Editor’s Verdict

Overview

Review

Headquarters | United Kingdom |

|---|---|

Year Established | None |

US Persons Accepted? |

MetaTrader 4 is a trading platform developed by MetaQuotes Software Inc. for trading Forex and CFDs (contracts for differences). It is freely available for download as software, either directly from the MetaQuotes website, or from a large majority of Forex and CFD brokers. As such, it is not really a “product” as traders cannot purchase it; it is a platform which you can choose to use as a trading tool if you wish. Most Forex and CFD brokers offer the use of the MetaTrader 4 platform with their trading accounts, either as the only option, or as one of at least two trading platform options. MetaTrader 4 is without question the most widely used and persistently popular online trading platform in the world when it comes to trading Forex and CFDs. However, despite this strong popularity, the MetaQuotes Software have announced that they will not be granting any new licenses to brokers for MetaTrader 4, which means that new brokers will not be able to offer it as a platform for their customers. They have also stated that they are no longer offering any technical updates or support to or for the product’s software, although as at January 2018 it is still possible to download a functional demo account. These developments show that MetaQuotes want brokers and traders to move away from MetaTrader 4 towards another product they offer, MetaTrader 5. Despite the same name and sequential number, MetaTrader 5 is by no means an upgraded 2.0 version of MetaTrader 4, so it is not clear how this situation will work out. Luckily, if you are working with an established Forex or CFD broker, you should be able to use MetaTrader 4 for some time longer, if you wish.

Should I Use MetaTrader 4?

If you are reading this review, you probably either want to learn more about the features of the MetaTrader 4 platform, or you need to decide whether to use this platform or another trading platform. As almost every Forex /CFD broker offers the use of MetaTrader 4 at the time of writing, it is a common decision which new traders face. Of course, it is impossible to say MetaTrader 4 is better or worse than other options, because it depends on what alternatives are available, and the alternative is often a proprietary trading platform unique to the Forex / CFD broker you are considering. Without knowing what your specific alternative is, no comparison or qualification can be offered.

It is fair to say that new traders often worry too much about which trading platform to choose. This is partly because too many brokers make a big deal out of trading platforms to hide the fact that they offer poor spreads, overnight fees, and service to their customers. The more often you trade, the more important your trading platform becomes: if you are trading once per day or per week, fast execution and navigation becomes almost irrelevant. It is important to understand that a trading platform will not help you become a better or more profitable trader. The most vital considerations are whether a platform is easy to understand and use, and whether it works efficiently without bugs, glitches, or any kind of crashes, which can be costly and disappointing in trading. There is very little room for execution mistakes in trading. Most traders would probably agree that MetaTrader 4 passes these tests. Let’s advance to look at the pros and cons of using the MetaTrader 4 platform.

Pros and Cons of MetaTrader 4

Advantages (“Pros”)

- The platform is offered by most Forex / CFD brokers, so if you ever need to change your broker, you probably will not need to learn to use another trading platform if you do not want to.

- Similar in layout, design and function to the MetaTrader 5 platform, so if you later want to switch to this, the second most popular and widespread trading platform, it should be easy for you to learn how to use it.

- Very user-friendly and intuitive.

- Available in stable builds for all devices, whether PC, laptop, tablet, smartphone etc.

- A huge range of different languages is supported.

- Can run as software, which tends to be stable, avoiding browser-based bugs and crashes.

- “One-click” trading is possible, making this an acceptable platform for scalpers.

- Excellent advanced charting capabilities.

- Hedging is possible (if allowed by the Forex / CFD broker).

- “Expert advisers” (EAs) can be run, automating trading execution according to an algorithm, or signals or chart templates. There is a large community familiar with the programming language required to create such EAs.

- Message section allows for communication to and from broker in real time, without having to leave the trading platform.

- A high level of security tis provided through a strong encryption protocol.

- A back-testing functionality is included.

- Add-on programs can be found which convert the platform into a trading simulator.

Disadvantages (“Cons”)

- Will not be updated or fixed by owners of the software license.

- New Forex / CFD brokers launching from 2018 will not be able to offer the MetaTrader 4 platform.

