Editor’s Verdict

Orbex prides itself on empowering traders to make more informed investment and trading decisions by offering 24/5 expert support, quality market research, trading signals, and a wealth of educational content assisting beginner traders. Fast order execution and high leverage provide algorithmic traders an advantage, while PAMM accounts cater to account managers. I reviewed this broker to determine if it delivers a competitive edge. Is Orbex the right broker for you?

Overview

A multi-asset broker with quality research and education for beginner traders.

Headquarters | Cyprus |

|---|---|

Regulators | CySEC, FSC Mauritius |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2010 |

Execution Type(s) | ECN/STP, No Dealing Desk |

Minimum Deposit | $100 |

Trading Platform(s) | MetaTrader 4 |

Average Trading Cost EUR/USD | 0.3 pips ($3.00) |

Average Trading Cost GBP/USD | 0.6 pips ($6.00) |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.38 |

Average Trading Cost Bitcoin | $2.36 |

Retail Loss Rate | Undisclosed |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 1.5 pips |

Minimum Commission for Forex | $5.00 - $8.00 per 1.0 standard round lot |

Funding Methods | 11(bank wires, credit/debit cards, Skrill, Neteller, Perfect Money, UnionPay, ENet, Fasapay, Przelewy24, Poli, Zola Africa and cryptocurrencies) |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

I like the educational content at Orbex, ensuring beginner traders can pour a deep foundation before placing their first trade. The availability of in-house research and services by Trading Central will guide first-time traders through markets. Advanced traders can connect their trading solutions to the Orbex infrastructure via the FIX API.

Retail Loss Rate | Undisclosed |

|---|---|

Regulation | Yes |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 1.5 pips |

Minimum Commission for Forex | $5.00 - $8.00 per 1.0 standard round lot |

Commission for CFDs / DMA | 0.16% |

Cashback Rebates | No |

Minimum Deposit | $100 |

Inactivity Fee | $20 monthly after six months |

Deposit Fee | Third-Party |

Withdrawal Fee | Third-Party |

Funding Methods | 11 |

Orbex Regulation and Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders to check for regulation and verify it with the regulator by checking the provided license with their database. Orbex presents international clients with regulated entities in Mauritius and Cyprus and maintains a secure trading environment.

Country of the Regulator | Name of the Regulator | Regulatory License Number |

|---|---|---|

Mauritius | Financial Services Commission | Undisclosed but verified |

Cyprus | Cyprus Securities and Exchange Commission | 124/10 |

Is Orbex Legit and Safe?

Orbex has maintained a legit and safe trading environment since 2010. With more than one decade of operational experience and a clean regulatory record, it earned the trust of its expanding, global client base. The FSC, a trusted regulator, offers a business-friendly environment to brokers and ensures secure conditions for traders. It has regulated Orbex since 2018. Orbex fully complies with the rules and capital requirements mandated by the FSC.Orbex also holds a license with CySEC.

Negative balance protection exists, vital for leveraged trading, and Orbex segregates client deposits from corporate funds. The only item missing from the security offering at Orbex is a third-party insurance policy in case of an unlikely default by this multi-asset broker.

Fees

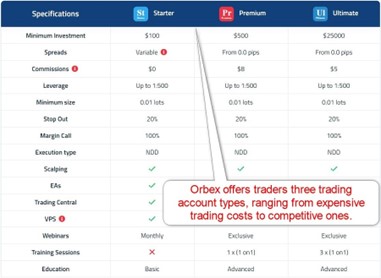

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability. Orbex higher expensive trading costs in its commission-free account but lowers them to the industry average in its commission-based alternative. Deposits above $25,000 receive a highly competitive pricing environment.

Average Trading Cost EUR/USD | 0.3 pips ($3.00) |

|---|---|

Average Trading Cost GBP/USD | 0.6 pips ($6.00) |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.38 |

Average Trading Cost Bitcoin | $2.36 |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 1.5 pips |

Minimum Commission for Forex | $5.00 - $8.00 per 1.0 standard round lot |

Deposit Fee | |

Withdrawal Fee |

Traders with deposits below $500 must trade in the commission-free trading account with minimum spreads of 1.5 pips or $15.00 per round lot. The commission-based alternative provides traders with raw spreads on major currency pairs for a commission of $8.00 per round lot, placing it near the industry average. Orbex offers a highly competitive cost structure for $25,000+ deposits, lowering commissions to $5.00 per lot.

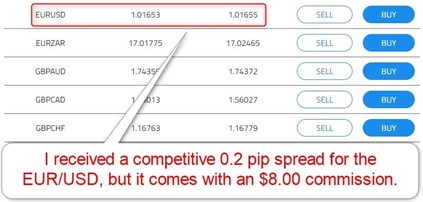

Here is a screenshot of Orbex quotes during the London-New York overlap session, the most liquid one, where traders usually get the lowest spreads.

The average trading costs for the EUR/USD at Orbex are:

Average Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

|---|---|---|

1.5 pips (Starter) | $0.00 | $15.00 |

0.2 pips (Premium) | $8.00 | $10.00 |

0.2 pips (Ultimate | $5.00 | $7.00 |

One of the most ignored trading costs is swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

Noteworthy:

- Orbex offers positive swap rates on qualifying short positions, where traders can get paid money to hold trades overnight

MT4 traders can access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights, in the commission-based Premium account.

