Editor’s Verdict

Overview

Review

Headquarters | United Kingdom |

|---|---|

Regulators | CySEC, FCA, FSA |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 1983 |

Execution Type(s) | ECN/STP |

Minimum Deposit | None |

Trading Platform(s) | MetaTrader 4, Proprietary platform, Web-based |

Average Trading Cost EUR/USD | 0.9 pips ($9.00) |

Average Trading Cost GBP/USD | 1.5 pips ($15.00) |

Average Trading Cost WTI Crude Oil | $0.12 |

Average Trading Cost Gold | $0.50 |

Average Trading Cost Bitcoin | $60.00 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

City Index was originally founded in 1983 and in 1984, began operations as a spread betting brokerage located out of the UK; in 2001, it added CFD trading. In 2005, the brokerage acquired the IXF Group and its two established brands, IFX Markets and Finspreads.com; in 2008, FX Solutions was acquired. In 2014, City Index was acquired by Gain Capital, a NYSE-listed firm. City Index is home to over 150,000 retail accounts, and $978 million in client assets as of its 2018 financial year end. City Index, now regulated in eight different jurisdictions across the globe, is one of the most well established and trustworthy brokerages in operation today.

Regulation and Security

The primary regulator of Gain Capital UK, the owner of City Index, is the Financial Conduct Authority (FCA). Client funds remain fully segregated, and traders are protected by the Financial Services Compensation Scheme (FSCS) up to £85,000. Other meaningful regulators include the Australian Securities and Investment Commission (ASIC) and the Monetary Authority of Singapore (MAS). City Index is one of the most transparent brokerages in the industry and a stellar example of a well-executed company.

City Index is considered one of the most transparent brokerages.

Gain Capital, the owner of this brokerage, provides a stable foundation.

