Editor’s Verdict

eToro USA Securities Inc., the unit offering stocks and ETFs, is a broker-dealer registered with the Securities and Exchange Commission (SEC). It is also Financial Industry Regulatory Authority (FINRA) and Securities Investor Protection Corporation (SIPC) member.

Overview

eToro USA LLC is registered as a Money Services Business with FinCEN, a government bureau administered by the US Department of the Treasury.

Cryptocurrency brokers in the US are required to obtain an operating license from each state separately. eToro USA holds licenses to conduct business in 20 of the 50 states.

Headquarters | Israel |

|---|---|

Regulators | ASIC, CySEC, FCA, FSA |

Tier 1 Regulator(s)? | Yes |

Owned by Public Company? | No |

Year Established | 2007 |

Execution Type(s) | Market Maker |

Minimum Deposit | $50 - $10,000 |

Negative Balance Protection | Yes |

Trading Platform(s) | Proprietary platform |

Average Trading Cost WTI Crude Oil | $0.05 |

Average Trading Cost Bitcoin | $574 |

Retail Loss Rate | 74% |

Minimum Raw Spreads | 0.8 pips |

Minimum Standard Spreads | 1.3 pips |

Minimum Commission for Forex | $0.00 |

Funding Methods | 10(bank wires, credit/debit cards, PayPal, Neteller, Skrill, Rapid Transfer, iDEAL, Klarna/Sofort, Trustly) |

Islamic Account | Yes |

Signals | No |

| US Persons Accepted? | Yes |

| Managed Accounts | No |

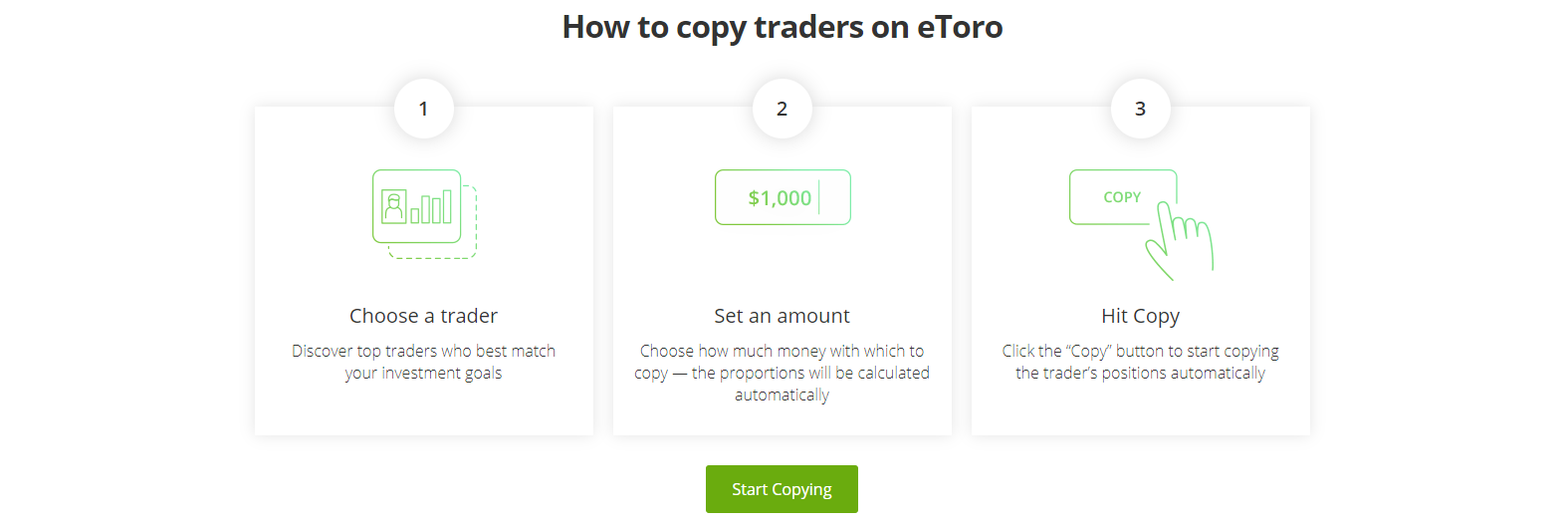

eToro, an established player in the social trading scene, ventured into the US market as a cryptocurrency broker in July 2018, adding stocks and ETFs in January 2022. Per the website, this step represents the first phase of its expansion plans. Since its inception in 2007, eToro has grown to cater to millions of traders from over 140 countries. CopyTrader, the in-house developed tool that powers social trading, remains its primary asset. The CopyTrader feature allows users to copy trades from other traders within the community with the ease of a few clicks. The emergence of cryptocurrencies presented a unique opportunity for eToro to push into the US market, an opportunity attributed generally to the differing regulatory frameworks for cryptocurrency. Presently, CopyTrader enables social trading in cryptocurrencies, representing a novel approach in this relatively new asset class.

Regulation and security

eToro USA Securities Inc., the unit offering stocks and ETFs, is a broker-dealer registered with the Securities and Exchange Commission (SEC). It is also Financial Industry Regulatory Authority (FINRA) and Securities Investor Protection Corporation (SIPC) member.

eToro USA LLC is registered as a Money Services Business with FinCEN, a government bureau administered by the US Department of the Treasury. One of the primary objectives of FinCEN is to combat attempts at money laundering, as well as other financial crimes. FinCEN is jointly comprised of federal and local law enforcement agencies, regulators, and the financial services community. FinCEN represents the US in the international Egmont Group, consisting of over 100 intelligence units cooperating to fight financial crime. The director, appointed by the Secretary of the Treasury, reports to the Under Secretary for Terrorism and Financial Intelligence.

Cryptocurrency brokers in the US are required to obtain an operating license from each state separately. eToro USA holds licenses to conduct business in 20 of the 50 states. It is the custodian of the eToro wallet, where client funds are stored. A valid phone number is required to enable two-factor authentication. Account security protocols follows industry standards, but omnibus accounts hold fiat currency and cryptocurrencies. They remain segregated from company funds but are pooled together from numerous clients. eToro, as a group, is compliant with all its regulators, and is expected to extend compliance to this operating subsidiary.

