Editor’s Verdict

Moomoo emerged as a disruptive equity in the USA with a well-known Chinese corporate owner listed on the NASDAQ. Traders get a commission-free cost structure with low margin rates, a cutting-edge desktop platform, a user-friendly mobile app, and quality trading tools. I conducted an in-depth review of this broker to evaluate its overall competitiveness. Should you trade with Moomoo?

Overview

Moomoo offers active equity and ETF traders a competitive trading infrastructure.

I like the Moomoo pricing environment and trading infrastructure, which is ideal for active traders. With a 6.8% margin rate, Moomoo is over 50% cheaper than other US-based brokers. Moomoo offers free Level 2 data with up to 60 levels of bid/ask data, and there are no account minimums, making it accessible to everyone. Unlike most US-based brokers, Moomoo focuses on active traders, and it would be a 5-star broker if it had a broader asset selection and modern payment processors.

Headquarters | United States |

|---|---|

Regulators | SEC |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2018 |

Execution Type(s) | ECN/STP |

Minimum Deposit | $0 |

Negative Balance Protection | |

Trading Platform(s) | Proprietary platform |

Average Trading Cost EUR/USD | Not applicable |

Average Trading Cost GBP/USD | Not applicable |

Average Trading Cost WTI Crude Oil | Not applicable |

Average Trading Cost Gold | Not applicable |

Average Trading Cost Bitcoin | Not applicable |

Retail Loss Rate | Undisclosed |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | Not applicable |

Minimum Commission for Forex | Not applicable |

Funding Methods | 2 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

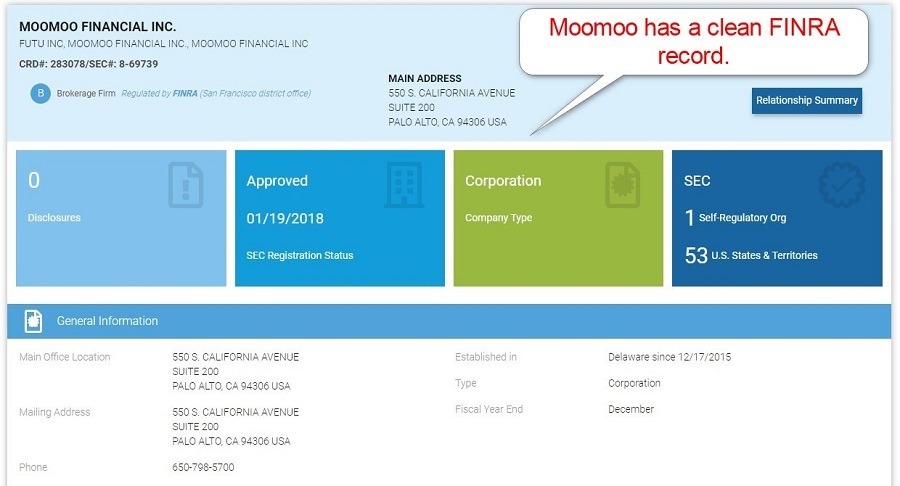

Moomoo Regulation & Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders check for regulation and verify it with the regulator by checking the provided license with their database. Moomoo operates with oversight from the SEC and FINRA.

Is Moomoo Legit and Safe?

Moomoo, founded in 2018, lacks operational experience, but its corporate owner, Futu Holdings, is publicly listed on the NASDAQ. Publicly listed Tencent is its largest investor, boosting its overall trust and safety. Moomoo segregates client deposits from corporate funds, and SIPC protection applies, limited to $500,000, including a $250,000 cash limit. Headquartered in California, Moomoo was developed solely for the US market. It complies with all rules and regulations while expanding its market share as a disruptive broker.

Therefore, Moomoo is a safe and trustworthy broker, and I highly recommend it to all active traders in the US.

Country of the Regulator | United States |

|---|---|

Name of the Regulator | SEC |

Regulatory License Number | 8-69739 |

Regulatory Tier | 1 |

Fees

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability. Moomoo offers commission-free equity, ETF, and ADR trading. Option trades come with a $0.65 per contract fee, matching the industry standard.

Other costs include:

- The SEC regulatory cost of 0.000008% of the transaction amount on sell orders with a $0.01 minimum.

- The FINRA trading activity fee (TAF) of $0.000145 per share with a $0.01 minimum and $7.27 maximum.

- An American Depository Receipt (ADR) custodian fee between $0.005 and $0.05 per share.

