Editor’s Verdict

Overview

Review

Headquarters | Cyprus |

|---|---|

Regulators | ASIC, CySEC, FSA |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2001 |

Execution Type(s) | Market Maker |

Minimum Deposit | €100 |

Trading Platform(s) | MetaTrader 4, Proprietary platform, Web-based |

Average Trading Cost EUR/USD | 0.8 pips ($8.00) |

Average Trading Cost GBP/USD | 1.4 pips ($14.00) |

Average Trading Cost WTI Crude Oil | $0.04 |

Average Trading Cost Gold | $0.40 |

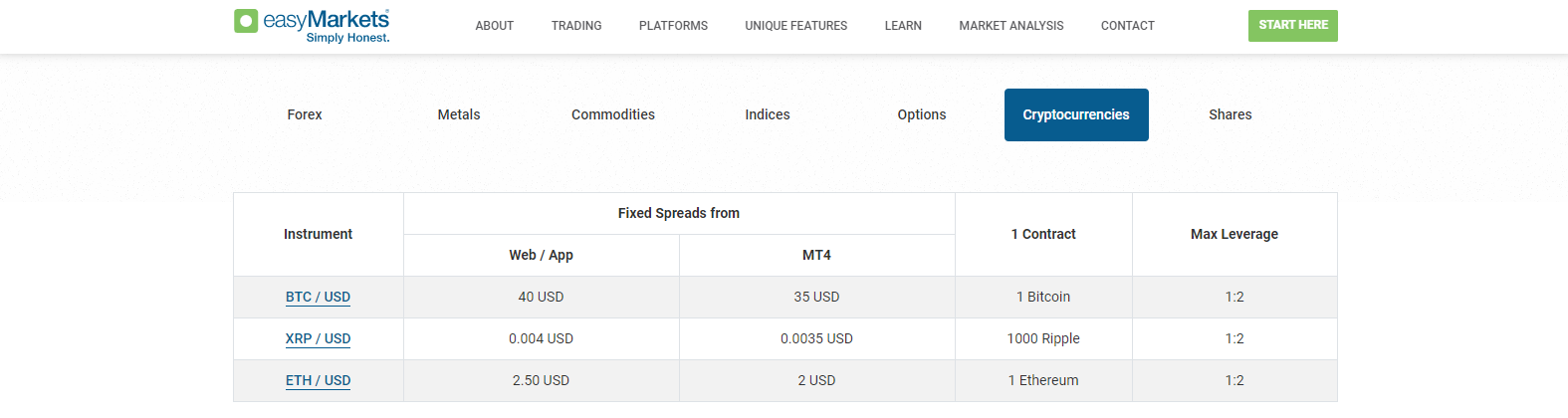

Average Trading Cost Bitcoin | $35.00 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

easyMarkets, in its original iteration as easy-forex, was founded as a Forex broker in 2001 with the overarching goal of democratizing Forex trading. To that end, easy-forex advanced minimum deposits from $25 by credit card which was viewed as a pioneering step across the industry. In 2016, the brokerage introduced CFD trading and, at the same time, re-branded itself from easy-forex to easyMarkets. easyMarkets prides itself on being a market maker, and the underlying philosophy is simple honesty. easyMarkets is the official sponsor of the Spanish football club, Real Betis, which shows that the company is looking to build its brand, and to stick around.

A proprietary trading platform, besides the popular MT4 trading platform, has been developed with more than 200 assets available for trade with a fixed spread. easyMarkets has a healthy balance sheet with stable cash flow; approximately 74% of the broker's retail traders tend to lose money, which directly profits easyMarkets.

Regulation and Security

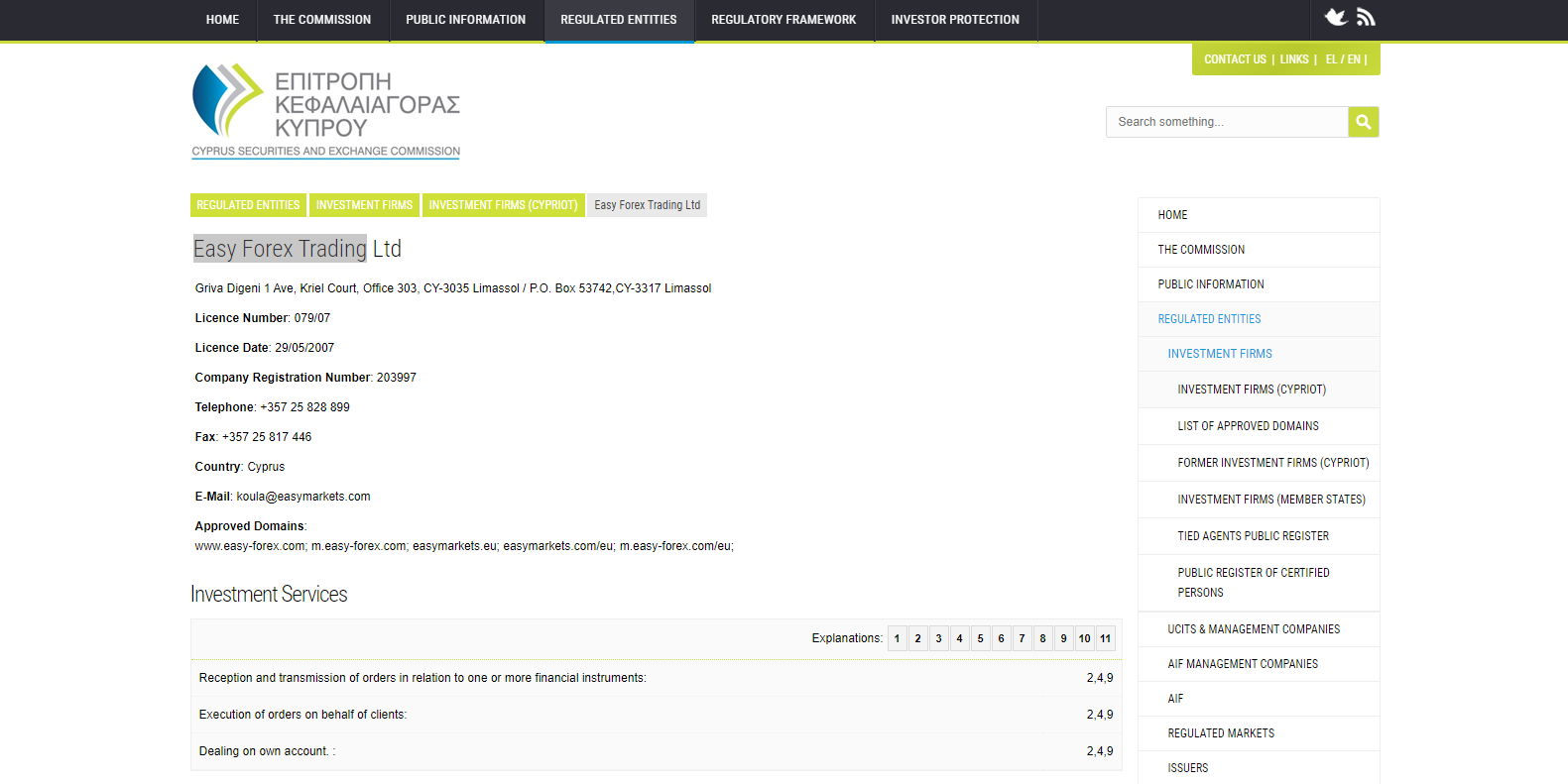

Easy Forex Trading LTD is the owner of easyMarkets, a broker authorized and regulated by the Cyprus Securities & Exchange Commission (CySEC). The registration number is HE203997, and the license number is 079/07, which was granted on May 29th 2007. In September 2020, the brokerage received FSA license in the Seychilles which allows easyMarkets to provide a wider range of services to traders outside of the EU.

Under the Financial Instruments Directive 2014/65/EU, or MiFID II, cross-border regulation across the EU is applicable. easyMarkets is thoroughly compliant with the EU’s 4th Anti-Money Laundering Directive, and all legal documents are published on their website. Clients' funds remain segregated from corporate funds and, as mandated by the EU Directive 2014/49/EU, easyMarkets participates in the Investor Compensation Fund (CIF). The maximum coverage is limited to €20,000 in the event of a default, which adequately covers the majority of retail traders. Negative balance protection and a guaranteed stop loss are also available for clients.

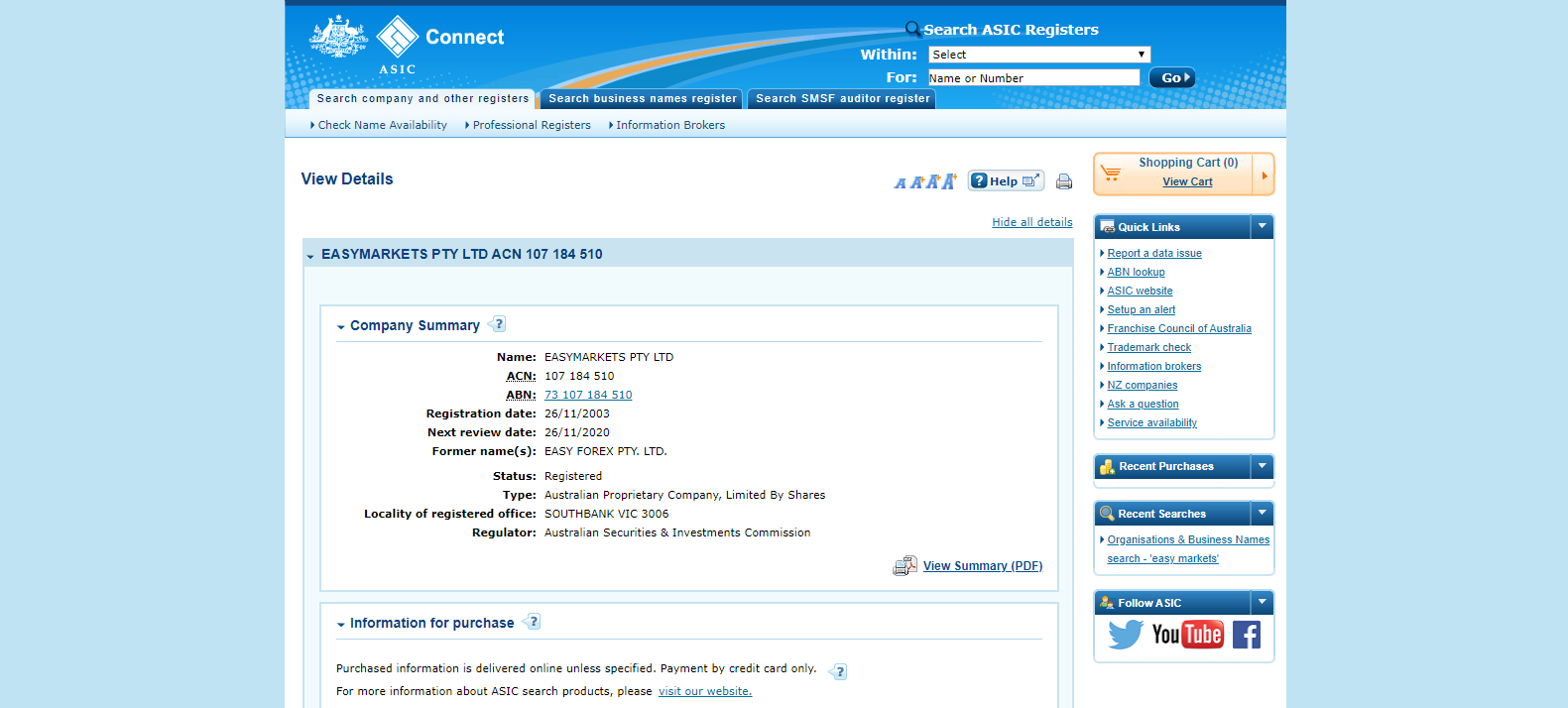

EasyMarkets Pty LTD is authorized and regulated by the Australian Securities and Investments Commission (ASIC) under ABN number 73107184510. Easy Forex Trading LTD is part of the Blue Capital Markets Group, but no further information is provided.

