Friedberg Direct Editor’s Verdict

Friedberg Direct, which was founded in 1971, is a division of the family-owned Friedberg Mercantile Group LTD, based in Toronto, Canada. The parent company has over $2 billion in assets under management (AUM). This broker remains one of the oldest and most trusted Canadian financial firms. Friedberg Direct partnered with FXCM and AvaTrade to offer Canadian traders access to two well-recognized Forex and CFD brokers. All accounts remain with Friedberg Direct and under oversight by the Investment Industry Regulatory Organization of Canada (IIROC). This review will cover the brokerage unit, in partnership with AvaTrade.

Overview

Friedberg Direct offers traders a regulated and secure trading environment.

Canada CIRO 1971 ECN/STP, No Dealing Desk $250 MetaTrader 4, MetaTrader 5, Proprietary platform, Web-based

Regulation and Security

The Investment Industry Regulatory Organization of Canada (IIROC) provides oversight of this broker, and Friedberg Direct has a clean track record. The Canadian Investor Protection Fund (CIPF) offers an additional safety net in the unlikely event of default by this well-capitalized broker with solid ownership. The CIPF protects assets up to C$3 million, if investors distribute them accordingly, via three C$1 million account options; it is by far the best protection available globally. Friedberg Direct fully segregates clients' deposits from corporate funds and maintains a safe and secure trading environment.

Friedberg Direct offers traders a regulated and secure trading environment.

Fees

Friedberg Direct provides commission-free trading accounts, earning most of its revenues from spreads. The mark-up on the EUR/USD is 0.6 pips, making it more competitive than most brokers that grant trading without commissions. Corporate actions such as dividends, stock splits, and mergers may impact equity and index CFDs, which this broker passes on to traders. Swap rates on leveraged overnight positions apply, and Friedberg Direct remains transparent about it. Deposit and withdrawal charges for bank wires exist, together with third-party costs for credit/debit cards. After three months of inactivity, a $50 (or currency equivalent) fee applies, which is unacceptably high; after twelve months, Friedberg Direct charges a $100 administration fee. The overall cost-structure is acceptable.

MT4/MT5 traders can easily access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Symbols.

2. Select the desired currency and then click on Properties located on the right side.

3. Scroll down until you see Swap Long and Swap Short.

Friedberg Direct earns most of its revenues from spreads in its commission-free trading accounts and provides details about all costs per asset class.

