Top Forex Brokers

A 2 Bar Reversal is basically just a Pin Bar reversal but formed over 2 sessions worth of data. The psychology behind both the 2 Bar and the Pin Bar are both the same. With both signals we are looking for price to go in one direction before faking traders out and snapping back quickly in the opposite direction.

2 Bar Reversal Structure

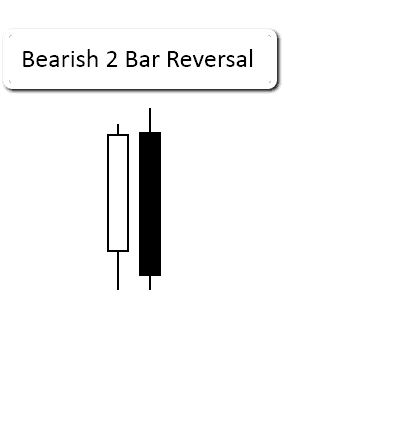

The 2 Bar Reversal is made up of 2 candles or bars. For a bearish 2 Bar reversal the first bar must go up and close near the sessions highs. The second bar must then open and snap back lower showing rejection of those previous highs and faking traders out. The candles below show what this description will look like on a chart.

Bearish 2 Bar Reversal

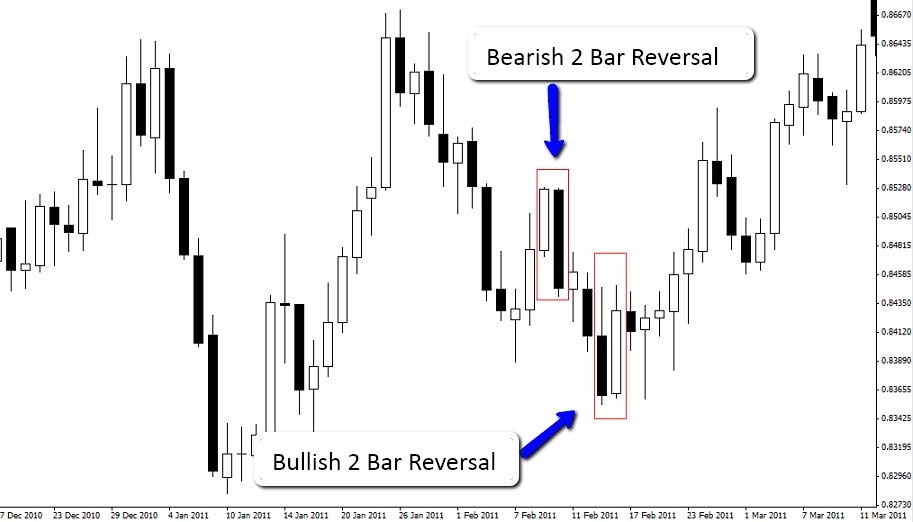

Examples of 2 Bar Reversal Found On Chart

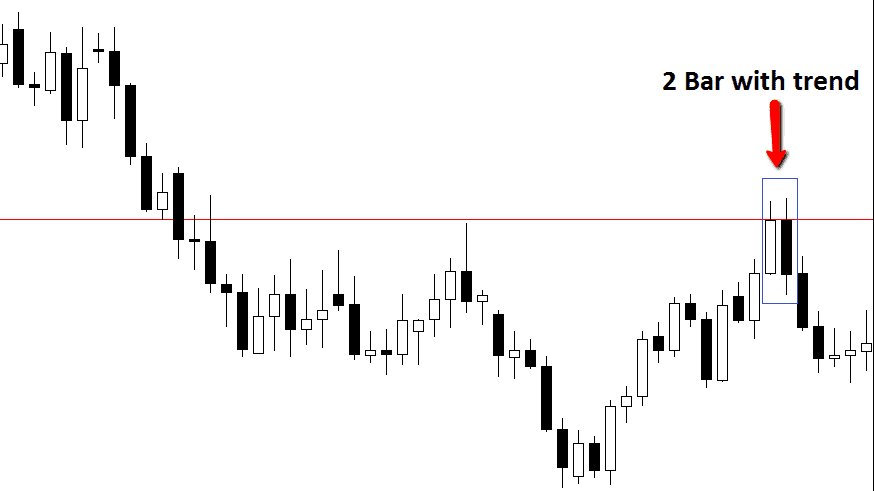

The best 2 Bar Reversals are normally found when the market is in a strong trend and a pullback occurs to a logical area of support or resistance. It is at these logical areas of supply and demand that traders can look for the 2 Bar reversal as entry signals with the trend.

Example 2 Bar Reversal With Trend

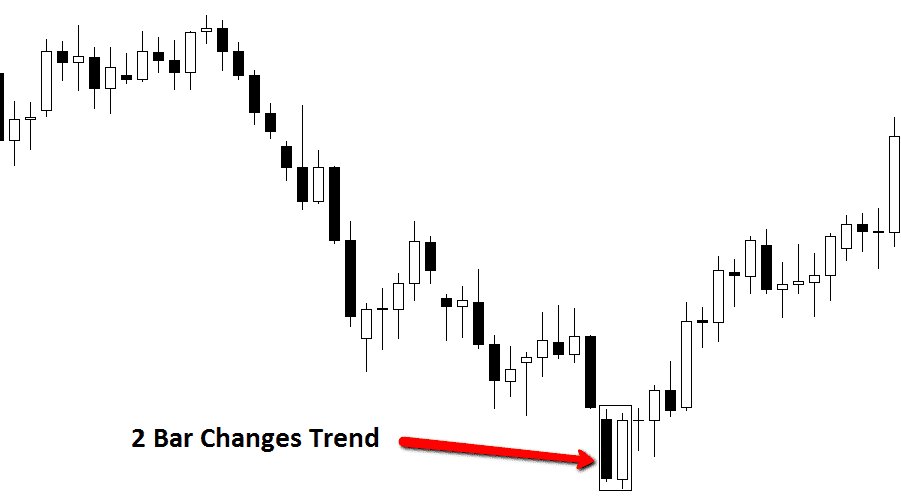

2 Bar Reversals can be traded in all sorts of markets. Because 2 Bar Reversals are reversal signals you will often find they are the signal that changes the direction of the trend.

2 Bar Reversal Changes Strong Trend

All traders will be able to spot and identify this very easily identifiable Price Action signal on their charts. Just because a trader spots a 2 bar Reversal however does not mean they should trade it. Not all 2 Bar Reversals are created equal and some have much higher percentage chances of working out than others.

You might also be interested in reading the below articles:

- Which Forex Pairs Range the Most?

- Which Forex Pairs Trend the Most

- Forex Trading Industry Statistics and Facts

- How to Count Pips on GBP/JPY

- Which Forex Pairs Move the Most?

FAQ

What is a reversal bar?

A reversal bar is one which exceeds the high or low of the previous bar, but which also closes higher or lower than the previous bar in the opposite direction.

What is bearish bar reversal?

A bearish bar reversal occurs when the high of the current bar exceeds that of the previous bar, but it closes lower than the close of the previous bar.

How Do You Use Bar Patterns to Spot Trade Setups?

Act on continuation bar patterns when the price is moving in a definite trend, and act on reversal bar patters when the trend has lost momentum or when there is a consolidation pattern with no trend.

How do you trade inside a bar?

Trading inside a bar means trading while the bar is still forming, not waiting for the bar to close. This can be a powerful tool especially if you want to enter a trade while on the wick of the current bar. The best way to trade inside a bar is have a chart on one side of the screen showing the bar forming and on the other side, show a price chart of the same thing but on a lower time frame.