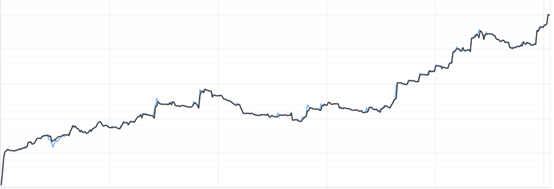

Ask any stock trader to offer an example of a hedge and he might say something like “selling Dax to protect a core long FTSE position”. This makes intuitive sense: both instruments are stock indices. Both instruments are highly correlated because they respond to the same dynamic (growth prospects).

Top Forex Brokers

FTSE / Dax Positive Correlation

Instead, if you ask any retail Forex trader what is hedging in Forex, you will likely get the following response: “being long 100.000 EURUSD and short 100.000 EURUSD”. However, any industry trader would call that an “offset”, or “not having a position”.

Many US retail Forex traders feel somewhat limited by the NFA ruling that effectively eliminated this kind of “hedging” for US clients, while many other jurisdictions still allow the practice.

What is Hedging in Forex?

If you google the term “Forex hedging strategies” the results that turn up are mostly questionable. Holding simultaneous long and short positions in the same instrument is an offset, not a hedge. For example, if you are long and short 100,000 EUR/USD, you are flat, not hedged.

In the best-case scenario, the capability to go long and short on the same currency pair, in the same account, can allow you to neutralise your exposure during big news events. For example, leading into March 12th, the EUR/USD currency pair had broken into a fresh downwards move.

EUR/USD Downwards Move

Let us hypothesize that we are then putting on a 100,000 EUR/USD short at 1.1960, after price encountered resistance ahead of the key round number at 1.2000.

EUR/USD Short Trade @1.1960

However, we also know that on the 17th there was an FOMC decision, and it is never a good idea to hold a large position open when the central bank of one of the currencies involved is about to announce a decision. So, with the possibility to go long and short on the EUR/USD, we could buy 100,000 EURUSD on a dip during London trade, effectively offsetting our previous short and locking in a gain of approximately 67 pips.

Here is the math:

SELL 100,000 EUR/USD @1.1960 = +119.600 USD

Pay 1 pip spread = -10 USD

BUY 100,000 EUR/USD @1.1890 = -118.900 USD

Pay 1 pip spread = -10 USD

“Locked in” P/L = +680 USD

Next in our example, the FOMC announcement causes the price to rally and hit 1.2000 but sellers return to the market, and we decide to “take off our hedge” at 1.1950, maintaining just the original short trade from 1.1960, because we believe in the current downtrend.

Here is the math now:

SELL 100,000 EUR/USD @1.1960 = +119.600 USD

Pay 1 pip spread = -10 USD

BUY 100,000 EURUSD @1.1890 = -118.900 USD

Pay 1 pip spread = -10 USD

SELL to Cover 100,000 EURUSD @1.1950 = +119.500 USD

Pay 1 pip spread = -10 USD

Consolidated (closed) P/L = +570 USD

Open P/L = +100 USD

This was a very profitable example, but even in the best cases like this, there are lessons to be learned:

First and foremost, it takes very accurate market timing to use “hedging” profitably. Without proper trading technique, blindly “offsetting” your exposure can do more harm than good.

Secondly, each subsequent “hedge” means you pay the spread again. Over time, this can add up, especially if you are trading off small timeframes.

If you keep a “hedged” position open overnight, you will need to take into consideration the rollover costs, which may not be advantageous and eat into your profits.

Your account will need to be large compared to the positions you are opening. Each “hedge” uses up margin and if you have a small account, the risk of incurring into a margin call increases substantially.

During news events, and especially during the 5PM EST rollover or during the Sunday Wellington Open, spreads can widen substantially which means your “hedge” is no longer effective. Some currency crosses, like EUR/AUD or GBP/CAD, can experience 10-15 pip spreads during periods of low liquidity. If your positions are too large or you have too much margin tied up in “hedges”, these wider spreads can trigger a margin call.

So even in the best-case scenario you are not being efficient with your capital.

You still need to be a good trader to make money – there is no escaping this reality.

Offsetting your exposure is a less efficient way to trade because you pay the spread more often, and you lock up valuable capital in margin instead of using it to get into other trades.

How Forex Hedging Strategies Can Encourage Poor Risk Management

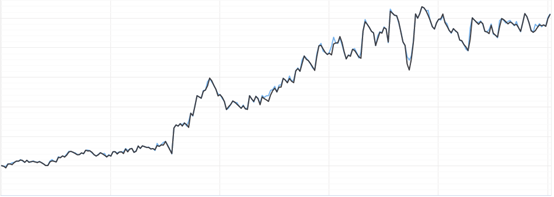

One of the most concerning aspects of many “Forex hedging strategies” is that they often lure traders into not using hard stop losses! Without stop losses, there is no accountability for bad timing or poor trading at all. A trader’s job is to deliver superior risk-adjusted rewards. To understand why, just compare these equity curves.

