Editor’s Verdict

Binance is the world’s leading cryptocurrency exchange, catering to 150M+ traders globally, with an average daily trading volume of $65+ billion. It maintains the most competitive cryptocurrency ecosystem, 300+ assets, low transaction fees, and supports algorithmic trading. Binance also remains true to the cryptocurrency vision of privacy and does not give in to regulatory pressures while always maintaining an open dialogue with its client base. We conducted an in-depth review of this cryptocurrency exchange to evaluate if you should trust your capital to Binance. Is Binance the best option for cryptocurrencies?

Overview

Binance maintains the most complete cryptocurrency ecosystem and ultra-low fees.

I like the security at Binance and the ability to verify assets via proof of reserves, allowing clients to ensure that Binance holds their assets in custody. Binance uses a Merkle Tree and zk-SNARKs, and clients can verify their assets when they wish. 24/7 customer support in 40 languages is another excellent feature. The entire Binance ecosystem caters well to cryptocurrency traders with follow-on transactions in mind, making Binance a rare but complete cryptocurrency exchange.

Headquarters | Malta |

|---|---|

Regulators | AMF, ASIC, CNMV, CONSOB, FMA, KNF, SEC, SFSA |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2017 |

Execution Type(s) | Market Maker |

Minimum Deposit | $0 |

Negative Balance Protection | |

Trading Platform(s) | Other, Proprietary platform, Web-based |

Average Trading Cost Bitcoin | 0.018% to 0.10% |

Retail Loss Rate | Undisclosed |

Funding Methods | 800+ |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Binance Regulation & Security

Trading with a regulated exchange will limit the potential for fraud and malpractice. I always recommend traders check for regulation and verify it with the regulator by checking the provided license with their database. Binance, unlike most cryptocurrency exchanges, has licenses, permissions, and authorizations issued by 18 regulators.

Country of the Regulator | United Arab Emirates, Australia, Bahrain, Spain, France, Indonesia, Italy, Japan, Kazakhstan, Lithuania, Mexico, New Zealand, Poland, Sweden, Thailand, South Africa |

|---|---|

Name of the Regulator | AMF, ASIC, CNMV, CONSOB, FMA, KNF, SEC, SFSA |

Regulatory Tier | 1, 1, 1, 1, 1, 1, 5, 5, 5, 2, 1, 2, 1, 1, 2, 2, 4, 2 |

Is Binance Legit and Safe?

Binance, founded in 2017, is one of the most secure and transparent cryptocurrency exchanges. Therefore, I applaud Binance for providing a real-world example that regulators should use to create effective regulation. However, it must be noted that Binance was fined $4.8 billion US, and the CEO stepped down in 2023, leading to increased questions regarding the reliability of Binance, which pleaded guilty to money laundering, unlicensed money transmitting, and sanctions violations.

The negative reviews on Trustpilot concerning losses often stem from users losing money trading, hacks from user errors, or fake accounts. It appears more of a smear campaign by competitors, as my review found no misconduct or malpractice by this cryptocurrency exchange. It even has a recovery fund for extreme cases, and its security is an industry-leading approach. Binance also goes above and beyond to assist clients in asset recovery from cyber crimes and cooperates with law enforcement to track down criminals.

Fees

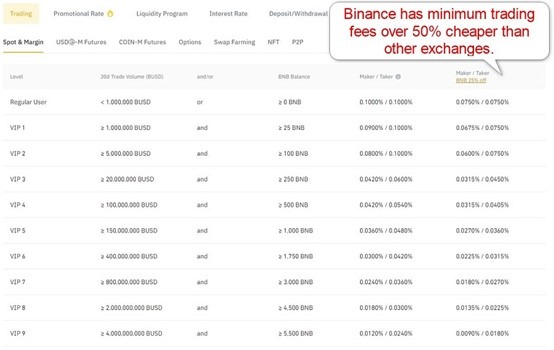

I rank trading costs among the most defining aspects when evaluating a cryptocurrency exchange, as they directly impact profitability. Binance follows the industry-wide maker-taker model, rewarding liquidity providers and charging higher fees for liquidity drainers.