Option traders pay the same SEC fee, but the FINRA TAF cost is $0.000244 per contract, plus an Options Regulatory Fee of $0.02905 per contract and OCC fees of $0.02 per contract with a $55.00 maximum.

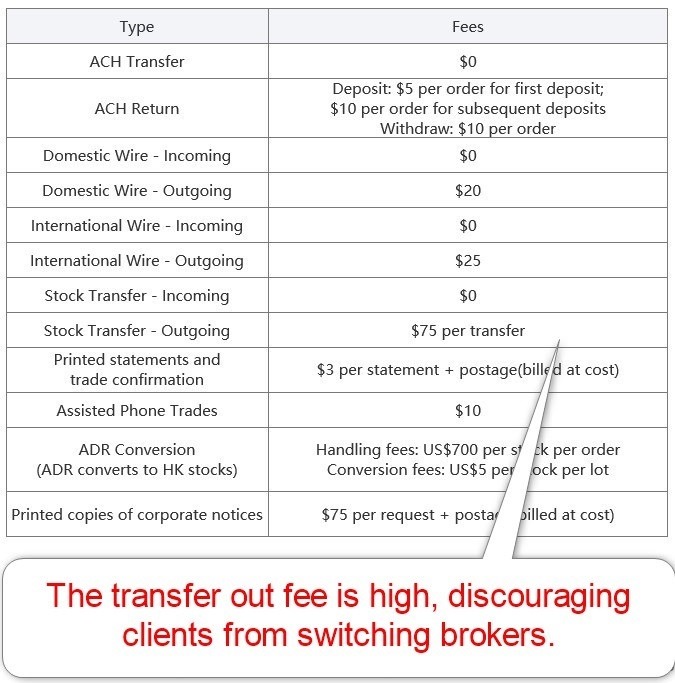

Here is a snapshot of Moomoo non-trading fees:

Trades in Hong Kong-listed equities face a 0.03% commission or HKD 3.00, whichever is greater, and a platform fee of HKD 15.00 per order.

Other costs include:

- A settlement fee of 0.002% of the transaction amount with HKD 2.00 minimum and HKD 100.00 maximum

- A 0.13% stamp duty

- A 0.000565% exchange trading fee

- A 0.0027% SFC transaction levy

- A 0.00015% FRC transaction levy

- Various corporate action costs

Chinese listed A-shares have a similar commission and trading platform fee, except in CNY instead of HKD.

Other costs include:

- A 0.00341% handling fee

- A 0.002% securities management fee

- A 0.001% CSDC transfer fee

- A 0.002% HKSCC fee

- Stamp duty of 0.05%

- A portfolio holding fee of 0.008% / 365 (calculated by day, charged by month)

- A 10% dividend tax

- Various corporate action costs

Margin traders get low financing rates of 6.8% for US and Hong Kong shares and 8.8% for Chinese A shares, which are over 50% lower than other US-based brokers. Additional notable costs are deposit and withdrawal fees and high transfer-out charges.

Average Trading Cost EUR/USD | Not applicable |

|---|---|

Average Trading Cost GBP/USD | Not applicable |

Average Trading Cost WTI Crude Oil | Not applicable |

Average Trading Cost Gold | Not applicable |

Average Trading Cost Bitcoin | Not applicable |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | Not applicable |

Minimum Commission for Forex | Not applicable |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | no |

Range of Assets

Moomoo offers traders US-listed equities, including OTC securities, ETFs, ADRs, options, Hong Kong-listed equities, and Chinese-listed A shares. While traders get no direct exposure to Forex, commodities, or bonds, they can access 3,000+ ETFs covering those asset classes. Options traders can choose from eleven strategies, but I would like more depth in the asset selection outside of ETFs. Overall, Moomoo covers its core market excellently.

Moomoo Leverage

Moomoo offers maximum leverage of 1:2, following typical margin trading rules across the US. It also has a feature to monitor risk levels with an easy-to-read gauge. Levered trading accounts require manual approval by the Moomoo team.

Traders must always use appropriate risk management with leveraged trading to avoid magnified trading losses.

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

Options | |

Futures | |

Synthetics |

Account Types

Moomoo keeps everything simple, offering an identical, taxable brokerage account with an optional margin account. There are no other account options like retirement-specific accounts, which are not Moomoo's target market. I like the trader-focused approach and simplicity of its account types.

Moomoo Demo Account

Moomoo offers a paper trading account with an excessive starting balance of $1,000,000, which traders can increase to $10,000,000. There are no time restrictions, which is outstanding, but the demo account balance counter-productive, as it can promote reckless trading among beginners while creating unrealistic trading expectations.