Due to the evolving nature of the cryptocurrency market and regulatory changes, frequent revision of terms and conditions is recommended.

Fees

eToro offers commission-free on Stock trading and ETF trading, earning revenue from an increased spread. Presently, eToro covers the regulatory fees charged by the SEC and FINRA, applicable with each transaction. eToro reserves the right to pass them onto clients at a future date, and eToro recommends checking the eToro fees page for updates.

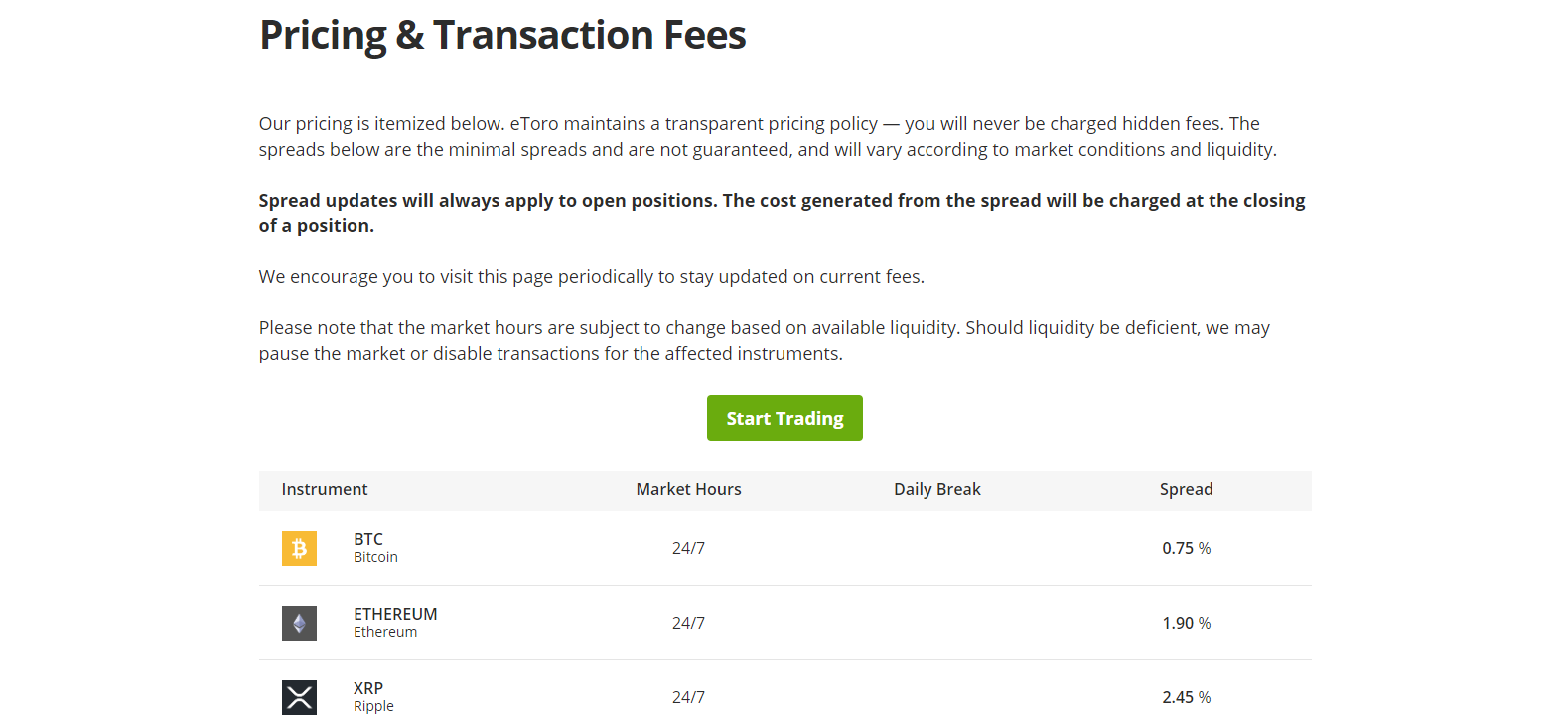

The fee structure is a percentage-based spread, which varies depending on the asset traded. It does not accurately reflect market forces, as the costs increase with the price of the underlying asset. Bitcoin carries a 0.75% spread, meaning the difference between the quoted buy (bid) and the sell (ask) price is $37.50 if the BTC/USD trades at $5,000. The same cross will incur a spread of $75.00 if the price increases to $10,000. As such, eToro USA profits with the appreciation of assets, which directly reduces traders' profitability.

eToro USA allows conversions between cryptocurrencies for a fee of 0.1%. Blockchain fees for sending and receiving funds are in place; eToro USA does not levy any additional costs. Ripple and Stellar wallets require a balance of 45 XRPs and 2.5 XLMs, respectively, which are locked. The eToro wallet uses a multi-sig solution and smart contracts to process Ethereum transactions. Senders must ensure receivers deploy it, as it is not supported universally. It is important that traders be aware that funds may be lost or locked in the blockchain if both parties do not use the same process.

A withdrawal fee of $5 is charged to all clients upon withdrawals, except for diamond clients who are not charged.

The pricing structure at eToro USA does not accurately reflect market forces.