EasyMarkets Pty LTD is also authorized and regulated in the Republic of Seychelles by the Financial Services Authority of Seychelles (License Number SD056). In June 2021, easyMarkets' Cypriot arm, EF Worldwide Ltd, became licensed by the Financial Services Commission in the British Virgin Islands (License Number SIBA/L/20/1135).

Easy Forex Trading LTD is authorized and regulated by the Cyprus Securities & Exchange Commission (CySEC).

Easy Markets Pty LTD is authorized and regulated by the Australian Securities and Investments Commission (ASIC).

Fees

Average Trading Cost EUR/USD | 0.8 pips ($8.00) |

|---|---|

Average Trading Cost GBP/USD | 1.4 pips ($14.00) |

Average Trading Cost WTI Crude Oil | $0.04 |

Average Trading Cost Gold | $0.40 |

Average Trading Cost Bitcoin | $35.00 |

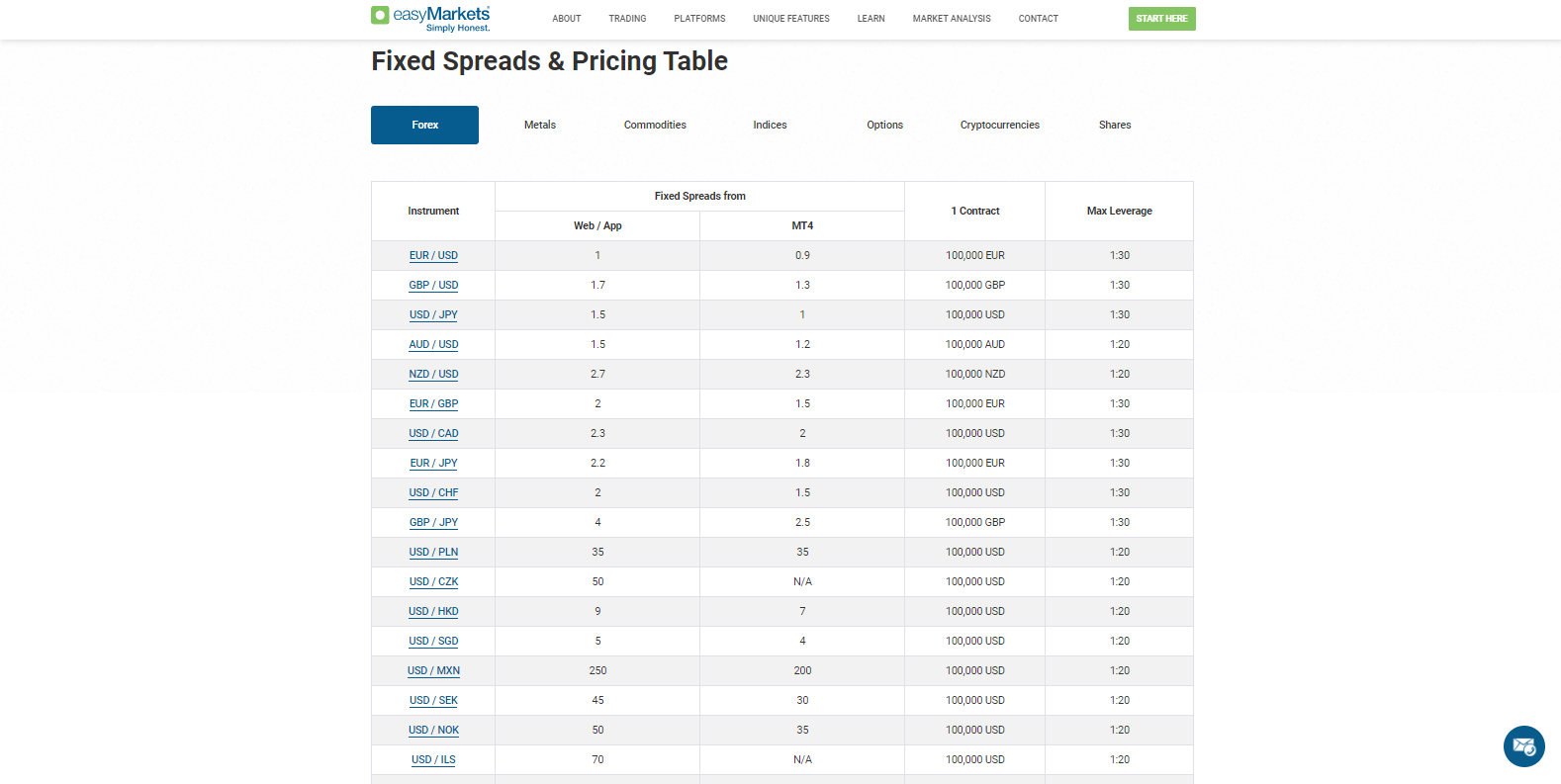

easyMarkets is a market maker and derives the majority of its income directly from clients’ losses. It also charges substantial spreads across assets; for example, the EUR/USD is listed with a 0.9 pips spread, but many other pairs carry a significantly higher mark-up. Of course, the spreads increase this broker’s cash-flow significantly. As is the case with all brokers, the trading environment favors broker income over traders' profits. Corporate actions apply to equity and index CFDs and are passed onto those portfolios in which those assets are held. Deposits and withdrawals are listed as free of charge.