The trading fees are significantly lower than competitors, often by more than 50%. Maker and taker fees start from 0.10% and can decrease to 0.012% and 0.024% via a volume-based nine-tier VIP program, respectively. They drop further if traders use the native BNB currency for transactions, starting from 0.075% and decreasing to 0.009% for makers and 0.018% for takers.

USD M-Futures have maker-taker fees from 0.02% and 0.05% to -0.01% and 0.0207%. It compares to Coin M-Futures, which cost from 0.02% and 0.04% and decrease to 0.00% and 0.017%.

Option traders pay a maker-taker fee starting from 0.03%, and VIP traders can decrease it to 0.00% and 0.016%. Swap farming, including the 30% rebate Binance applies, incurs fees between 0.042% and 0.105%, while NFTs cost between 0.10% and 0.90%.

Average Trading Cost Bitcoin | 0.018% to 0.10% |

|---|---|

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | false |

Here is a snapshot of Binance maker-taker fees:

The most ignored trading costs are swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

Binance levies borrowing fees dependent on the cryptocurrency asset and charges it hourly. The financing costs at Binance are low, making it a trader-friendly pricing environment.

Binance Trading Hours

Asset Class | From | To |

|---|---|---|

Cryptocurrencies | Sunday 00:00 | Saturday 23:59 |

Options | Sunday 00:00 | Saturday 23:59 |

Futures | Sunday 00:00 | Saturday 23:59 |

Range of Assets

Binance lists 369 cryptocurrency assets, focused on the Top 100 cryptocurrencies by market capitalization and highly liquid meme coins, tokens, DeFi solutions, liquid staking, gaming, and various other sub-sectors of the evolving cryptocurrency sector. Binance also offers futures and options trading for advanced trading strategies.

While over 10,000 assets exist in the cryptocurrency sector, I like how Binance provides a well-balanced choice of proven coins and projects while adding more to its asset selection, which traders can view under the “New Listing” section. The asset selection at Binance is suitable for most traders and strategies, including institutional clients.

Binance Leverage

Maximum Retail Leverage | 1:5 |

|---|---|

Maximum Pro Leverage | 1:5 |

Binance offers a maximum cryptocurrency leverage of 1:5 for its cross-margin category, which is the default setting, but traders can lower it to 1:3 when they place their orders. Spot trades are unleveraged at 1:1. Negative balance protection exists, but it works differently than at Forex brokers. Binance uses a practice known as Smart Liquidation to avoid negative balances but will use its Insurance Fund to cover potential deficits for which it charges clients an insurance clearance fee.

Therefore, Binance ensures traders cannot lose more than their portfolio. Traders should always use appropriate risk management with leveraged trading to avoid magnified trading losses.

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

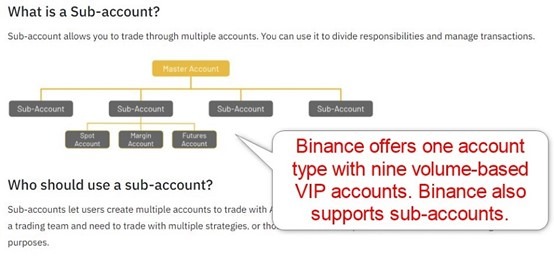

Account Types

Binance has one account type for all clients, but a volume-based nine-level VIP program that can lower trading fees exists. I like this simplified approach, as there are no minimum deposit requirements. Binance bases everything on volume traded.

Sub-accounts are available, which allow clients to execute various strategies on different accounts or opt for one per asset for better risk management.

Binance Demo Account

Binance offers a demo account on its futures trading platform with a default balance of 3,000 USD. There is no time limit, and traders can easily switch between live and demo. Traders can add more funds in different coins, and the Binance demo account suffices to evaluate the trading conditions or test strategies.

I want to caution beginner traders when using demo trading as an educational tool, and they should consider the limitations. Demo trading does not grant exposure to trading psychology and can create unrealistic trading expectations.

Trading Platforms

Unlike other cryptocurrency exchanges that rely solely on web-based trading platforms and mobile apps, Binance offers a cutting-edge desktop alternative. Traders get access to Level 2 data, and the Binance trading platform includes a charting package. Additionally, Binance allows traders to connect to TradingView and trade directly from advanced charts. Its user-friendly mobile app is ideal for casual traders who follow social trends and want to transact cryptocurrencies without conducting in-depth analytics.