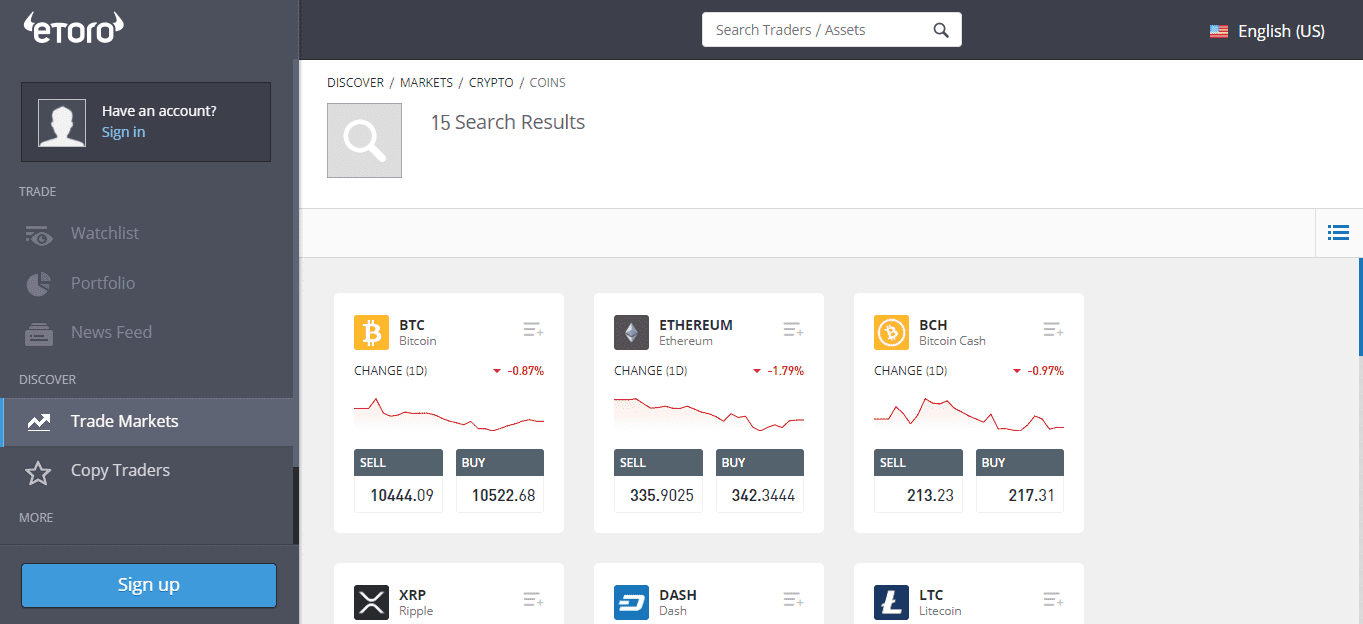

What Can I Trade

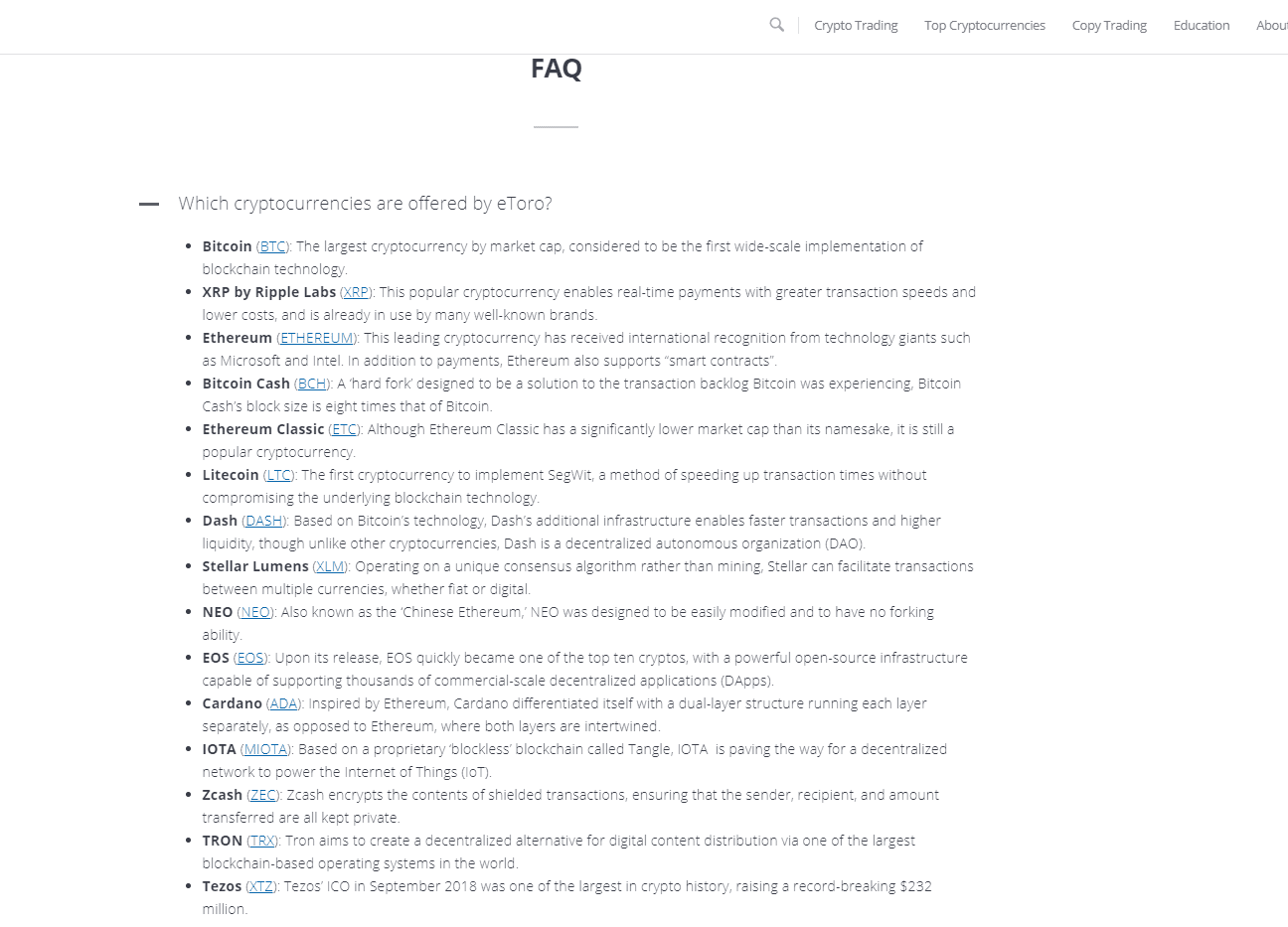

eToro USA LLC offers traders 45 cryptocurrencies and its in-house developed cryptocurrency wallet. They cover approximately 75% of the crypto sector market cap. It also presents five crypto-themed portfolios for traders to copy, delivering a diversified approach with a lower risk profile. eToro USA LLC describes each portfolio and lists the asset allocation, performance statistics, and other relevant data, allowing traders to make more informed decisions.

eToro USA LLC now offers trading in 1,765 stocks and 220 ETFs. They offer retail traders, especially millennials and GenZ, the primary trader base at eToro USA LLC serves, a balanced introduction to equity trading. The broker notes that many first-time traders use cryptocurrencies as a gateway to trading, based on their traders, before they expand into equity trading. Please note that the current list of stocks includes US-listed ones only, but eToro USA LLC is likely to expand into non-US stocks in the future as it seeks to broaden its asset selection.