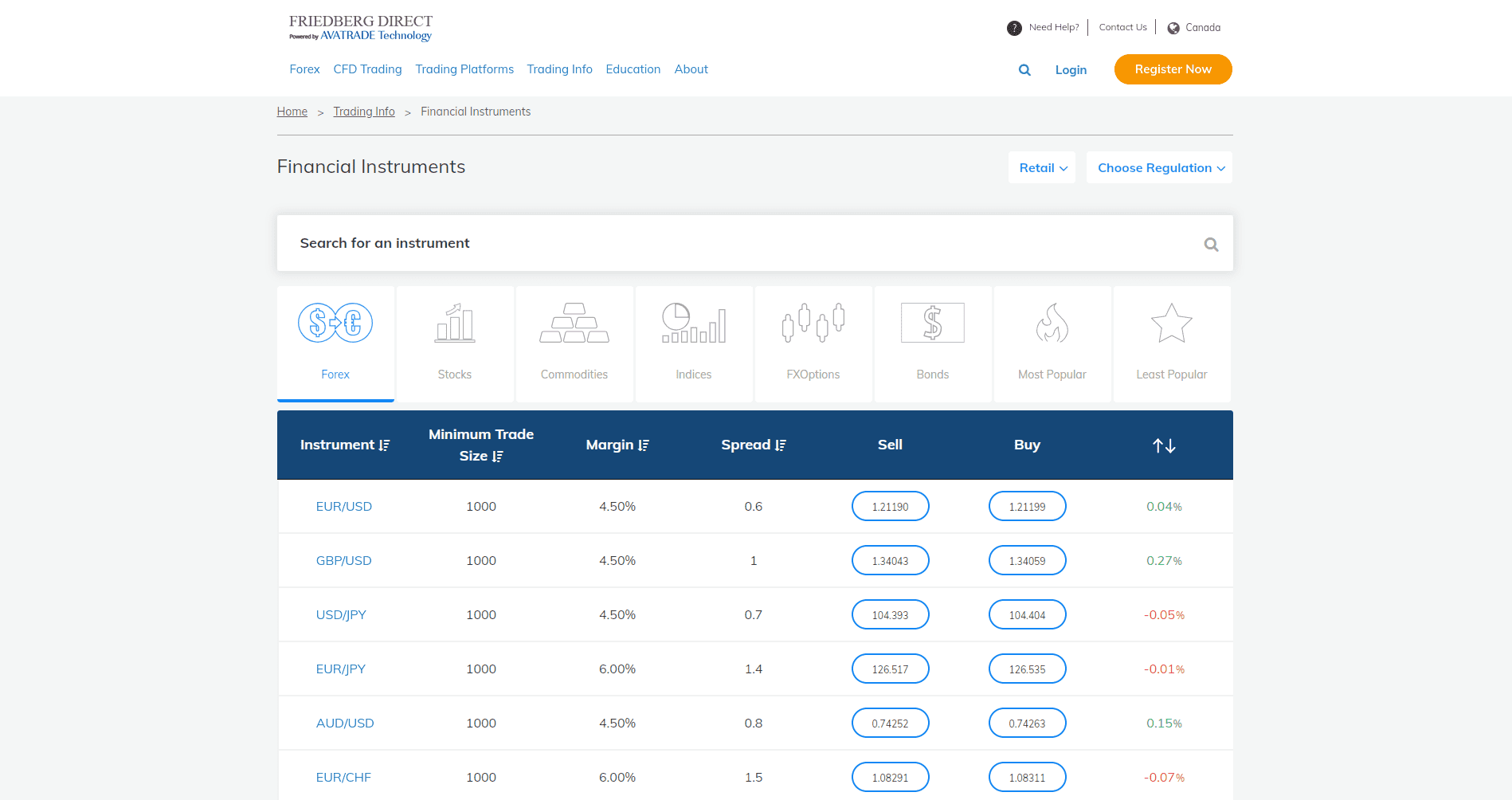

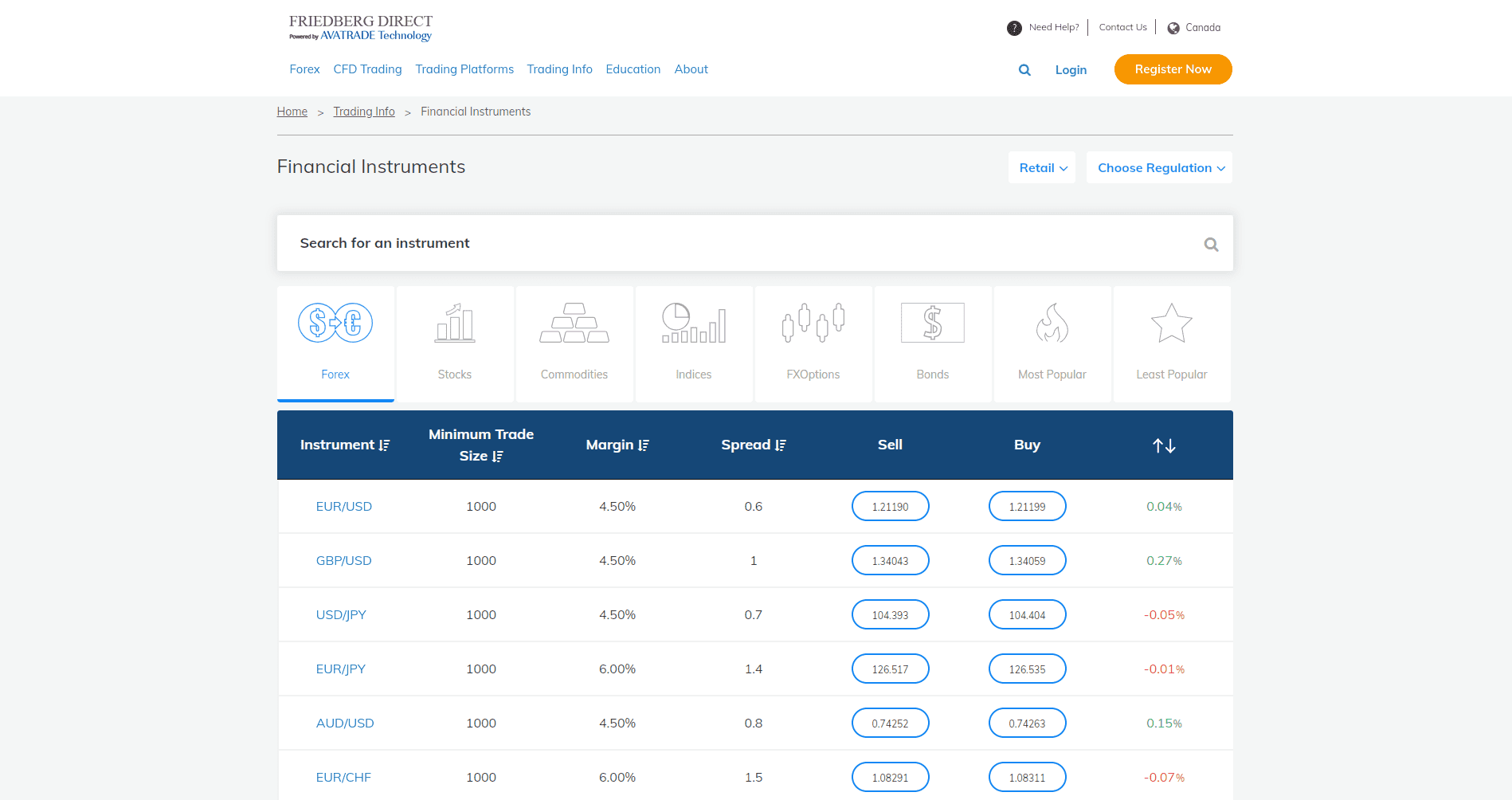

What Can I Trade

Traders have access to a below-average 37 currency pairs but to an above-average 29 commodities. With 522 equity CFDs, this sector represents the bulk of trading instruments. Completing the asset selection are 16 index CFDs and two bond CFDs. Friedberg also offers 42 option contracts. With 648 assets in total, most retail traders will have plenty of choices, but pure Forex traders do not have adequate market coverage.

Friedberg Direct offers 648 assets across six sectors.

Account Types

Friedberg Direct does not list any account types, inferring that the same CFD trading account is available to all traders. Nonetheless, that is no excuse for not providing information regarding account features, similar to other well-established competitors. The registration form indicates that new traders should have more than C$25,000 in savings, with an annual income above C$25,000. However, the fine print reveals that those values are not mandatory and that Friedberg Direct will consider all submitted data. Per its statement, the execution model appears to be straight-through processing (STP)/ no dealing desk (NDD), but the overall absence of details remains an unfortunate management oversight.