What Can I Trade

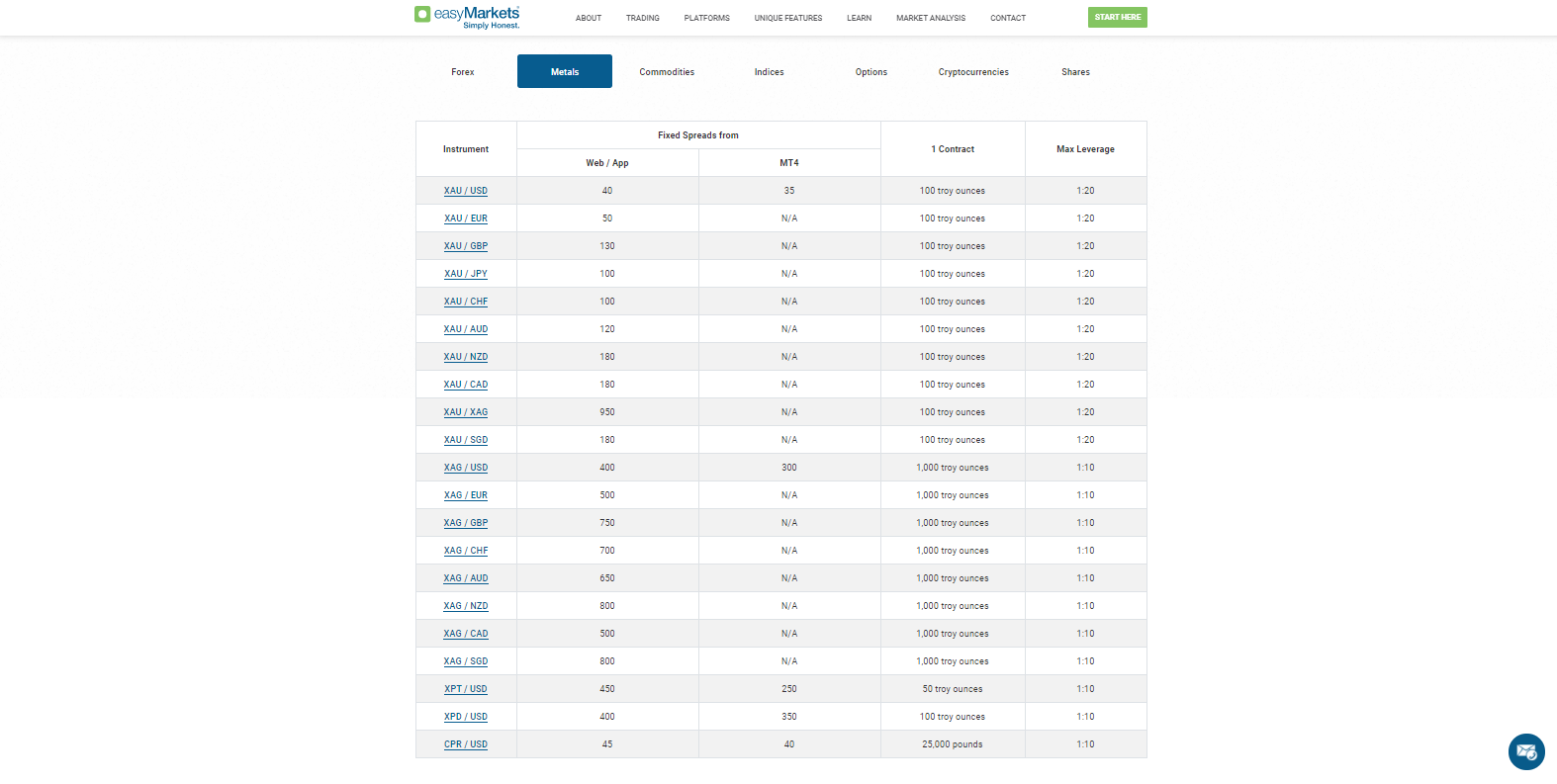

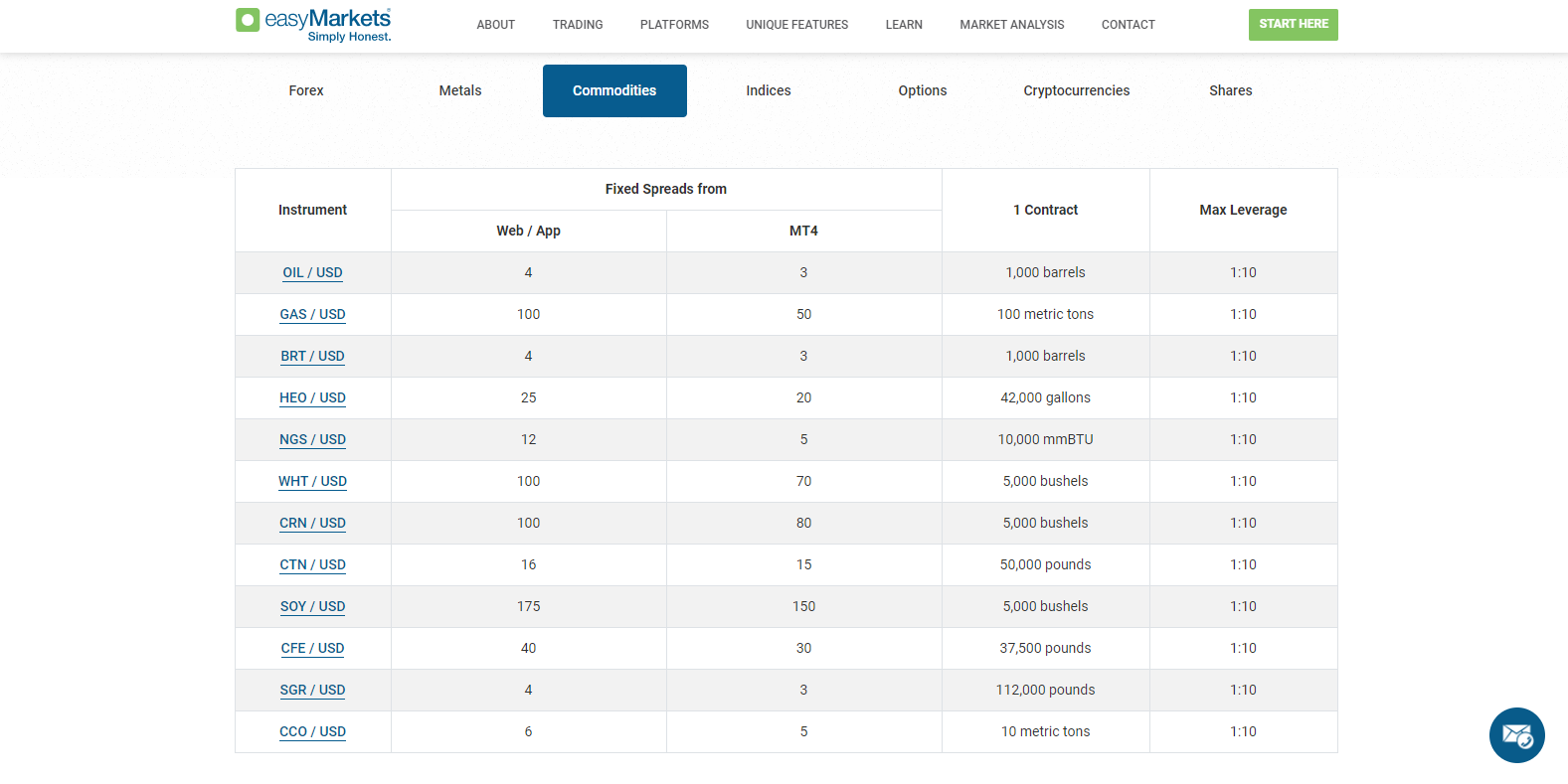

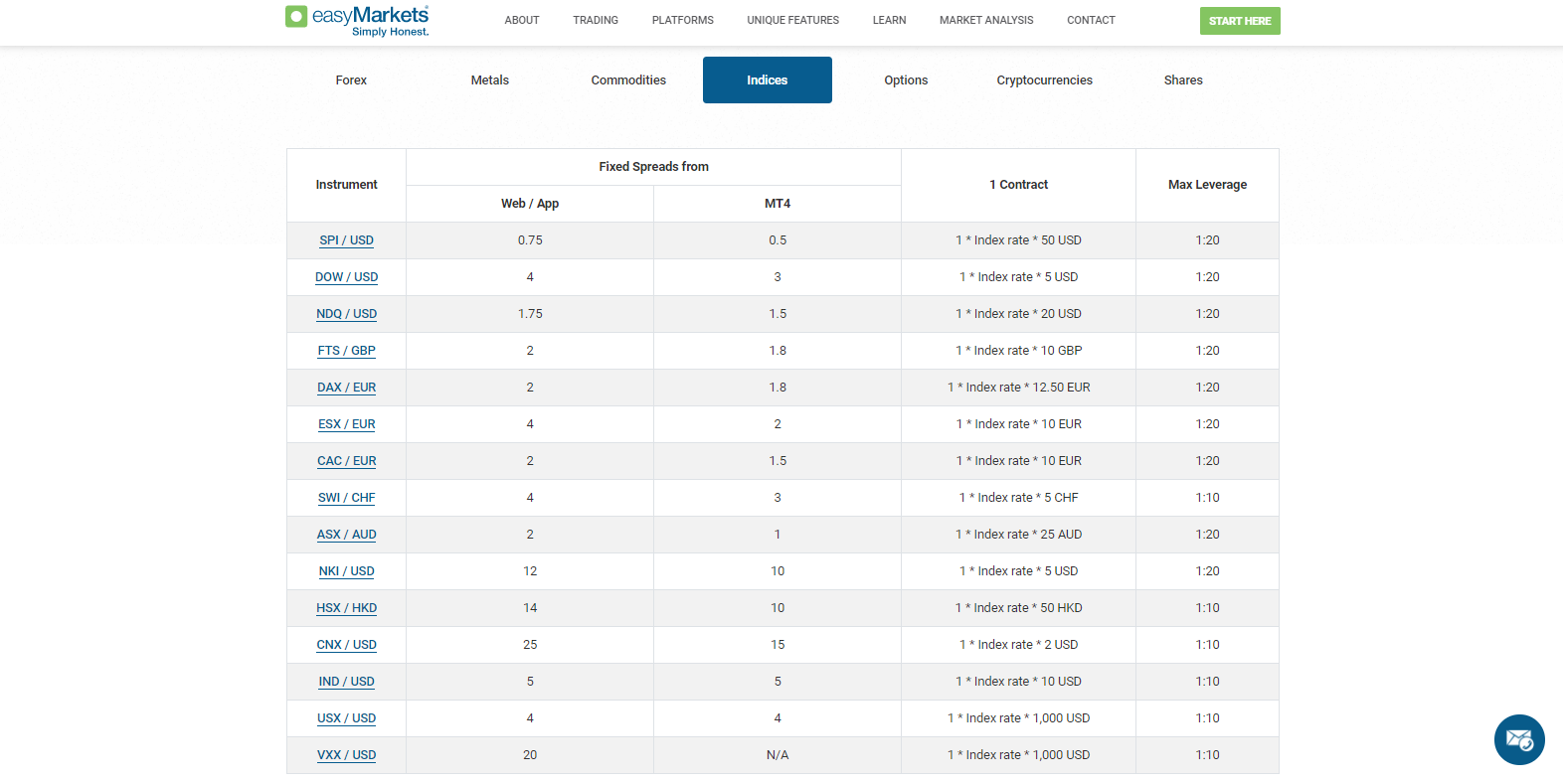

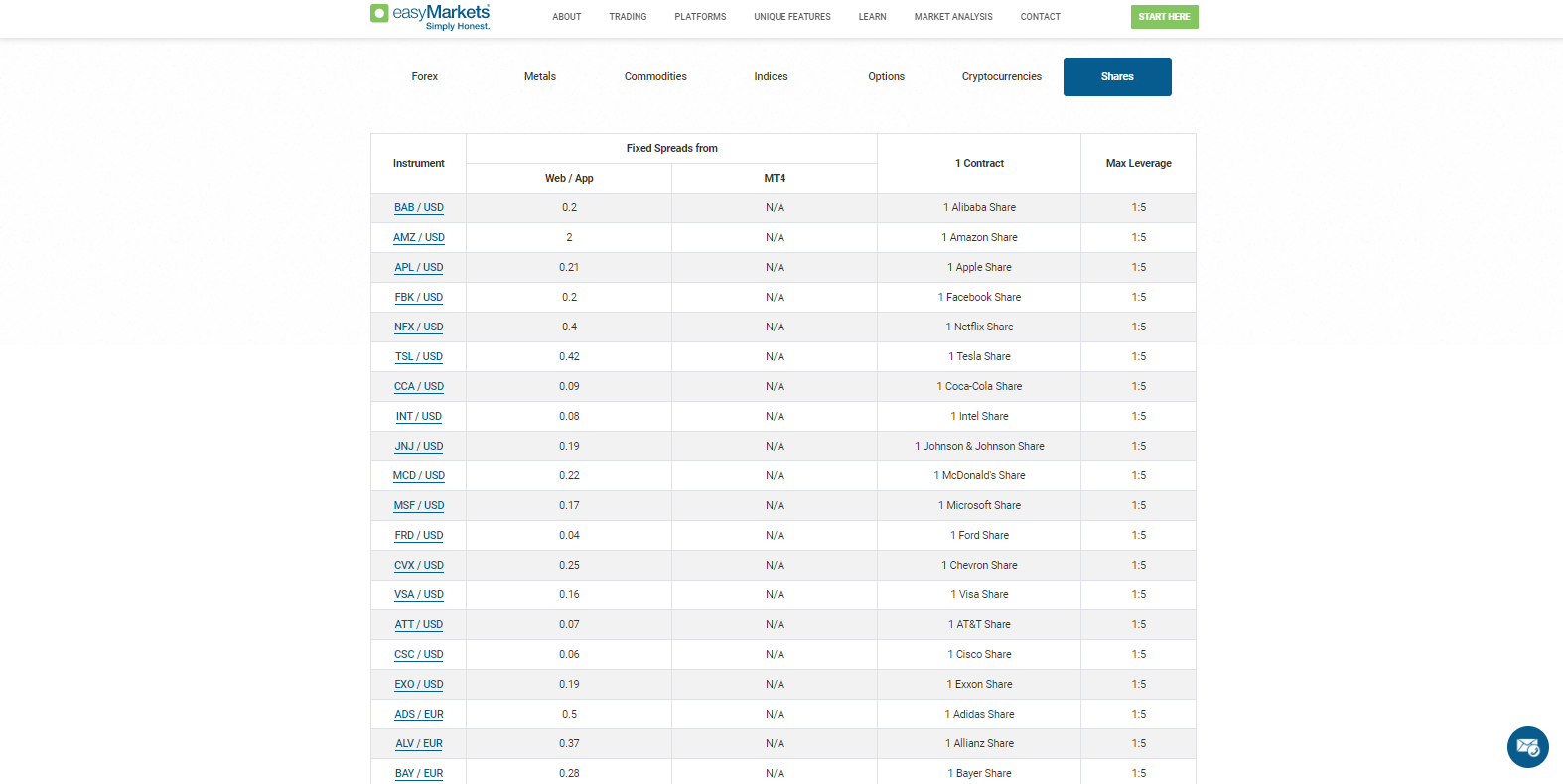

Over 200 assets across six investment classes are accessible at easyMarkets; specifically, Forex, metals and commodities, equity CFDs, index CFDs, and cryptocurrencies.