I want to caution beginner traders when using demo trading as an educational tool, and they should consider the limitations. Demo trading does not grant full exposure to trading psychology and can create unrealistic trading expectations.

Trading Platforms

Moomoo provides a modern desktop trading platform and a user-friendly mobile app. It features a high-quality charting package with 63 technical indicators and 38 drawing tools, free Level 2 data, customizable stock screeners with 100 variables, and AI-supported trade alerts. Traders also get 24/7 streaming news from providers, including Bloomberg, Dow Jones, Benzinga, and Investorplace.

The desktop version supports multi-screen support with up to six monitors, supporting advanced traders. I like the Moomoo trading platform but cannot ignore the absence of algorithmic trading support.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Unique Features

I like the combination of commission-free trading and free Level 2 data. Moomoo has a trader-focused approach, which shows in its trading infrastructure, including low financing rates for margin accounts. There is nothing unique about Moomoo, but it executes its business model better than competitors, making it a unique feature that separates it from the pack.

Research & Education

Moomoo is an execution-only broker. It neither publishes in-house research nor sources it from third parties. While it creates a service gap to most competitors, I do not consider it a negative, given the abundance of free and paid-for research available online. Traders may find “Sparks” appealing, which are thematic investment themes they can follow.

Beginners at Moomoo get a wealth of quality educational content via seven courses. It presents a solid introduction to core aspects, and the library offers everything first-time traders are required to learn the basics in dozens of well-structured articles.

While I like the educational offering at Moomoo, I advise beginners to learn about trading psychology and the relationship between leverage and risk management from free third-party providers while avoiding paid-for courses and mentors.

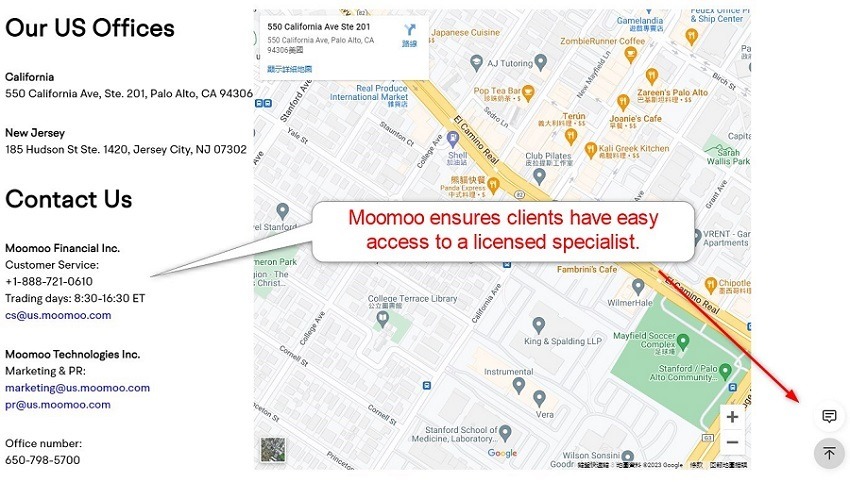

Customer Support

Moomoo offers customer support Monday through Friday between 8:30 a.m. and 4:30 p.m. (EST) via e-mail, phone, or live chat (available 24/7). I advise traders to consult the extensive FAQ section, which answers most questions. Momoo explains its products and services well, and I found no need to ask further questions, but I miss a direct line to the finance department, where most issues can arise.

Customer Support Methods |   |

|---|---|

Support Hours | Monday through Friday between 8:30 a.m. and 4:30 p.m. (EST) / 24/7 (live chat) |

Website Languages |  |

Bonuses and Promotions

As I conducted my review, Moomoo offered all new clients up to 15 free stocks plus one Tesla or Google (Alphabet) stock. Each share has a value between $2 and $2,000, and the amount of free shares depends on the deposit amount in a three-tier system. A $100 deposit qualifies for five stocks, while traders get ten for a $1,000 deposit and 15 for $10,000 plus the Tesla or Google (Alphabet) stock.

Terms and conditions apply, and I recommend traders read and understand them before requesting any bonus or promotion.

Moomoo also has an affiliate program labeled Moomoo Influencer Program.

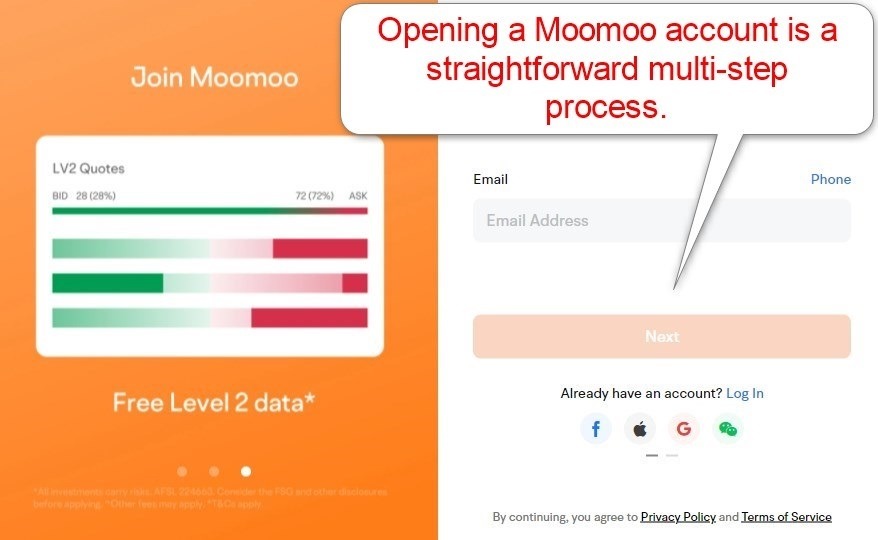

Opening an Account

Moomoo maintains an online application in line with other US-based brokers. The fast step-by-step process asks new clients to submit standard personal information, which they should be able to complete within a few minutes. Traders can also use their Facebook, Google, Apple, or WeChat IDs to register for an account. Moommo aims to approve accounts on the same day, which could take up to three business days.

Account verification is mandatory at Moomoo, in compliance with global AML/KYC requirements. Moomoo states that it will provide unverified clients with instructions to upload required documents securely.

Minimum Deposit

There is no Moomoo minimum deposit requirement.

Payment Methods

Moomoo only accepts bank wires or bank-related options like ACH.

Accepted Countries

Moomoo only caters to US residents.

Deposits and Withdrawals

The secure Moomoo back office or mobile app handles all financial transactions for verified clients.

Moomoo only supports bank wires or ACH transfers in US Dollars. A currency conversion fee of up to 300 basis points applies for non-USD deposits. Clients get up to $1,000 in instant buying power, which will gradually increase to $10,000 based on the net worth of the account. Moomoo offers instant buying power for all ACH transfers in transit, allowing clients to trade immediately following a deposit.

ACH transfers are free of deposit or withdrawal fees, while domestic bank wires incur a $20 fee and international ones $25. Withdrawal processing times range between one and three business days. The name on the Moomoo account and bank account must match.

Is Moomoo a good broker?

I like the Moomoo trading environment for traders due to commission-free trading, a cutting-edge trading platform, and AI-assisted trade alerts. Margin accounts get financing rates over 50% cheaper than competitors across the US, providing a significant cost advantage. Moomoo has excellent corporate ownership publicly listed on the NASDAQ and emerged as a disruptor with its custom-tailored offering for demanding traders, including free Level 2 data.

I highly recommend Moomoo to US-based traders, as it would be a 5-star broker if it had abroader asset selection and modern payment processors. Regrettably, algorithmic trading is unavailable, but the core at Moomoo competes or outclasses the best US-based brokers.

Clients can withdraw cash via bank wires or ACH from their secure back office or mobile app. ACH withdrawals are free, but domestic bank wires cost $20 or $25 for international ones. The minimum investment amount depends on the asset price and trading volume. Moomoo does not have monthly or annual fees, but asset-dependent trading costs apply. Yes, Moomoo is an excellent choice for beginners due to its superb educational content, cutting-edge trading platform and tools, commission-free trading, and no minimum deposit requirement. Moomoo caters to US residents, but Moomoo also features subsidiaries catering to clients in Singapore and Australia. Yes, the corporate owner of Moomoo is a Chinese company listed on the NASDAQ. Yes, Moomoo is a trustworthy broker with a clean FINRA record whose corporate owner is a publicly listed company on the NASDAQ.FAQs

Can I withdraw cash from Moomoo?

How much does Moomoo charge for withdrawal?

What is the minimum investment for Moomoo?

Does Moomoo cost money?

Is Moomoo good for beginners?

Is Moomoo only for US citizens?

Is Moomoo a Chinese-owned company?

Is Moomoo trustworthy?