Friedberg Direct uses unverifiable marketing hype to attract new traders.

Trading Platforms

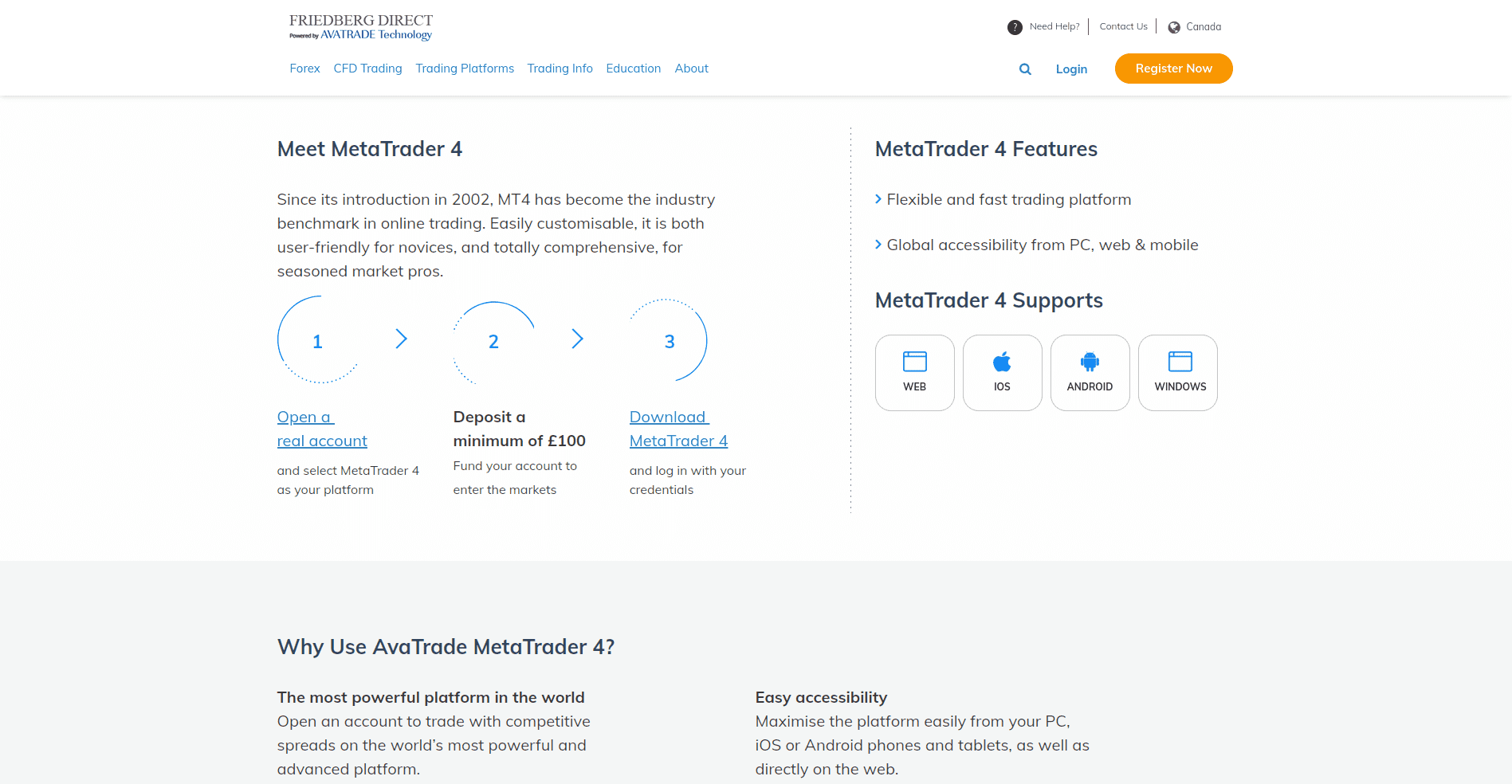

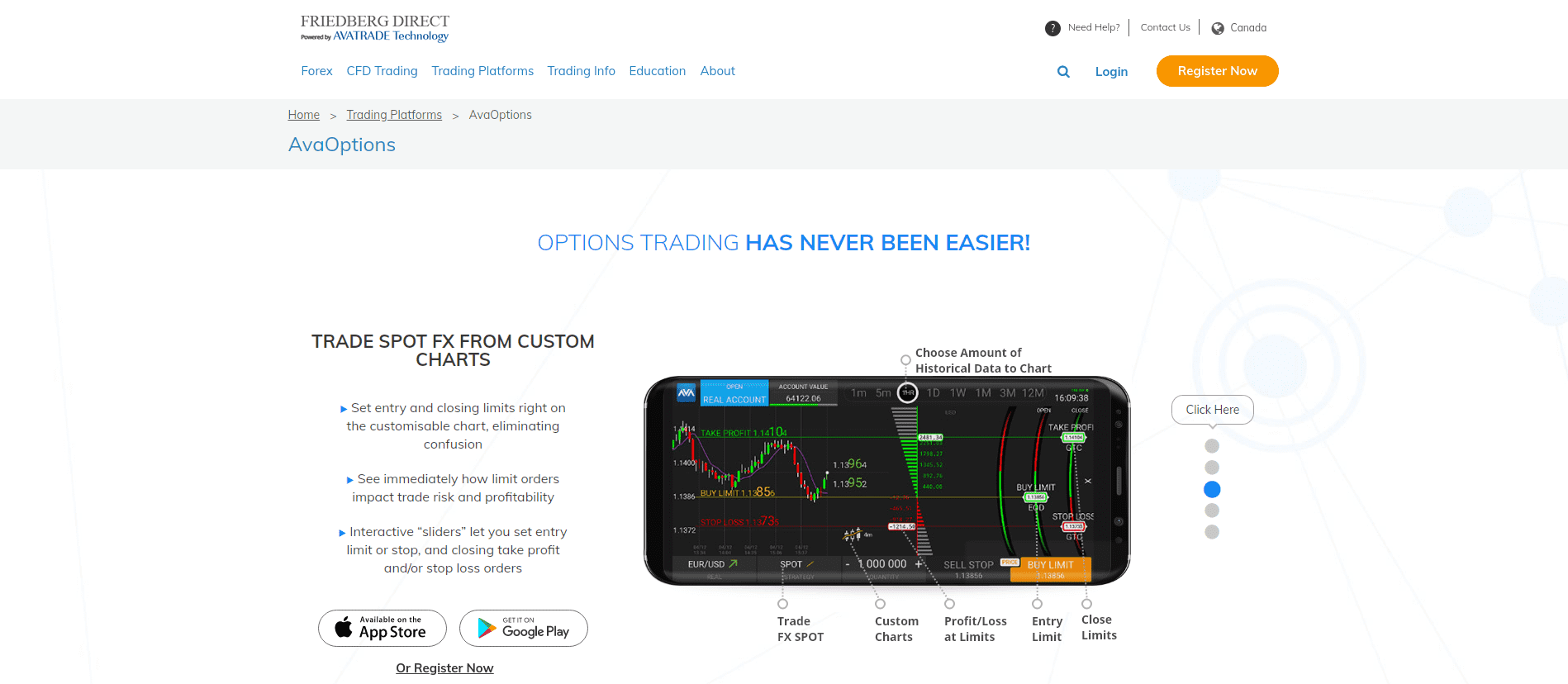

Traders may choose between the MT4 and MT5 trading platforms, which are available as a desktop client, webtrader, and mobile application. Friedberg notes that MT5 is not available in all regions, without providing further details. The introduction to MT5 remains minimal compared to the more in-depth one for MT4. In either case, Friedberg Direct only provides the out-of-the-box version without sourcing any of the required third-party plug-ins. That leaves traders with a below-average trading experience, contradicting its marketing claims of providing “the best Forex trading experience.” The proprietary AvaOptions trading platform is also available; however, with only 42 assets, and those primarily in the Forex market, the usability of the AvaOptions platform remains limited. While the MT4 infrastructure enables traders to upgrade to a cutting-edge trading solution, it requires the trader's own investment as Friedberg Direct fails to support it.

Only the core MT4 trading platform is available at Friedberg Direct.

Friedberg Direct states that MT5 is not available in all regions, though no further information is provided.

AvaOptions is equally available at Friedberg Direct.

Unique Features

Other than misleading marketing claims about the trading environment and contradictory information about available assets, Friedberg Direct possesses no unique features, aside from the positive aspect of its sound corporate ownership.

Research and Education

Friedberg Direct neither provides in-house nor third-party research, placing it notably behind that of well-established competitors. It operates an execution-only business model and places less focus on value-added services. The result of its business model creates a less favorable broker.

It does make an exception when it comes to education, however, where Friedberg Direct maintains a valuable selection of written content and videos. Trading for Beginners consists of 51 quality articles. The section would benefit from improved navigation; presently, it is one long down-scroll. The down-scroll is unfortunately interrupted by five Register Now buttons, which takes away from the educational content and leaves a marketing-driven impression. This broker repeats the same process within each article. Rather than adding charts and other supporting images to enhance the article's value, the orange Register Now buttons draw focus away from education. Overall, the numerous registration buttons constitute an unfortunate misstep, detracting from what is otherwise quality content and ruining the trader's learning experience.

Professional Trading Strategies feature 22 well-described technical trading strategies but, as with the Trading for Beginners section, Friedberg Direct's marketing negate the valuable information. The frequency of the registration buttons throughout the section's content effectively lowers the quality of the article and taints the user experience. Friedberg Direct essentially converted a valuable asset into a liability.