Naturally, the Forex market remains the broker's primary focus, where asset selection is quite extensive. Lofty spreads represent a critical disadvantage, however, where the mark-up is not competitive. Overall asset selection for pure Forex traders remains exceptional, but traders may find a more competitive trading environment elsewhere; those seeking cross-asset diversification, will not be served adequately. Commodities and metals are presented thoroughly, but equity and index CFDs are fairly limited, and nine cryptocurrencies are available. In November 2021, easyMarkets added 6 new crypto offerings to their prior selection, including: Cardano, Polkadot, Algorand, ChainLink, Solana, and Uniswap.

Asset selection in the Forex market is highly respectable.

Precious metals are equally well represented.

The commodity market presents traders with another substantial diversification opportunity.

Index CFDs offer the most basic names only.

Equity CFDs remain scarce and fail to satisfy even the basics.

Nine cryptocurrency pairs are offered.

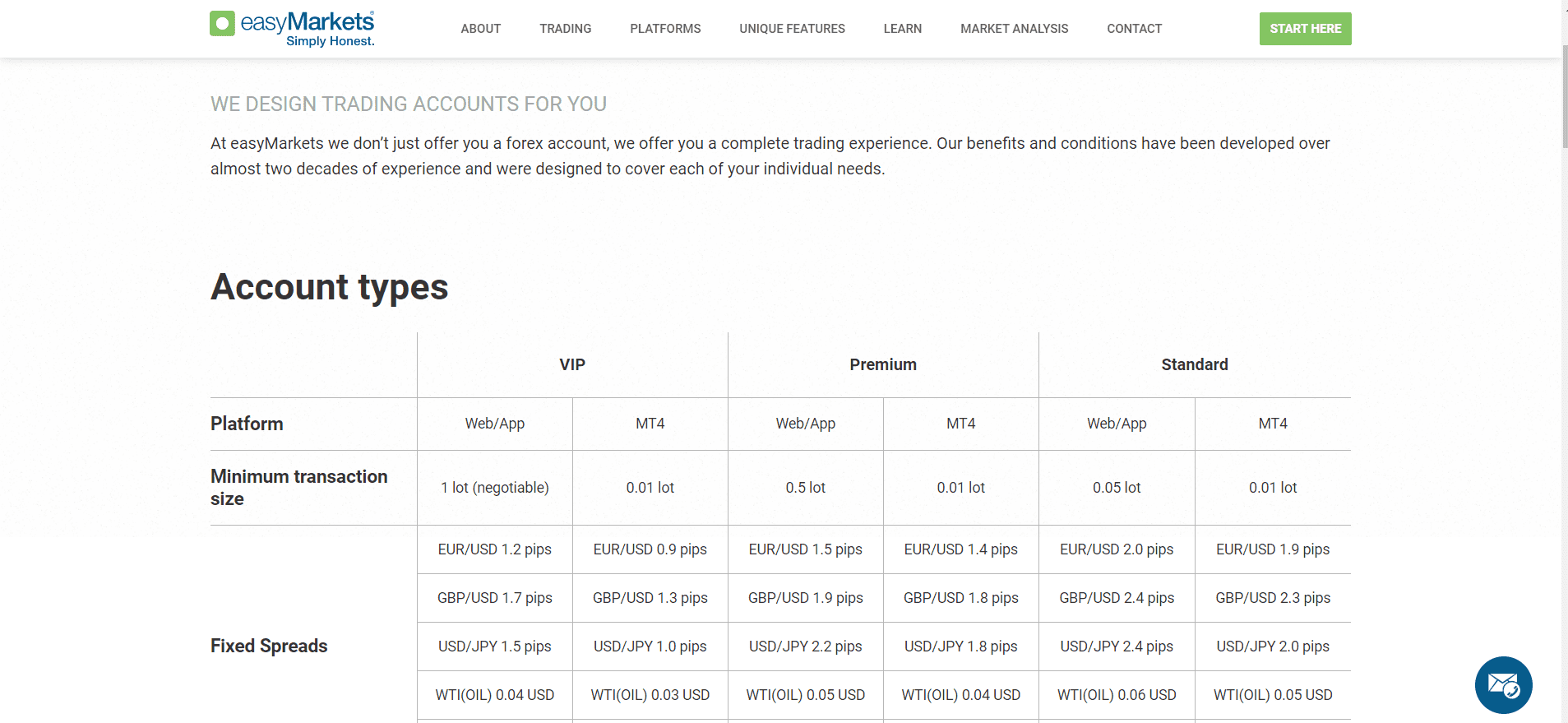

Account Types

easyMarkets offers only one account type, which is branded as the VIP account. The minimum deposit is €100, and the highest leverage is 1:30. Trading conditions vary depending on platform selection, which is not a very popular direction for brokers to take. Broadly speaking, traders get tighter spreads in the MT4 trading platform, though some critical features seem to be lacking. The proprietary webtrader platform which was developed by easyMarkets requires a higher minimum trade size while the spreads are increased; this is equivalent to charging a fee for using the easyMarkets proprietary platform.

The VIP service is available with a minimum deposit of $2,500; the “VIP” label is largely a misnomer as the client receives virtually nothing of value which would suggest VIP handling. The buy-in currency was changed to US Dollars from Euros; easyMarkets suggested that the change was an effort to democratize forex trading. However, this is largely viewed as a marketing gimmick to attract greater deposits which contradicts the premise of democratization.

All features listed, with the exception of a personal analyst, are equal to what is provided in the easyMarkets webtrader. A professional account is available if at least two of the broker's three requirements are satisfied. In that case, ICF protection is removed in return for higher leverage with cash rebates available based on trading volume.

Trading conditions differ based on the trading platform; a VIP upgrade service for a higher deposit is also marketed.

Trading Platforms

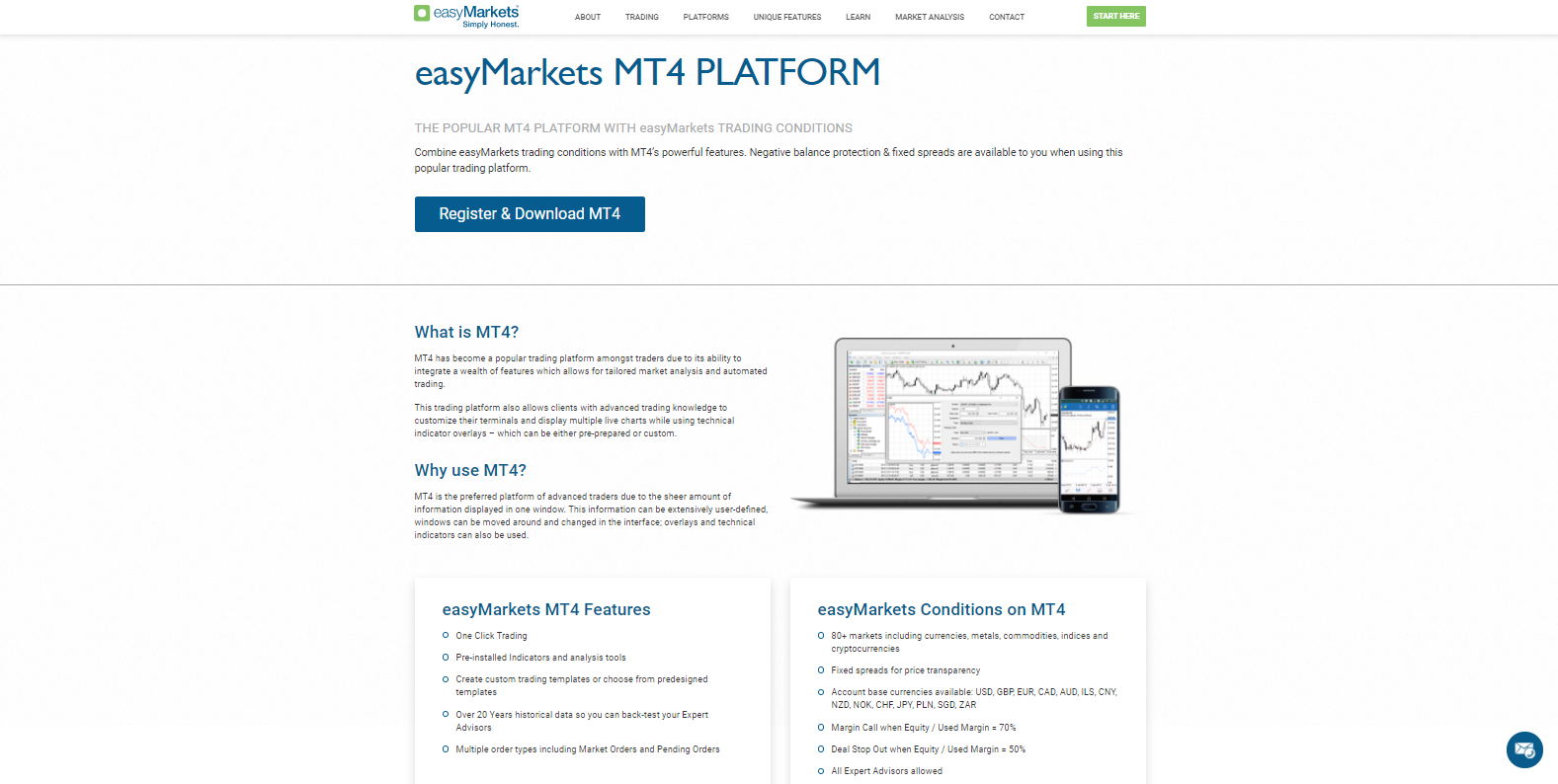

The MT4 trading platform is offered to traders, but easyMarkets fails to provide any of the required and critical third-party plugins which are necessary to unlock full functionality. MT4 is still one of the most popular trading platforms available, given its full support for automated trading solutions and back-testing functionality. The primary MT4 platform, as provided by this broker, lacks core features and represents a sub-standard trading portal. Hundreds of millions of dollars and man hours have been invested by fintech companies and financial firms to develop the necessary upgrades; tweaking MT4 with those plugins could construct an immensely robust trading solution.