Account Types

One account serves all traders. eToro USA does not provide any information on this, and merely provides potential traders with the option to open one. Other subsidiaries of this broker feature a more detailed account description but despite missing information, the simplicity is appreciated.

The required verification process is the sole mention of accounts at eToro USA.

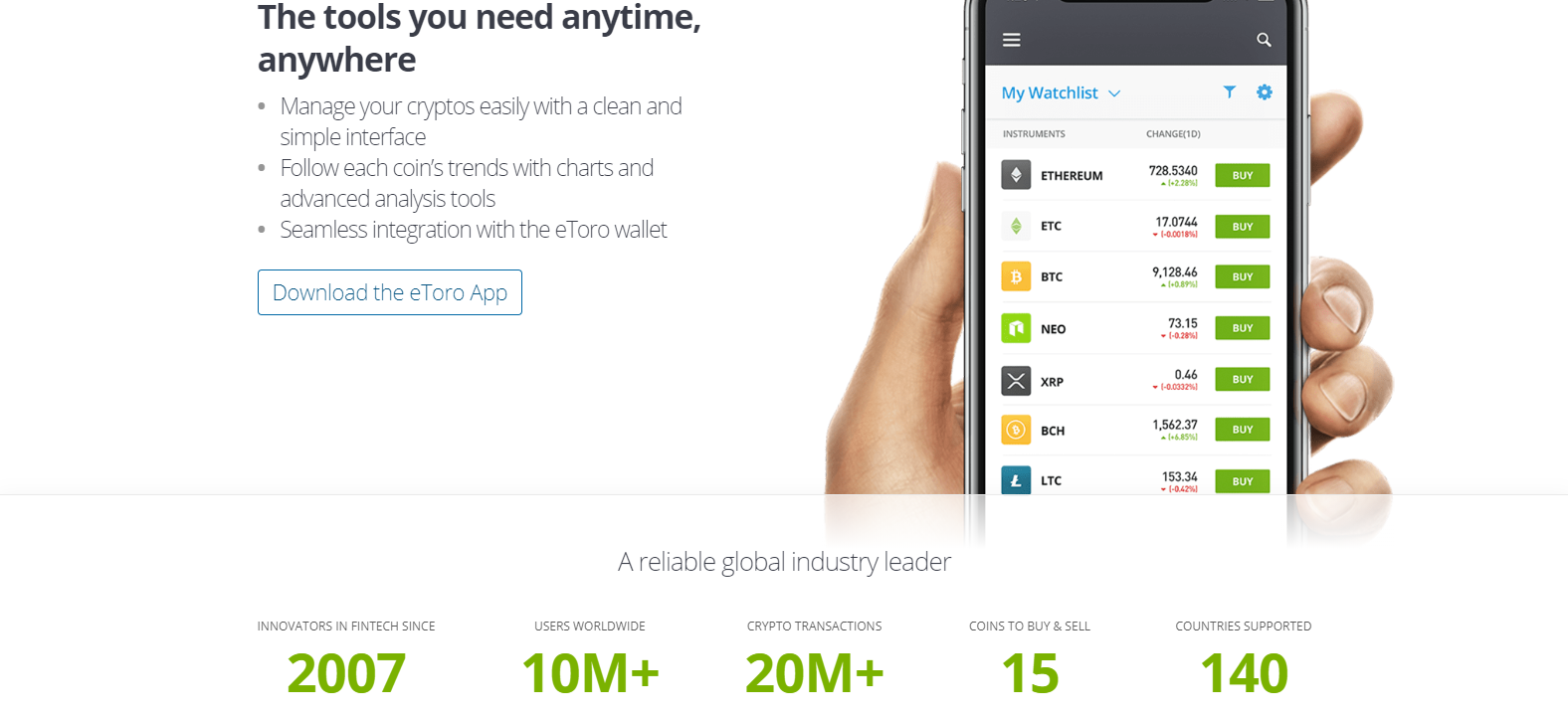

Trading Platforms

The eToro USA homepage promotes the mobile version and invites potential traders to download it, but only the most basic details are provided. Given the prominence of the mobile version invitation on the homepage, it would appear that eToro USA's target audience is young, mobile traders who prefer to place a trade based largely on social media interaction.

While the webtrader is not mentioned prominently, it can be accessed from the eToro website. As any broker's trading platform marks the core of its trading operations, the failure to emphasize it represents a serious and puzzling misstep, especially as this broker denotes trustworthiness and client volume, which are testament to an excellent marketing team.

The webtrader itself does lack important features, however. Even though all of eToro's operating subsidiaries are focused quite heavily on social trading, proper analytics should still be provided. Most trades tend to lack intensive research and are merely copied by other traders, which can be an advantage for new traders, but a significant disadvantage for advanced traders who want proper research capabilities. Signal providers are required to uses third-party tools.

Trading platform available at eToro USA.

The homepage does note the mobile trading app, though it fails to provide pertinent information.