Fees

Average Trading Cost EUR/USD | 0.9 pips ($9.00) |

|---|---|

Average Trading Cost GBP/USD | 1.5 pips ($15.00) |

Average Trading Cost WTI Crude Oil | $0.12 |

Average Trading Cost Gold | $0.50 |

Average Trading Cost Bitcoin | $60.00 |

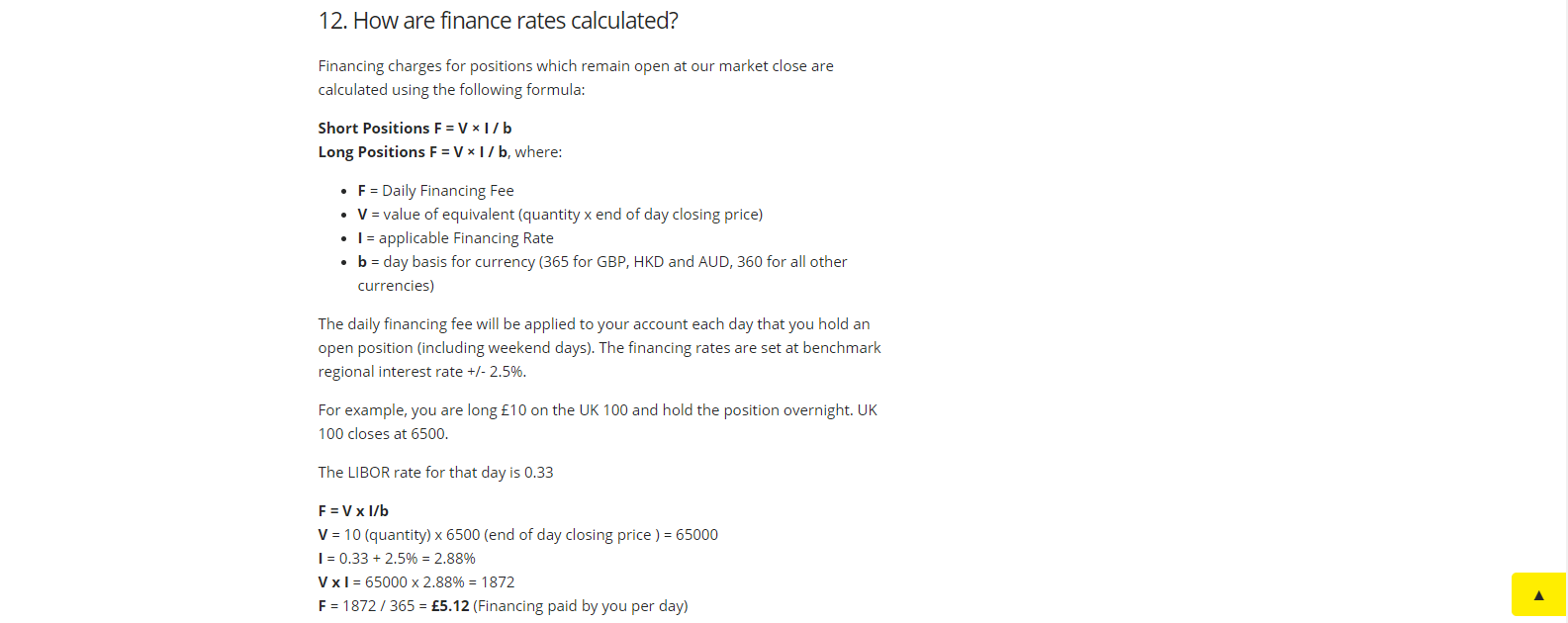

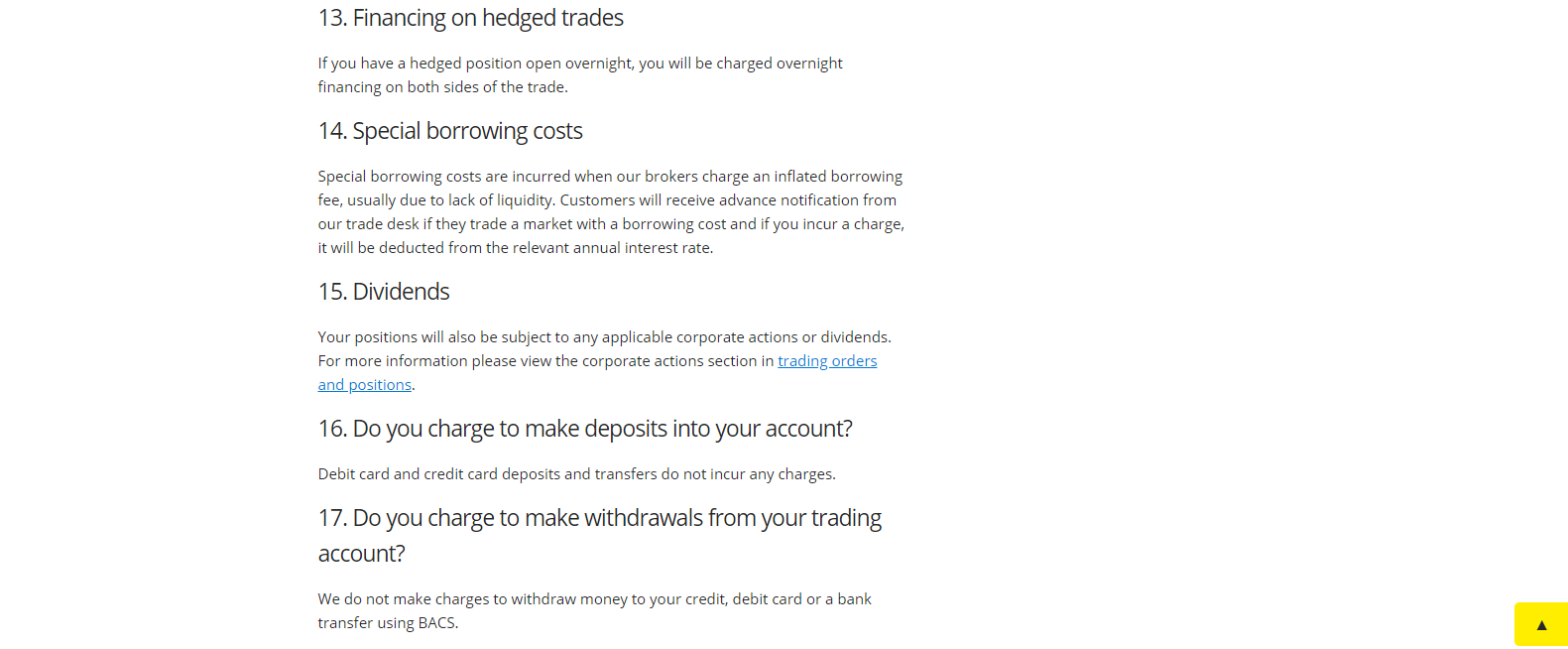

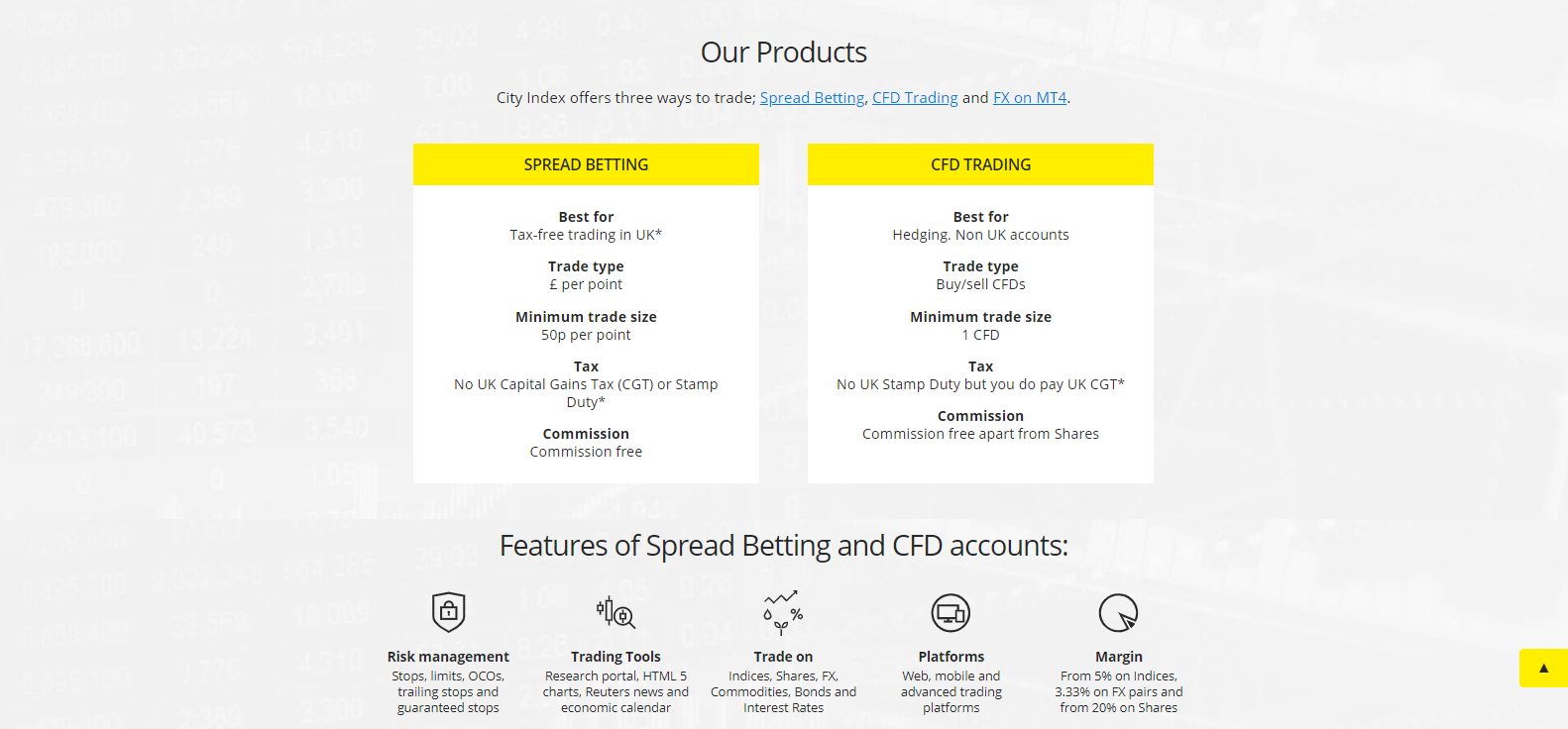

This broker derives its revenue from spreads and commissions. The spread betting and MT4 accounts feature competitive spreads, as low as 0.5 pips in the EUR/USD and 1.0 points in indices. Commissions apply on equity CFDs, and are as low as 0.08%, but no less than £10 or the currency equivalent. Corporate actions (such as dividends) are passed on to traders, while overnight financing charges also apply. A £12 monthly inactivity fee applies after 36 months. The overall pricing environment remains excellent and is extremely competitive.

All involved trading costs with examples are listed. The overall pricing environment is excellent.