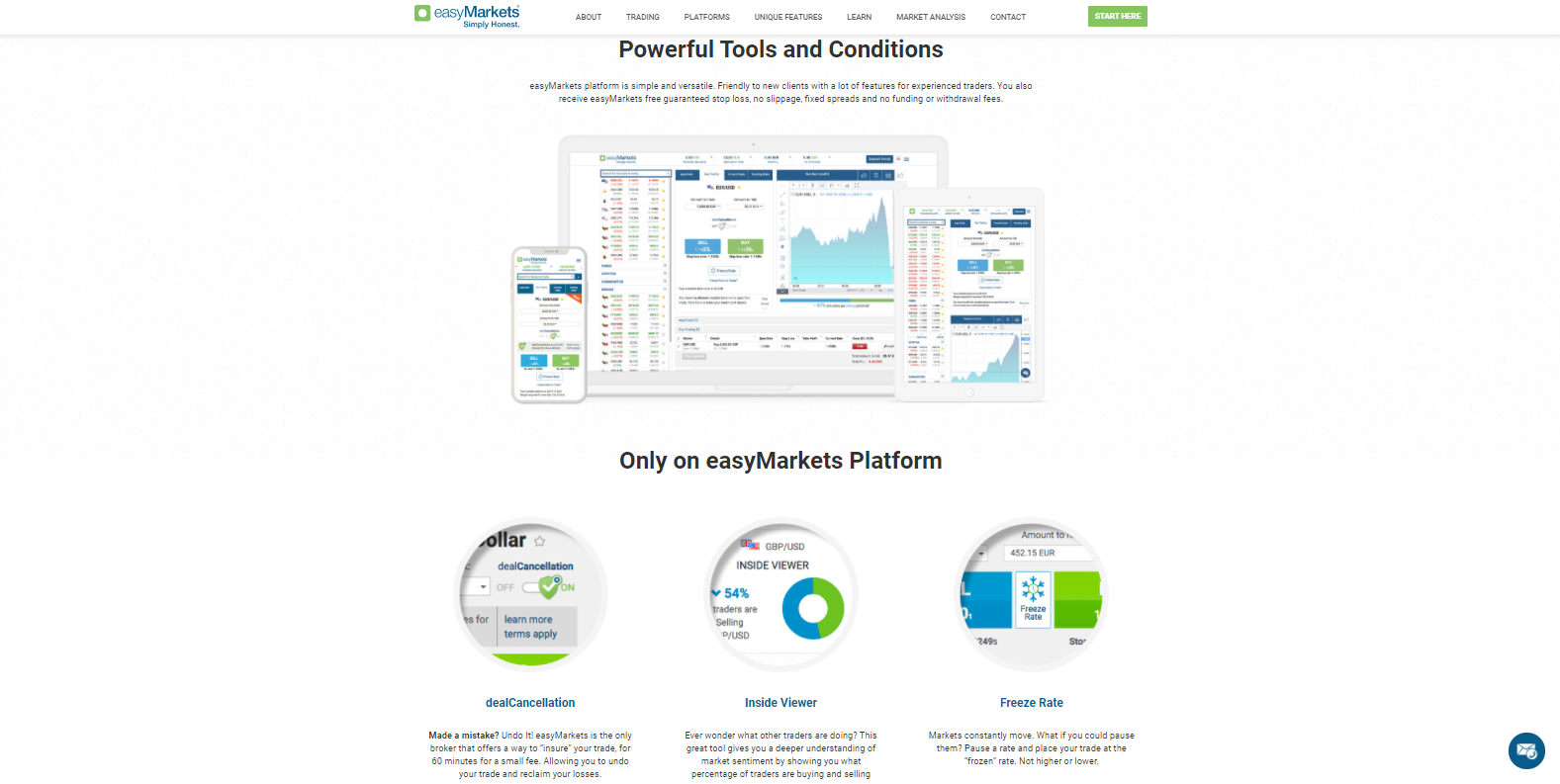

easyMarkets has countered the shortage of investment into MT4 by creating their proprietary webtrader, advertised as an intuitive, powerful, and simplified trading platform. While the user-interface looks modern and clean, it doesn’t support automated trading or allow the introduction of third-party plugins which many traders find to be helpful, if not entirely necessary. Two of the core features marketed by this broker, dealCancellation and Freeze Rate, are exclusively granted in this platform. The easyMarkets webtrader also comes with a hidden cost to traders in the form of higher spreads, which is quite unfortunate, and may serve as a deterrent from traders choosing this option. Options trading is provided through this platform as well, and traders who seek the full range of products and services offered are forced to pay more for access to them.

easyMarkets traders have their choice of two different trading platforms, but we found in this easyMarkets review that the MetaTrader 4 option would likely be better, despite the higher costs, because it offers more potential to traders who are willing to invest in their own upgrades. It should also be noted that many brokers don’t offer access to MT4 plugins; this is unfortunate, but easyMarkets isn’t alone in this regard.

The MT4 trading platform is provided as the basic version only but remains the best choice available at easyMarkets.

Forex traders are levied with hidden costs (in the form of higher spreads) for access to the easyMarkets webtrader. This is the sole option to unlock all of the products and services provided by the brokerage.

Unique Features

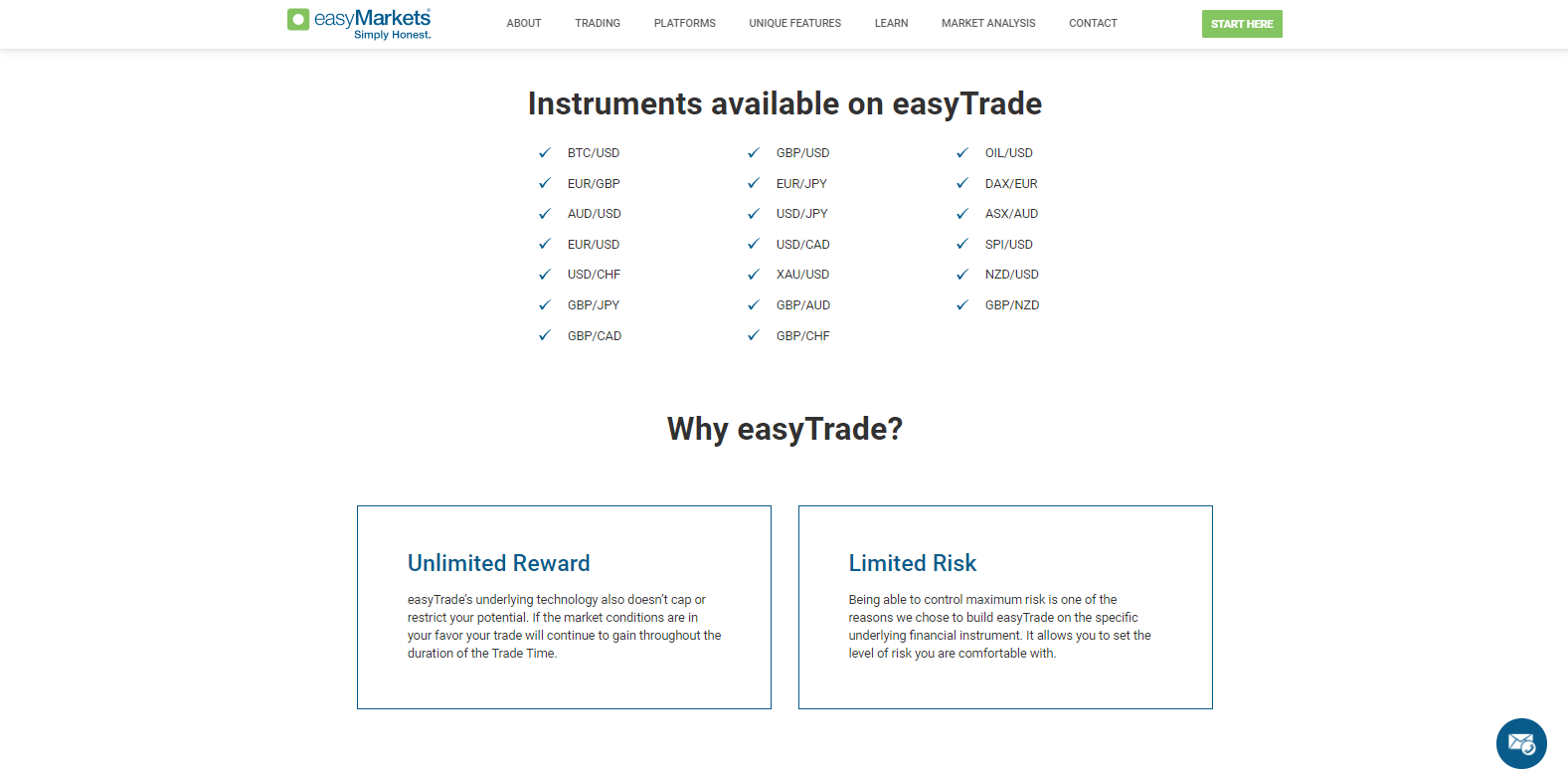

easyMarkets offers three unique trading tools, accessible only on webtrader, its proprietary trading platform. A lesser version of what can be accomplished in the MT4 trading platform, through a plugin, is provided by easyTrade. The purpose is to enhance risk management, but what this broker fulfilled mirrors binary options trading more than Forex; only twenty assets are available for this type of trade.

