Banxso Editor’s Verdict

Banxso is a relatively new South African broker claiming to be “not your grandfather’s bank.” It targets millennials and GenZ traders, offering a broad choice of currency pairs from its Banxso X trading platform or MT4/MT5. I reviewed this broker to evaluate its trading conditions and conclude if it lives up to its hype. Should Banxso become your next broker?

Banxso Pros and Cons

Overview

An exciting new MT4/MT5 broker offering TipRanks and a well-balanced asset selection.

Headquarters | South Africa |

|---|---|

Regulators | FSCA |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2022 |

Execution Type(s) | Market Maker |

Minimum Deposit | $100 |

Trading Platform(s) | MetaTrader 4, MetaTrader 5, Proprietary platform |

Average Trading Cost EUR/USD | 0.2 pips |

Average Trading Cost GBP/USD | 0.4 pips |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.23 |

Average Trading Cost Bitcoin | $50.00 |

Retail Loss Rate | Undisclosed |

Minimum Raw Spreads | 0.8 pips |

Minimum Standard Spreads | $0.00 |

Minimum Commission for Forex | No |

Funding Methods | 2+(bank wires and credit/debit cards) |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

I like the asset selection at Banxso, which offers traders an in-depth choice of trading instruments. The availability of fractional share dealing caters well to its primary trader base, confirming that the Banxso management conducted its research and understood the needs of its traders.

Banxso Highlights for 2024

- South African broker with a domestic license from the South African Financial Sector Conduct Authority (FSCA).

- AutoBanxso trading bot for MT5.

- Services by TipRanks and Trading Central.

- Cooma Social for copy trading.

- 8.7% interest rate on your account equity.

- Volume-based rebate program rewarding high-volume traders.

- Beginner education, trading videos, and success managers that will call Banxso clients.

- Bitcoin deposits and withdrawals.

Banxso Regulation & Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders to check for regulation and verify it with the regulator by checking the provided license with their database. Banxso presents clients with one regulated entity and maintains an overall secure trading environment.

Is Banxso Legit and Safe?

Banxso is a legit broker, managed and operated by the South African company Banxso Proprietary Limited. It segregates client deposits from corporate funds and has a license from the South African Financial Sector Conduct Authority (FSCA).

Banxso promises negative balance protection for all its clients, even though the FSCA does not mandate it, so this guarantee adds value. This means traders can never be held liable for an amount greater than the balance in their account, so can never lose more than they deposit.

Since Banxso launched on 1st April, 2022, it lacks a multi-year record to confirm its safety and trustworthiness. Banxso has the proper infrastructure in place and appears on course to expand its business internationally. Traders have no reason to believe that this broker will not honor its commitment and provide safe trading conditions.

Country of the Regulator | South Africa |

|---|---|

Name of the Regulator | FSCA |

Regulatory License Number | 37699 |

Regulatory Tier | 2 |

Only South African resident traders can open an account at Banxso right now, but the management team announced extensive expansion plans, which it seeks to complete in 2022. It will allow international traders to manage portfolios at Banxso.

The planned 2022 Banxso expansions include:

- Banxso.eu in EU member states with CySEC regulation

- Banxso.co.uk in the United Kingdom with FCA regulation

- Banxso.ae in the Arab Emirates with DFSA regulation

- Additional regulated subsidiaries in Seychelles and Mauritius catering to international traders

- An unregulated but duly registered subsidiary in Saint Vincent & Grenadines

Banxso Fees

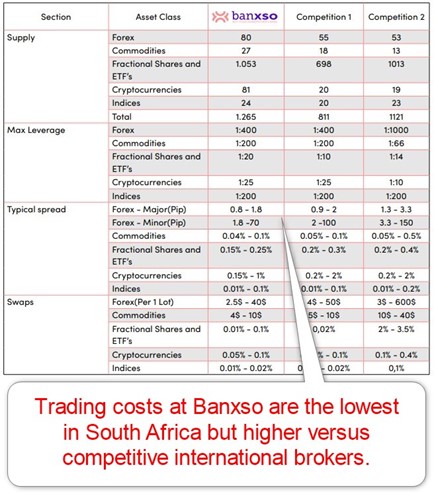

Banxso offers traders commission-free Forex trading with higher spreads and above-average equity costs.

The commission-free Forex cost structure, with minimum spreads of 0.8 pips or $8.00 per 1 standard lot, is the cheapest I have seen at any South African Forex / CFD broker.

Costs for equity traders range between 0.15% and 0.25%, which compares to 0.08% and 0.10% for international competitors. Banxso notes the listed costs apply to professional accounts and regrettably fails to detail how traders can obtain professional account status.

Banxso states an inactivity fee applies after three months of dormancy but does not list the amount in the published terms and conditions.

