For more than fifteen years, DailyForex has been a trusted authority on forex brokers, establishing a strong reputation for detailed research and integrity. Using a methodology refined from years of working within the retail brokerage industry, we empower traders to pick the best broker for them, as with this Interactive Brokers review. Discover more about our comprehensive review process and how we maintain transparency and impartiality here.

Editor’s Verdict

Interactive Brokers, founded in 1978, became the most prominent online trading platform in the US based on the number of daily average revenue trades. It is a S&P400 member and offers 160+ markets across 36 countries in 28 currencies. After concluding my Interactive Brokers review, I can recommend it to demanding traders seeking a professional trading environment. Is Interactive Brokers the best choice for you?

Overview

Interactive Brokers provides a cutting-edge trading infrastructure with ultra-low fees.

Headquarters United States Regulators ASIC, Central Bank of Ireland, CFTC, FCA, MAS, SEBI, SEC Tier 1 Regulator(s)? Owned by Public Company? Year Established 1978 Execution Type(s) Market Maker Minimum Deposit $0 Negative Balance Protection Trading Platform(s) Proprietary platform Average Trading Cost EUR/USD Account and account-tier dependent Average Trading Cost GBP/USD Account and account-tier dependent Average Trading Cost WTI Crude Oil Account and account-tier dependent Average Trading Cost Gold Account and account-tier dependent Average Trading Cost Bitcoin Account and account-tier dependent Retail Loss Rate Undisclosed Minimum Raw Spreads 0.1 pips Minimum Standard Spreads Not applicable Minimum Commission for Forex $2.00 Funding Methods 2 Islamic Account Signals US Persons Accepted? Managed Accounts

Interactive Brokers Five Core Takeaways:

- 3.45M client account, with 3.473M daily revenue trades

- $11.7B in excess regulatory capital

- Excellent asset selection

- Limited deposit and withdrawal methods

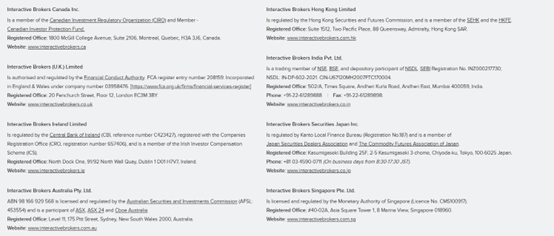

Regulation and Security

Country of the Regulator | Australia, Canada, Hong Kong (SAR), Ireland, India, Japan, Singapore, United Kingdom, United States |

|---|---|

Name of the Regulator | ASIC, Central Bank of Ireland, CFTC, FCA, MAS, SEBI, SEC |

Regulatory License Number | 36418/8-47257, undisclosed but confirmed, C423427, 208159, 433554, undisclosed, INZ000021730, undisclosed, CMS100917 |

Regulatory Tier | 1, 1, 1, 1, 1, 1, 2, 1, 1 |

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend that traders check regulations and verify them with the regulator by double-checking the provided license with their database. Interactive Brokers has ten regulated entities and a good track record.

These are Interactive Brokers’ affiliates:

Is Interactive Brokers Legit and Safe?

My Interactive Brokers review found no verifiable misconduct or malpractice by this broker, founded in 1978. Therefore, I recommend Interactive Brokers as a legitimate and safe broker.

Interactive Brokers regulation and security components:

- Interactive Brokers is regulated in the US, Canada, the UK, Ireland, Australia, Hong Kong, India, Japan, and Singapore

- Founded in 1978

- Segregation of client deposits from corporate funds

- Negative balance protection in select jurisdictions

- Investor protection schemes (dependent on regulatory requirements)

What would I like Interactive Brokers to add?

Interactive Brokers ticks all the boxes, but traders must choose the proper regulatory jurisdiction, if possible, as the security features differ.