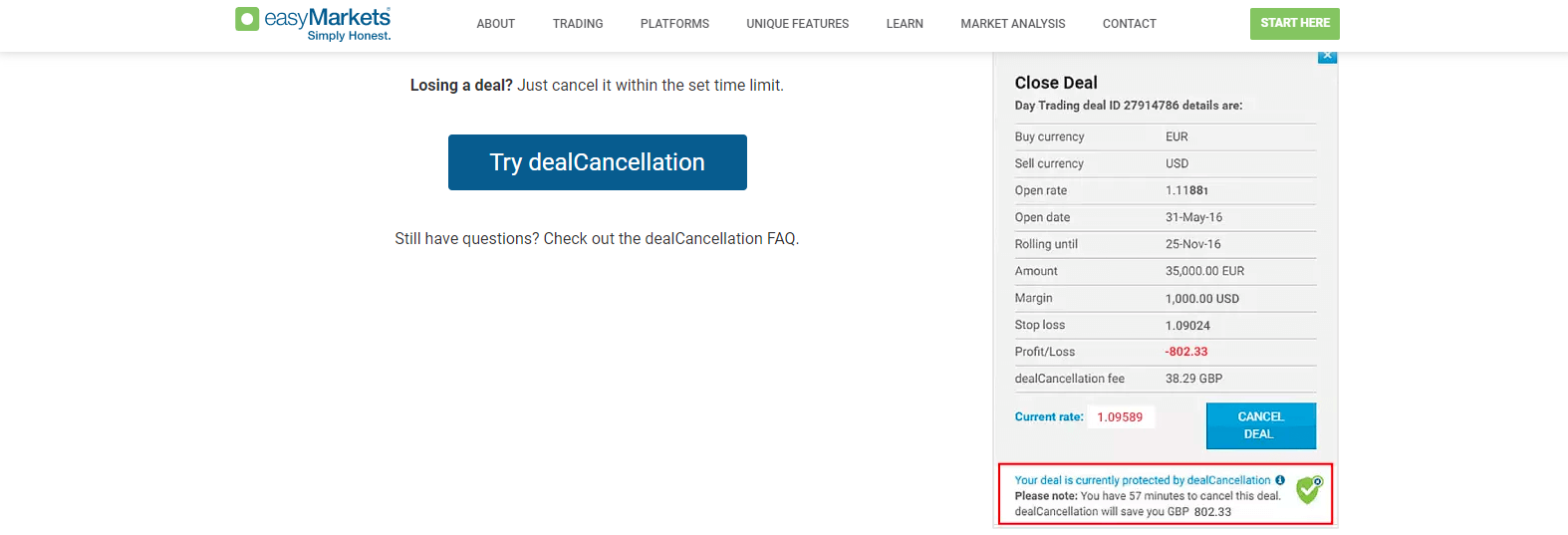

dealCancellation grants 60-minute insurance at a cost. It allows traders to cancel a losing trade; the implication is that the trades are never executed. easyMarkets will collect a substantial fee for each canceled trade despite the absence of trading activity. dealCancellation is an innovative approach but serves mostly to charge traders for trades that aren’t executed. It may yield a small savings, but still gives the broker pocket change, which really adds up for traders.

The Freeze Rate feature allows traders to freeze the displayed price for a few seconds, in theory to allow for the entry of trades. In practice, this offering is similar to one-click and automated trading, as provided in the MT4 trading platform, though the MT4 offerings are far superior. No broker has the possibility to “freeze” a live market, and the impression one gets is that trades on the easyMarkets webtrader are merely simulated.

Finally, easyTrade is deemed to enhance risk management, but is available on just 20 assets and mirrors binary options trading.

dealCancellation is essentially an innovative albeit disingenuous way to charge traders unnecessary fees, and a solid marketing medium for inexperienced or naive traders.

Freeze Rate allows traders to freeze the displayed price for a few seconds and provides evidence of a simulated trading environment within the easyMarkets webtrader platform.

Research and Education

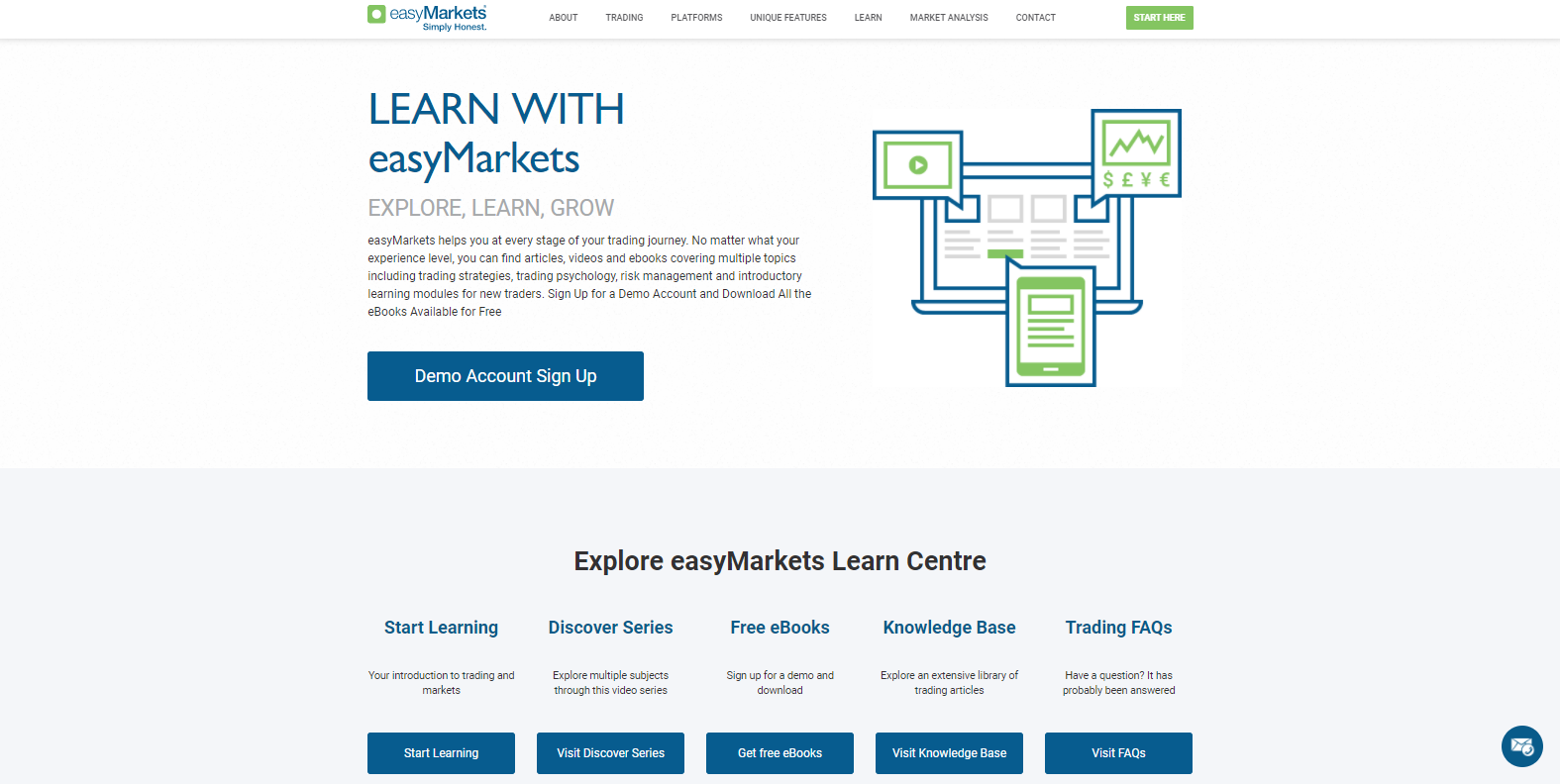

easyMarkets provides a dedicated division for research and education. The research category is divided into six sections, though only the blog is original content; the other five sections are simply a collection of data not created by this broker. The educational section offers more value and is separated into five categories. A mix of videos and written content is accessible, and one division is devoted to the psychology of trading, which may be the first positive development at this brokerage.