What Can I Trade

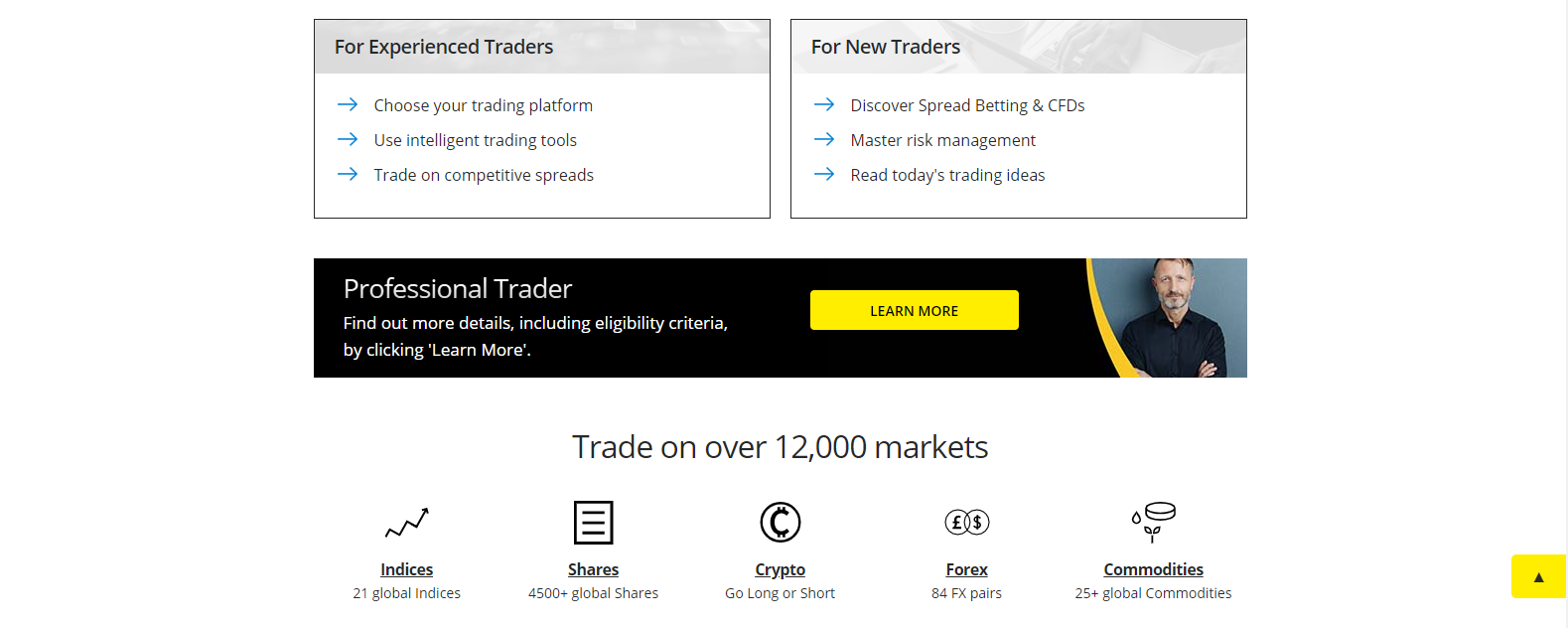

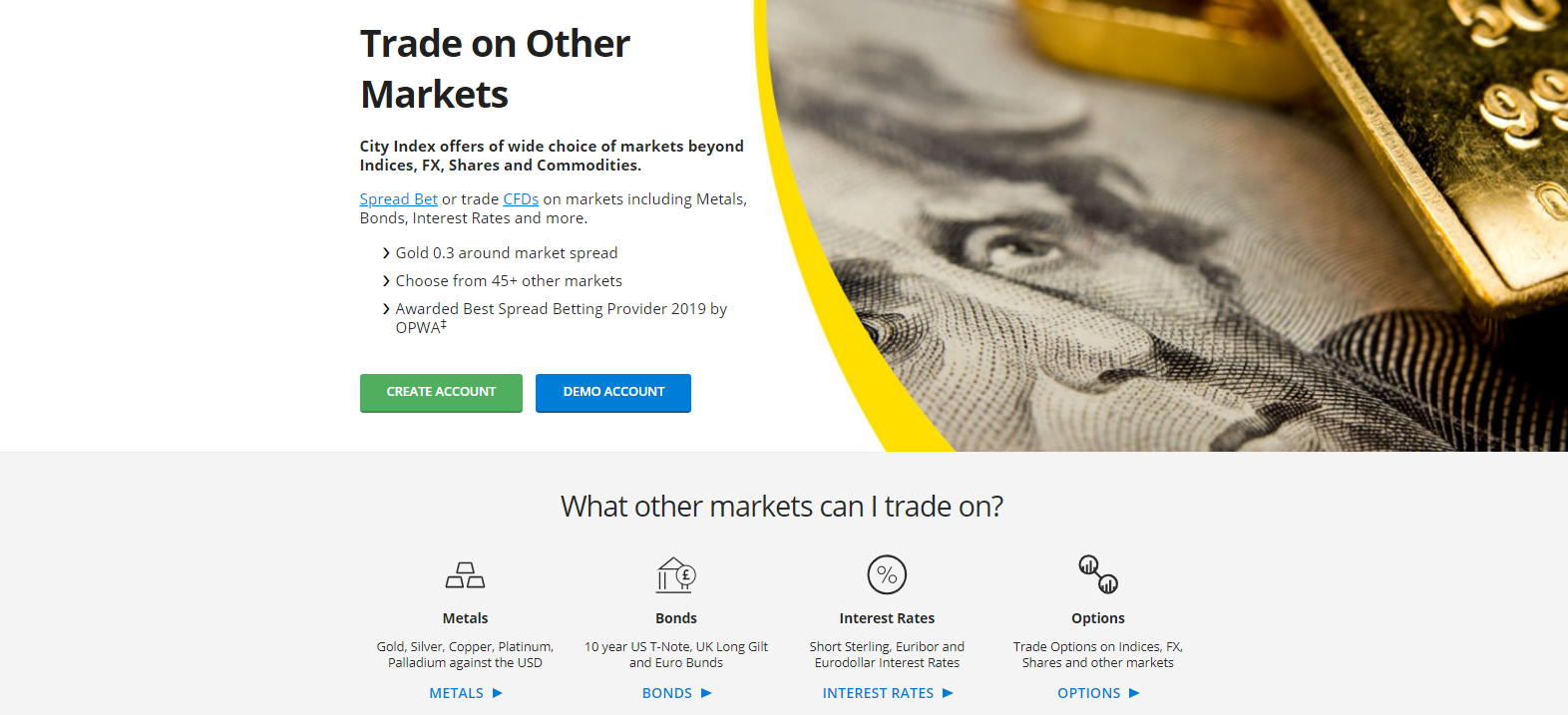

With over 12,000 assets across nine categories, the selection is outstanding for all types of traders and asset management firms. Proper cross-asset diversification is possible, and every trading strategy has numerous opportunities across the global financial system. Pure Forex traders have access to 84 currency pairs, complemented by commodity CFDs and a primary cryptocurrency selection. Over 4,500 equity and 21 index CFDs provide coverage of the most liquid assets across numerous markets. Other asset categories include bonds, interest rates, and options.

Asset selection at City Index is exceptional, catering to traders across the spectrum.

Besides core assets, traders have access to a wide range of secondary markets.

Account Types

City Index offers Spread Betting as well as CFD accounts, while Forex trading on the MT4 platform is singled out as a separate account option. Spread betting is ideal for UK-based traders, as it is free of capital gains tax and stamp duty. Trading conditions in the CFD account remain equally appealing.