Fees

Average Trading Cost EUR/USD | Account and account-tier dependent |

|---|---|

Average Trading Cost GBP/USD | Account and account-tier dependent |

Average Trading Cost WTI Crude Oil | Account and account-tier dependent |

Average Trading Cost Gold | Account and account-tier dependent |

Average Trading Cost Bitcoin | Account and account-tier dependent |

Minimum Raw Spreads | 0.1 pips |

Minimum Standard Spreads | Not applicable |

Minimum Commission for Forex | $2.00 |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | false |

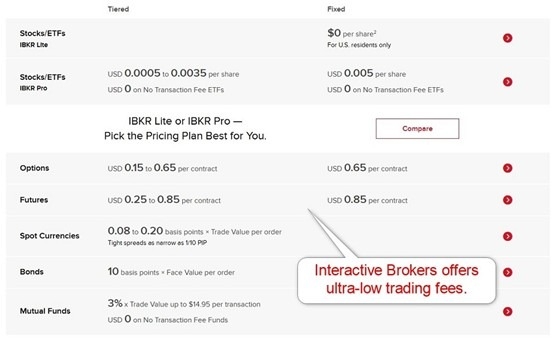

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability. Interactive Brokers excels with ultra-low trading fees, offering traders a competitive edge, but given the asset selection, the fee structure is complex. Forex traders get tight spreads from 0.1 pips for commissions between $1.00 and $2.00 per order. Cryptocurrency traders pay between 0.12% and 0.18% of the deal value with a $1.75 minimum commission but no more than 1% of the trade value.

Equity traders trading US-listed shares pay a commission between $0.0000 and $0.0035 per share per deal. Interactive Brokers offers many commission-free assets, and the overall cost structure ranks among the best industry-wide.

Deposits are always free, and Interactive Brokers offers one free withdrawal monthly before a withdrawal fee applies. An inactivity fee does not exist, but currency conversion fees apply where necessary.

Swap rates on leveraged overnight positions are the most ignored trading costs. Depending on the trading strategy, they may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

During my Interactive Brokers review, I found a detailed list of margin and financing rates broken down by currency. Interactive Brokers also offers a calculator, allowing traders to swiftly get the rate for their account type and margin loan.

Interactive Brokers Trading Hours

Asset Class | From | To |

|---|---|---|

Currency Pairs | Sunday 20:00 | Friday 15:50 |

Cryptocurrencies | Sunday 20:00 | Friday 15:50 |

Commodities | Sunday 20:00 | Friday 15:50 |

Crude Oil | Sunday 20:00 | Friday 15:50 |

Gold | Sunday 20:00 | Friday 15:50 |

Metals | Sunday 20:00 | Friday 15:50 |

Equity Indices | Sunday 20:00 | Friday 15:50 |

Stocks (non-CFDs) | Monday 04:00 | Friday 20:00 |

Bonds | Monday 08:00 | Friday 17:00 |

ETFs | Monday 04:00 | Friday 20:00 |

Options | Sunday 20:00 | Friday 15:50 |

Futures | Sunday 20:00 | Friday 15:50 |

Range of Assets

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

Interactive Brokers offers 160+ markets across 36 countries in 28 currencies, ensuring traders have an unmatched asset selection among online brokers. Active and passive traders, and those favoring automated trading solutions, have sufficient trading instruments to manage a well-diversified portfolio.

Bond traders have more than 1,000,000 instruments. There are over 43,000 mutual funds, from 600 fund families, including 18,000 without transaction fees, and

investors can trade over 15,000 ETFs globally on 90+ market centers, including commission-free ETFs.

Interactive Brokers offers the following asset classes:

- Equities

- ETFs

- Forecast Contracts

- Warrants

- Structured Products

- Options

- Futures and FOPs

- Spot currencies

- Cryptocurrencies

- Metals

- Bonds

- Mutual funds

- CFDs

- EFPs

- Hedge funds

- Robo portfolios

Interactive Brokers Forex Leverage

Interactive Brokers offers up to 50:1 leverage depending on the currency pair.

What should traders know about Interactive Brokers’ leverage?

- The leverage depends on the regulatory jurisdiction and account classification

- Negative balance protection exists, as mandated by regulators

- Traders should always use appropriate risk management with leveraged trading to avoid magnified trading losses

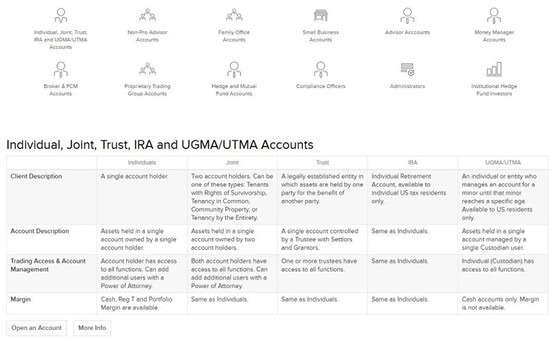

Account Types

Interactive Brokers offers a wide range of account types. Each one features a different cost structure and benefits. Interactive Brokers describes all available options well.