Unique Features

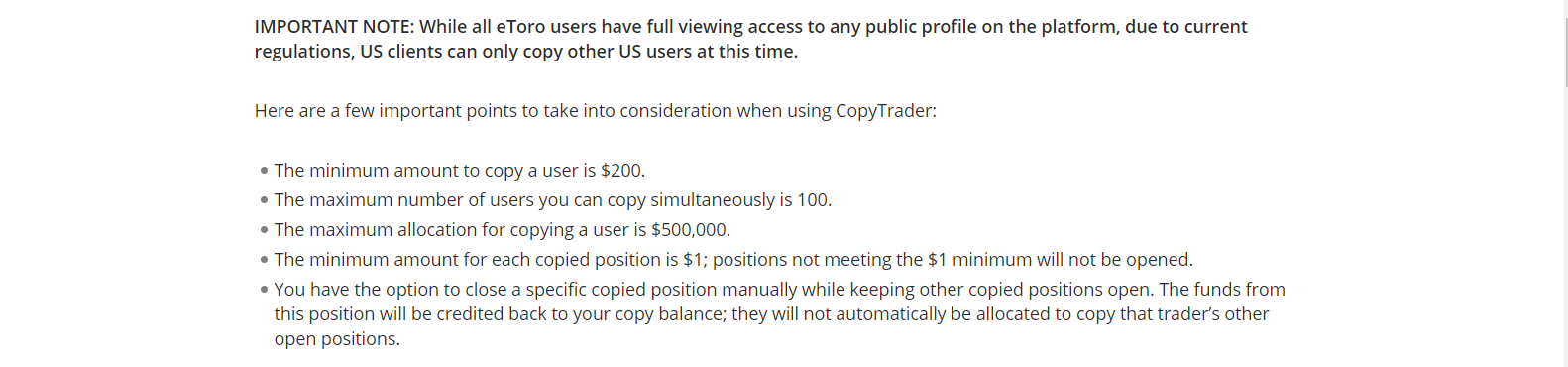

The CopyTrader feature represents the core unique asset of this broker. New traders may find the allure of following others in the network with a few clicks as innovative. An efficient three-step process is considerably user-friendly; the steps consists of finding a trader to copy, dedicating an amount, and confirming the process. Up to 100 traders may be copied simultaneously. CopyTrader calculates the position sizes automatically; while convenient, it does not allow for specific risk management. A stop-loss may be applied, however, and traders have the ability to pause or cancel the copy relationship at any time.

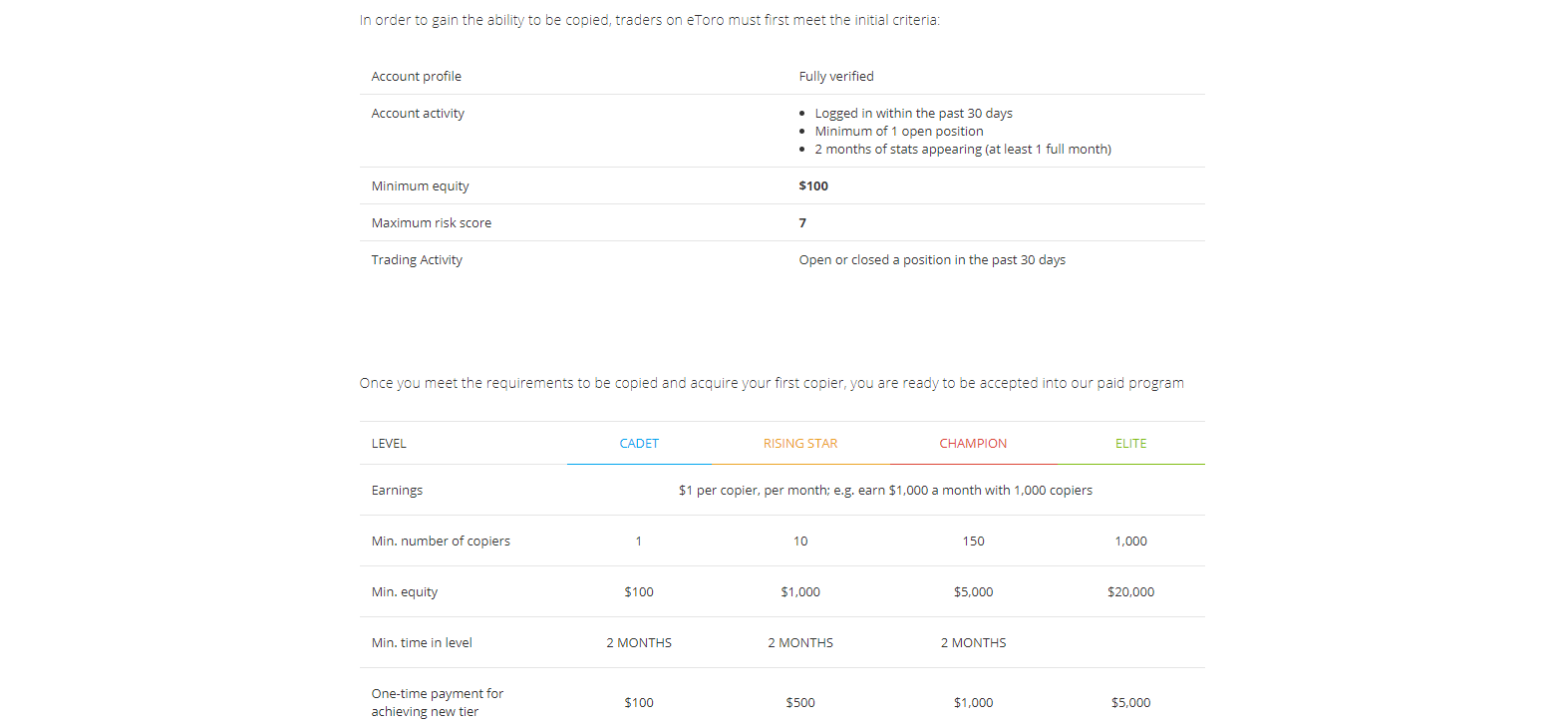

Another innovative feature is the Popular Investor Program, which encourages community growth. The program essentially pays traders for having a network of followers, as it produces increased trading volume. The four-tier system of this program will give well followed traders, who may operate from only a small deposit, an additional revenue stream. eToro stresses the importance of building a community, and this program provides a monetary incentive.