Average Trading Cost EUR/USD | 0.2 pips |

|---|---|

Average Trading Cost GBP/USD | 0.4 pips |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.23 |

Average Trading Cost Bitcoin | $50.00 |

Minimum Raw Spreads | 0.8 pips |

Minimum Standard Spreads | $0.00 |

Minimum Commission for Forex | No |

Deposit Fee | |

Withdrawal Fee |

One of the most ignored trading costs is swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

Noteworthy:

- Swap rates for long positions at Banxso are notably cheaper than competitors, allowing diversified traders to achieve lower trading costs here.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights, in the commission-free Banxso account.

Taking a 1 standard lot buy/sell position, in the EUR/USD, at the minimum spread and holding it for one night will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.8 pips | $0.00 | -$2.89 | X | $10.89 |

0.8 pips | $0.00 | X | -$2.51 | $10.51 |

Taking a 1 standard lot buy/sell position, in the EUR/USD, at the minimum spread and holding it for seven nights will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.8 pips | $0.00 | -$20.23 | X | $28.23 |

0.8 pips | $0.00 | X | -$17.57 | $25.57 |

Range of Assets

Banxso maintains a well-balanced and competitive asset selection, and I especially like the choice of currencies. Traders with smaller portfolios will benefit from fractional share dealing on over 1,000+ equities and ETFs. Banxso states 8,000+ overall assets, making it a promising new broker competing well with industry leaders.

Asset List Overview

Commodities | |

|---|---|

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

ETFs | |

Futures | |

Synthetics |

Banxso Leverage

Banxso allows maximum Forex leverage of 1:400, commodity and index traders get 1:200, and equity and ETFs 1:20. It presents a highly competitive offer, ensuring traders can manage portfolios with an edge.

Banxso Trading Hours

Asset Class | From | To |

|---|---|---|

Commodities | Monday 00:00 | Friday 22:59 |

Crude Oil | Monday 00:00 | Friday 22:59 |

Gold | Monday 00:00 | Friday 22:59 |

Metals | Monday 00:00 | Friday 22:59 |

Equity Indices | Monday 00:00 | Friday 22:15 |

Stocks | Monday 09:00 | Friday 22:00 |

How to Open Banxso Account

Banxso ensures a swift account opening process and only asks for a name, e-mail, mobile phone number, and desired password. The process takes less than 20 seconds to complete, but Banxso currently only accepts South African resident traders. Banxso plans to expand internationally by the end of 2022.

Banxso complies with KYC/AML requirements and requires all new clients to pass verification. New clients must submit a copy of their government-issued ID, preferably a passport, and one proof of residency document no older than six months.

Minimum Deposit

The minimum deposit at Banxso is a relatively affordable US $100, or ZAR 1,500.

Payment Methods

Banxso accepts bank wires and credit/debit cards.

Withdrawal options |    |

|---|---|

Deposit options |    |

Accepted Countries

Banxso presently only accepts traders resident in South Africa but has ambitious expansion plans throughout 2022 to cater to an international trader base.

Banxso Deposits and Withdrawals

The secure Banxso back office oversees all financial transactions.

Banxso does not list deposit or withdrawal fees, but third-party charges apply. Processing times depend on the payment method. After Banxso receives a deposit, it can take one business day to credit the trading account. Banxso states it aims to complete the internal withdrawal process within three business days. Only verified trading accounts may request withdrawals with previously verified methods.

Traders using credit/debit cards must send a copy of the front and the back of each credit/debit card to pass verification. For bank wires, traders must send a copy of the bank receipt. Banxso sends all withdrawals to the source of the deposit until a full refund of the deposit, at which point the trader can add an alternative method if desired.

Banxso Account Types

Banxso offers one account type to all clients, staying true to its simplified approach favored by its core trader base. I would appreciate an account introduction on its website, as potential traders must source the information from the Banxso terms and conditions, which appear outdated. A volume-based rebate program would improve the offering.

Banxso Demo Account

While Banxso does not state the availability of a demo account on its website, traders have access to one. It is unclear if Banxso offers unlimited, flexible demo accounts, as supported by MT4/MT5, or only for its proprietary Banxso X trading platform. I want to caution beginner traders against using a demo account as an educational tool. It creates unrealistic trading expectations, and the absence of trading psychology negates the educational value.

Banxso Trading Platforms

Traders at Banxso get the core MT4/MT5 trading platforms, which support algorithmic trading and have an embedded copy trading service. They are available as a desktop client, a lightweight, web-based alternative, and a mobile app. The proprietary Banxso X trading platform is another choice, but Banxso does not publish detailed information about its functionality.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Unique Features

Banxso makes bold statements about its AI technology. In addition to claims about superior AI technology, Banxso states that its little-known trading strategies can help traders manage portfolios, but details are currently hard to find.

