Editor’s Verdict

ATFX is a Top 10 MT4/MT5 multi-asset broker established in 2017. Its impressive operational statistics include 6,500+ webinars and 3,400+ seminars, ultra-deep liquidity pools with an internal FinTech division as a prime-of-prime liquidity provider and upgraded trading MT4/MT5 trading platforms. Still, I rank ATFX among the best Forex brokers for beginners, as it offers excellent research and education. My comprehensive analysis of the ATFX trading environment covered all core aspects. Should you trade at ATFX?

Overview

ATFX offers a genuine STP trading environment with deep liquidity.

Headquarters | United Kingdom |

|---|---|

Regulators | ASIC, CySEC, FCA, FSA, FSC Mauritius, FSCA, SCA, SEC |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2017 |

Execution Type(s) | ECN/STP |

Minimum Deposit | $500 |

Negative Balance Protection | |

Trading Platform(s) | Other, MetaTrader 4, MetaTrader 5 |

Average Trading Cost EUR/USD | $18.00 |

Average Trading Cost GBP/USD | $20.00 |

Average Trading Cost WTI Crude Oil | $0.05 |

Average Trading Cost Gold | $0.38 |

Average Trading Cost Bitcoin | $25.00 |

Retail Loss Rate | Undisclosed |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 1.8 |

Minimum Commission for Forex | $7.00 per 1.0 standard round lot |

Funding Methods | 5 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

ATFX Five Core Takeaways:

- A well-regulated broker with insurance protection

- Trading Central and Autochartist services

- User-friendly mobile app and in-house copy trading service

- A balanced asset selection of 300+ trading instruments

- No cryptocurrency trading, deposits, and withdrawals

ATFX Regulation & Security

Country of the Regulator | United Arab Emirates, Australia, Cyprus, Hong Kong (SAR), Mauritius, Seychelles, United Kingdom, South Africa |

|---|---|

Name of the Regulator | ASIC, CySEC, FCA, FSA, FSC Mauritius, FSCA, SCA, SEC |

Regulatory License Number | 760555, 44816, 418036, 20200000078, 285/15, C118023331, SD093, BUM667 |

Regulatory Tier | 1, 2, 1, 2, 1, 4, 4, 1 |

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend that traders check regulations and verify them with the regulator by double-checking the provided license with their database. ATFX has eight regulated entities with clean track records.

Is ATFX Legit and Safe?

My ATFX review found no verifiable misconduct or malpractice by this broker, founded in 2017. Therefore, I call ATFX as a legitimate and safe broker.

ATFX regulation and security components:

- Regulated by the UK Financial Conduct Authority (FCA), the South African Financial Sector Conduct Authority (FSCA), the Australian Securities & Investments Commission (ASIC), the UAE Securities and Commodities Authority (SCA), the Cyprus Securities and Exchange Commission (CySEC), the Mauritian Financial Services Commission (FSC), the Seychelles Financial Services Authority (FSA), and the Hong Kong Securities and Futures Commission (SEC)

- Founded in 2017

- Segregation of client deposits from corporate funds

- Negative balance protection

- $1M liability insurance per trader arranged by Willis Towers Watson and underwritten by syndicates at Lloyd’s of London

What would I like ATFX to add?

ATFX meets all security criteria. The only thing missing is more transparency about its core management team.

Fees

Average Trading Cost EUR/USD | $18.00 |

|---|---|

Average Trading Cost GBP/USD | $20.00 |

Average Trading Cost WTI Crude Oil | $0.05 |

Average Trading Cost Gold | $0.38 |

Average Trading Cost Bitcoin | $25.00 |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 1.8 |

Minimum Commission for Forex | $7.00 per 1.0 standard round lot |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | true |

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability. During my ATFX review, I found three commission-free cost structures and one commission-based alternative. Their availability depends on the ATFX entity, with its international one featuring one commission-free option.

The commission-free Standard account has above-average minimum spreads from 1.8 pips or $18.00 per 1.0 standard round lot.

ATFX levies a monthly inactivity fee of $10 or a currency equivalent after six months of dormancy. Traders pay zero deposit or withdrawal fees except on bank wires below $1,000. I found no mention of currency conversion fees.

The minimum trading costs for the EUR/USD at ATFX are:

Minimum Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

2.6 pips (Micro) | $0.00 | $26.00 |

1.8 pips (Standard) | $0.00 | $18.00 |

1.0 pips (Premium) | $0.00 | $10.00 |

0.1 pips (Raw) | $7.00 | $8.00 |

Swap rates on leveraged overnight positions are the most ignored trading costs. Depending on the trading strategy, they may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

MT4/MT5 traders can access swap rates from their platform by following these steps:

1. Right-click the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Range of Assets

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

ATFX offers 300+ assets covering Forex, commodities, indices, equity CFDs, and ETFs. While the absence of cryptocurrency trading is notable, the asset selection suffices for most trading strategies.