Binance also supports algorithmic trading and lists nearly 80,000 bots managing almost $90M in assets. It makes Binance the most complete cryptocurrency exchange with the best trading platforms.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Unique Features

Binance is the only cryptocurrency exchange catering to the crypto lifestyle and offers many unique features. Some of the most noteworthy ones are:

- It is a free tax service which includes customized crypto tax reports of all transactions.

- Gift cards

- Binance Pay allows traders to spend and send in 70+ cryptocurrencies.

- The Binance token launch platform

- The Binance airdrop portal

- The Binance Vise debit card with up to 8% cashback on Euro and cryptocurrency purchases

- The Binance Auto-Invest Plan

- The BNB blockchain and token for Web3 applications

- The Binance Web3 wallet

- NFTs and Fan Tokens

- Mining pools

- Cryptocurrency loans

- The OTC trading desk

- Binance Earn, including high-yield investments, staking, and farming.

Binance offers more than a cryptocurrency exchange, and I recommend users take time to discover everything Binance enables and how it supports the crypto lifestyle with its vast ecosystem.

Research & Education

Binance Research offers weekly reports offering well-written insights into potentially market-moving events, but Binance does not publish actionable recommendations. The Binance blog additionally features must-read content under its Market section. I appreciate the Binance effort in generating market-relevant content, and traders requiring actionable trading signals will find ample resources online for free.

The Binance Academy is the best resource for crypto beginners I have reviewed, and I highly recommend first-time traders take their time and study the articles carefully. Beginners get 440+ articles in 31 languages, and the well-structured design of the Binance Academy makes navigating the wealth of content swift and user-friendly. It covers more than crypto topics. Beginners can also learn about technical analysis, the economy, and personal finance.

Binance has created a genuine approach to education, and the Binance Academy serves as a blueprint for educating beginners. It includes courses with videos and quizzes, dozens of learn & earn modules, and a Study Week with a 60,000 USD price pool shared among participants.

Therefore, I advise beginners to start their education at Binance. I further advise traders to seek in-depth education covering trading psychology and the relationship between leverage and risk management while avoiding paid-for courses and mentors, as Binance does not cover those topics.

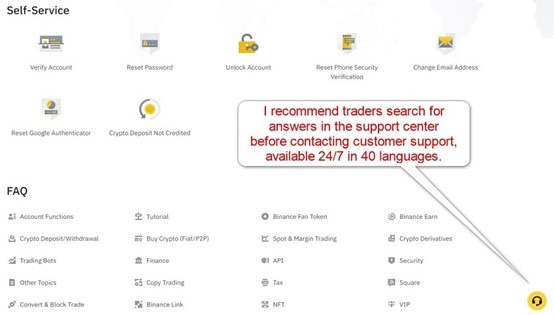

Customer Support

Binance offers 24/7 customer support via live chat in 40 languages, and it has an extensive support centre, but I am missing phone support and a direct line to the finance department. Binance explains its products and services well, and many traders should not require assistance. Most valid complaints about Binance cover slow customer support, but Binance works to improve this weak link in an otherwise world-class and industry-leading cryptocurrency exchange.

Bonuses and Promotions

Binance offers rewards of up to 100 USD to clients. It also has a 60,000 USD price pool for its Study Week and dozens of learn & earn modules. A high-paying affiliate program and refer-a-friend campaign are also available for passive income seekers. The latter pays up to 100 USD and includes a raffle for a Tesla Model 3. Terms and conditions apply, and I advise traders to read and understand before entering.

Customer Support Methods |  |

|---|---|

Support Hours | 24/7 |

Website Languages |                   |

Opening an Account

Binance deploys a fast online application form. Traders can sign up using their e-mail, phone, Google, or Apple IDs. Binance will send a 6-digit verification code to complete the process. There are no unnecessary steps, and I appreciate the absence of data mining.

Account verification at Binance is necessary, and besides the industry standard of uploading a copy of a government-issued ID and one proof of residency document, Binance requires a Liveness Check, a video confirmation of the traders holding ID documents and turning them around. It goes further than the requirements by any regulator to pass AML/KYC stipulations, but its Liveness Check could be too much for some traders.