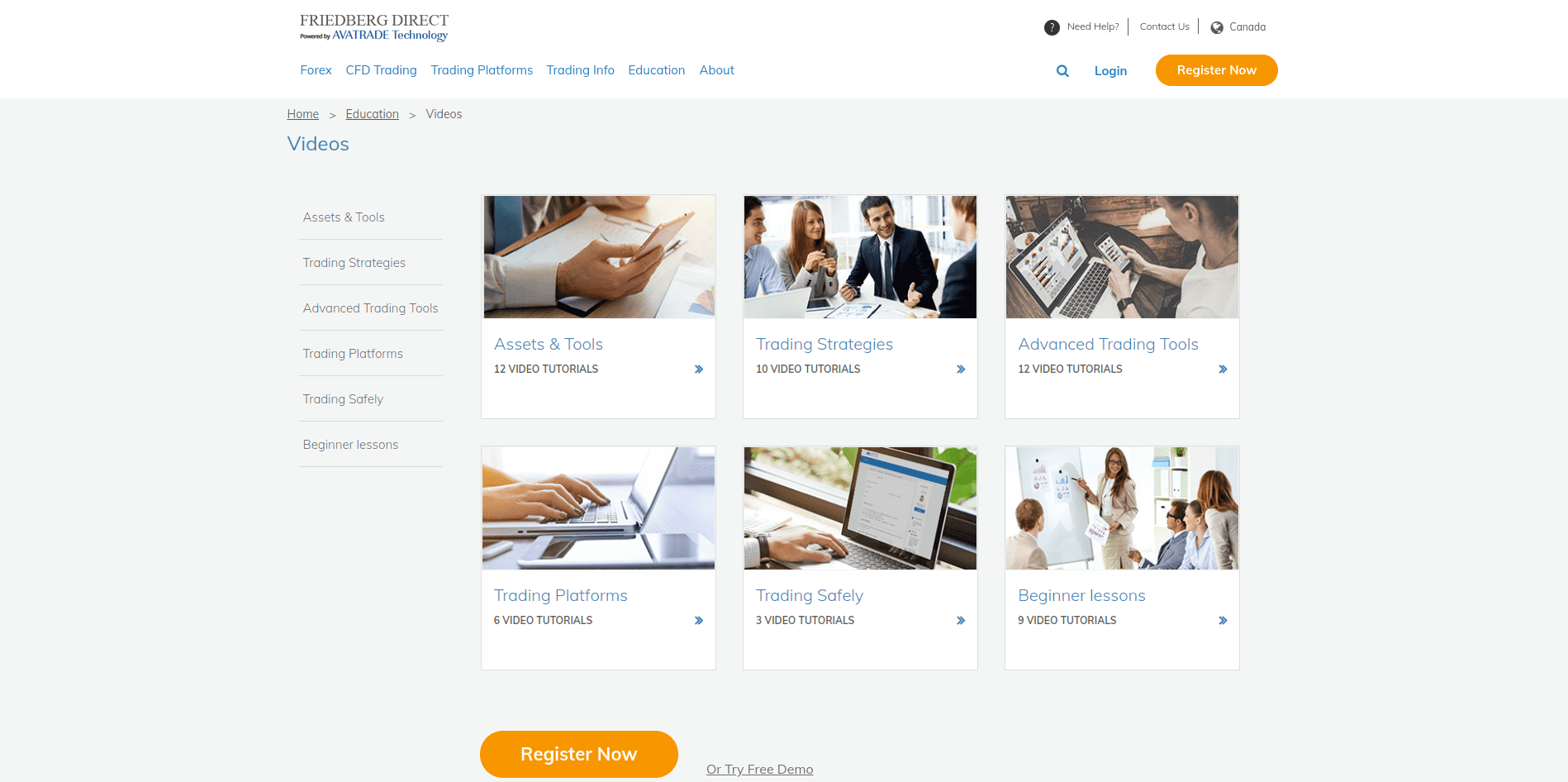

The extensive video library provides significantly better educational value and will be more appealing to millennial traders, the majority of whom prefer short videos over written content. The content is well-organized, and the videos are hosted on Vimeo; the overall experience is both pleasant and informative. The single eBook that Friedberg Direct makes available free of charge requires significantly more than just a name and email address; the intent seems to be only to garner contact information for future marketing campaigns, as traders must leave their name, e-mail, and country, as well as a phone number in order to access the eBook.

The Trading for Beginners section features quality content, frequently and infuriatingly interrupted by marketing.

Throughout each article, Friedberg Direct's orange Register Now buttons are included; charts and images that would otherwise add value are notably absent.

The marketing ploy continues with the Professional Trading Strategies category.

The video library represents the best educational value at Friedberg Direct.

The “free” eBook requires a full name, email address and phone number; the intent appears to be for marketing purposes including, potentially (and unacceptably), cold-calls.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/6 |