ATFX offers the following choice of assets per asset class:

- 44 Forex pairs

- 11 cryptocurrencies

- 6 metals and energies

- 15 indices

- 200+ equity CFDs and ETFs

ATFX Leverage

Maximum Retail Leverage | 1:500 |

Maximum Pro Leverage | 1:500 |

What should traders know about ATFX’s leverage?

- Maximum retail Forex and index leverage is 1:500

- Cryptocurrency leverage is 1:10

- Metals and energies max out at 1:400, except for gas, which tops out at 1:50

- Index traders get 1:100

- Equity traders receive 1:20

- Not all assets within a sector qualify for the maximum leverage

- Negative balance protection exists, ensuring traders cannot lose more than their deposit

- Traders should always use appropriate risk management with leveraged trading to avoid magnified trading losses

ATFX Trading Hours

Asset Class | From | To |

|---|---|---|

Currency Pairs | Monday 00:05 | Friday 23:55 |

Cryptocurrencies | Monday 00:05 | Friday 23:55 |

Commodities | Monday 01:01 | Friday 23:55 |

Crude Oil | Monday 01:01 | Friday 23:55 |

Gold | Monday 01:01 | Friday 23:55 |

Metals | Monday 01:01 | Friday 23:55 |

Equity Indices | Monday 01:05 | Friday 23:59 |

Stocks | Monday 01:05 | Friday 23:59 |

ETFs | Monday 16:33 | Friday 22:59 |

Account Types

The ATFX account types depend on the entity and regulatory environment. Traders who select the international option will receive a commission-free Standard account with a $500 minimum deposit requirement. Other options are a Cent account for a $100 minimum deposit, a Premium account, and a Raw account with a commission-based cost structure for a $10,000 minimum account balance. ATFX also has a demo account and a swap-free Islamic account.

My observations concerning the ATFX account type are:

- The account availability depends on the entity and regulator

- A $500 minimum deposit requirement

- A maximum retail leverage of 1:500

- A margin call at 100% of account margin

- An automatic stop-out at 30% of account margin

- STP order execution

- Raw spread trading from 0.0 pips

- Deep liquidity pools, including an in-house prime-of-prime liquidity provider

- A minimum transaction size of 0.01 lots

$7.00 per 1.0 standard round lot commissions for Forex traders

ATFX Demo Account

Demo trading does not grant exposure to trading psychology and can create unrealistic trading expectations. Therefore, I want to caution beginner traders about using demo trading as an educational tool and suggest they consider its limitations.

What stands out about the ATFX demo account?

- ATFX offers demo accounts

- Customizable MT4/MT5 demo accounts are offered

- A demo account requires registration but not account verification

Trading Platforms

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Traders can choose between the full suite of MT4/MT5 trading platforms and the proprietary ATFX Mobile Trading App for mobile traders. MT4/MT5 are available as powerful desktop clients, lightweight web-based alternatives, and popular mobile apps.

I recommend the desktop clients, as they offer all the functions, including algorithmic trading. Traders can upgrade MT4 via 25,000+ custom indicators, templates, and EAs, while MT5 features 10,000+. ATFX also upgrades its trading environment with services from Trading Central and Autochartist.

Unique Features

During my ATFX review, I found the MAM/PAMM accounts for multi-account management and traditional account management services and the in-house copy trading, ATFX CopyTrade, which allows copy traders to follow up to 100 signal providers per account, as two stand-out features for retail traders.

Research & Education

I rank the research at ATFX among the highest quality services as it features actionable trading recommendations by Trading Central and Autochartist. ATFX also publishes supportive research content on its website and has an in-house curated Trader Magazine.

What about education at ATFX?

ATFX shines with its educational offering, which includes 6,500+ webinars and 3,400+ seminars. Beginners also benefit from well-structured video courses featuring 85 short videos and 14 e-books. With the Trading Central educational value, ATFX maintains an industry-leading course for first-time traders.

My conclusion:

- I advise first-time traders to consider the high-quality educational content published by ATFX.

- Beginners should also seek in-depth education from third parties focusing on trading psychology and the relationship between leverage and risk management

- Avoid paid-for courses and mentors

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |                  |

ATFX offers 24/5, multi-lingual customer support via e-mail, phone, WhatsApp, and live chat. Unfortunately, a dedicated FAQ section is missing. Therefore, traders may have to search for answers using their favourite search engine.

Bonuses and Promotions

When this ATFX review was written, I found that ATFX neither offered bonuses nor promotions.

Awards

ATFX has dozens of industry awards. Three of the most recent ones include the Best Forex MT4 Broker - Latin America 2024 Global Brand Magazine Awards 2024 award, the Most Reliable Broker - Africa FAME Award Finance Magnates 2024 award, and the Institutional Forex Broker of the Year 2024 Corporate Excellence Awards 2024 Corporate Vision Magazine award.