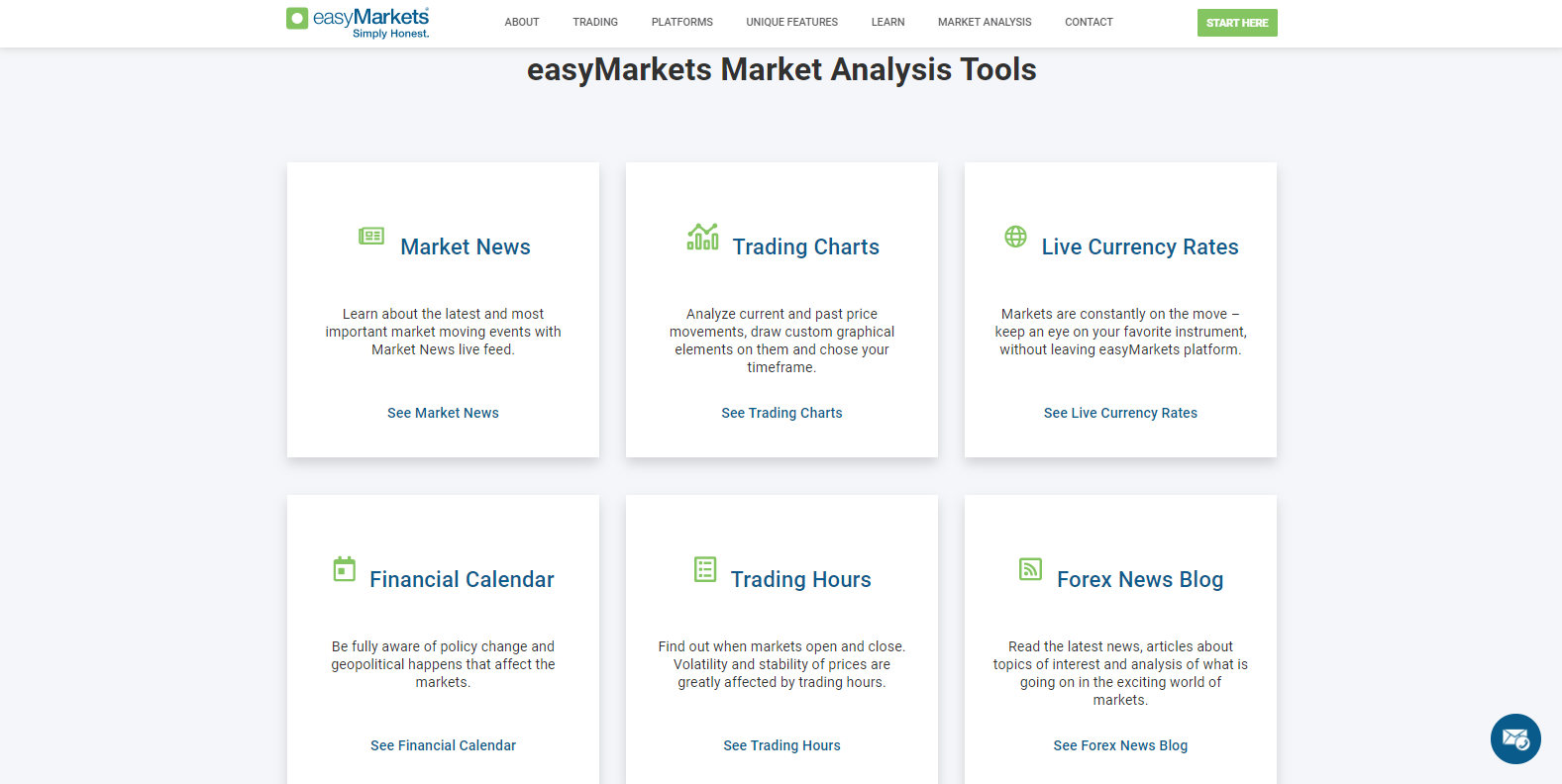

Research

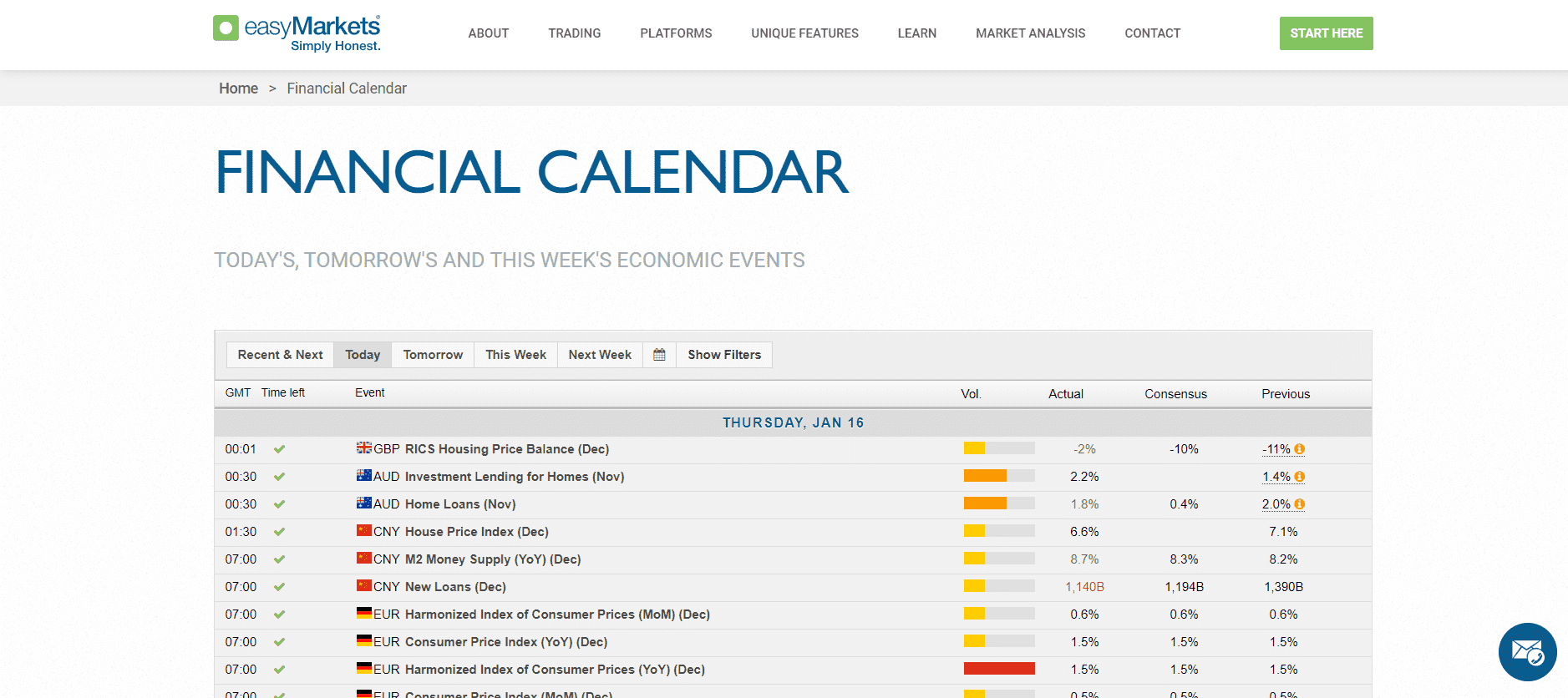

The market news section is a financial news feed, which can be found inside the MT4 trading platform. Trading charts offers very little of substance, and live currency rates can be obtained from the trading platform. A financial calendar is available which can be filtered to provide relevant upcoming financial data; potentially market moving events are shown in red under the volatility column. Trading hours is exactly what one would expect. The blog is the sole section where easyMarkets provides in-house content. On the whole, the research section is quite unremarkable, and the market analysis section is sorely lacking in substance and could do with a complete overhaul.

The research section consists of six categories, unfortunately, all not specifically valuable to traders. The information can be more efficiently retrieved from within the MT4 trading platform.

The financial calendar shows potential market moving events with a red indicator under volatility; the data can be filtered for relevancy for each trader.

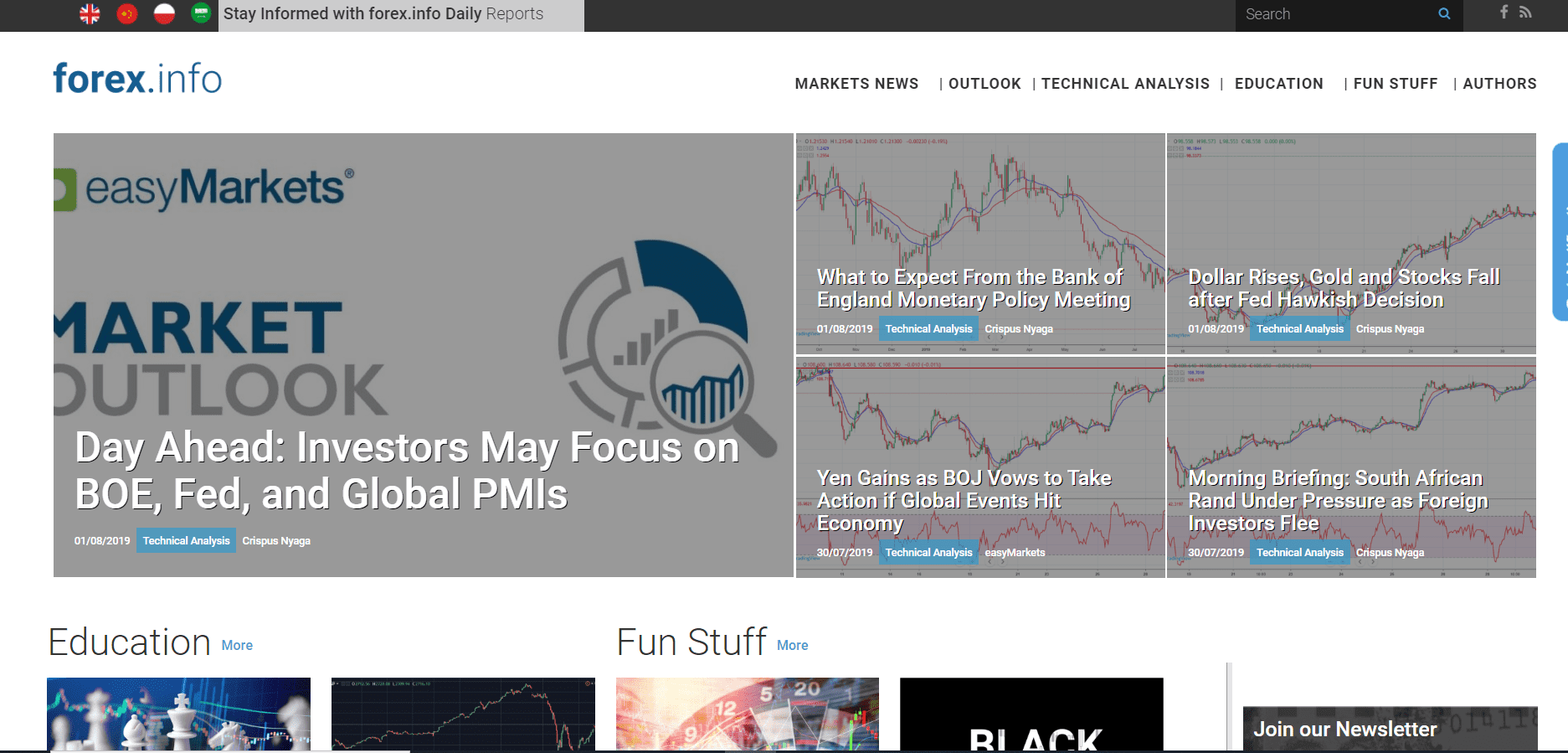

easyMarkets has an offsite blog with various content which can be accessed from the market analysis section landing page. It contains five categories, including Market News, Outlook, Technical Analysis, Education and “Fun Stuff.”

Education

Unlike the inadequate research division, the educational segment does offer valuable content geared toward new traders. The Get Started segment offers seventeen videos with a solid introduction to the Forex market, while the Discovery Series adds three more videos, complementing a properly executed segment. The quality tapers off from here, however; traders may download nine eBooks, but the Knowledge Base is nothing more than an FAQ section. New traders may obtain a good introduction to Forex trading, but more in-depth material to serve advanced traders is unavailable. The educational segment offers potential, but the overall execution represents a failed opportunity for broker and traders alike.