Website Languages |   |

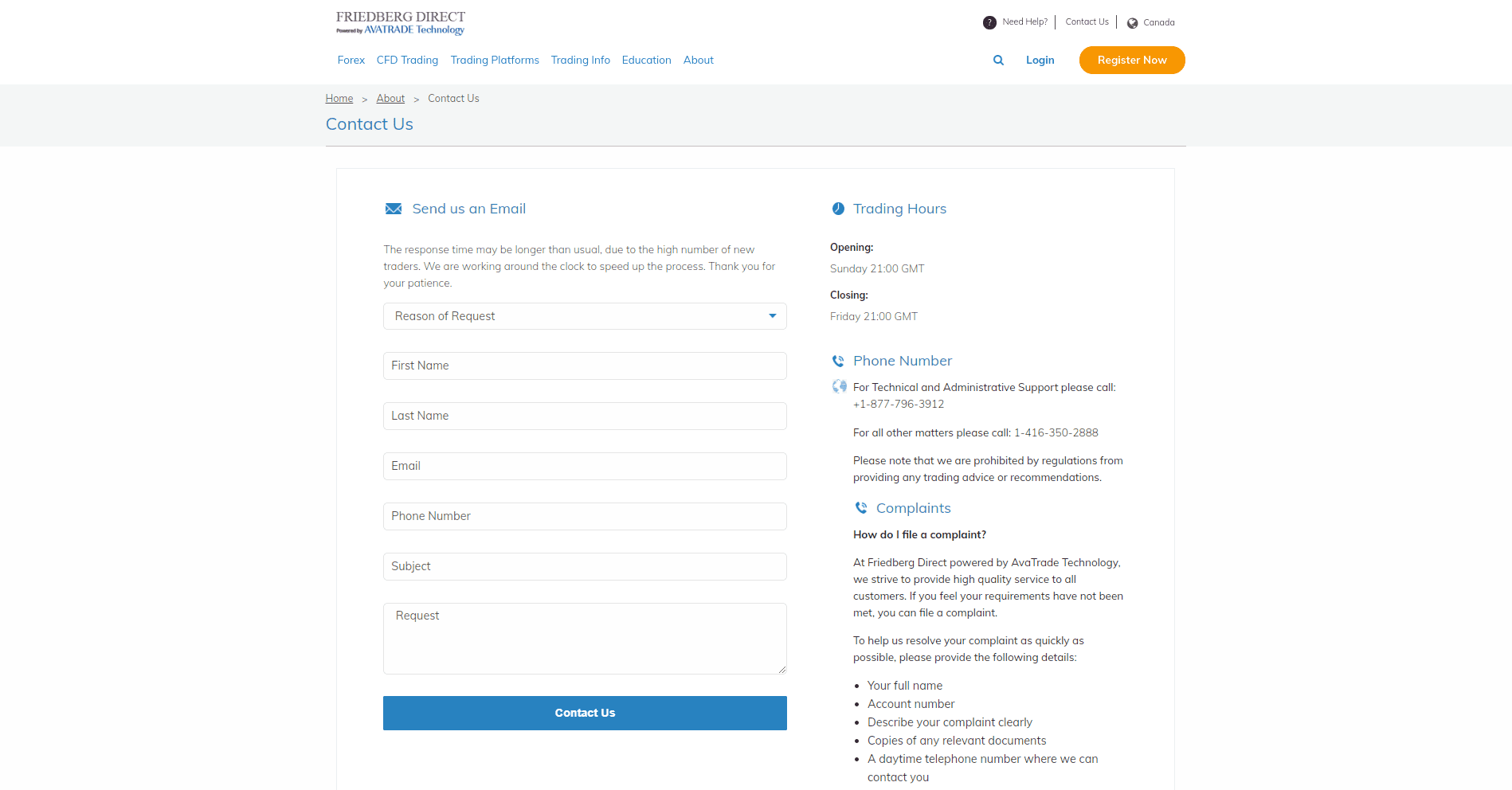

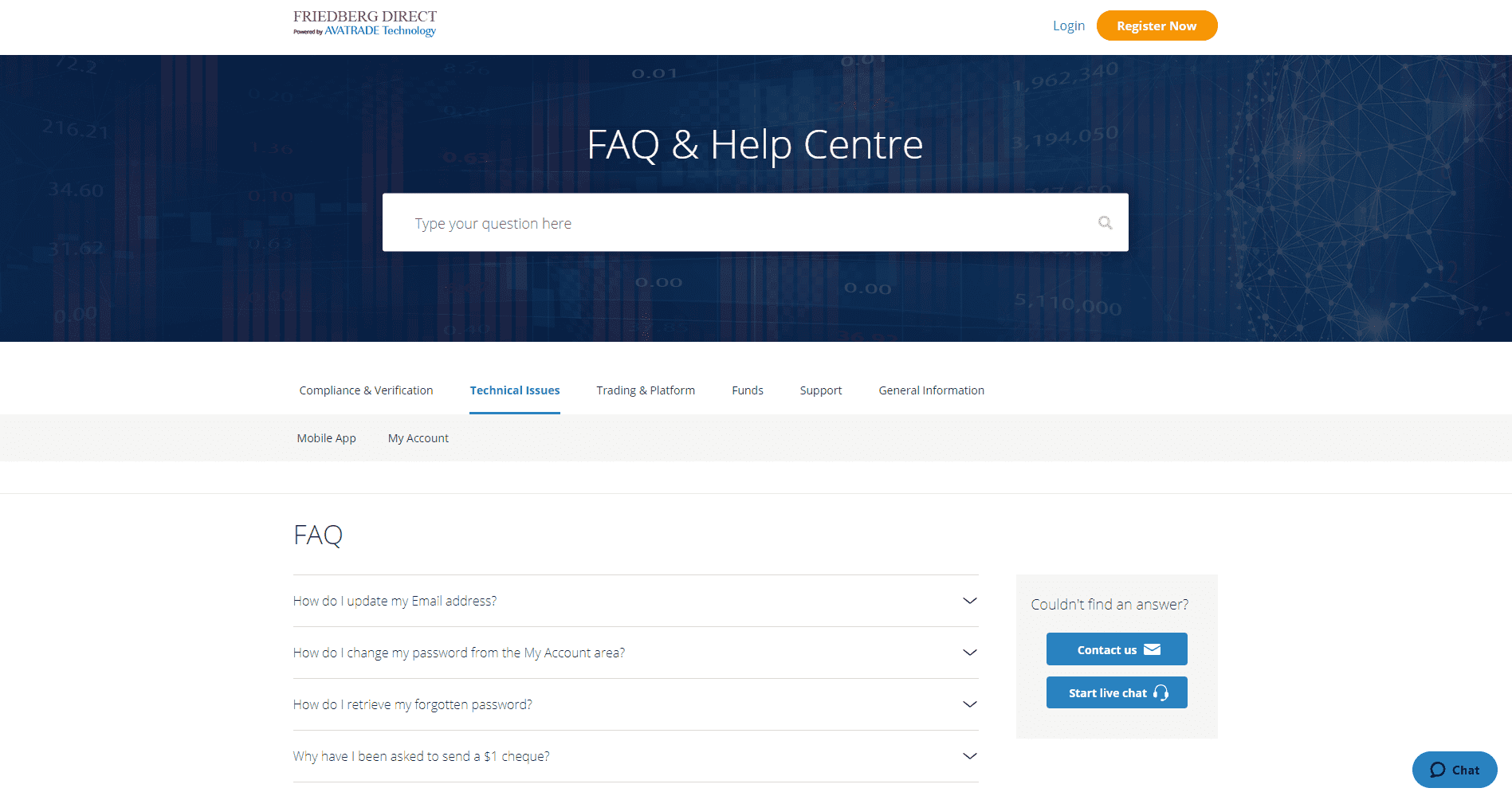

Customer support is available 24/6, from Sunday 2100 to Friday 2100. Clients can request assistance via e-mail, webform, or by calling; regrettably, Friedberg does not provide a toll-free number. The FAQ section attempts to answer most questions, and is also where this broker hides its live chat function. A dedicated complaint form does exist. The overall approach to customer service, though below average compared to competitors, is acceptable at Friedberg Direct. Having said that, while most traders generally do not require customer assistance at a well-managed broker, the absence of key information may require more help than usual.

Customer support is adequate but remains comparatively below average.

