Editor’s Verdict

Freetrade is a UK-based stockbroker catering to long-term buy-only investors with three account options. Traders can opt for general investment accounts, ISAs, and SIPPs. Most investment activity is only available via a mobile app, confirming that Freetrade caters primarily to first-time millennial hobby investors. I have reviewed Freetrade to evaluate this broker and identify any unique features so you can determine if Freetrade is a broker you should trust with your investments.

Overview

Freetrade offers ISA and SIPP accounts to investors favouring a mobile app.

I like the availability of fractional share dealing and money market ETFs at Freetrade, which also presents a competitive choice of equities and ETFs. It offers investors with more substantial assets a more attractive cost structure, charging a monthly/annual fee instead of a transaction-based commission. Smaller portfolios may find the costs too high to access desired products and services.

Headquarters | United Kingdom |

|---|---|

Regulators | FCA |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2016 |

Minimum Deposit | £0 |

Negative Balance Protection | |

Retail Loss Rate | Undisclosed |

Funding Methods | 4 |

Islamic Account | |

US Persons Accepted? | |

Managed Accounts |

Freetrade Regulation & Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders check the regulatory status and verify it with the regulator by checking the provided license with their database. Freetrade has one well-regulated subsidiary.

Is Freetrade Legit and Safe?

Freetrade, founded in 2016, is a UK FinTech company and investment broker which segregates client deposits from corporate funds. Freetrade is also a member of the London Stock Exchange. The FSCS protects client deposits up to £85,000, and Freetrade undergoes annual audits by Deloitte to ensure its financial health meets strict regulatory standards.

My review did not find any misconduct or malpractice by this broker, and I can confidently rate Freetrade as a legitimate and safe investment broker.

Country of the Regulator | United Kingdom |

|---|---|

Name of the Regulator | FCA |

Regulatory License Number | 783189 |

Regulatory Tier | 1 |

Fees

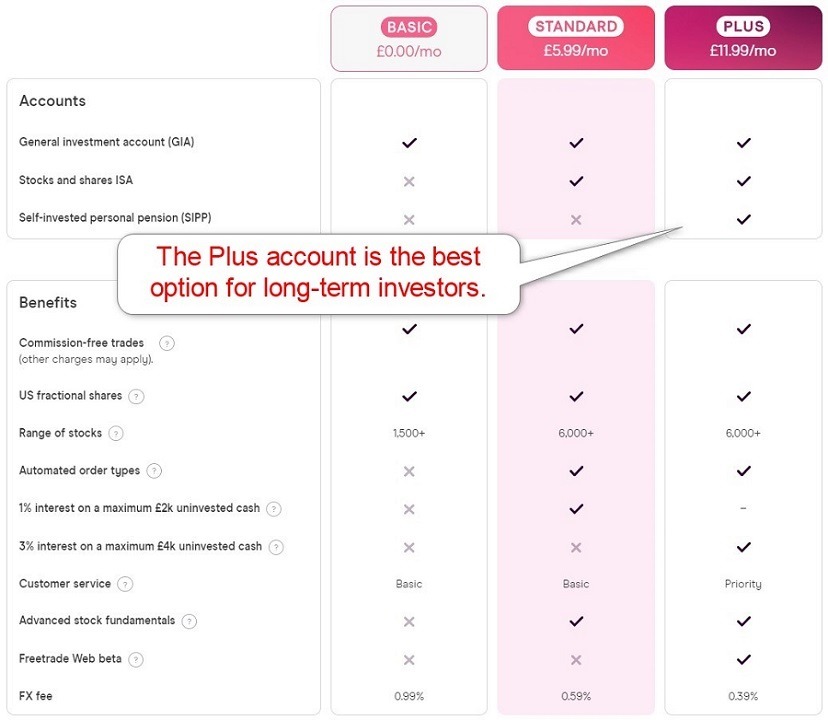

I rank trading costs among the most critical factors when evaluating a broker, as they directly impact profitability. Freetrade lacks transparency regarding spreads, but the low-volume nature of its business model makes it insignificant, as Freetrade caters to long-term buy-and-hold investors. Freetrade states that it makes no money from spreads, merely passing orders on to market makers and always looking for the best possible bid or ask price. Freetrade offers commission-free trading but has two account options that require monthly fees of either £59.88 or £119.88 paid annually. It is a compelling concept and can lower investment fees for clients with more substantial portfolios. The drawback is that smaller portfolios face a more expensive per-investment fee structure.

Here is a snapshot of Freetrade trading fees:

Noteworthy:

- Freetrade only offers British Pound accounts and applies a currency conversion fee between 0.39% and 0.99%, dependent on the account subscription, which is a replacement for commissions and can significantly increase investment costs.

- More expensive monthly subscription plans of £5.99 and £11.99 exist.

Deposit Fee | |

|---|---|

Withdrawal Fee | |

Inactivity Fee | FALSE |

Range of Assets

Freetrade offers investors up to 6,000 equities and ETFs across the UK, the EU, and the US. It also provides access to 150 investment trusts, and fractional share dealing on US equities is available. The overall asset selection is beneficial for investors, especially for retirement planning, and the risk profile of Freetrade clients is generally low. Therefore, this broker has created a suitable choice of investment products.

Freetrade Leverage

Freetrade does not offer leveraged trading and only maintains cash-only options.