Equity Curve Trader A

Equity Curve Trader B

Trader A has a much smoother equity curve than Trader B. As such, Trader A has produced better risk-adjusted returns. Trading without stop losses makes it impossible to determine your risk, because without a stop loss, you are risking your entire account on every trade.

Take for example a strongly trending “runaway” market. Suppose you bought USD/JPY at 109.35. Eventually the bullish trend loses strength and you “hedge” at 110.33.

USD/JPY “Hedge” @109.40

The market finds support and you close your “hedge” at 109.40. However, the downwards momentum continues and since you do not have a hard stop loss, you end up underwater.

USD/JPY “Hedge” @109.40 Causes Major Loss

Without a hard stop loss, the losses can just keep growing. Also, by holding the initial long position, you are “blinded” because you will likely interpret all subsequent price action in the context of your initial trade, instead of being more objective.

A Real Forex Hedging Strategy

By now it should be clear that having two opposite positions simultaneously in the same currency pair is not “hedging” but “offsetting exposure”. A true hedge instead requires 2 positions in different instruments that are highly correlated.

In Forex specifically, only a few brokers offer option contracts which would be the simplest and most effective way to hedge against a spot Forex position. I will not go into option details here, but just to understand this example you should know that:

- A call option gives the buyer the right to buy a currency pair at a certain strike price at a certain date in the future.

- A put option gives the buyer the right to sell a currency pair at a certain strike price at a certain date in the future.

For example: imagine being long of 100,000 EUR/USD from 1.1400 and seeing rejection bars forming at a previous support zone/likely resistance zone. You may want to buy a put option for the same amount. This way you will maintain your original exposure, but you will be “hedged” if the price starts to retrace against your trade.

Hedging Faltering Long Trade with Put Option

When the market hits the support zone and bounces, if you are convinced the uptrend will continue, you might want to take off the hedge by selling your put option.

Removing Hedge as Long Trade Recovers

However, consider that (at the time of writing) buying a put would cost you around 70 pips, with a 3-pip spread. So, to break even on the “hedge”, the price would need to decline by 76 pips. Therefore, you should ask yourself whether you really need to “hedge” your position in the first place, or whether it is simply better to trail your stop loss, get taken out, and then get back in the trade at a better price.

Finally, some people use the term “hedging” to describe taking positions in highly positively correlated currency pairs. For example, selling GBP/USD to “hedge” a long EUR/USD position.

This is not a true hedge because the entire position is not being protected. What is really happening here is the creation of a synthetic long EUR/GBP position. You have “hedged” the USD exposure, but you are still exposed to movements in the cross rate.

The FIFO Rule in Forex

Despite having limited value (if at all), the practice of opening both long and short positions in the same currency pair seems to be popular in the retail market and there was quite a lot of opposition to the U.S. National Futures Association’s FIFO rule, which was introduced in 2009. This rule blocked any “hedging” on the same account, because traders are required to close the oldest trades first in the case where there are several open trades on the same pair and of the same size. Hence the name FIFO: first in, first out.

FIFO was already used by stocks and futures platforms, so this was just a way of bringing the Forex market to the same practise. To understand how the FIFO rule works in Forex, let us work through an example.

Say you are building a position in EUR/USD:

Bought 100,000 EUR/USD at 1.1800 on April 5th, 2021.

Bought 100,000 EUR/USD at 1.2000 on April 22nd, 2021.

The price has since moved up to 1.2100 but has come back towards 1.2050. You want to close your second position (opened at 1.2000). Due to FIFO, you cannot. Any scaling out will necessarily affect your initial position first. Only after the original 100,000 bought on April 5th has been entirely sold, will your broker work on your second order from April 22nd.

Final Thoughts

Any “Forex hedging strategy” can be replicated in a non-hedge fashion, avoiding the extra spreads, extra margin requirements, negative carry, and poor risk management practices. In my experience, most traders use “hedging” to avoid placing a stop loss and it is done simply as an attempt to avoid taking a loss and being “wrong”. This is the exact opposite of what successful trading is all about.

Do not be discouraged if you live in a jurisdiction that does not allow “hedging” in your Forex trading account. This rule will in fact force you to become a better trader all-round.

FAQs

Is Forex hedging profitable?

The capacity to go both long and short on the same currency pair in the same account can be useful to trade around a core position, or to trade 2 different strategies in the same account. To that end, the profitability depends on the traders’ skill. Hedging is not a guaranteed way to make money.

What is the best hedging strategy?

There is no best way to use the hedging facility, and in fact, most traders would be better off not using it.

Does Forex allow hedging?

Certain countries like the UK allow hedging, while other countries like the USA do not.

How do you hedge Forex pairs?

The best way to properly hedge Forex pairs is to employ call or put options. But very few Forex brokers offer such options.