The account types offered are:

- Individual, Joint, Trust, IRA and UGMA/UTMA Accounts

- Non-Professional Advisor Accounts

- Family Office Accounts

- Small Business Accounts

- Advisor Accounts

- Money Manager Accounts

- Broker & FCM Accounts

- Proprietary Trading Group Accounts

- Hedge Fund & Mutual Fund Accounts

- Compliance Officers Account

- Administrators Account

- Institutional Hedge Fund Investors Account

My observations concerning the Interactive Brokers account types are:

- The account minimums and trading conditions depend on the account type.

- Given the many choices, it will require more time to read through the material to make the proper account choice and configuration.

- It is well worth the time to optimize the settings before getting started. The process remains straightforward and well-explained.

- Margin rates rank among the lowest industry-wide, with rates as low as 4.83%

- IBKR Lite clients get $0 commissions on US-listed stocks and ETFs.

- Interest of up to 3.83% in USD accounts.

- Stock Yield Enhancement Program pays income on the fully paid shares of stocks.

Interactive Brokers Demo Account

Demo trading does not grant exposure to trading psychology and can create unrealistic trading expectations. Therefore, I want to caution beginner traders when using demo trading as an educational tool, and they should consider the limitations.

What stands out about the Interactive Brokers demo account?

- Data is delayed by 10-15 minutes except for OTC spot FX and OTC spot Metals, which is non-delayed.

- A demo account requires registration but not account verification.

- The default balance is $1,000,000.

Interactive Brokers Margin Rates

Interactive Brokers offers US-based leveraged traders the lowest margin rates countrywide. They also benefit from blended rates based on a five-tier system. For example, a trader with a $1,000,0000 margin balance pays the margin rate for the first $100,000 based on the tier-1 rate and the remaining $900,000 based on the tier-2 rate. The Interactive Brokers margin rates for the IBKT Lite accounts are up to 200 basis points higher than for the IBKR Pro accounts.

Here is an overview of Interactive Brokers margin rates for USD accounts:

Tier | IBKR Pro | IBKR Lite |

≤ $100,000 | 5.830% (BM + 1.50%) | 6.830% (BM + 2.50%) |

100,000 ≤ 1,000,000 | 5.330% (BM + 1.00%) | 6.830% (BM + 2.50%) |

1,000,000 ≤ 50,000,000 | 5.080% (BM + 0.75%) | 6.830% (BM + 2.50%) |

50,000,000 ≤ 250,000,000 | 4.830% (BM + 0.50%) | 6.830% (BM + 2.5%) |

> 250,000,000 | 4.830% (BM + 0.50%) | 6.830% (BM + 2.5%) |

Interactive Brokers Interest Rates

Interactive Brokers pays interest on positive settled cash balances to traders meeting the criteria based on blended annual rates, which apply to uninvested cash, while cash below $10,000 receives no interest payment.

Here are the eligibility requirements to qualify for Interactive Brokers interest rates:

- The cash balance of the Interactive Brokers accounts

- The net asset value (NAV) of the client account

- The account base currency of the cash balance

- The Interactive Brokers account segment of the uninvested cash balance

Here is an example of Interactive Brokers interest rates for USD accounts:

Account Cash Balance | Net Asset Value $50,000 | Net Asset Value$90,000 | Net Asset ValueAbove $100,000 |

$1,000,000 | N/A | N/A | 3.792% |

$100,000 | N/A | N/A | 3.447% |

$50,000 | 1.532% | 2.758% | 3.064% |

$25,000 | 1.149% | 2.068% | 2.298% |

$0 - $10,000 | 0% | 0% | 0% |

Please note that Interactive Brokers does not consolidate multiple accounts and currencies for the interest rate calculations.

Interactive Brokers App

The IBKR Mobile App is one of the most cutting-edge mobile apps in the industry. It includes authentication with the IBKR Mobile authentication (IB Key) using fingerprint and Face ID to authenticate account-related activities. US-based traders will also benefit from the mobile check deposit function. Mobile traders can access 160 markets, including stocks, options, futures, currencies, bonds, advanced order types, and trading tools. The IBKR Mobile App also features innovative trading tools like the Interactive Brokers Options Wizard and options spread grid.