Besides the three distinct account types, City Index has three trader classifications. The Trader account is the default classification for retail traders. An invite-only upgrade to Premium Trader, based on activity, represents a genuine token of appreciation and consists of a dedicated relationship manager and invitations to special hospitality events. The Professional account provides access to the most superior trading environment, but there is specific criteria which needs to first be met. That criteria includes a minimum trading volume over a period of time, a financial instruments portfolio in excess of £500,000, and strong working knowledge and experience working with leveraged products. According to the website, a trader must meet two of the three requirements in order to be eligible for inclusion as a Professional Trader.

City Index maintains three account types and three trader classifications, each with an improved trading environment.

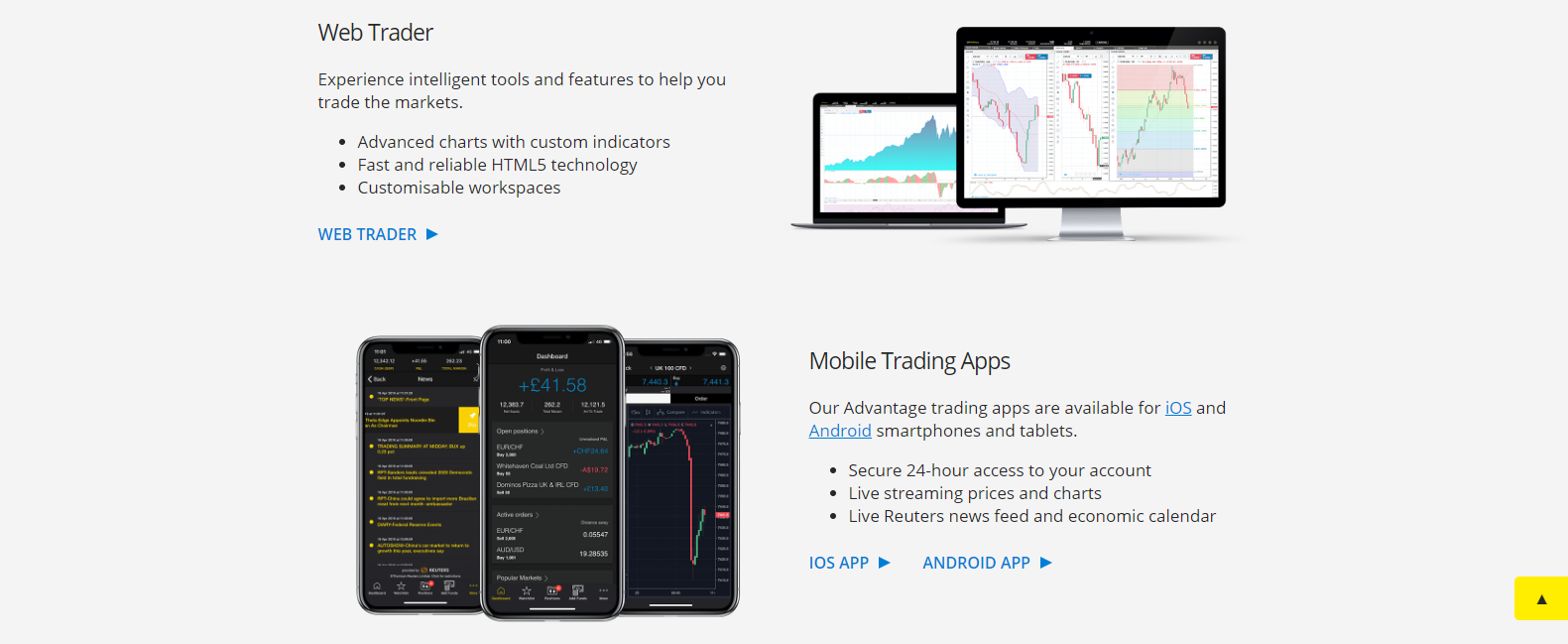

Trading Platforms

AT Pro, the proprietary trading platform of City Index is an excellent gateway to financial markets. It is available as a powerful HTML5 Web Trader, a mobile version, or as a downloadable desktop version. The MT4 trading platform is available as the basic version, without any of the required third-party add-ons to unlock its full potential. Traders with existing automated trading solutions developed on the MT4 infrastructure will enjoy access to an outstanding trading environment. All other traders are advised to take advantage of the AT Pro platform.