- No social trading element (although social trading usually does more harm than good, so this could be an advantage instead of a disadvantage).

- Programming language used for Expert Advisors (EAs) is different to that used in the MetaTrader 5 trading platform.

- The back-testing functionality does not come with high-quality historical data.

- Some users complain of relatively slow execution, and broker manipulation of the platform, although it is unclear how brokers would be less able to manipulate other trading platforms.

Features

This review concludes with explanations and details of the major functions of the MetaTrader 4 trading platform:

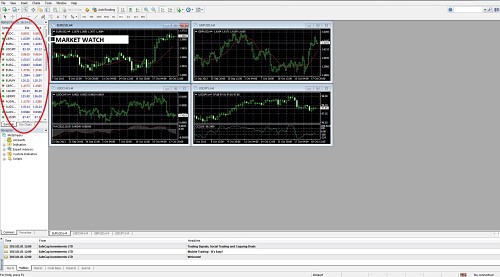

MARKET WATCH

A list of the current prices of all the instruments a broker offers for trading.

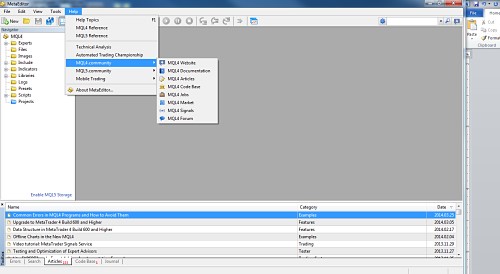

MT4 EXPERT ADVISORS

Expert Advisors are small programs written in MetaQuotes Language 4 (MQL4) which can implement an automated trading strategy or a customized indicator. They are a useful tool for implementing of automated trading. Customized Expert Advisors may be created through the "MetaEditor" feature.

Further information is available on Expert Advisors by way of the "MetaEditor" window, "Help" and then "MQL4 Community".

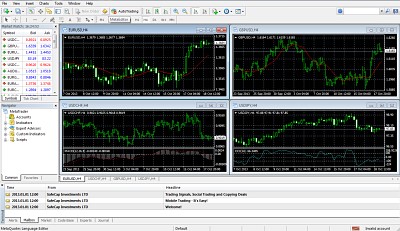

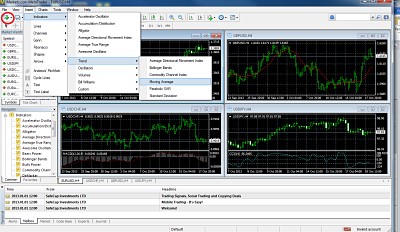

MT4 INDICATORS

There are many pre-installed indicators. Customized MT4 indicators and other free MT4 indicators can be downloaded, placed within the “Indicators” directory, and then moved onto a chart of a selected currency pair.