Traders can download the IBKR Mobile App from the Google Play Store, where 1M+ traders have downloaded it, and 51K+ traders have rated it 4.6 out of 5.0. Interactive Brokers is highly engaged with its Android user base and responds to comments. The Apple App Store has no download stats for the IBKR Mobile App, but 9K+ traders have given it a 4.5 out of 5.0 rating.

Interactive Brokers Trader Workstation

The proprietary trading platform Trader Workstation (TWS) is one of the most complete and advanced trading platforms available to brokers. It features TWS Mosaic for complete customization of the workspace, including linking windows and symbol action by color using the grouping blocks, customized market scanners, premium newswire, and analyst research subscriptions. Classic TWS caters to traders seeking more advanced features and algorithmic trading, including one-click order entry from bid and ask prices. TWS also provides broad research, news, and market data from several sources. Real-time monitoring and more than 100 order types and algorithms enhance the trading experience. Risk management tools include The Risk Navigator, the Model Navigator, and Option Analytics.

Interactive also offers a web-based alternative, a lighter version of TWS. It is more suitable for most retail traders but equally packed with essential trading features and superior to most competitors. A mobile application is available.

Trading Platforms

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

IBKR's IBKR Desktop combines proven and modern technologies into a superior trading platform regardless of an investor's trading experience.

The proprietary trading platform Trader Workstation (TWS) is one of the most innovative trading platforms offered by brokers, featuring TWS Mosaic for full customization of the workspace and Classic TWS for traders seeking more advanced features and algorithmic trading. TWS also provides broad research, news, and market data from several sources. Real-time monitoring and more than 100 order types and algorithms enhance the trading experience.

Interactive also offers a web-based alternative, a lighter version of TWS. It is more suitable for most retail traders but equally packed with essential trading features and superior to most competitors. A mobile application is also available.

The recently enhanced IBKR mobile app provides the functionality investors need to trade and manage their account on-the-go.

Unique Features

Adding tremendous value to the competitive core trading environment is the Interactive Brokers Investors’ Marketplace. Investors' Marketplace provider count comprises 739 investment services, 463 research, 607 technology, 304 administrative, and 77 business develop.

The Mutual Fund/ETF Replicators assist traders in finding similar performances with lower costs. The Probability Lab supports options traders, while PortfolioAnalyst provides an excellent solution for portfolio optimization. Interactive Advisors is the Robo portfolio unit of Interactive Brokers, granting traders access to a wide variety of options from just $100.

Interactive Brokers also supports third-party developers with three APIs to develop custom trading solutions and automated trading systems. IB SmartRouting ensures the best pricing, and the overall technology infrastructure remains excellent.

Research and Education

While TWS includes research from Morningstar and Zacks, among other providers, and news from Reuters and Dow Jones, Interactive Brokers also maintains Traders’ Insight and the Quant Blog. Traders will find high-quality market commentary, including from third-party sources, together with trading ideas. Relevant videos are equally available in yet another value-added service by Interactive Brokers. There are 220+ IBKR Podcasts on the recently revamped IBKR Campus site, including discussions with researchers, leading financial services companies, and veterans from the financial field.

What about education at Interactive Brokers?

Interactive Brokers offers new traders a market-leading educational section. The Interactive Brokers Campus consists of numerous categories to ensure a well-structured program is in place. The Traders’ Academy offers three levels and an excellent start for new traders to begin their education.

Webinars offer interactive lessons from industry experts, and an extensive video library features one of the industry’s finest collections of valuable content. The Student Trading Lab allows educators to access material for educational purposes. Interactive Brokers maintains one of the best services for new traders.

My conclusion:

- First-time should start their education at the Interactive Brokers Campus

- I strongly recommend that beginners seek in-depth education from third parties focusing on trading psychology and the relationship between leverage and risk management

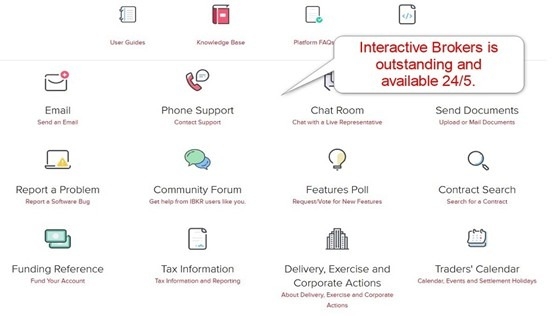

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |  |

Customer support via live chat is available 24/5 and is the most convenient form to contact a representative. Clients may also send an e-mail or call. The FAQ section answers most questions, video tutorials explain core products, and most traders are unlikely to require further assistance. Interactive Brokers ensures clients have swift access to customer support in case of need.