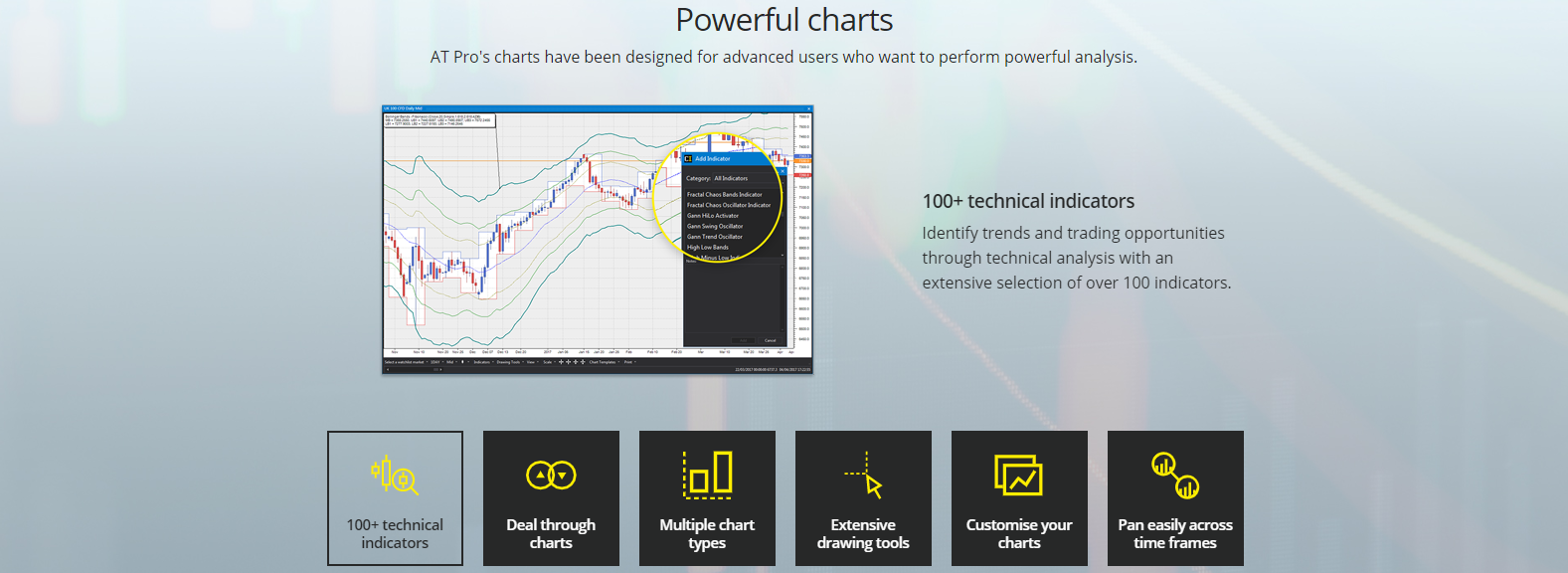

Over 100 technical indicators allow manual traders to tweak their analysis, while the innovative deal ticket features all necessary information. Real times news is curated by Reuters, inside the technical/fundamental analysis portal. Other essential features include a phenomenal charting package, precision drawing tools, and valuable market data. AT Pro represents one of the most advanced trading platforms available to traders in today's financial markets.

Traders may manage their portfolios directly from inside the HTML5 webtrader or trade on the go using their mobile device.

AT Pro and MT4 are equally available as a desktop version for efficient portfolio management.

Unique Features

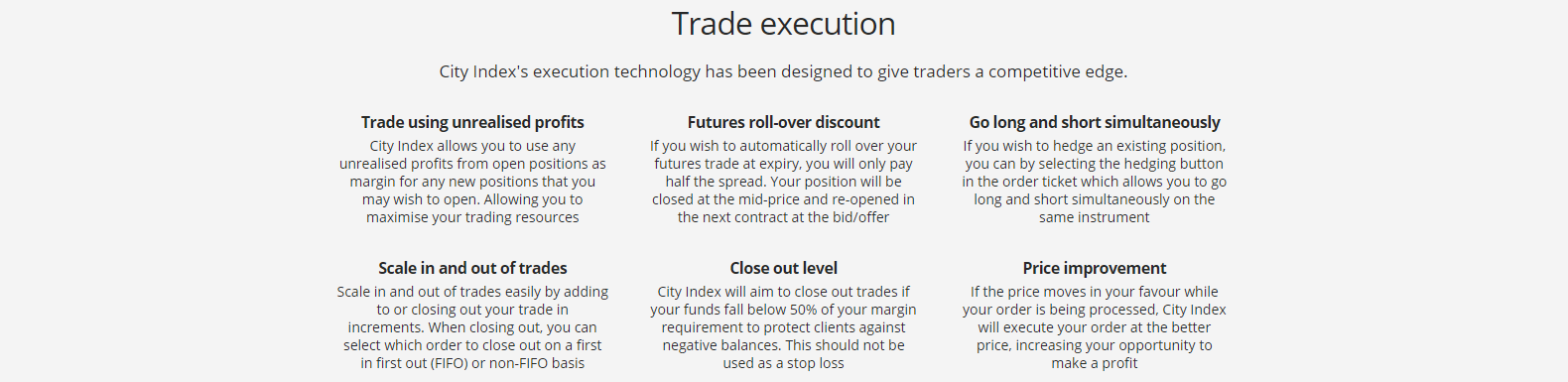

The charting package of the AP Pro trading platform represents an essential benefit for manual traders. Full customization allows traders to approach markets based on their preference, design their workspaces, and directly transfer their settings from one device to another. Superior trade execution, choice of order types, including partial closures of positions and hedging tools, provide traders with additional tools to increase profitability.

City Index ensures traders have access to a high-quality trading environment developed with cutting-edge tools to generate a competitive edge.

Trade Execution Tools

Order Execution Tools

Research and Education

City Index maintains excellent research capabilities. Trading Central, a leader in independent third-party analytics, powers a comprehensive technical analysis suite, embedded inside the AT Pro platform. It also remains at the core of extensive fundamental analysis, including a What-If analysis for EPS forecasts. Global data is streamed directly to AT Pro, and company metrics are well-presented. SMS trading signals are also supported, ensuring traders never miss a profitable opportunity.