Taking a 1.0 standard lot buy/sell position, in the EUR/USD, at the average spread in the commission-based Premium account and holding it for one night will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

|---|---|---|---|---|

0.2 pips | $8.00 | -$10.8250 | X | $20.8250 |

0.2 pips | $8.00 | X | $3.7180 | $6.2820 |

Taking a 1.0 standard lot buy/sell position, in the EUR/USD, at the average spread in the commission-based Premium account and holding it for seven nights will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

|---|---|---|---|---|

0.2 pips | $8.00 | -$75.7750 | X | $85.7750 |

0.2 pips | $8.00 | X | $26.0260 | -$16.0260 |

Noteworthy:

- After three days, including weekends, traders would earn money for holding a short position in the EUR/USD and other select assets, assuming no movement in price action, which is unlikely, but the example shows the possibility at Orbex

Range of Assets

Orbex serves retail traders 300+ CFDs, covering Forex, cryptocurrencies, commodities, indices, and blue-chip stocks with listings in the US, the UK, and the Eurozone. The stock selection focuses on the US market as well as trending names on social media, where Orbex offers several ADRs. The choice of cryptocurrencies, commodities, and indices remains more limited, granting beginners an introduction to each sector.

Asset List Overview

Commodities | |

|---|---|

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

ETFs | |

Futures | |

Synthetics |

Orbex Leverage

Orbex grants maximum Forex leverage of 1:500, 1:100 for commodities and indices, 1:20 for equity, and 1:2 for cryptocurrencies. It varies depending on the asset, as transparently listed by Orbex on its website. Leverage can be an edge for competent traders. Negative balance protection exists, meaning traders cannot lose more than their deposits.

Orbex Trading Hours (GMT +3)

Asset Class | From | To |

|---|---|---|

Cryptocurrencies | Monday 00:05 | Friday 23:55 |

Forex | Monday 01:02 | Friday 23:57 |

Commodities | Monday 01:02 | Friday 23:57 |

European Equities | Monday 10:02 | Friday 18:30 |

US Equities | Monday 16:31 | Friday 23:00 |

Noteworthy:

- Equity markets open and close each trading session, unlike Forex and commodities, which trade 24/5

- Orbex does not offer 24/7 cryptocurrency trading

I recommend the following step for MT4 traders to access trading hours:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Sessions.

Account Types

Orbex offers one commission-free trading account, Starter, with a minimum deposit of $100. For a minimum commitment of $500, traders qualify for the commission-based Premium alternative, where trading costs decrease towards the upper end of the industry average. The Ultimate account requires a deposit of $25,000, and traders get a highly competitive pricing environment there. All three account types have maximum leverage of 1:500, and the minimum transaction size is 0.01 lots.

Orbex Demo Account

Orbex’s Demo Account enables you to gain access to Orbex’s full Educational Library and practice trading online 100% free. You may choose to fund your demo account with up to $5,000,000 in free virtual funds and test your trading skills on any Orbex MT4 platform.

You can practice trading 24/5 on over 300 CFDs, including stocks, Forex pairs, commodities, indices, and cryptocurrencies with up to 1:500 leverage. Aspiring traders may test the Orbex trading conditions before considering a live account.

I recommend a demo account balance is selected similar to the amount of the planned live deposit. I also want to caution beginner traders against using a demo account as a full substitute for real money trading. It creates unrealistic trading expectations, and the absence of real risk usually negates the simulated experience.

Trading Platforms

Traders at Orbex get the core MT4 trading platform, upgraded via the Trading Central plugin, available to all funded trading accounts. MT4 remains the industry favorite due to its versatile infrastructure. It fully supports algorithmic trading via EAs and has an integrated copy trading service. MT4 is available as a desktop client, a web-based alternative, and a mobile app.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Unique Features

Orbex offers free VPS hosting, supporting algorithmic traders who require 24/5 market access. It also has the FIX API, enabling demanding traders to connect their trading solutions to the Orbex infrastructure. The PAMM module supports asset managers and allows investors passive trading and investing via an account manager. Orbex requires all PAMM managers to commit their own capital to the strategy, ensuring complete alignment of interests.

Research and Education

Orbex features one of the more competitive and quality research sections, a hidden gem at this broker.Orbex maintains a blog featuring quality market commentary and research, consisting of actionable trading ideas, well-written technical analysis, and video content. It complements services by third-party Trading Central.

One of the best features of Orbex is its educational section, where beginner traders receive one of the most comprehensive and quality approaches to teaching the basics. The content includes well-written and easy-to-understand written content, videos, e-books, and quizzes. Traders may also benefit from the dozens of webinars, which remain archived. Orbex also holds trading seminars in its core markets, while the Forex glossary explains essential terminology.