Bonuses and Promotions

Neither bonuses nor promotions were offered at the time this Interactive Brokers review was completed.

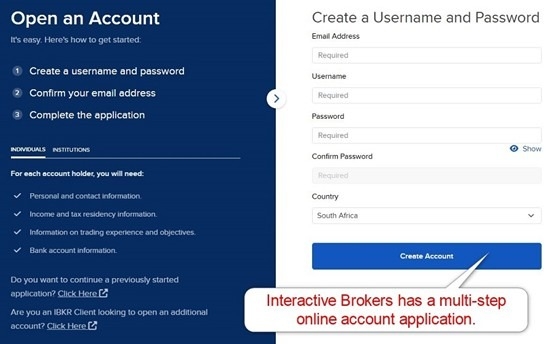

Opening an Account

An online application will process new accounts. Given the vast choices, the process may take a bit longer than most competitors.

What should traders know about the Interactive Brokers account opening process?

- Interactive Brokers complies with global AML/KYC requirements

- Account verification is mandatory

- Most traders pass verification by uploading a copy of a government-issued ID and a proof of residency document issued within the past six months

- Interactive Brokers requires a tax identification number from the resident country

- All documents must be in English

- Interactive Brokers may ask for additional information on a case-by-case basis

Minimum Deposit

The minimum deposit requirement is $0, but certain products and services may have minimum requirements.

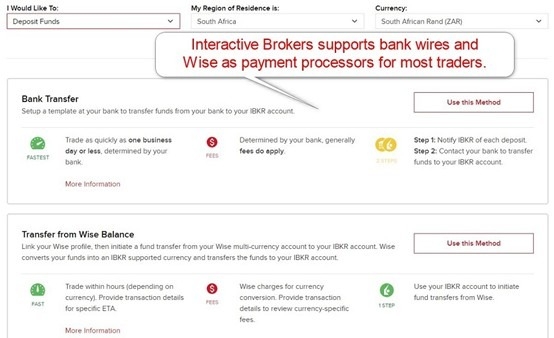

Payment Methods

Withdrawal options |   |

|---|---|

Deposit options |   |

Interactive Brokers supports bank wires and payments processed by Wise.

Accepted Countries

Interactive Brokers accepts traders from almost all countries.

Deposits and Withdrawals

The secure Interactive Brokers back office handles all financial transactions for verified clients.

What are the key takeaways from the deposit and withdrawal process at Interactive Brokers?

- A minimum deposit requirement does not exist

- Interactive Brokers offers one free monthly withdrawal before a withdrawal fee applies

- External processing times and fees depend on the bank

- In compliance with AML regulations, the name of the trading account and payment processor must be identical

Is Interactive Brokers a good broker?

I like the trading environment at Interactive Brokers for its cutting-edge trading infrastructure, ultra-low trading fees, and industry-leading asset selection. It is one of the most respected brokers operational, publicly listed on the NASDAQ stock market. Besides the industry-leading core trading environment, Interactive Brokers excels with its research capabilities and market commentary sourced internally and via third-party partnerships. The educational division offers new retail traders a valuable and well-structured course.

The sole disappointment at Interactive Brokers remains the funding method. Competitors will find it challenging to match the overall product and services portfolio, and Interactive Brokers enjoys a top spot in the online broker industry.

IBKR has no monthly fees. Interactive Brokers scrapped its minimum deposit requirement, but select services require a specific account balance. They include research from third-party providers and margin accounts, available from $2,000. Interactive Advisors, the Robo advisory division, is available from $100. Numerous add-on services face additional costs, including market data. Another reason is the high trading volume, which allows Interactive Brokers to earn significantly more revenues from a low pricing environment. Interactive Brokers features one of the best educational programs for new traders with the IBKR Campus. It provides plenty of high-quality tools and presents excellent value. With a wealth of sophisticated trading tools, research, education, and competitive pricing across an unmatched asset selection, Interactive Brokers is one of the best online brokers operational today.FAQs

Does Interactive Brokers charge a monthly fee?

What is the minimum deposit for Interactive Brokers?

Why is Interactive Brokers so cheap?

Is Interactive Brokers good for beginners?

Is Interactive Brokers good?