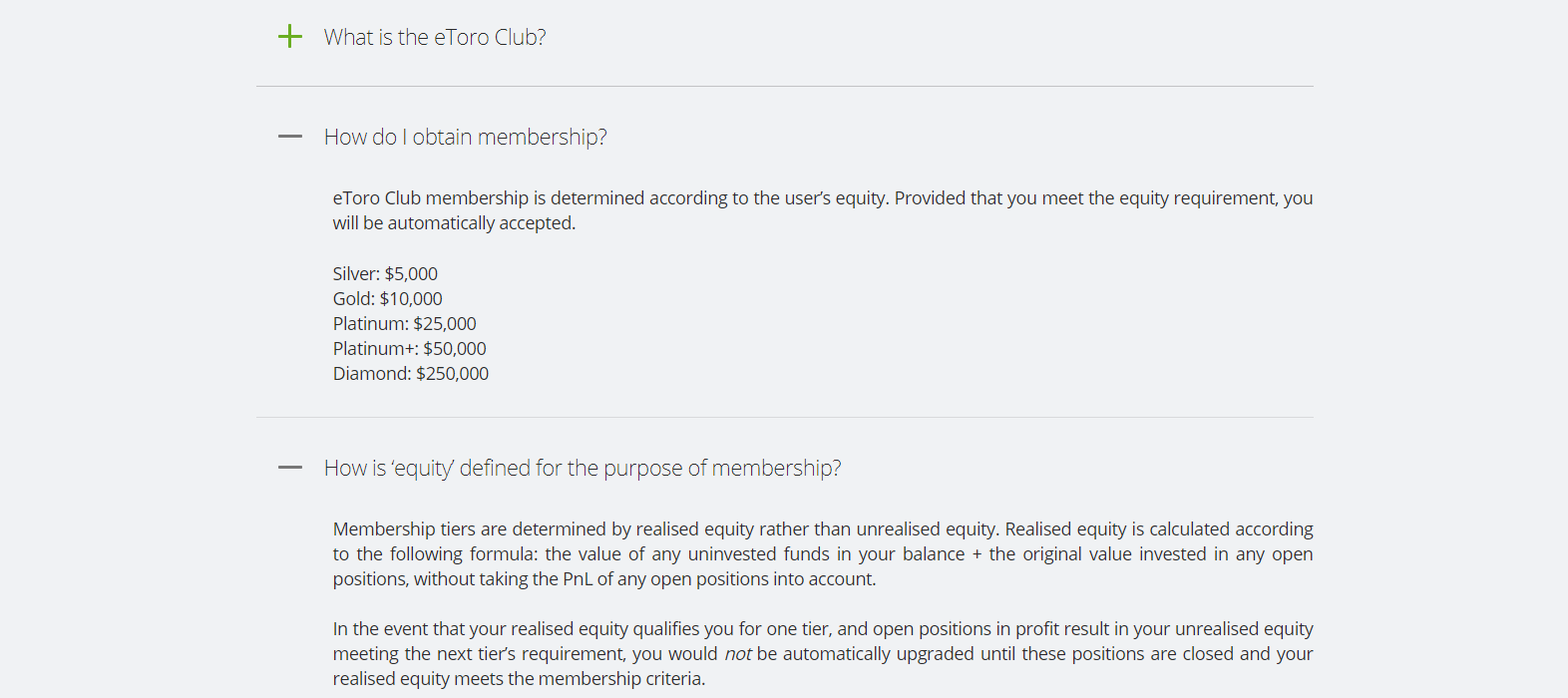

Adding one other improvement to the social trading environment is the eToro Club. Access to the Club provides some traders with research; analytics are provided from the gold tier, which are unlocked only after total assets exceed $10,000. The five-tier system is dependent on portfolio value. While an account upgrade is a welcome addition, a more relevant metric might be trading volume rather than portfolio size.

The CopyTrader feature implements a user-friendly three-step system to copy traders across the eToro network.

eToro USA traders may view all portfolios but, per regulatory authority, can only follow those which are domiciled in the US.

The Popular Investor Program offers some signal providers with an additional revenue stream.

The eToro Club consists of five tiers with an automatic upgrade, based on portfolio value.

Research is provided through the eToro Club for gold members and higher.

Research and Education

With the exception of eToro Club members who hold at least Gold status, eToro USA does not generate research for its traders.

The eToro blog features a Market Insights and Trading Essentials category, where traders can find relevant articles and explanations concerning the cryptocurrency market. While it promotes entry-level understanding, it is absent of adequate market research and trader education.

Until eToro USA invests in essential auxiliary services, it may only attract a high number of inexperienced traders who choose to follow the company's experienced traders. eToro recommends that signal providers educate their followers about deployed strategies, and their approach in order to better promote understanding.

The eToro blog's Market Insight category features well-presented content about market developments.

Trading Essentials offer entry-level content.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |                    |