The FAQ section is where Friedberg Direct hides its live chat function.

Bonuses and Promotions

Neither bonuses nor promotions are available at Friedberg Direct.

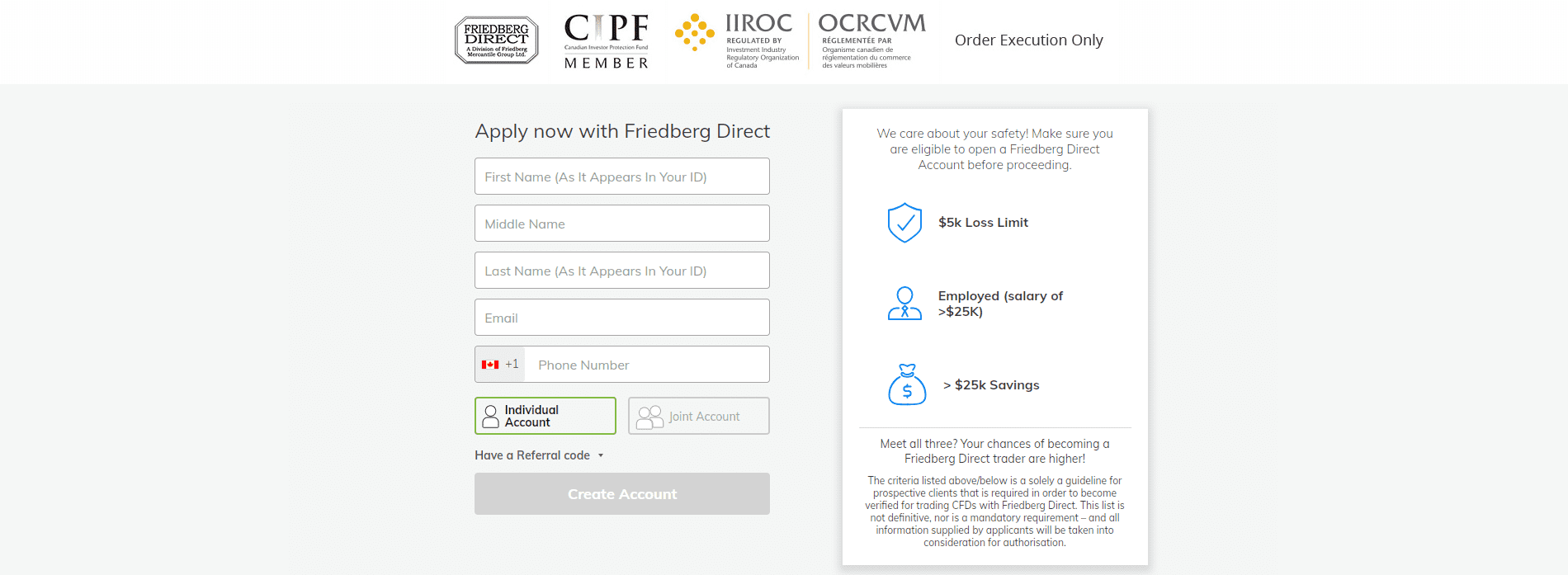

Opening an Account

Friedberg Direct only accepts Canadian clients, by its own account, preferably employed, with a salary above C$25,000 and with savings above the same amount. The broker does note that it will evaluate all data before approving or rejecting an application. Though one could argue that the eligibility criteria set out could be construed as discriminating, or even discriminatory, Friedberg Direct implements those guidelines under the guise of “security.” It should be noted that no other broker demands similar “eligibility criteria.”