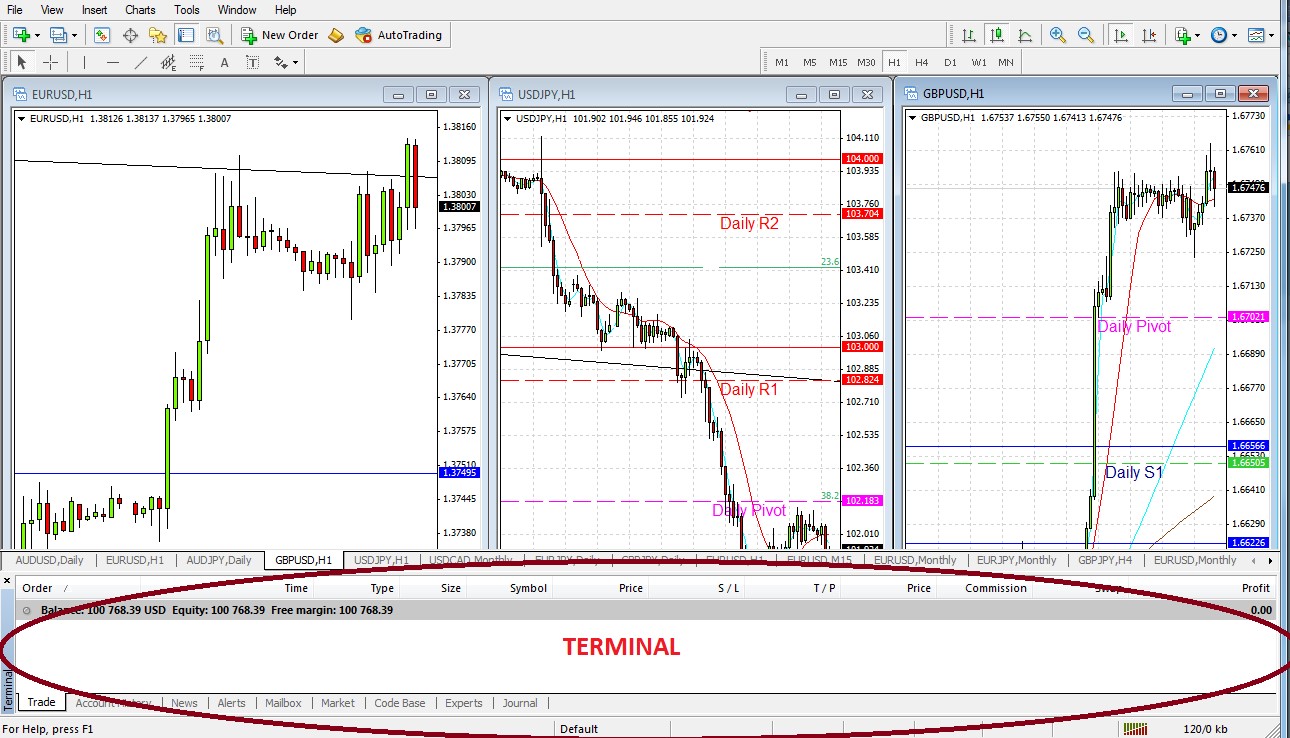

TERMINAL

The "Terminal" is at the bottom of the screen, it is where trades are executed.

TRADE

This shows every open trade.

ACCOUNT HISTORY

This shows the history of all closed trades.

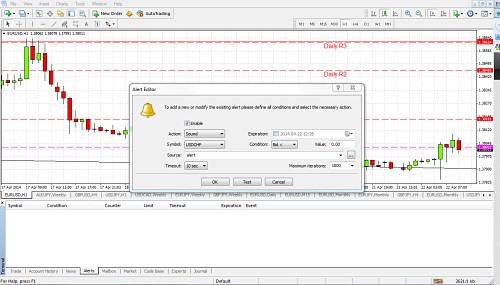

ALERTS

New alerts are created by right-clicking within the terminal window when the Alert tab is on, then by clicking on “Create”, bringing up the relevant dialog box.