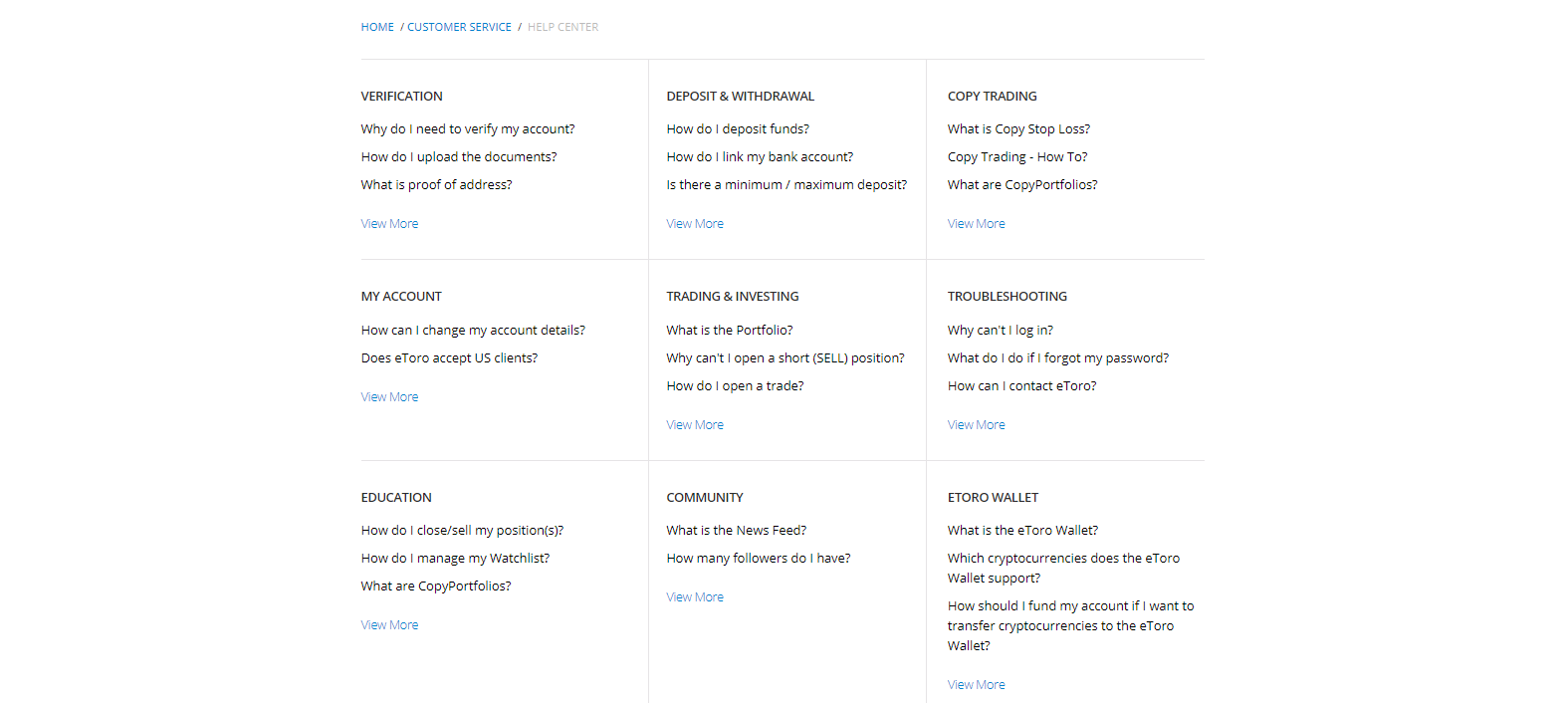

The Help Center provides primary customer support. It is divided into nine categories and attempts to answer the most common questions. Traders who require further assistance may contact the Customer Service Center; existing users have access to live chat, while visitors are asked to fill out the webform. A phone number or e-mail address is not provided, and neither are the hours of operation. Customer support is a service most traders never require, especially at a well-operated brokerage such as eToro USA.

The Help Center answers the most common questions.

In the Customer Support Center, traders may obtain additional assistance.

Bonuses and Promotions

eToro USA does not feature bonuses or host promotions due to regulatory restrictions. Membership into the eToro Club is automatically granted, based on portfolio size.

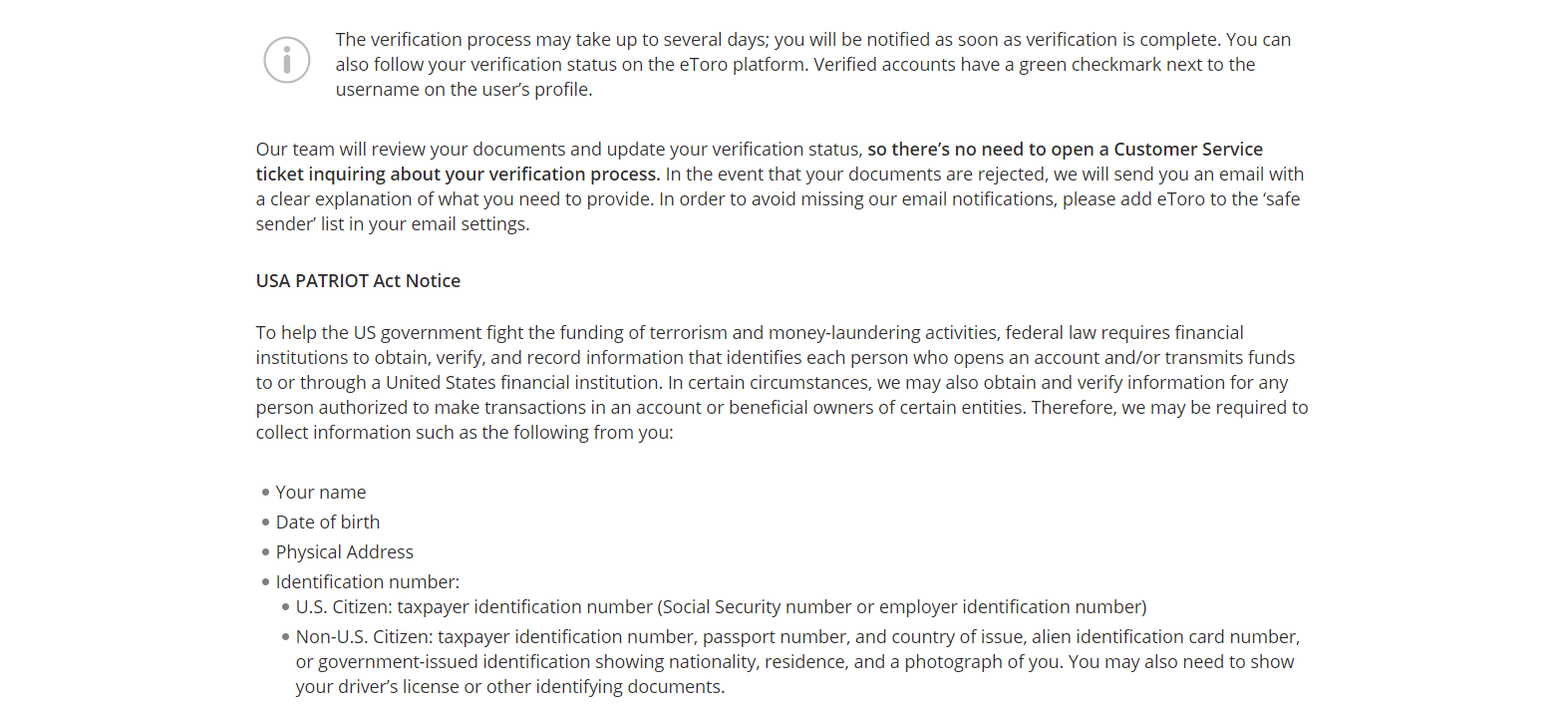

Opening an Account

The online application form handles new accounts, following established industry standards. A username, password, and e-mail address complete the first step. The second step consists of a verification process as required to comply with regulatory AML/KYC stipulations. Traders are asked to forward a copy of their ID and one proof of residency document. The trading account is fully functional once the submitted records are approved.