Research & Education

The primary research tool at Banxso comes via TipRanks, a well-known and trusted third-party provider of independent analysis and ratings focused on equity markets. Banxso notes in-house technical analysis, a personal trading analyst, and sentiment analysis.

Banxso introduces a wealth of educational resources. It lists online courses, personal face-to-face coaching sessions, and interactive webinars hosted by Banxso trading experts.

I like the structure and idea behind the educational approach of Banxso, honoring the FSCA commitment to educating traders following decades of fraud across South Africa that hurt confidence in the domestic financial system. Unfortunately, I am missing more in-depth details, as this presents a notable competitive edge.

Bonuses and Promotions

As I conducted this review, Banxso neither offered bonuses nor hosted promotions.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/7 |

Website Languages |  |

Customer support at Banxso is available 24/7 and consists of e-mail support, phone support, and messengers WhatsApp and Telegram. Banxso also welcomes in-person meetings at its office in Cape Town but asks clients to schedule one via Calendly. E-mail response times are within 24 hours, but I recommend the messengers for non-urgent questions and phone support for time-sensitive issues. Before calling, traders should have all necessary information handy to expedite the process.

Is Banxso a Good Broker?

I like the trading environment at Banxso as it offers a well-balanced asset selection. Unlike most new brokers who maintain a limited choice of trading instruments, Banxso features 8,000+ assets, including 80 currency pairs and 1,000 fractional shares. While the commission-free pricing environment is quite competitive internationally, it is the lowest among all South African-based brokers. Swap rates for buy orders are up to 50% cheaper, but Banxso does not list detailed positive swap rates for qualifying positions. This should help diversified traders to achieve lower overall costs.

Services from TipRanks offer excellent valuer to equity traders, and I like the overall idea Banxso attempts to realize. Regrettably, it lacks details on its core competitive advantage, and I would like its website to introduce them better. Banxso is an exciting new broker, and if it realizes its plans, it can compete well internationally.

FAQs

Is Banxso a market maker?

Yes, Banxso is a market maker.

What is the maximum leverage at Banxso?

Banxso offers maximum Forex leverage of 1:400, commodities, and indices at 1:200, cryptocurrencies of 1:25, and equity and ETFs at 1:20.

How long does it take to withdraw money from Banxso?

Banxso aims to complete the internal withdrawal process within three business days.

Is Banxso legit?

Banxso is a new South African broker operating as a legit entity with regulatory oversight from the FSCA. It also has ambitious expansion plans, including acquiring licenses from five more regulators.

What are Banxso’s trading hours?

Banxso notes: “Banxso operates for trading 24/7. However, specific trading hours for individual stocks may vary depending on market conditions.” Customer support is also available 24/7, and traders can check the trading platform for asset-specific trading hours.

Does Banxso operate a bank?

Despite its slogan: “Not your grandfather’s bank,” Banxso does not operate a bank. It is a CFD brokerage.

Does Banxso provide VPS?

Banxso does not provide VPS hosting that supports 24/5 low-latency Forex trading.

Is Banxso suitable for spread betting?

Banxso offers CFD trading but not spread betting, making it unsuitable for spread betters.

Is Banxso recommended for hedging?

Hedging is possible at Banxso, but traders should consider the high trading fees and evaluate if hedging is economically viable for their portfolios.

Is Banxso suitable for auto-trading?

Banxso offers MT5, making it a suitable Forex broker for auto-trading.

Is Banxso good for scalping Forex?

Banxso is not ideal for scalpers due to high trading fees and raw spread trading availability.

Does Banxso offer a demo account?

Banxso offers a risk-free demo account, which includes access to all educational tools.

Which trading platform does Banxso offer?

Banxso offers MT5, which supports algorithmic trading, for which Banxso offers its in-house developed EA and its proprietary BanxsoX trading platform.

How do I open an account with Banxso?

Banxso has a swift online application requiring a name, e-mail, phone number, and desired password. Account verification is mandatory, which most traders pass by uploading a copy of their government-issued ID and one proof of residency document.

How do I withdraw money from Banxso?

Verified traders can request withdrawals from the secure and user-friendly Banxso withdrawal section in the myBanxso back office.

What is the minimum deposit for Banxso?

The Banxso minimum deposit of $250 is higher than most competitors but within a reasonable range and typical for South African Forex brokers.

Is Banxso good for beginner traders?

Banxso offers a quality introductory educational course with 100+ videos and 23 video trading courses, making it a good choice for beginner traders.

Is Banxso safe?

Banxso operates under South African Financial Sector Conduct Authority (FSCA) oversight.