Traders may take advantage of an excellent research suite.

Besides the well-respected Trading Academy, the educational team compiled a superb range of training videos and written content. It allows new traders to engage in a well-designed and in-depth course.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |  |

Customer support is available 24/5. Clients may e-mail City Index, use the webform, call the help desk, or utilize the live chat function. It is unlikely that traders will require assistance at this well-operated broker, but it is easily accessible in case a need arises.

Detailed answers to the most common questions may be retrieved from the Help & Support section, enhanced by examples, where applicable.

Bonuses and Promotions

While City Index does not offer bonuses or promotions, a cash rebate on Forex and indices trading is available for professional traders.

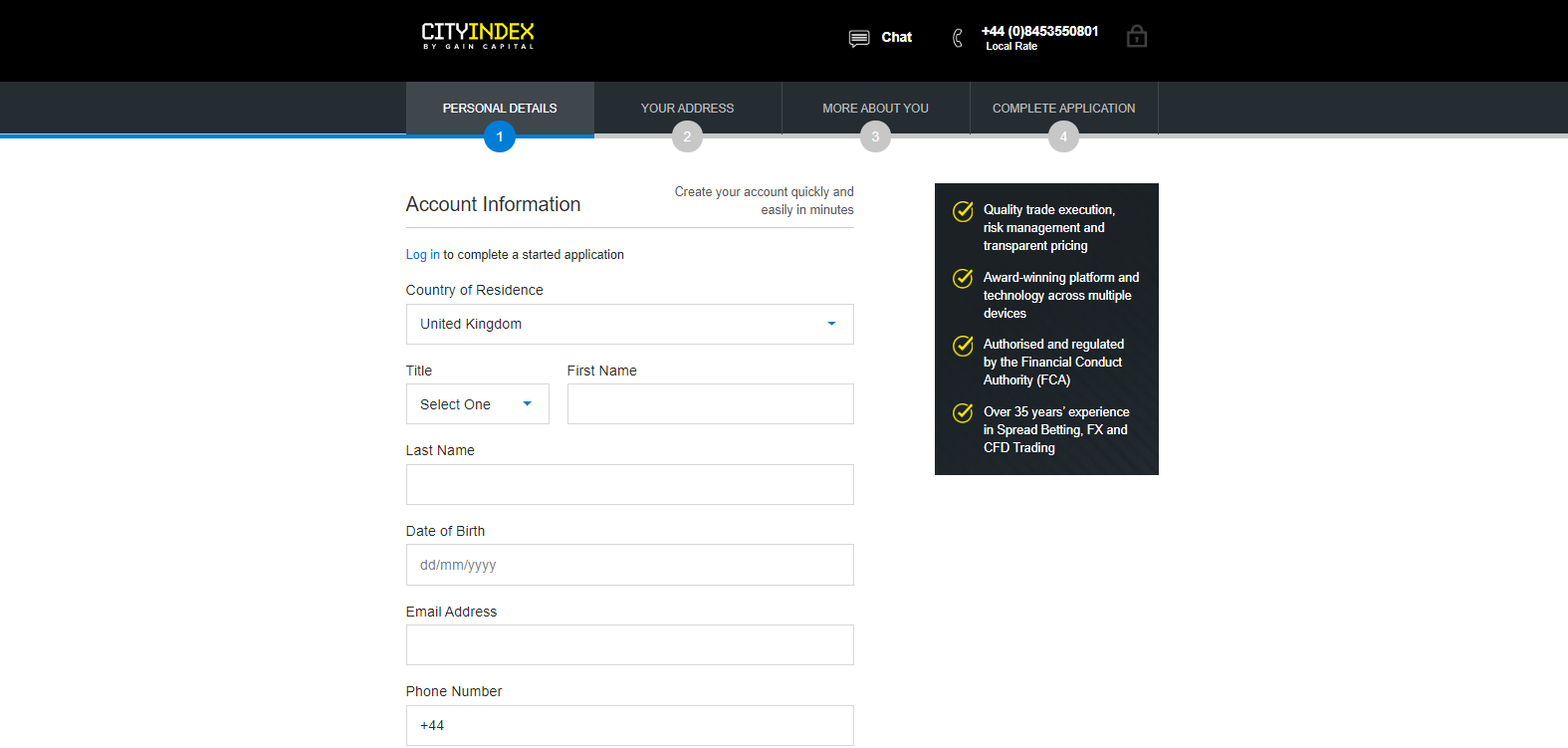

Opening an Account

New account applications are processed by a four-step online form. The required information is standard operating procedure and grants traders access to the back-office. Per regulatory requirements, a verification process to satisfy AML/KYC requirements are necessary. A copy of the trader’s ID and one proof of residency document will complete the process.