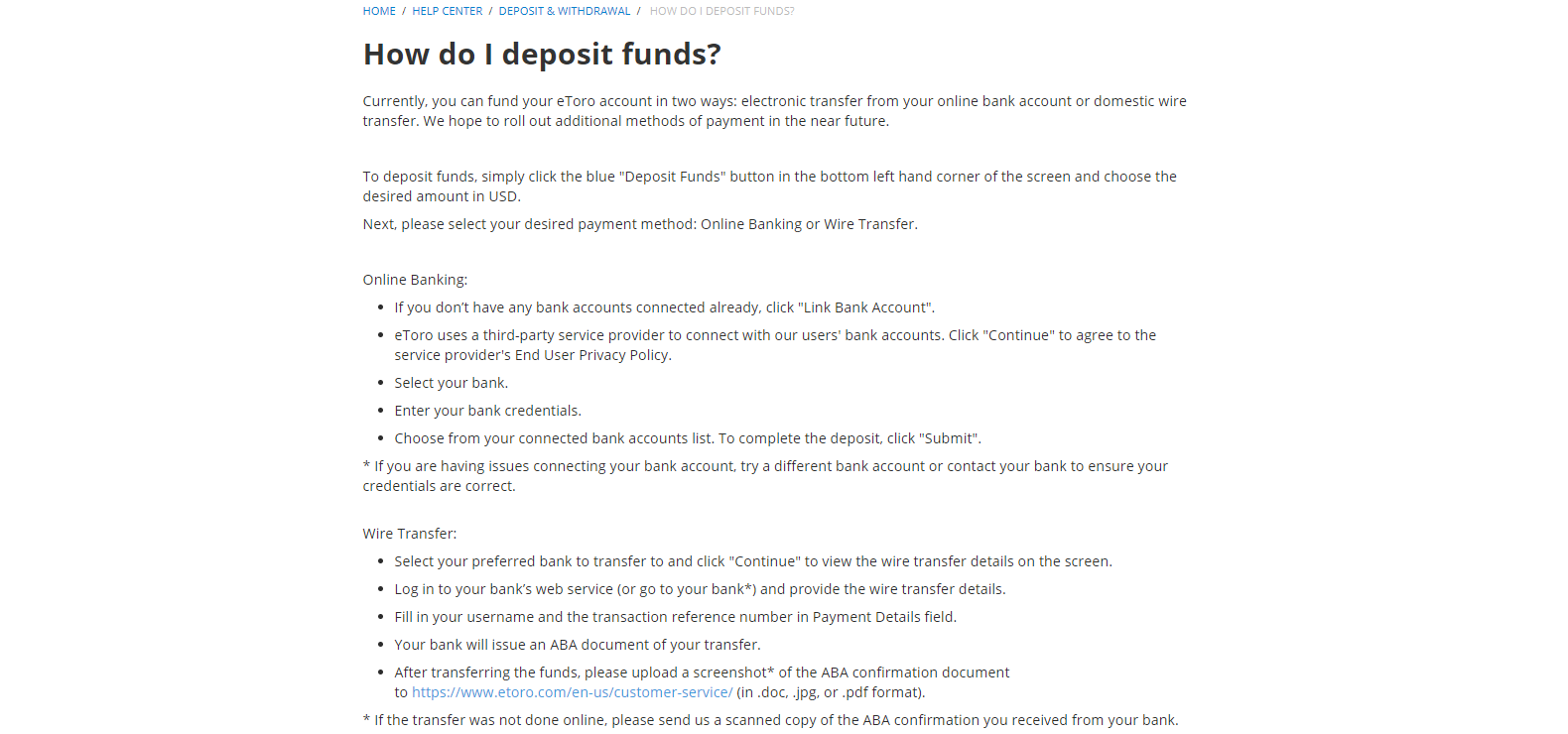

Deposits and Withdrawals

In keeping with US regulations, eToro USA supports deposits and withdrawals through credit/debit cards or bank wires. The minimum deposit is $50, with a daily maximum of $10,000, and processing times may be as long as seven business days (depending on the method used). The name on the payment processor and the eToro USA account must be identical, in compliance with AML regulations. The inclusion of more payment and withdrawal options, and an improvement in the overall processing times, would greatly benefit this broker.

Deposit and withdrawal options are limited.

Trading Platform

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Summary

eToro USA marks the expansion of the social trading platform eToro into the US market. Given regulatory restrictions, it merely operates as a cryptocurrency broker registered with FinCEN. It notes this as the first phase, though it has been nearly two years since any meaningful development. That being said, eToro USA is one of the only regulated online cryptocurrency brokers in the United States, and is a solid option for US-based traders who want to trade without dealing with the complexities of a proper blockchain exchange.

Signal providers who have third-party access to research capabilities can generate a revenue stream through the Popular Investor Program. It is unfortunate that eToro does not provide the proper analytics for those traders who desire it.

eToro USA offers a limited asset selection, which is relatively overpriced. Though they advertise that they do not assess a management fee, the mark-ups on the spread of assets more than cover their expenses and should be a consideration for new traders. Most eToro traders operate their portfolios at a loss. The eToro trading platforms, both the mobile version and the webtrader, are essentially quite basic.

The concept of social trading in cryptocurrencies has generated attention across social media, and the implementation of CopyTrading, as developed in-house by eToro, has gained popularity among new traders. Most new traders attracted to social trading have no need for core trading tools and wish to follow others with a few clicks. To that end, eToro USA has delivered on the technology. For new traders who are heavily influenced by social media, this broker can easily fill that void.

Securities trading offered by eToro USA Securities, Inc. (“the BD”), member of FINRA and SIPC. Cryptocurrency offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD.

FAQs

Is eToro USA free?

This broker does not charge commissions for trades, but the mark-up on spreads is elevated.

Is eToro USA good for new traders?

CopyTrader allows traders to follow others in the network. It is suitable for beginners, but caution is advised when copying trades from the community.

Can I make money on eToro USA?

Traders can earn money. The most profitable solution is the Popular Investor Program, where signal providers are compensated for community development.

Can you use eToro in the USA?

eToro USA, a wholly-owned subsidiary of eToro, caters exclusively to the US market as a cryptocurrency broker.