A look at the easyMarkets educational section:

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | Unspecified |

Website Languages |        |

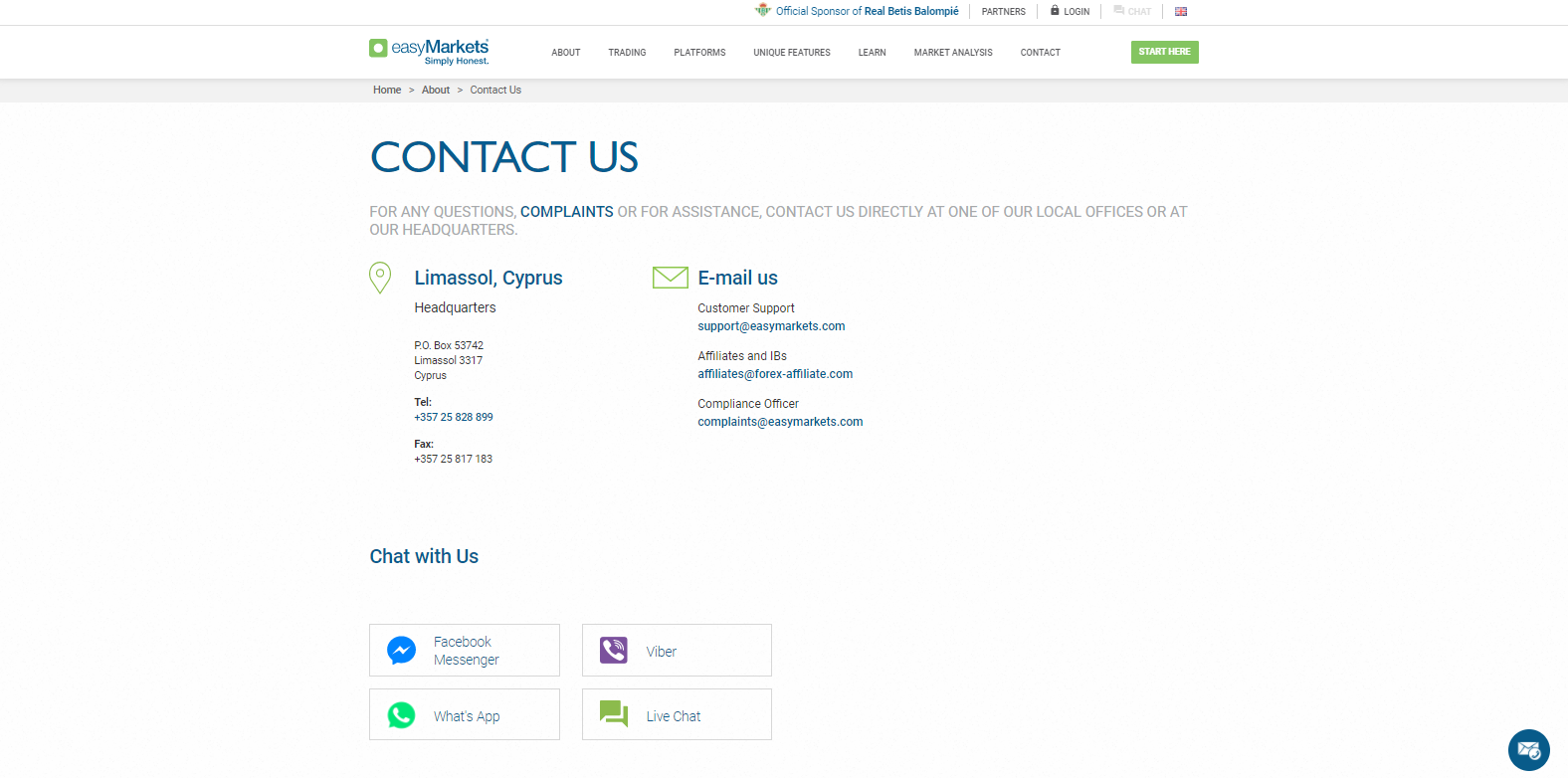

easyMarkets customer support may be reached via phone, e-mail, live chat, or assorted messenger apps. They also have a presence on social media, e.g. Facebook, Twitter, Instagram, etc., and contact can also be made in that manner. Support hours are not provided, but normal business hours are assumed. Overall, we were satisfied during this easyMarkets review to see that customer support appears easily accessible, if needed.

Bonuses and Promotions

This broker retains a dedicated promotional section. At the time of this review, easyMarkets offered three promotions; a first deposit bonus, a partnership programme, and a refer-a-friend bonus.

Opening an Account

New accounts are opened online, and the process is surprisingly short at easyMarkets. Traders are initially only required to prove their e-mail address and create a password or connect through their Google or Facebook account. However, when reading through the Client Agreement (which is reached by clicking on the terms and conditions link on the sign up page), it becomes clear from the Know Your Customer section that new traders are required to verify their account as mandated by regulatory requirements. This is usually completed by submitting a copy of the trader’s ID and proof of residency document.

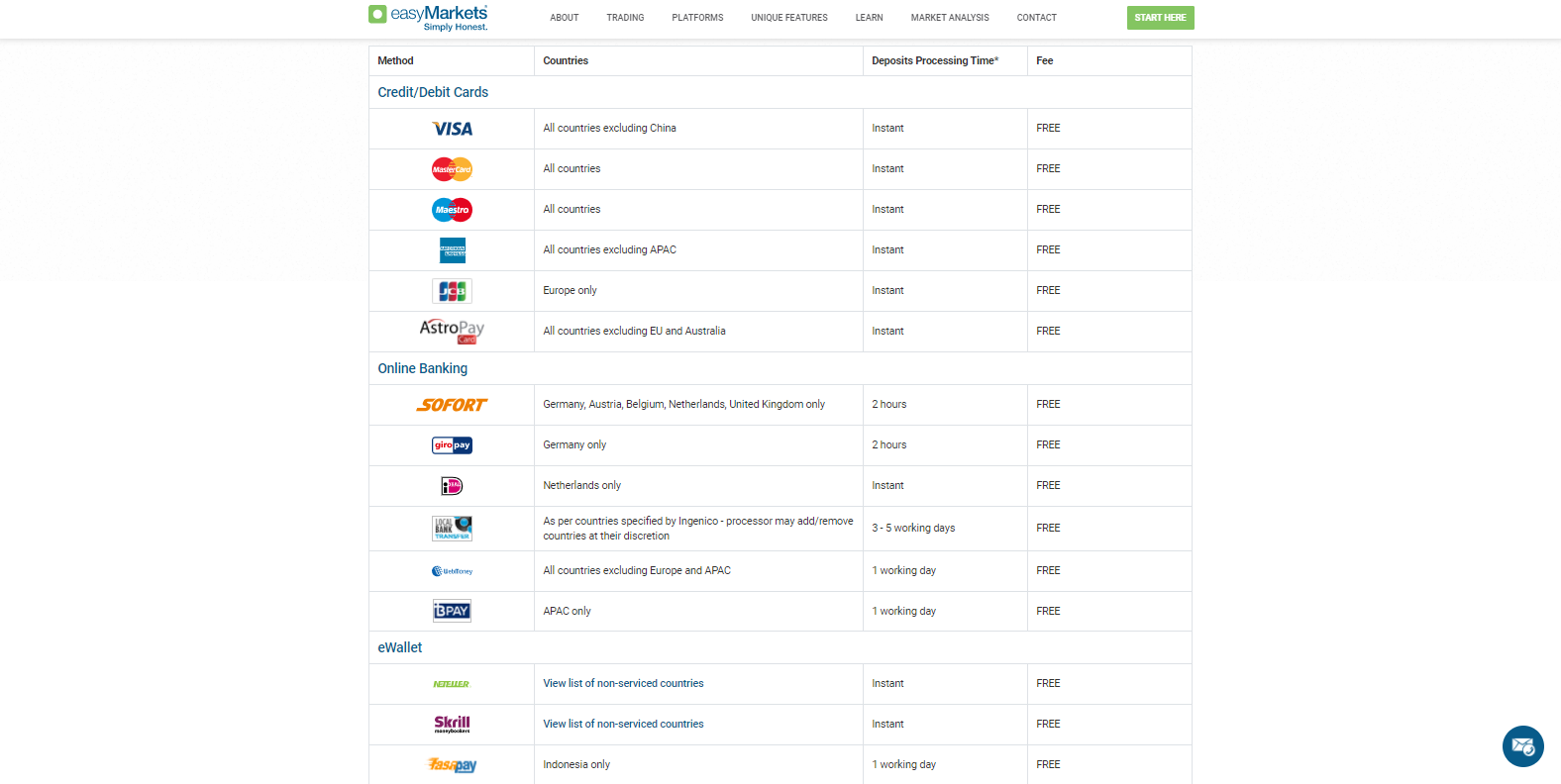

Deposits and Withdrawals

Deposits and withdrawals remain free of charge, but third-party fees may be applicable. Traders have plenty of choices, which include bank wires, credit and debit cards, Skrill, Neteller, Sofort, as well as several regional-only options. The processing times are listed between instantaneously and five business days, and the overall selection of payment options is solid. As required by its regulator, the name on the easyMarkets account and the payment processor needs to be the same.

Trading Platform

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Summary

easyMarkets appears to be a solid brokerage on the surface with impressive operational statistics. With 142,500 traders, more than 56.3 million executed trades, and over $2.92 trillion in trading volume plus official sponsorship of Real Betis Balompié, a Spanish division one football club, this broker portrays the image of a dominant player in the industry.

After the first impression, however, traders may realize that easyMarkets offers trading conditions that don’t compete well with other leading Forex brokers. Unfortunately, spreads are on the high side. While transparency is adequate, easyMarkets does charge traders for the usage of its proprietary trading platform through higher spreads than those available in the broker’s MT4 platform. The MT4 platform is given as a basic version only; instead of providing traders with required third-part plugins to unlock the platform's full potential, this broker created a lower quality webtrader. It is jammed with somewhat useless features and suggests limited to no authentic trading activity in its webtrader.

The broker's attempt at providing research is less than ideal, even though the education section is respectable. From a trader's perspective, the high trading costs, coupled with the choice between two mediocre trading platforms make this broker a second-tier option. Traders would be wise to consider other options despite the polished impression easyMarkets website conveys.

FAQs

Where is easyMarkets based?

easyMarkets is headquartered in Limassol, Cyprus.

How does easyMarkets make money?

easyMarkets is a market maker and profits directly from its traders’ losses. With 74% operating accounts at a loss, the cash flow remains substantial. This broker additionally levies excessive mark-ups on spreads.

How can I deposit into an easyMarkets account?

Traders have plenty of choices, which include bank wires, credit and debit cards, Skrill, Neteller, Sofort, and several regionalonly options.

What is the minimum lot size at easyMarkets?

The minimum trading size is listed as 0.01 lots in the MT4 trading platform, and 0.05 lots in the easyMarkets webtrader.

When does a margin call take place at easyMarkets?

easyMarkets fails to provide this information on their website, but as a CySEC regulated broker, a margin call is likely to be issued at a 50% equity-margin ratio.

Is easyMarkets regulated?

Easy Forex Trading LTD is the owner of easyMarkets, authorized and regulated by the Cyprus Securities & Exchange Commission (CySEC). The registration number is HE203997, and the license number is 079/07, which was granted on May 29th 2007. Easy Markets Pty LTD is authorized and regulated by the Australian Securities and Investments Commission (ASIC) under ABN number 73107184510.

What is the maximum leverage offered by easyMarkets?

The maximum leverage is 1:30 but remains asset dependent.

How do I open an account with easyMarkets?

easyMarkets has an online application form, which is the standard operating procedure.

Does easyMarkets offer the MetaTrader Trading Platform?

easyMarkets provides the MT4 trading platform, as well as its proprietary webtrader platform.