Editor’s Verdict

Degiro is a European stockbroker catering to traders from 17 countries, owned by a publicly listed German bank and brokerage firm. It features low trading fees for equities, ETFs, and related futures and options contracts. Clients get a user-friendly, web-based, proprietary investment platform – I have reviewed Degiro below to determine if it grants long-term investors, in particular, a competitive edge. Is Degiro the right broker for your portfolio?

Overview

A low-cost equity and ETF broker catering to 17 countries.

I like the choice of equities and ETFs at Degiro, making it an ideal stockbroker for the countries where it accepts clients. The low transaction fees present the most notable competitive advantage, and being part of a publicly listed bank and brokerage in Germany ensures the highest level of regulatory oversight and, therefore, investor protection.

Headquarters | Netherlands |

|---|---|

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2008 |

Trading Platform(s) | Proprietary platform |

Average Trading Cost EUR/USD | Not applicable |

Average Trading Cost GBP/USD | Not applicable |

Average Trading Cost WTI Crude Oil | Undisclosed |

Average Trading Cost Gold | Undisclosed |

Average Trading Cost Bitcoin | Not applicable |

Retail Loss Rate | Undisclosed |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | Not applicable |

Minimum Commission for Forex | Not applicable |

Funding Methods | 2 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Degiro Regulation & Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders check for regulatory status and verify it with the regulator by checking the provided license with their database of approved firms. Degiro operates with the oversight of two regulators.

Country of the Regulator | Germany, Netherlands |

|---|---|

Regulatory License Number | Undisclosed |

Is Degiro Legit and Safe?

Degiro, founded in 2008, became part of the German bank and broker Flatex AG in July 2020, a publicly listed company in Germany under the name flatexDEGIRO Bank AG. The parent company opted to maintain Degiro as a separate entity within its group of companies. Each client opening a Degiro account gets an automatic cash checking account at flatexDEGIRO Bank AG. While I understand the ease of having your brokerage account and bank under the same umbrella company, I dislike the automatic bank account.

The brokerage account has the protection of the German Investor Compensation Scheme, which compensates investors up to 90% of their assets with a €20,000 maximum in case of default. Bank deposits at flatexDEGIRO Bank AG are guaranteed up to €100,000 by the German Deposit Guarantee Scheme.

As an EU bank and broker, Degiro and flatexDEGIRO Bank AG operate under the strict rules of the ESMA protocol and European Central Bank. Therefore, I rate Degiro as a legitimate and safe broker.

Fees

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability, especially when making lots of transactions. Degiro maintains low operating costs with a flat fee structure. A €1.00 handling fee applies to each transaction. US and Canadian equities cost €1.00. Most European equities cost €3.90, which increases to CHF5.00 for Swiss equities and €5.00 for Asian instruments. Despite the rise in fees, they remain ultra-competitive.

ETFs in the Degiro ETF Core Selection are commission-free plus the €1.00 handling fee, and global ETFs incur a €2.00 commission. Options and futures contracts carry a €0.75 commission, and bonds cost €2.00 per transaction.

Investment funds come with a €3.90 commission plus a 0.20% service fee. Short sellers pay a fee between 1.00% and 2.00%, depending on the category. Degiro also applies a 0.25% currency conversion cost. A 0.25% connectivity cost for exchanges is due annually, with a €2.50 maximum, which can add up for multi-asset portfolios. Live price feeds can cost between €5.00 and €10.00 monthly, depending on the exchange market data.

The most ignored trading costs are swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant cost per trade. I always recommend that traders check them before evaluating the total trading costs. Degiro lists financing rates of 4.50% on borrowed funds and a 5.90% unallocated debit rate.

Range of Assets

Degiro is primarily an equity and ETF broker, including associated futures and options contracts. It also provides a balanced choice of investment funds. Traders can trade a range of bond products. While Degiro does not offer cryptocurrency trading, it has a selection of ETFs and ETNs providing exposure to the sector. Commodity trading is available via futures contracts and ETFs. Notably missing is Forex trading, but the choice for equity-focused portfolios is highly competitive.