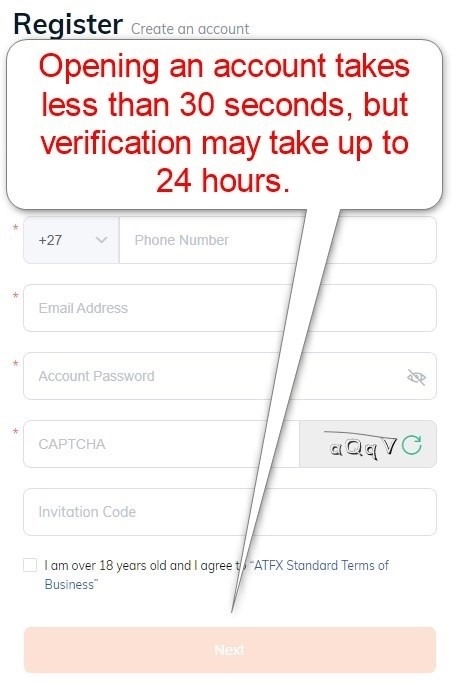

Opening an Account

Traders can open an ATFX account in less than 30 seconds, but verification takes up to 24 hours. Traders can start by submitting their country of residence, name, phone number, e-mail, and desired password. The application also asks for the selection of a trading platform. The rest is the typical KYC procedure without data mining.

What should traders know about the ATFX account opening process?

- ATFX complies with global AML/KYC requirements

- Account verification is mandatory

- Most traders pass verification by uploading a copy of a government-issued ID and one proof of residency document

- ATFX may ask for additional information on a case-by-case basis

- Trading conditions, including account types, minimum deposit requirements, maximum leverage, and asset availability, differ among the eight ATFX entities and regulatory jurisdictions

- Some ATFX entities will engage in regulatory-mandated data mining

Minimum Deposit

The minimum deposit at ATFX is $500 ($100 for the Cent account), but the requirement will vary by ATFX entity.

Payment Methods

Withdrawal options |       |

|---|---|

Deposit options |       |

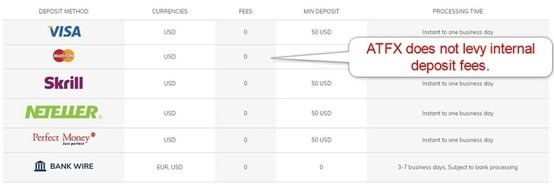

ATFX supports bank wires, credit/debit cards, Skrill, Neteller, and Perfect Money.

Accepted Countries

ATFX accepts traders resident in most countries, except those in Canada, Japan, the Democratic People’s Republic of Korea (DPRK), Iran, the United States of America (USA), or “any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.”

Deposits and Withdrawals

The secure ATFX client portal handles all financial transactions for verified clients.

What are the key takeaways from the deposit and withdrawal process at ATFX?

- The minimum deposit is $50, except for a $0 requirement for bank wires, after traders make the minimum deposit requirement to open an account

- Accepted deposit currencies depend on the ATFX entity

- ATFX does not levy internal deposit fees

- Withdrawals are free except for bank wires below $1,000

- Internal processing times are between instant or near-instant, except for three to seven days for bank wires

- External processing times and fees depend on the payment processor

- In compliance with AML regulations, the name of the trading account and payment processor must be identical

- ATFX will send the deposit amount back to the funding method

Is ATFX a good broker?

I like the trading environment at ATFX for beginners, as they receive upgraded MT4/MT5 trading platforms, competent research, actionable trading signals, and excellent education. Traders also get an in-house developed mobile trading app and copy trading service. The STP order processing and deep liquidity ensure fast order processing. ATFX is a well-regulated and secure broker. Therefore, I recommend ATFX to beginners, as it is a well-managed brokerage with a clean track record and industry-leading client protection.

FAQs

How do I withdraw money from ATFX?

The client portal handles all withdrawals for verified ATFX traders.

What is the minimum deposit for ATFX?

The ATFX minimum deposit depends on the account type and ATFX entity, but the minimum deposit for the Standard account is $500.

Is ATFX a regulated broker?

Yes, the UK Financial Conduct Authority (FCA), the South African Financial Sector Conduct Authority (FSCA), the Australian Securities & Investments Commission (ASIC), the UAE Securities and Commodities Authority (SCA), the Cyprus Securities and Exchange Commission (CySEC), the Mauritian Financial Services Commission (FSC), the Seychelles Financial Services Authority (FSA), and the Hong Kong Securities and Futures Commission (SEC) regulate ATFX.

Is ATFX legit or not?

ATFX has been a legitimate broker operational since 2017 with a clean track record.