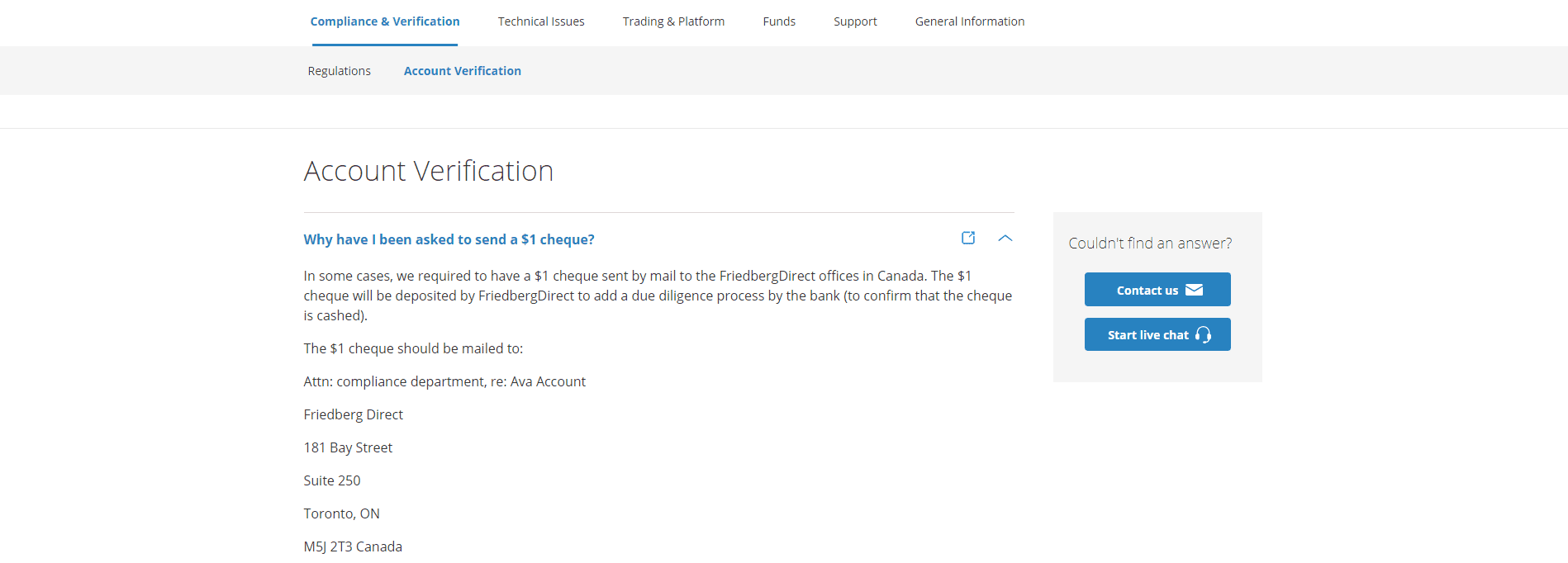

An online form processes new accounts. The first step asks for name and contact details, but the second step requires account verification, in line with regulatory stipulated AML/KYC requirements. A copy of the trader's ID and one proof of residency document usually completes the account opening process. Per their account, in some cases, Friedberg Direct will ask new clients to mail a C$1 cheque, a rather unusual step.

Friedberg Direct's account application demands higher eligibility criteria than most online brokers.

Some traders are required to mail a C$1 cheque to Friedberg Direct for bank verification purposes.

Deposits and Withdrawals

Similar to US brokers, Friedberg Direct only allows bank wires and credit/debit cards as deposit methods. The minimum deposit amount is C$300 for Canadian Dollar accounts and $250 for US Dollar accounts. Friedberg processes withdrawal requests within 24 hours, but it can take up to seven business days for funds to arrive in the trader's account. Since Friedberg Direct does not cater to international traders, it appears a rather lengthy amount of time for a domestic-only transaction. The limited payment options remain unacceptable for a broker in the 21st century.

Friedberg Direct only allows bank wires and credit/debit cards as payment options.

Traders must withdraw 100% of their initial deposit via a credit/debit card before requesting a wire transfer for any balance left in the account.

A domestic-only seven business day withdrawal period remains unacceptable.

Trading Platform

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

Summary

Friedberg Direct is a Canadian execution-only broker whose biggest asset is being part of the Friedberg Mercantile Group LTD, a family-owned financial firm in operation since 1971. Regrettably, Friedberg Direct does not maintain a leading brokerage; it partnered with FXCM and AvaTrade, but the trading environment is significantly less competitive. It is heavy on marketing but fails to deliver substance. Friedberg Direct is regulated and has a clean track record. Though this online broker claims that all new account applications will be considered, the eligibility criteria they have set out for new traders could be construed, not just as discriminating, but discriminatory.

Only the core MT4 trading platform is available, while limited availability of the MT5 platform is noted, and the AvaOptions platform is available with a reduced asset selection. Together, traders are left with an uncompetitive trading environment unless they personally invest in the MT4 infrastructure and its countless upgrade possibilities. Friedberg Direct does not provide research, nor do they source it from third-parties. While an educational section is maintained it is, regrettably, littered with orange Register Now buttons, which detracts from an otherwise quality collection of written content and videos. Overall, Friedberg Direct is an uncompetitive broker that does possess the infrastructure to provide a notably improved trading environment, if it so chooses. No, this broker is a legit and IIROC regulated CFD broker, owned by Friedberg Mercantile Group LTD, in operation since 1971. Friedberg Direct offers commission-free trading accounts, but a C$50 per month inactivity fee applies after three months, and a C$100 administration fee is assessed after twelve months. The minimum deposit for Canadian Dollar accounts is C$300, and the one for US Dollar accounts is $250. The maximum leverage is 1:33, but only for the USD/CAD. Most other Forex pairs trade with 1:25 and below. Friedberg Direct is a Canadian execution-only broker offering trading accounts in partnership with FXCM and AvaTrade.FAQs

Is Friedberg Direct a scam?

What are the Friedberg Direct fees?

What is the Friedberg Direct minimum deposit?

What is the maximum leverage at Friedberg Direct?

What is Friedberg Direct?