The Account Opening Process follows Industry-wide Standard Operating Procedures

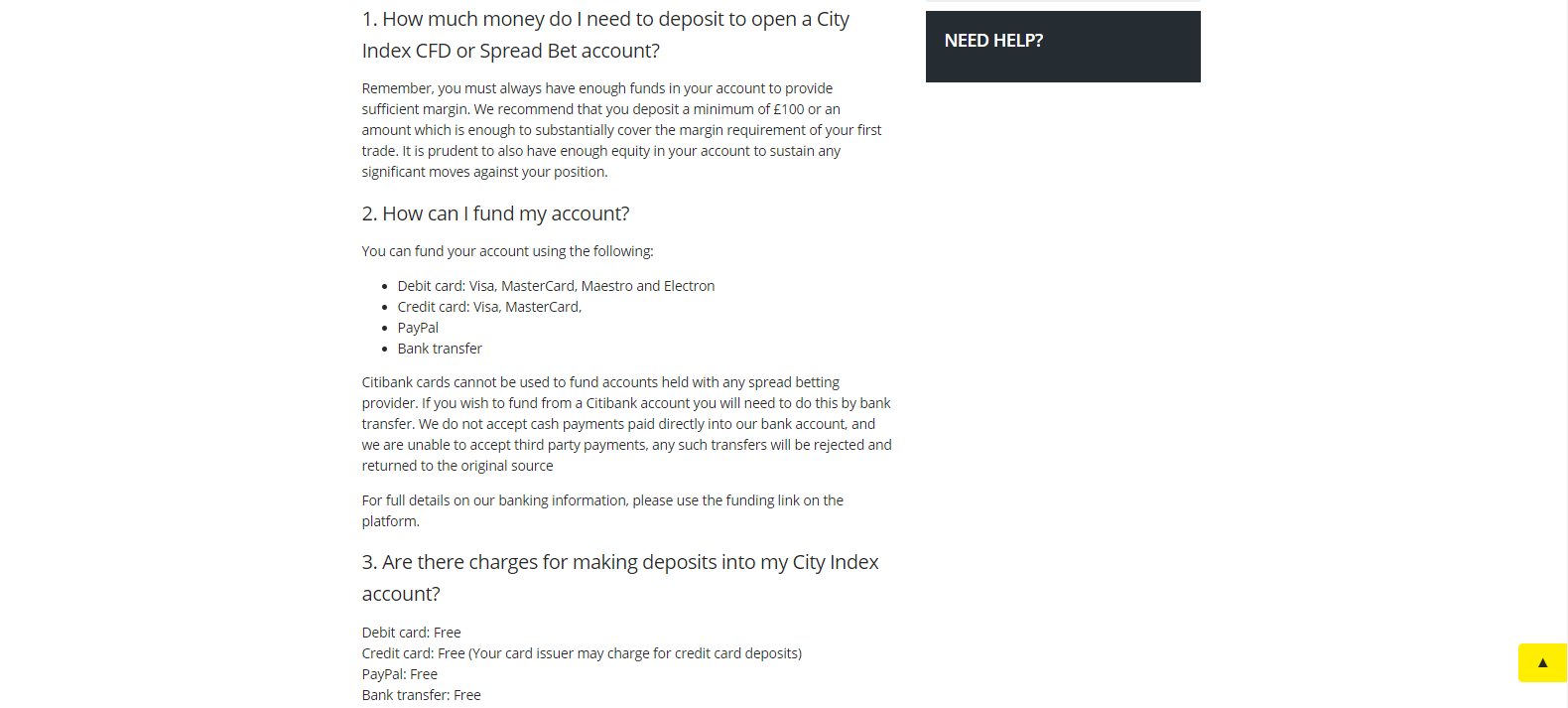

Deposits and Withdrawals

Deposit and withdrawal options are limited to bank wires, credit/debit cards, and PayPal. More alternative funding options would be a welcome change, and this is an area of improvement that City Index should consider. No minimum deposit is required, but £100 is recommended. The minimum withdrawal is £50, with a maximum online amount of £20,000 per single transaction. Credit/debit cards are limited to £20,000 per 24 hours. City Index does not levy transaction fees, but third-party charges may apply.

Deposits & Withdrawal Options are Limited

Trading Platform

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Summary

City Index is a top tier broker in operation since 1983. Traders are treated to a well-regulated trading environment, a competitive pricing structure, and an excellent trading platform. Over 12,000 assets across nine sectors are available. Trading Central powers the core research suite, Reuters streams live news, and an outstanding charting package supports manual traders. The MT4 trading platform supports automated trading solutions. New traders have access to an in-depth educational program, while the invite-only Premium Trader account features exclusive perks for high-volume traders. City Index caters to over 150,000 traders, and the overall products and services qualify it as a prime brokerage.

FAQs

Is City Index a good broker?

Well-capitalized corporate ownership,regulation in eight jurisdictions, an excellent trading platform, and acompetitive trading environment form the core of the trading environment thatplaces this broker near the top of the brokerage scene.

Is City Index regulated?

The FCA out of the UK is the primary regulator, while seven additional jurisdictions enhance the oversight of global operations.

What is the minimum deposit at City Index?

There is no minimum deposit, but City Index recommends £100.

What is the maximum leverage offered by City Index?

The maximum leverage depends on the asset traded, the total position size, and the classification of the trader. Retail traders are limited to 1:30, while Professional traders qualify for up to 1:400.

What are the trading fees at City Index?

Spreads are as low as 0.5 pips for currency pairs and 1.0 points on indices. Equity CFDs carry a fee of 0.08% with a minimum of £10 or the currency equivalent.