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

Degiro Leverage

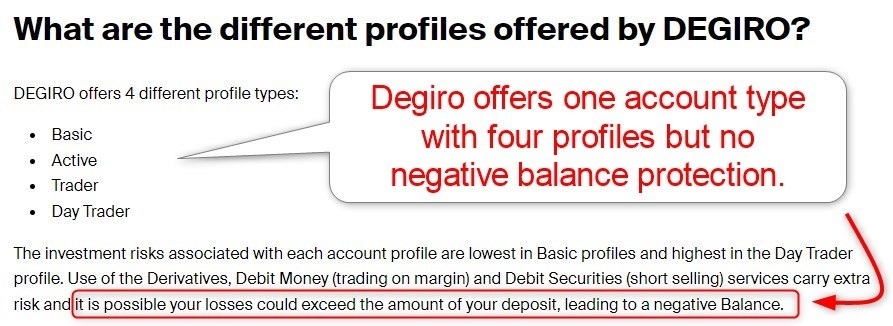

Degiro offers margin trading, internally labelled Debit Money, but does not disclose the maximum leverage. Since Degiro operates under ESMA rules, the Degiro maximum equity leverage is likely 1:5, but the availability of leverage is asset dependent. Degiro notes that clients who wish to engage in margin trading must upgrade their account status to Active or Trader within the trading platform. The free upgrade requires clients to pass two appropriateness tests and agree and sign additional conditions.

Degiro does not offer negative balance protection but notes that its risk department will close positions and charge clients should they fail to meet margin calls. Traders should always use appropriate risk management with leveraged trading to avoid magnified trading losses.

DEGIRO Trading Hours

Asset Class | From | To |

|---|---|---|

Commodities | Sunday 24:00 | Friday 23:00 |

Crude Oil | Sunday 24:00 | Friday 23:00 |

Gold | Sunday 24:00 | Friday 23:00 |

Metals | Sunday 24:00 | Friday 23:00 |

Account Types

Degiro needs to introduce its account profiles, but its FAQ section notes Basic, Active, Trader, and Day Trader. All clients start with Basic, a long-only, unleveraged cash account. The other three options require upgrades to the account status, which is free but includes passing appropriateness tests and signing additional conditions. I find the lack of details concerning the account profiles unacceptable. A dedicated Islamic account is unavailable, but the Basic account profile meets the requirements for a Sharia-compliant option.

Degiro Demo Account

Degiro does not offer a demo account, and I find it unacceptable. It reasons that Degiro accounts are free, and a demo account is unnecessary. It shows that Degiro needs to gain more understanding about the importance of demo trading for beginners and seasoned traders, and there is no excuse for it.

Trading Platforms

Degiro only offers its proprietary, web-based trading platform. It is a user-friendly option but only supports manual trading. Since Degiro is primarily a long-only investment broker, the absence of algorithmic trading is less of a factor due to this focus. Still, it is potentially a significant obstacle from an active trader perspective.

Degiro claims 2,000,000+ instruments in its trading platform, which features many analytics tools and filters to assist clients in finding the assets they wish to invest in. Analyst views and ESG ratings are two tools. While Degiro notes a dozen attributes, but they are all basic ones every trader or investor should expect from their platform.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Unique Features

The asset selection for long-term investors is unique, coupled with competitive transaction fees. However, there is nothing extraordinary about Degiro. It executes its core business well, and its ownership by a publicly listed bank is noteworthy from a security and trust perspective.

Research & Education

Degiro is an execution-only broker and does not offer its research. Degiro notes that its trading platform features analyst views and provides investment ideas via its blog. Since research is available online for free and via fee-based services, I do not consider its absence a negative for Degiro. Still, I want to note the services gap it creates versus some of its competitors in the market.

Degiro offers an excellent educational section for beginners. I recommend first-time investors take advantage of the available content and work through the online lessons. It also features introductory content for each asset class, while its strategy section covers eight topics. Clients may also watch four videos from the documentary section.

Therefore, beginners should start their journey by checking out the quality Degiro educational content before learning about trading psychology and the relationship between leverage and risk management from online educational resources available for free, often as good as paid-for trading courses and mentors.

Customer Support

Support Hours | 24/7 |

|---|---|

Website Languages |                |

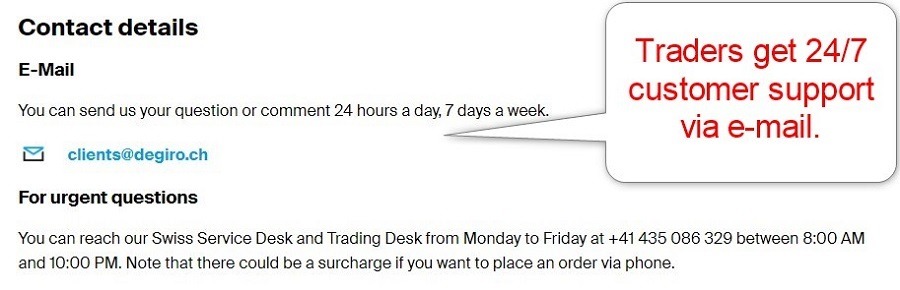

Degiro offers 24/7 customer support via e-mail, and phone support is available Monday through Friday from 8 a.m. to 10 p.m. Swiss time via its Swiss Service Desk, which includes a trading desk. Regrettably, a direct line to the finance department, where most issues can arise, is missing. The FAQ section answers many questions, and Degiro describes its products and services well.

Bonuses and Promotions

Degiro offers neither bonuses nor other deposit promotions, which remain prohibited by the ESMA, the super-regulator for all EU-based brokers.

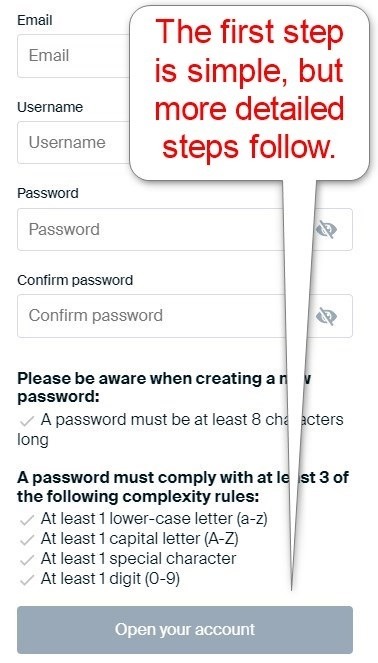

Opening an Account

Degiro starts the account opening process with a quick online form asking for an e-mail, username, and desired password. Degiro will send a verification e-mail, granting access to the next step, where clients must submit a range of personal details, including tax information, before gaining access to the client portal area and web-based trading platform.

The firm requires and collects more details than most brokers, as it also opens a bank account, and I dislike this aspect of the Degiro approach. Asking clients to commit 100% to Degiro without granting a demo account is unacceptable, making Degiro one of the weakest brokers from an account opening perspective.

Demo Account | No |

|---|---|

Managed Account | No |

Islamic Account | No |

Other Account Types | No |

OCO Orders | No |

Interest on Margin | No |

Degiro complies with global AML/KYC requirements, making account verification mandatory. Most traders will get verified by sending a copy of their government-issued ID and one proof of residency document to satisfy the broker's compliance procedures. Degiro may ask for additional supporting information on a case-by-case basis.

Minimum Deposit

Degiro does not have a minimum deposit requirement.

Payment Methods

Degiro only accepts direct bank wires.

Withdrawal options |  |

|---|---|

Deposit options |  |

Accepted Countries

Degiro caters to clients from 16 EU countries and Switzerland.

Deposits and Withdrawals

The secure Degiro back office manages all financial transactions for verified clients.

Degiro only lists bank wires and SOFORT as deposit and withdrawal methods, which I find disappointing but in line with its forced bank account opening with each registration. No internal transaction fees apply, except for a 0.25% currency conversion cost where the client deposits a non-account currency. Still, traders should consider potential intermediary third-party bank fees. Degiro credits SOFORT deposits within 30 minutes but notes that withdrawals can take two to four business days.

Is Degiro a good broker?

I like the Degiro trading environment for its low transaction fees and choice of equities and ETFs. It explains why this firm has grown into a leading European brokerage, owned by a German bank and broker publicly listed in Germany. Regrettably, Degiro only caters to 17 countries. The absence of a demo account is inexcusable, and the forced bank account opening with each Degiro brokerage account is annoying. I recommend Degiro for long-term buy-only investors. Still, more active traders will encounter shortfalls in the overall offering, most notably the absence of algorithmic trading. Degiro has no minimum deposit requirement. Degiro does not charge a monthly account fee, but some optional services incur a monthly or annual fee. Degiro honours all valid withdrawal requests from verified traders. Degiro has its headquarters in the Netherlands. Degiro primarily uses the bank of its corporate owner, flatexDEGIRO Bank AG. Degiro has a high-quality educational offering but no demo accounts, making it an average choice for beginners. The corporate owner of Degiro is a German bank and broker publicly listed in Germany. Therefore, Degiro ranks among the most trusted brokers in the EU.FAQs

What is the minimum deposit in Degiro?

Does Degiro charge a monthly fee?

Can you withdraw money from Degiro?

What country is Degiro from?

What bank does Degiro use?

Is Degiro good for beginners?

How trustworthy is Degiro?