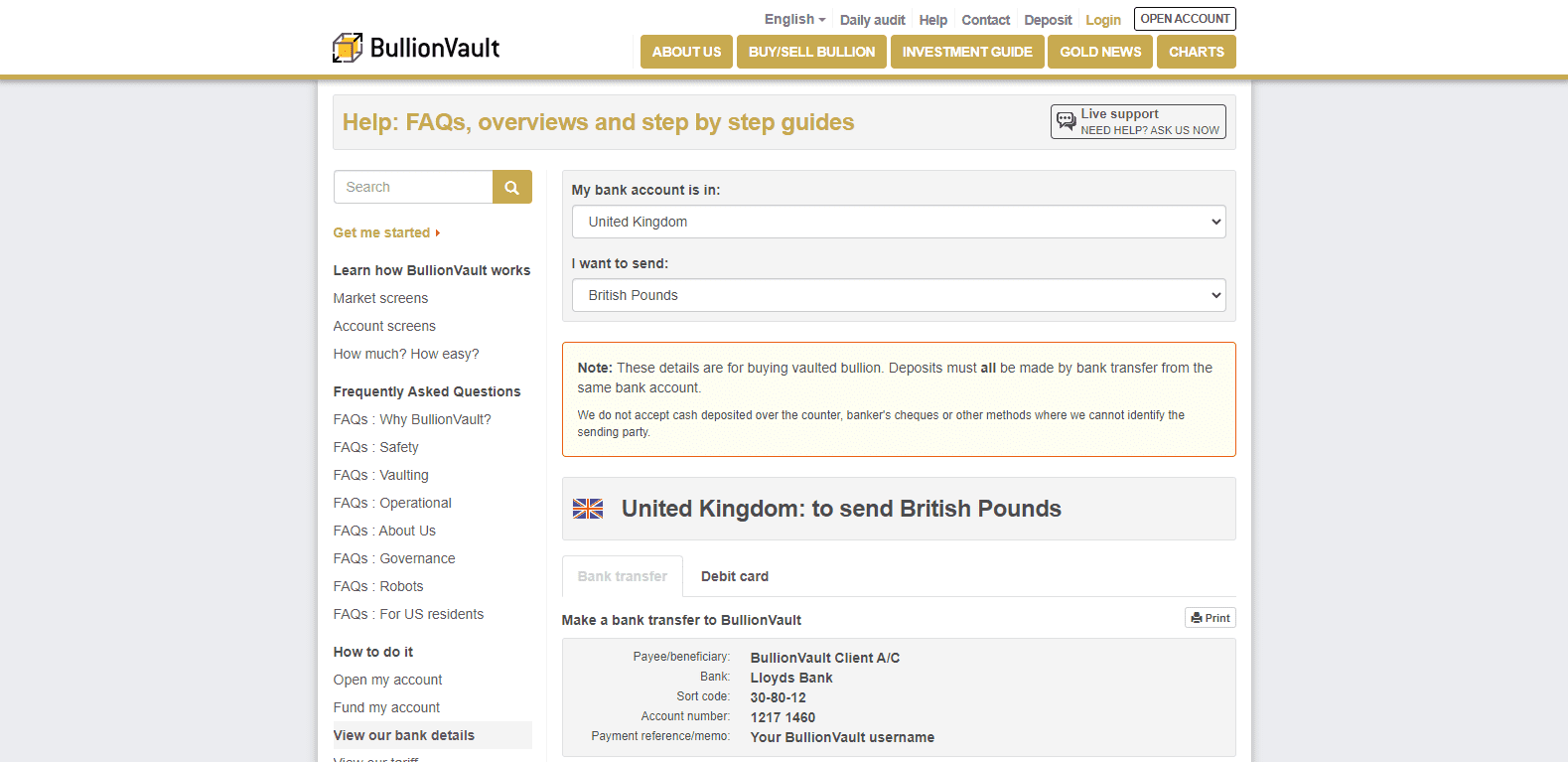

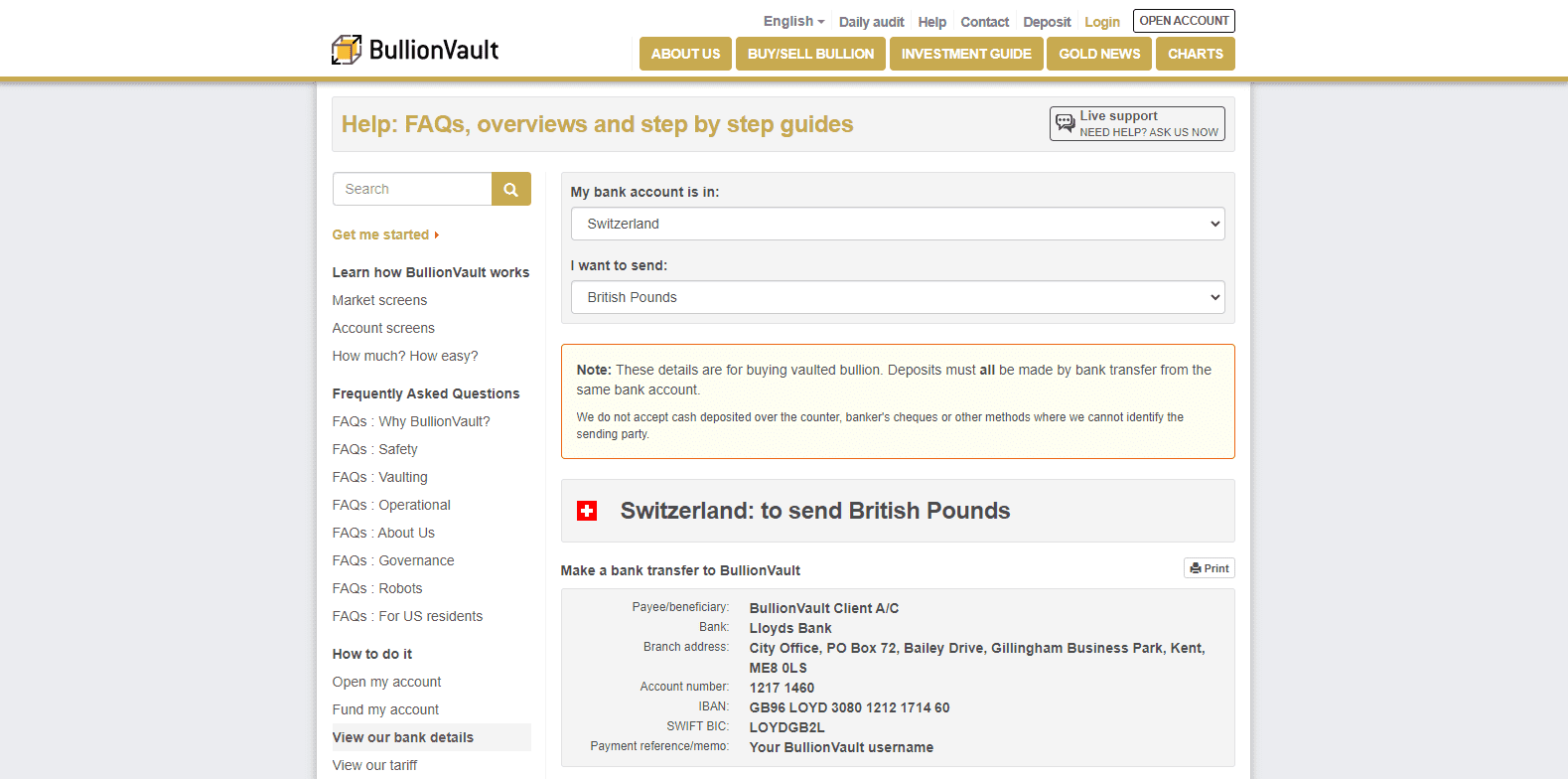

Deposits and Withdrawals

Deposits and withdrawals are processed via bank wires only, except for UK clients who are depositing British Pounds; in that case, they may use a credit/debit card to fund their account. No other options are available, which is regrettable. Bank wires are the most expensive form of transacting, rendering BullionVault for international clients, especially those with only a small portfolio, a costly choice.

UK clients only can make a deposit via credit/debit cards, but bank wires are the sole option for withdrawals.

International clients have only expensive bank wires as an option for deposits and/or withdrawals.

Summary

BullionVault offers the opportunity to purchase physical gold, silver, and platinum under a bailment agreement; the physical assets are stored globally, across five vaults. A slightly overpriced cost structure and a highly disorganized approach to sourcing the information and executing orders poses significant obstacles. Research is unavailable, and while scattered educational content exists, a proper education portal remains missing. With the exception of UK clients making a deposit in Pound Sterling, a bank wire transfer is the sole means of transacting for everyone else, compounding unnecessary costs. The website itself is very dated, from a design and functionality perspective, where a modified spreadsheet processes trades. Investors who seek an execution-only alternative to purchasing precious metals stored in a secure vault could benefit from BullionVault; however, the rest will find the services sub-par.

FAQs

What is BullionVault?

BullionVault allows clients to purchase physical gold, silver, and platinum, which is stored across five vaults globally.

BullionVault - Should you buy gold here?

While costs are slightly elevated, investors who seek physical assets may consider BullionVault an option.

What are the BullionVault fees?

On top of slightly elevated spreads, commissions between 0.05% and 0.50% plus an annual storage fee exist. Clients, especially international ones, should consider the cost of wire transfers.

Is BullionVault a scam?

No, it is a legit and trustworthy business.

How safe Is BullionVault?

BullionVault is a member of the London Bullion Market Association and the London Platinum and Palladium Market. Three independent professional bullion market vault operators and LBMA security transport companies manage the vaults, while an insurance policy exists.