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

Account Types

Clients can choose between the general investment account (GIA), the stocks and shares ISA, and the self-invested personal pension (SIPP). The ISA account is an excellent choice for UK investors, as it provides a tax-efficient option with an annual allowance of £20,000, meaning investors pay no dividend or capital gains tax up to that limit. It requires the Standard subscription, which costs £5.99 monthly or £59.88 annually, and the currency conversion fee is 0.59%.

The SIPP account, which the Investors’ Chronicle voted as the best low-cost SIPP platform, includes tax relief on contributions of up to £40,000, and clients can pool multiple pension plans into the Freetrade SIPP account. It costs £11.99 monthly or £119.88 annually, and the currency conversion fee is 0.39%. Investors also get a web-based trading platform, making it the only account type I can recommend.

Freetrade Demo Account

Freetrade has no demo accounts.

Trading Platforms

Freetrade relies on its mobile app, confirming that its core market is first-time millennial traders with a part-time investment approach and zero knowledge. A web-based option exists for clients with the Plus package, which costs £119.88 annually. I find this approach unsatisfactory, as committed investors require the tools to effectively manage portfolios, which is impossible via a mobile app in just a few clicks. Freetrade failed to introduce its app, but the Google Play Store displays a sub-standard app, and I cannot recommend it to investors. Freetrade approaches investing as a mobile game, which shows in what it believes investors require. The absence of the most basic research functions speaks volumes about where management is with its understanding of financial markets.

Overview of Trading Platforms

MT4/MT5 Add-Ons | |

|---|---|

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

Unique Features

The unique feature that stands out to me is the availability of money market ETFs, which can pay over 5.00% annually.

Research & Education

Freetrade offers no research and does not source it from third parties. It used to publish market commentary with investment trends but has not updated this section since January 2023. It is not a mark against Freetrade, as there is plenty of free and fee-based research. Still, the absence creates a massive service gap versus well-established competitors.

Freetrade features dozens of well-written investment guides, and I can highly recommend them to beginners, but they lack a classroom-style introduction to investing.

Therefore, beginners should consult online educational resources available for free. They should begin with in-depth content covering psychology and risk management while avoiding paid-for courses and mentors.

Customer Support

Freetrade has an in-app chat feature, offers e-mail support, and relies on its community. An FAQ section exists where clients will find many answers, which I recommend as a first step. I miss having a direct line to the finance department, where most issues can arise, as phone support does not exist. My review also found countless complaints about the quality of customer service. I was unable to confirm support hours.

Bonuses and Promotions

Freetrade offers a free share worth £50 to £1,200 for every new client who opens an ISA account and funds it with a minimum of £5,000. Terms and conditions apply, and clients should read and understand them before accepting any incentive.

Opening an Account

Opening an account at Freetrade is only possible by downloading the app, which is only available to UK residents. However, an EU-wide expansion will follow.

Account verification remains mandatory, as Freetrade complies with the FCA and global AML/KYC requirements. The process includes a selfie check alongside a government-issued ID. Should the selfie check fail, manual approval via a copy of a government-issued ID and one proof of residency document exists.

Freetrade fully complies with its regulator and global AML/KYC requirements. Therefore, account verification is mandatory, which most traders will satisfy by uploading a copy of their government-issued ID and one proof of residency document. Freetrade may ask for additional information on a case-by-case basis.

Minimum Deposit

There is no Freetrade minimum deposit requirement.

Payment Methods

Freetrade payment methods are bank wires, debit cards, Apple Pay, and Google Pay.

Accepted Countries

Freetrade presently only caters to UK residents but plans an EU-wide expansion.

Deposits and Withdrawals

The Freetrade mobile app handles all financial transactions for verified clients.

Regrettably, Freetrade provides fragmented details about deposits and withdrawals. There is no minimum deposit or withdrawal amount, but currency conversion fees apply. Freetrade prefers bank wires, which it executes via TrueLayer. Apple Pay and Google Pay are available for deposits but have a lifetime maximum of £250, rendering them useless. Freetrade does not accept credit card transactions. Only bank wires are available for withdrawals, which take two to three business days.

The name and the address on the payment processor and Freetrade trading account must match. I prefer a more transparent deposit and withdrawal section over having to source information bit by bit from the FAQ. The lack of modern payment processors for a mobile-first investment app is a significant disadvantage.

Withdrawal options |  |

|---|---|

Deposit options |  |

Is Freetrade a Good Broker?

I like the investing environment at Freetrade for its choice of equities and ETFs, including fractional share dealing in US shares and money market ETFs. Unfortunately, this is where the positives end. Providing a low-quality mobile app is a major drawback, and the subscription-based model is expensive for small portfolios and non-UK investors. Since only GBP accounts are available, the high currency conversion fees applicable to non-UK transactions replace commissions. I cannot recommend Freetrade, which feels like a rushed idea to catch up to competitors with a compelling core business plan but failed execution in many respects. No, Freetrade is not ideal for beginners. While it offers a simple approach, it lacks cutting-edge tools and research capabilities for investors to make informed decisions. Freetrade is not suitable for any short-term trading strategy and only suits long-term buy-and-hold investors. Yes, all clients are the beneficial owners of all shares they purchase at Freetrade. Freetrade makes money from monthly subscriptions and expensive currency conversion fees. Freetrade offers the infrastructure, like any broker, but the ability to make money depends 100% on the investor.FAQs

Is Freetrade good for beginners?

Is Freetrade good for day trading?

Do I own my shares on Freetrade?

How does Freetrade make its money?

Can you make money on Freetrade?