I highly recommend beginner traders take advantage of the quality educational content at Orbex, read, watch, and listen to the lessons, take the quizzes, and ensure they fully understand the covered topics before placing their first trade.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |   |

Orbex offers 24/5 customer support available via e-mail, live chat, and a callback function. The help center attempts to answer most questions, and Orbex explains its products and services well. I doubt most traders will require additional assistance. The only item missing is a direct line to the finance department, where most issues arise.

Bonuses and Promotions

Promotions are offered at Orbex, including commission-free CFD trading on 200+ equity CFDs and a twelve-month trading promotion rewarding six traders with gold bars during each of the four rounds. The sole requirement for entry is to trade 20 lots for three months. Terms and conditions apply, and traders should read and understand them before participating.

Awards

Orbex has received seventeen industry awards from well-respected sources. They are a statement of the ongoing efforts by Orbex to maintain a competitive edge for its clients.

Among the seventeen Orbex awards are:

- Best FX Arabic Platform - Middle East Forex & Investment Summit 2011

- Fastest Growing Broker in China - International Investment & Finance Expo 2012

- Most Innovative ECN Broker - Jordan Forex Expo 2013

- Best Analysis Provider - Saudi Money Expo 2016

- Best Trading Education Provider - The European 2018

- Best Forex Broker - Global Business Outlook 2019

- Best Trading Conditions - Dubai Forex Expo 2020

- Decade of Excellence - Global Banking & Finance Review 2021

I like to highlight the awards Orbex has received for best analysis and education provider, as Orbex excels in both categories.

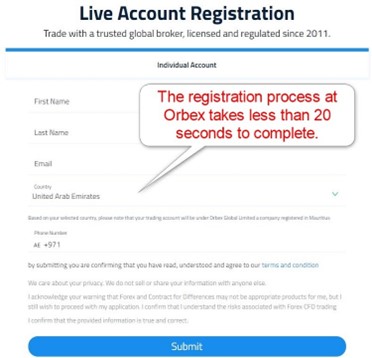

Opening an Account

Orbex requires a minimal online application, which traders can typically complete in less than 20 seconds, asking for the name, e-mail, country, and valid mobile number. I like that Orbex does not collect unnecessary data and keeps the registration process hassle-free.

Account verification remains a necessary last step, usually satisfied by sending a copy of your ID and one proof of residency document.

Minimum Deposit

The minimum deposit at Orbex is $100 for the Starter account, $500 for Premium, and $25,000 for Ultimate.

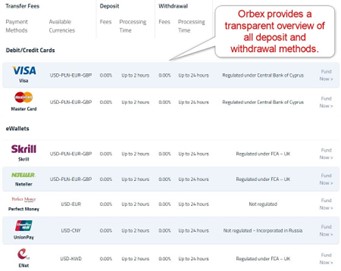

Payment Methods

Orbex accepts payment by bank wires, credit/debit cards, Skrill, Neteller, Perfect Money, UnionPay, ENet, Fasapay, Przelewy24, Poli, and cryptocurrencies.

Accepted Countries

Traders from most countries can open accounts at Orbex. The most notable exceptions are residents of the USA, Cuba, Sudan, Syria, and North Korea.

Deposits and Withdrawals

The secure Orbex back office handles all financial transactions for verified clients.

Deposits and withdrawals at Orbex are free of internal charges, but traders may face third-party payment processor costs. The processing time for all deposits is up to two hours, except for bank wires, which can take up to five business days. Orbex processes all withdrawals within 24 hours after receiving a request, with bank wires the exception. Traders may have to wait longer to receive their funds, dependent on the payment processor and geographic location.

I like the inclusion of cryptocurrencies. Orbex primarily serves the Middle East, where demand for cryptocurrency transactions continues to expand. Traders may open accounts in USD, EUR, GBP, and PLN as their base currencies.

Supported countries and currencies:

Kenya - KES Ghana - GHS Tanzania - TZS Uganda - UGX Rwanda - RWF Zambia - ZMW Central Africa (Cameroon) - XAF West Africa (Burkina Faso, Côte d'Ivoire / Ivory Coast, Mali, Senegal) - XOF

Is Orbex a good broker?

I like the trading environment at Orbex for beginner traders. They have access to high-quality research and education, where I rank Orbex among the market leaders in each category. The out-of-the-box MT4 trading platform gets the Trading Central plugin upgrade, and Orbex offers free VPS hosting. It also has the FIX API for advanced traders who deploy their trading solutions. The PAMM module caters to account management, where Orbex requires each account manager to commit capital before accepting investor funds.

Orbex is a trustworthy and secure Forex broker, and its promotions cater well to its core market. High leverage, fast order execution, and a high-paying partnership program are its best features.

FAQs

Is Orbex regulated?

Orbex is regulated by the Mauritius Financial Services Commission and the Cyprus Securities and Exchange Commission.

Does Orbex offer a demo account?

Orbex offers a demo account and does not list a time limit, making it ideal for testing strategies and fixing bugs in algorithmic trading solutions.

Does Orbex have a partnership program?

The Orbex partnership program ranks among the highest paying in the industry.

What is the Orbex minimum deposit?

The minimum deposit is $100, but traders should consider depositing at least $500, if possible, for access to cheaper trading costs.