Role of Central Banks

The primary mandate of central banks, at least for the institutionally independent ones in more developed nations, is to achieve or preserve monetary stability, which usually entails keeping inflation under control and keeping the exchange rate of the local currency relatively stable against the currencies of its major trade partners, o r the currencies in which it holds major reserves.

There are several tools that central banks can use to achieve these objectives. While the most prominent one is setting the interest rate, other tools can be used, such as open market operations, which involve acquiring and selling short-term government securities, or changing reserve requirements, which aids credit expansion.

Generally, in this context a central bank will pay most attention to setting the rate of interest, depending on its assessment of the current state of the economy as well as its forecasts. This assessment is key because it can tilt the balance towards a policy emphasizing increasing employment and economic growth, and policies whose main purpose is keeping inflation under control at a relatively low level.

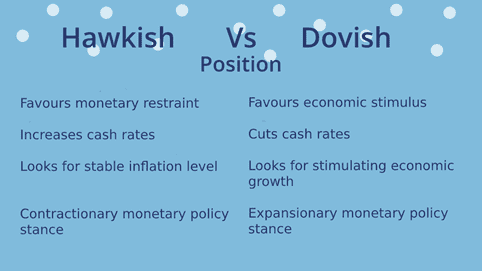

What are “Hawkish” and “Dovish”?

A central bank is said to be "hawkish" when it decides to raise the interest rate, adopting a contractionary monetary policy stance, in an attempt to keep inflation low and the value of its currency relatively high. In the same way, it is described as "dovish" when it adopts an expansionary monetary policy stance, cutting the interest rate, in an attempt to stimulate economic growth and employment, and to lower the relative value of its currency.

Forward Guidance

Most central banks have a governing council that meets periodically to discuss and formulate matters related to monetary policy. For example, the European Central Bank's governing council usually meets twice a month, while the Federal Reserve’s Federal Open Market Committee usually meets every five to eight weeks.

After making decisions about monetary policy going forward, central banks usually convene a press conference and communicate it to the world, as well as giving explanation as to why decisions were taken and what they are hoped to achieve. Moreover, the governing committee usually communicates its perceptions about the current state of the economy, as well as its expectations for economic growth, the inflation rate, the unemployment level, and the future course of monetary policy.

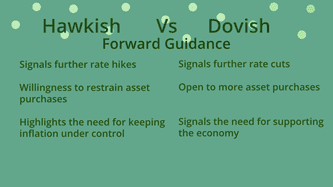

The act of communicating the probable course of monetary policy into the future has become known as "forward guidance" and has increasingly become a key tool for modern central banks despite an ongoing controversy about its effectiveness. The reason why it became so relevant in the years following the financial crash of 2008 is the persistence of historically low interest rates which effectively left central banks with little room to be any more dovish using traditional interest rate tools. affecting the bank’s capacity to stimulate economic growth. This has become known as the “zero lower bound problem” and created a necessity to rely on other means of influencing markets, especially given the effects of long-term interest rates on economic decisions.

There are, of course, downsides to relying on forward guidance as a policy tool. For example, instead of causing a desired effect in the economy, announcing an extended duration of exceptionally low cash rates could be interpreted as an announcement of a grim economic outlook. In other words, how the market interprets an announcement matters a lot, as it can cause unintended consequences.

In this context, a central bank is said to adopt a dovish position when it signals its intention to keep interest rates low for a long period of time, while adopting a hawkish position is signaling that rate hikes are likely to come in the foreseeable future. There are other declarations that may make the bank look dovish, like pledging to continue with an asset purchase program.

Notice that this is not about the actual actions the bank is taking, but about a verbal commitment that may or not affect the market in the desired way. This continues feeding a controversy regarding the effectiveness of the tool, despite the insistence of the main world central banks in relying on it.

Hawkish vs Dovish: Case Study

Before the beginning of his term as Chair, back when he was just a member of the Federal Reserve Board of Governors, Jerome Powell was often described as "hawkish" by the press, given his persistent cautiousness about the expansive (another term implying “dovishness”) approach that the Federal Reserve was adopting in the aftermath of the 2008 financial crisis.

Back then, Powell was often portrayed in the media as a dissenting voice, questioning the decisions of the previous Federal Reserve chairmen, Ben Bernanke and Janet Yellen, who at the time were guiding the bank through an unconventional path, adopting a dovish monetary policy stance.

Over time, Powell became more dovish, turning to be more supportive of Janet Yellen's approach and signaling his preference for a FED focused more on aiding economic growth and combating unemployment instead of monetary restraint. When he became the Chair, despite his initial preference for a more hawkish position, his willingness to continue with Yellen's legacy became clearer over time, resulting in his approach being seen as even more dovish.

Powell is not the only central bank leader whose position changed from "hawkish" to "dovish" over time. It is well known that ex-Fed Chairs such as Ben Bernanke and Alan Greenspan backed decisions that they previously opposed. We should also notice that both the media's and market's perception about the position of the institution is taking is key here, in other words, despite the fact that monetary policy stance may arguably not be objectively "dovish" or "hawkish", if it perceived to be such by market actors, it will have an effect accordingly upon the Forex market.

Bottom Line

Forex traders can increase their odds of trading profitably by monitoring the policies of central banks which control the currencies which they are trading, and trading accordingly.

The rule is to be more bullish on a currency which is being managed with a more hawkish policy, and more bearish on a currency being managed with a more dovish policy.

Monetary policy can be a good driver for long-term trends, especially on the rare but potentially very profitable occasions where a central bank makes a major policy shift.

Although there is a lot of arcane and technical economic language in analysis of central bank policies, monitoring policy can be as simple as reading Forex fundamental analysis which sums up central bank policies as hawkish or dovish. It is worth making a little effort to learn how to read fundamental analysis too.

FAQs

What does “dovish” mean?

Adopting a "dovish" monetary policy stance means to favor stimulating economic growth and employment instead of monetary restraint. Therefore, a "dovish" position often implies favoring interest rate cuts and signaling further reductions in the interest rate.

Is hawkish bullish?

Usually, yes. In the context of monetary policy and central banks, a more hawkish approach will tend to produce a rise in the relative value of the currency, which is called a bullish scenario.

What is dovish Forex?

It means that the central bank has decided to cut the interest rate and pursue an expansionary monetary policy.

What does it mean to be hawkish?

Being hawkish means imposing monetary restraint through increasing the interest rate and/or reducing or ending any policies of monetary expansion, possibly even including monetary tightening by reducing money supply.