Minimum Deposit

Binance has no minimum deposit requirement, but some payment processors may have minimums.

Payment Methods

Withdrawal options |     |

|---|---|

Deposit options |     |

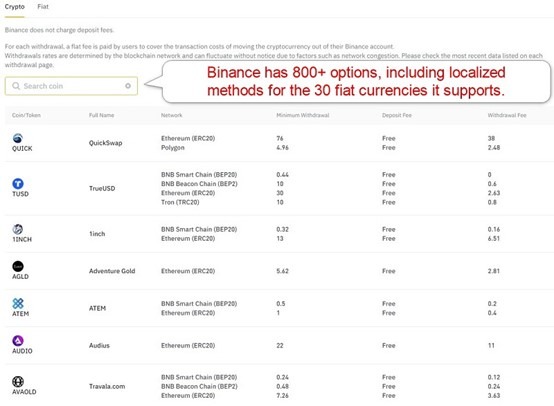

Binance payment methods include bank wires, credit/debit cards, and cryptocurrencies. Localized bank-related options for 29 countries and the Eurozone are available, where the 30 fiat currencies Binance accepts are the local currency. Binance does not offer e-wallets as payment processors. Traders have 800+ options to fund their accounts, including P2P transactions.

Accepted Countries

Binance caters to clients from 100+ countries listed in its country and region selector. Traders can double-check, as the registration form allows phone numbers from countries not listed in the country overview. The Binance Prohibited List includes residents of Canada, Malaysia, the Netherlands, and the USA.

Deposits and Withdrawals

The secure Binance back office or mobile app handles all financial transactions for verified clients.

Binance accepts 30 fiat currencies and hundreds of cryptocurrencies, and Binance has no minimum deposit requirement or deposit fees for cryptocurrency deposits. Binance levies a maximum fee of 2% on credit/debit card transactions, while online banking and bank wires may incur additional charges. The minimum withdrawal amount and withdrawal fees depend on the currency and payment processor. Binance typically processes withdrawal requests between 30 and 60 minutes, making it one of the fastest in this category.

There are over 800+ options, and Binance does an excellent job listing minimums and fees on its website. The withdrawal page lists the most up-to-date costs, including network fees, ensuring traders know what fees apply. Please note third-party processing charges and currency conversion fees may apply for bank wires and credit/debit card transactions.

Is Binance a good cryptocurrency exchange?

I like the trading environment at Binance as it is the only cryptocurrency exchange that caters to the lifestyle of cryptocurrency traders. With licenses from 18 regulators, industry-leading security, and an investor compensation fund, Binance also ranks among the most secure exchanges. Trading fees are also the lowest, often more than 50% cheaper than competitors, and the best educational platform for beginners.

Binance offers deep liquidity, supports algorithmic trading, features a cutting-edge desktop trading platform besides its web-based alternative and user-friendly mobile app, and connects to TradingView. The unique features and cryptocurrency ecosystem are the best in the industry. Binance has established itself as the dominant cryptocurrency exchange and lifestyle company, and the nearest competitors are years away from being able to compete. However, some investors may justifiably fear Biance due to their recent regulatory issues. We suggest conducting deeper research into what changes have been made at Binance since November 2023.

FAQs

Why is Binance controversial?

Binance challenges the status quo, which is typical for a disruptive industry like cryptocurrencies and digital assets, but for the community it caters to, there is no controversy. It stems more from traditional regulators and individuals or entities who need help understanding cryptocurrencies and judge them prematurely.

Should I leave my crypto on Binance?

Binance holds 100%+ of client assets in custody, mostly in cold storage. Therefore, users can leave their assets on Binance, but it is wise to consider individual cold storage solutions.

What are the cons of using Binance?

Binance presents an entire ecosystem with dozens of services, and it may take beginners some time to learn about everything Binance offers.

Can you really make money from Binance?

Binance offers the infrastructure to make money, but it depends 100% on traders.

Can Binance be trusted?

Binance has licenses from 18 regulators, excellent security features, and an established track record of assisting clients in asset recovery from cyber crimes. It also holds 100%+ of client assets in custody, and traders can always verify proof of reserves via Merkle Tree and zk-SNARKs. However, Binance was convicted in November 2023 of money laundering, unlicensed money transmitting, and sanctions violations.