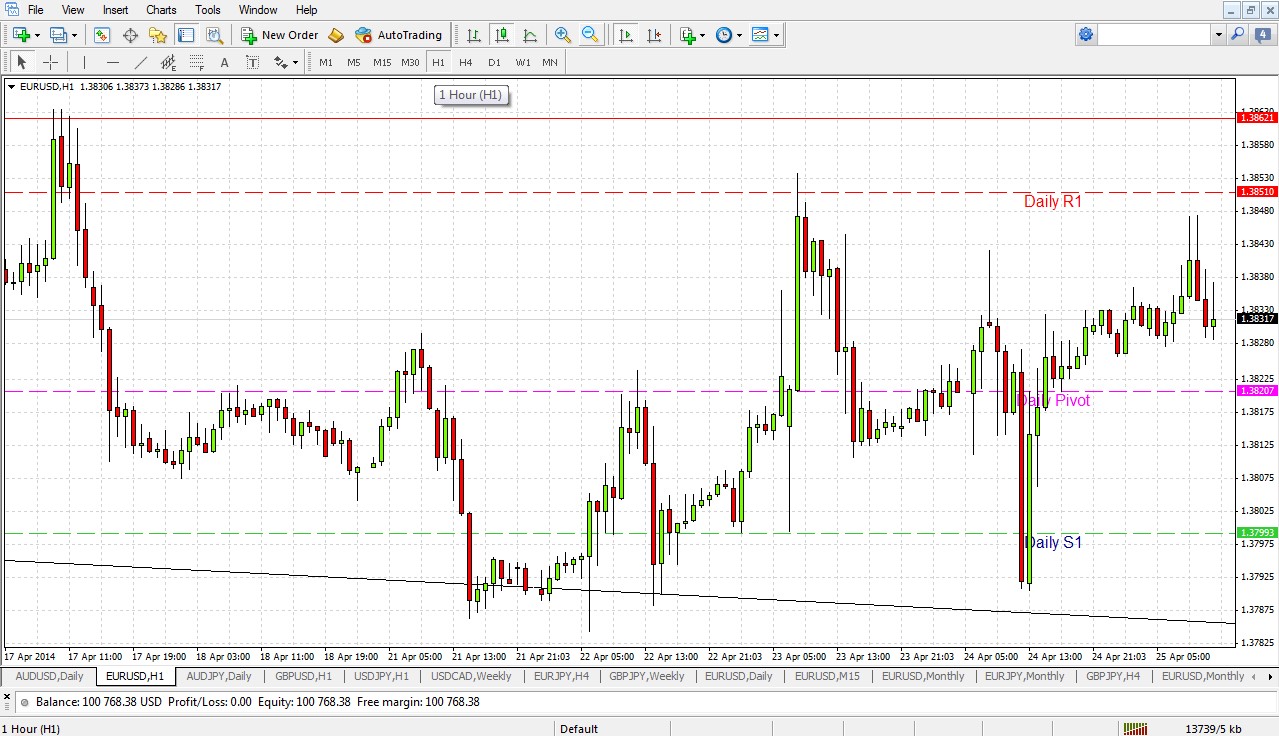

TIME FRAMES

Set by clicking on the required periodicity button in the lower toolbar:

EXECUTING TRADES

The heart of the platform’s functionality when connected to a broker, is the actual execution of trades.

OPENING ORDERS

Opening new trades at market or set to open at specified prices as either limit (at a better price than the market price) or stop (at a worse price than the market price) orders. The order input dialog box can be accessed in either of two ways. Firstly, by clicking on the “New Order” icon within the upper toolbar:

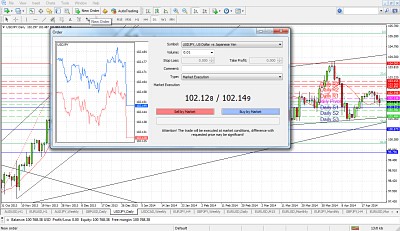

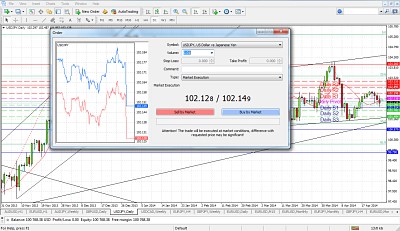

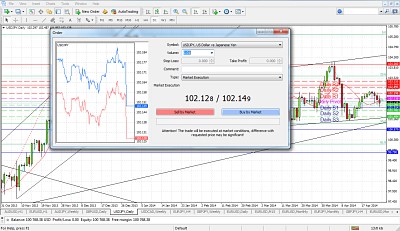

MARKET ORDERS

How to open a new trade immediately at the market price. The dialog box shows the prices that are available for both long (buy) and short (sell) trades. Input the quantity in lots next to the “Volume” label, and then click on the lower pink (for short) or blue (for long) button. Stop loss and take profit levels for the trade may also be added before executing the trades, or left unfilled:

LIMIT OR STOP ORDERS

How to set a new trade to be executed only if the price reaches a predetermined level. Open the dialog box but select “Pending Order” from the “Type” menu within the order dialog box, and follow the earlier instructions for market orders:

MODIFYING OR CLOSING ORDERS

Open trades or pending trades can be closed (cancelled) or modified, for example changing stop loss or take profit levels. This is done by left-clicking on an open trade shown in the Terminal window when the “Trade” tab is selected and then left-clicking on “Modify or Delete Order” in the pop-up menu, which brings up another dialog box where the change can be made intuitively: