Editor’s Verdict

Overview

Review

Headquarters | United States |

|---|---|

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2013 |

Execution Type(s) | Market Maker |

Minimum Deposit | $0 |

Trading Platform(s) | Proprietary platform |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Robinhood Markets, founded in 2013, is a pioneer in commission-free trading. In 2015, this US-based financial services company officially launched its trading app. Making financial markets accessible to all traders without additional costs remains the mission of Robinhood, which has over 13,000,000 users according to its latest SEC filing. Robinhood caters primarily to millennial traders with an average age of 26. It also expanded into cryptocurrency trading via Robinhood Crypto. Another attractive feature is fractional shares trading, eliminating the need for massive deposits to trade blue-chip equities. Robinhood does sell its order book to high-frequency trading firms, which prompted the US Securities and Exchange Commission (SEC) to launch a probe in September 2020. Robinhood remains in high demand among new retail traders, many of whom generally have little to no knowledge of financial markets. Nearly half of all Robinhood traders claim to use it daily, and 90% at least weekly; most traders prefer to trade from their mobile phones.

Regulation and Security

Robinhood operates under the oversight of the Financial Industry Regulatory Authority Inc. (FINRA), a private US corporation that acts as a self-regulatory organization (SRO); the SEC remains the ultimate regulator. Robinhood is also a member of the non-profit Securities Investor Protection Corporation (SIPC). As previously mentioned, in September 2020, the SEC launched a probe into Robinhood for selling its order book to high-frequency trading firms, allowing them to front-run client orders and potentially resulting in less favorable pricing for Robinhood traders. In December 2018, it also falsely claimed that its checking and savings accounts, granted via Sutton Bank of Ohio, were SIPC insured. The SIPC denied those claims, and Robinhood rebranded the service into Cash Management the following day.

Robinhood is a member of FINRA and the SIPC.

Is Robinhood Safe?

With retail traders rushing to open new accounts, especially over the past twelve months, online brokers capture the bulk of interest. Millennial traders lead the way, and Robinhood became one of their favorite destinations for US-based traders. Together with social news aggregation platform Reddit, they have gathered the attention of financial markets. Before new traders consider opening an account, they ask themselves, is Robinhood safe? The US Securities and Exchange Commission (SEC) regulated Robinhood, placing it under the oversight of one of the most active global regulators, also under an uncompetitive one compared to international brokers. Money at Robinhood also remains protected up to $500,000 for securities and $250,000 for cash, covered by the Securities Investor Protection Corporation (SIPC). Robinhood is also a voluntary member of the self-regulatory organization (SRO) Financial Industry Regulatory Authority (FINRA). Founded in December 2014, it gained moderate operating experience and compliant with strict capital requirements.

The SEC launched an investigation in September 2020 for failing to disclose to clients that it sells client order flows to high-frequency trading firms. In December 2020, Robinhood settled for $65 million. The same year, it confirmed the hacking of at least 2,000 accounts and theft of client capital. Robinhood was not upfront and honest about the severity of the security breach. So, is Robinhood safe? From a security and regulatory perspective, it is, but it is not as trustworthy as it should be. The most significant risk to traders at Robinhood is rushing to leveraged trading without considering all aspects. The crowd mentality generally leads to high-risk trades and long-term losses, and Robinhood does not provide sufficient information regarding the topic. Robinhood is safe from a structural perspective but lacks in areas where it should offer more. The popularity of it warrants a more in-depth approach to risk management tools.

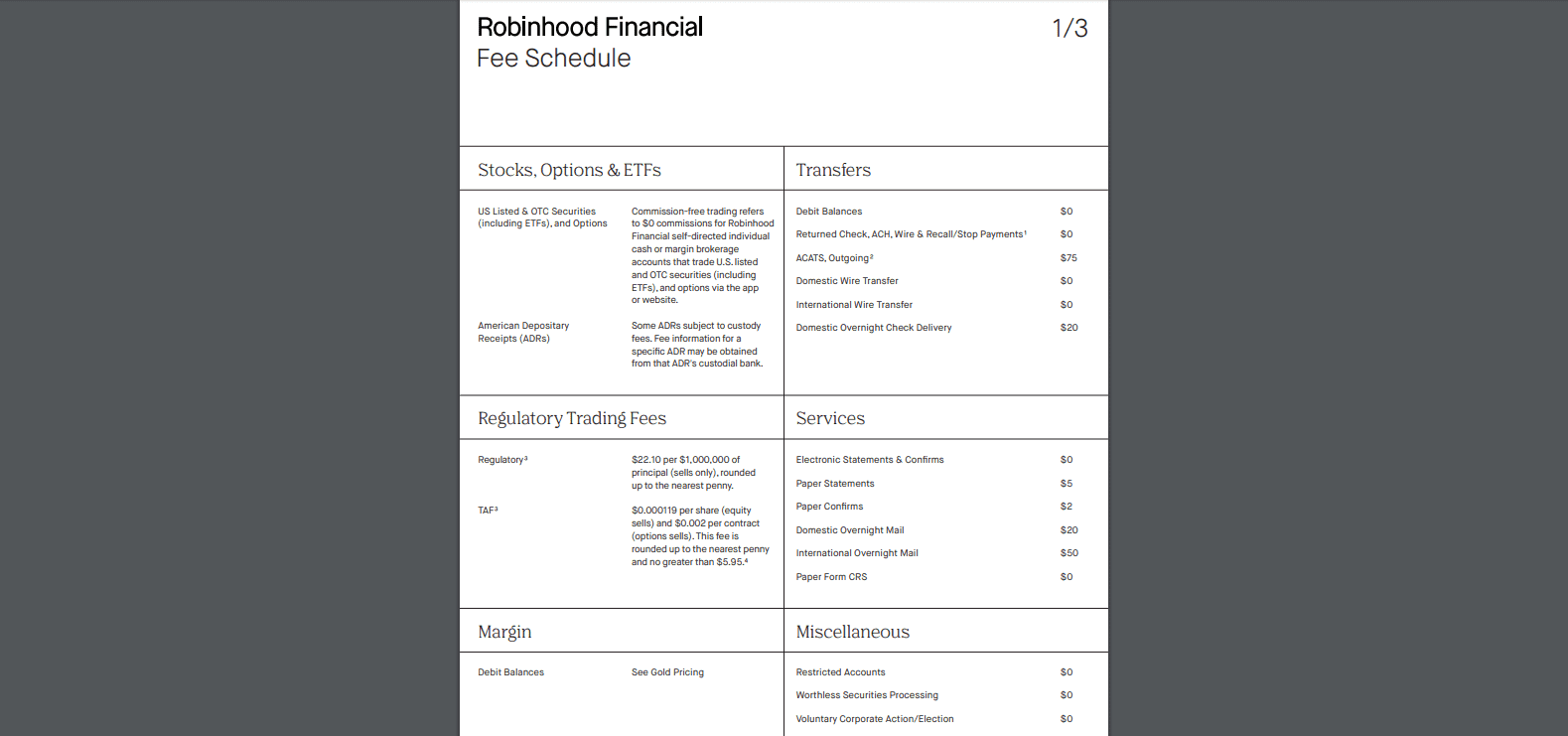

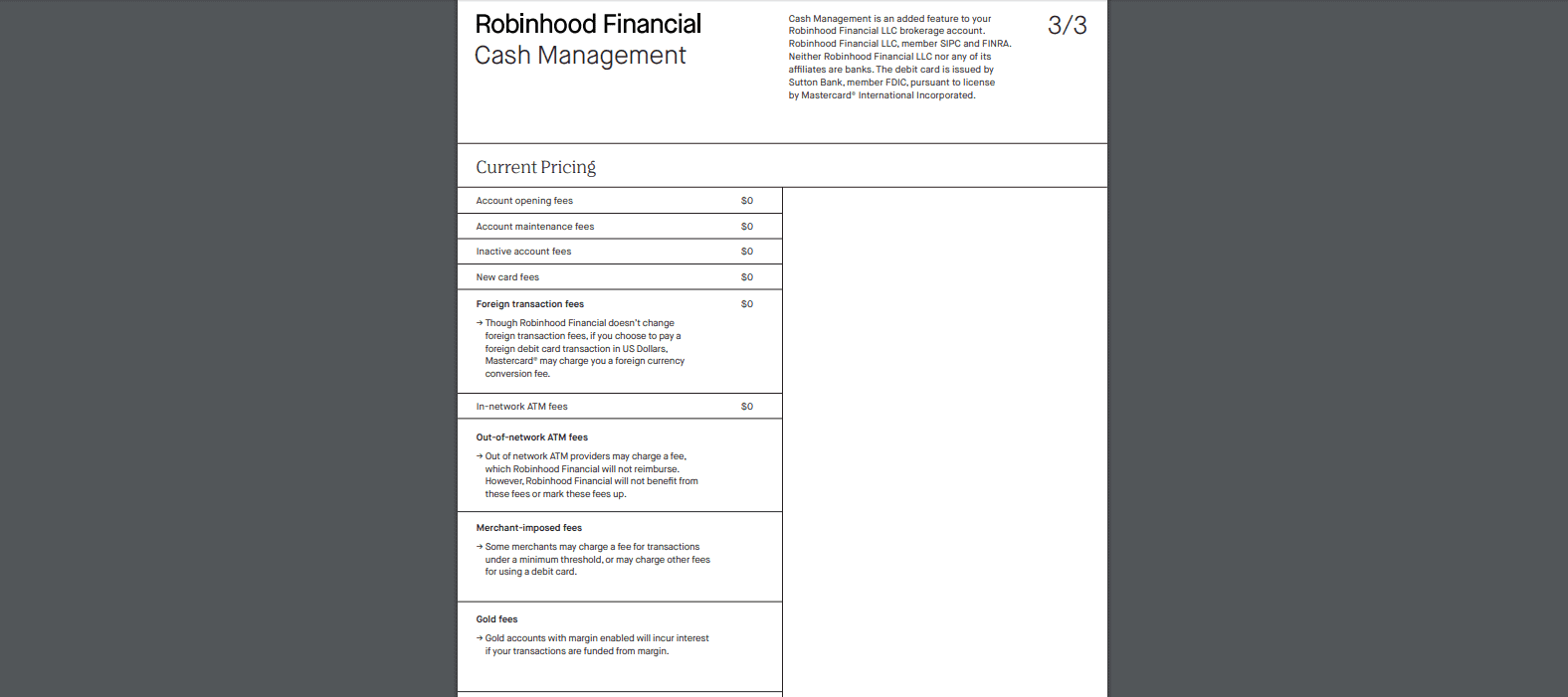

Fees

While Robinhood offers $0 commission trading on stocks, ETFs, and options with Robinhood Financial, and with cryptocurrencies via Robinhood Crypto, additional costs apply. The company earns interest on cash balances of clients, which it does not pass on to clients. Selling client information to outside firms represents another source of revenue for Robinhood; however, that does not impact trading costs for clients. Robinhood also earns overnight financing costs related to margin lending, a primary source of income. Regulatory trading fees apply, while trading in Gold always carries additional costs. A multi-tier legacy pricing structure exists, and third-party deposit and withdrawal charges may apply.

Robinhood does not disclose how it handles corporate actions such as dividends, splits, and mergers. Since December 2019, an automatic dividend reinvestment scheme was introduced, suggesting the company does pass income from corporate actions on to client portfolios. The overall cost structure remains competitive, but Robinhood fails to display spreads, which is a disappointment. Many commission-free brokers tend to carry a more significant difference between the buy and ask price of assets, booking substantial profits at the expense of traders.

Robinhood maintains a low-cost trading environment but fails to disclose spreads.

Robinhood Trading Hours

Asset Class | From | To |

|---|---|---|

Cryptocurrencies | Monday 00:00 | Sunday 24:00 |

Gold | Monday 00:00 | Friday 23:00 |

Stocks (non-CFDs) | Monday 02:00 | Saturday 02:00 |

ETFs | Monday 02:00 | Saturday 02:00 |

Options | Monday 15:30 | Friday 22:15 |

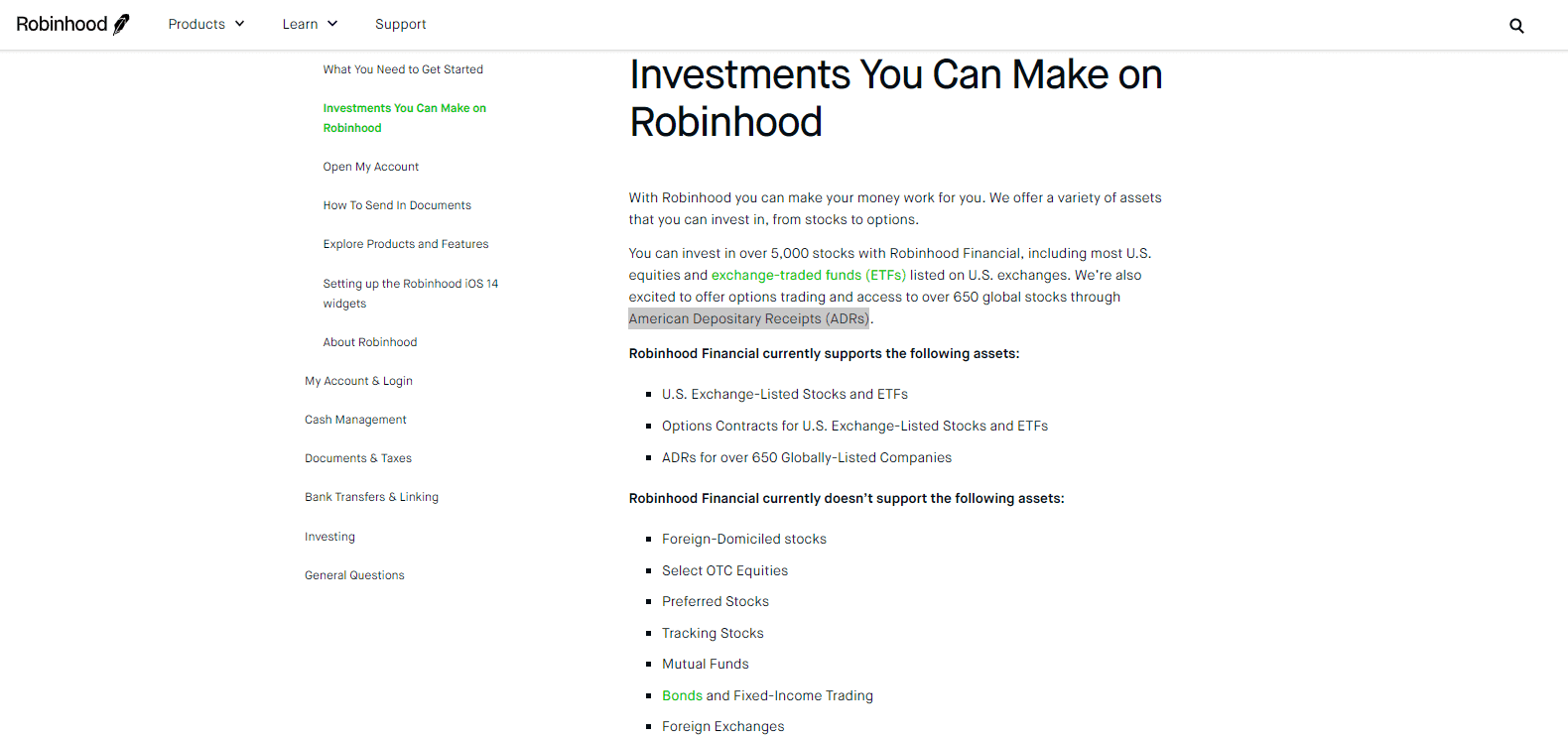

What Can I Trade

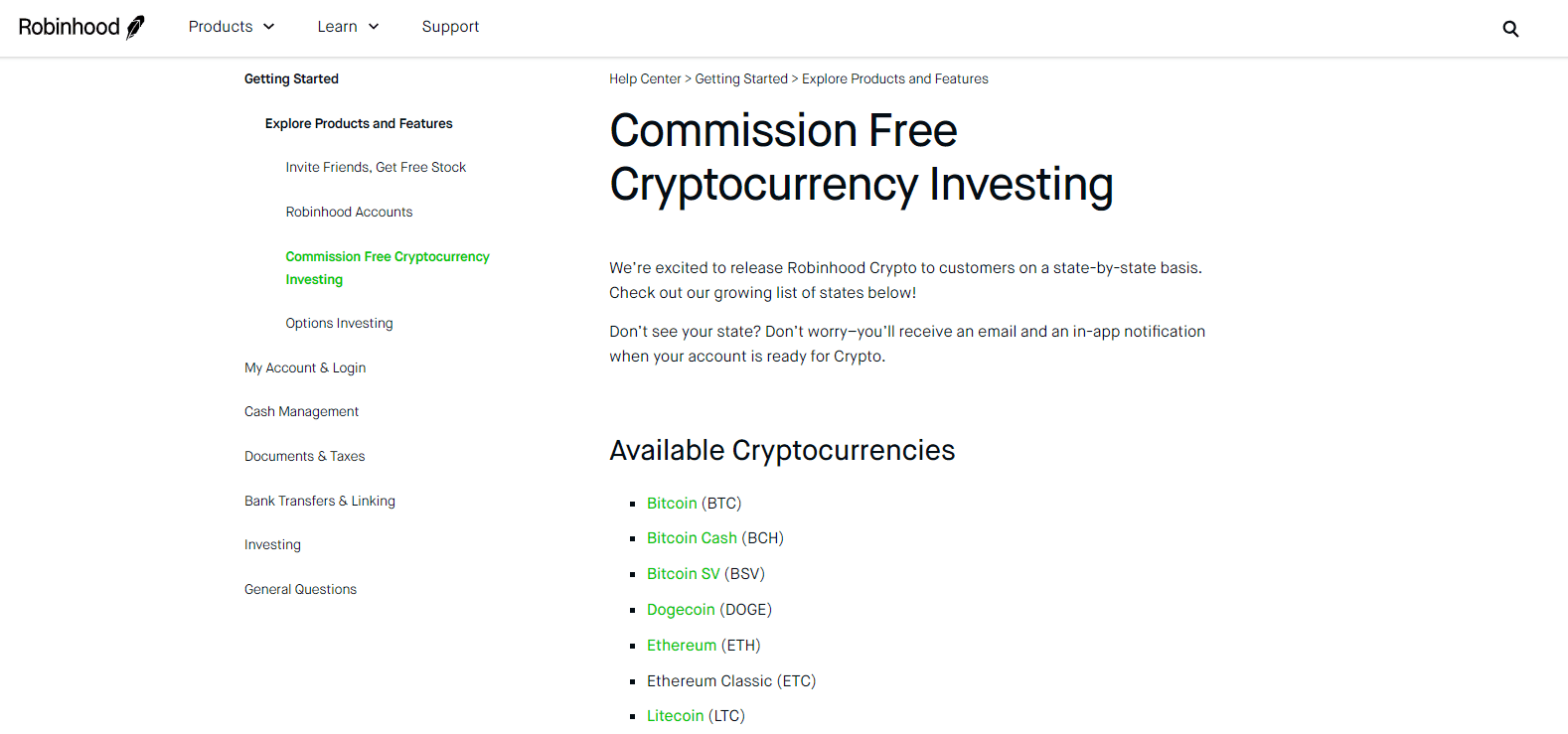

Traders at Robinhood have access to over 5,000 US-listed equities and ETFs plus options, more than 650 global companies via American Depositary Receipts (ADRs), and cryptocurrencies. It is important to remember that cryptocurrency trading is available on Robinhood Crypto, which is not a member of FINRA or SIPC. The asset selection at Robinhood offers US-based retail traders good choices but remains concentrated on US markets only. Therefore, traders are without the ability to achieve true cross-asset diversification or competitive exposure for a well-rounded portfolio. Robinhood introduced fractional shares trading in December 2019, which allow traders to make minimum purchases of $1. New clients with small deposits can build a diversified portfolio, which carries no value outside of Robinhood.

Robinhood offers primarily US-listed assets.

Robinhood Crypto allows the trading of seven cryptocurrencies.

Fractional share trading is available at Robinhood.

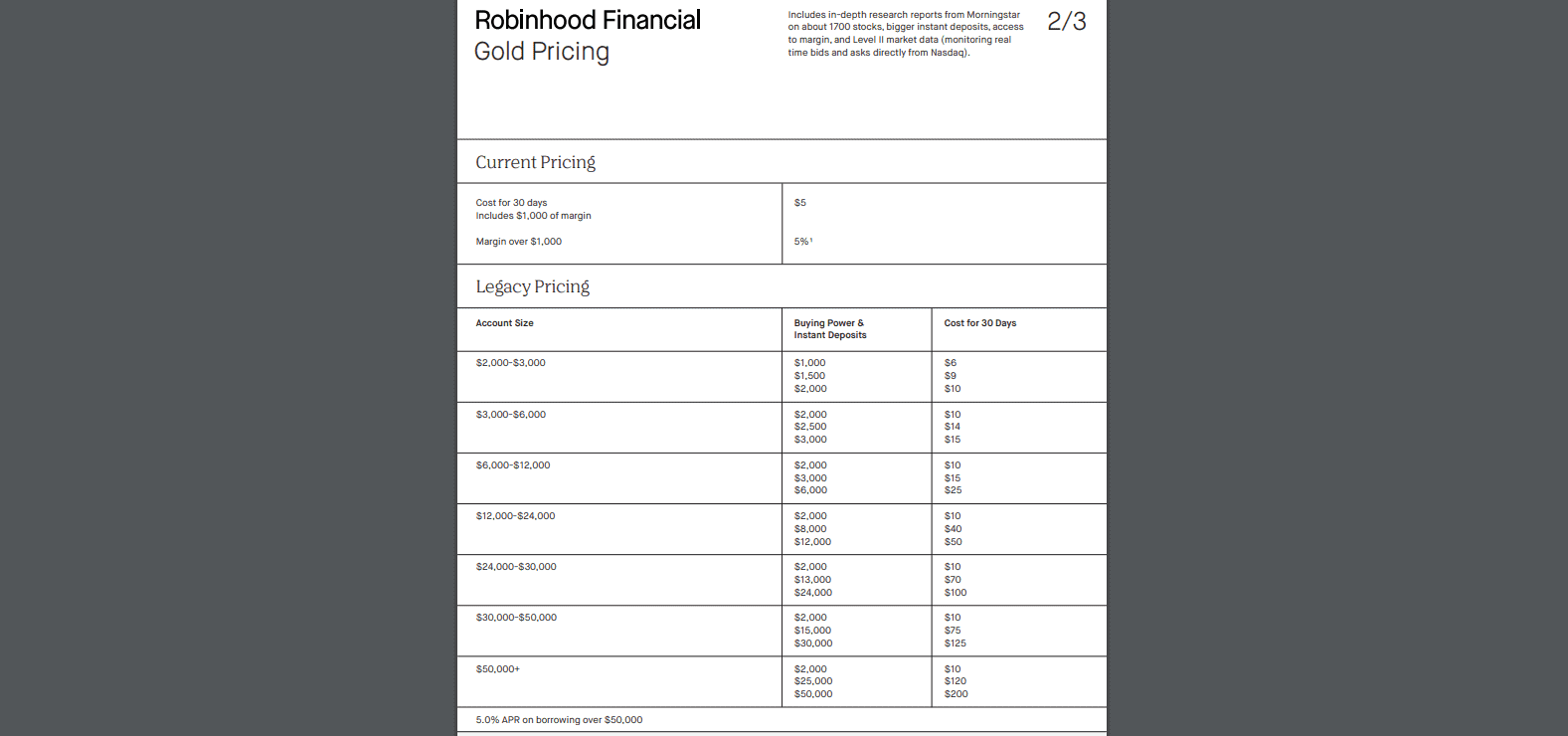

What is Robinhood Gold?

Robinhood Gold is an upgrade to the standard account for a monthly cost of $5. The upgrade provides access to research from Morningstar, Level II data from NASDAQ, and an increase in instant deposits to at least $5,000. Another benefit is margin trading, but US regulations require an account balance of $2,000 before a regulated broker can extend margin trading. Robinhood charges 2.5% in annual interest payments on any borrowed amount above $1,000, calculated daily. Traders can deactivate margin trading if they do not wish to use it but want to take advantage of the other premium services provided in the Robinhood Gold account. A 30-day trial period is available, and if traders fail to opt-out, the $5 monthly fee applies. The $5 cost includes a $1,000 margin, but regulatory restrictions in the US offer 1:2. Pattern day traders with a balance above $25,000 receive up to 1:4. By comparison, well-regulated international brokers offer 1:500, making the Robinhood Gold account an uncompetitive product globally but the only one available to US traders.

Traders may consider the value of the Morningstar research. It carries a $199 price tag annually for the premium package, directly from Morningstar. Traders must keep in mind that the research reports are not daily. The cost for NASDAQ Level II is as low as $10 per month. At Robinhood Gold, traders can get both for just $5 monthly ($60 per year). It represents a valuable offer, and committed traders should take advantage of the upgrade. Traders will also benefit from the small leverage of the account grants, which is better than nothing at all. Before upgrading to Robinhood Gold, we recommend trades to have at least $2,000 in their standard account. Otherwise, they are ineligible for margin trading. A balance below it will make the upgrade less valuable.

Robinhood Stock Trading

Robinhood stock trading is how Robinhood started, driven by creating a commission-free platform for retail traders. It refers to exchange-traded funds (ETFs) as bundled investments and counts on millennial traders to ignore that competitive trading tools or infrastructure are missing. It does provide a basic introduction to stock trading and grants new traders one free stock as a bonus for opening an account. While the value can range between $3.00 and $225.00, 98% of bonus shares remain between $2.50 and $10.00. Robinhood Financial LLC is the unit that operates the brokerage division, and Robinhood Securities LLC clears client orders. The former attracts retail traders while the latter sells their data to high-frequency trading firms and market makers. New traders should read the information Robinhood publishes about stock trading, then seek a more detailed educational course and learn before chasing a free stock and making a deposit with Robinhood based on its popularity.

After downloading the Robinhood app but before making a deposit, we urge traders to compare the spreads on equities with other brokers to get a clear picture of the commission-free trading environment. Robinhood introduced fractional share trading, which allows purchases with as little as $1. It provides small portfolios the opportunity to diversify and compares to micro-accounts at international brokers. Fractional stock trading is ideal for new traders to test their trading strategies, but Robinhood only supports manual trading. A bulk of the Robinhood crowd believes they can move financial markets. It confirms the lack of knowledge of most Robinhood clients. The average portfolio has between $1,000 and $5,000 with more than 13,000,000 traders. One positive feature at Robinhood stock trading is its price improvement, listed at $2.58 per 100 shares. It also executed 93.00% of orders at the US NBBO rate or better, confirming access to deep liquidity pools. It does not substitute the absence of a competitive trading platform, which Robinhood hides with its commission-free cost structure, well-received by millennial traders.

Robinhood Options

Robinhood added options trading to its asset selection, which represents another high-risk trading solution for a client base that may not have the necessary background information for it. Robinhood options trading is commission-free and has no per-contract fees. Millennial traders flock to commission-free offers, and Robinhood takes advantage of its leadership position in the US among them. Once again, a detailed description is missing and replaced by a brief introduction that sounds appealing to new traders. Robinhood does not have the trading platform or tools to provide options trading competitively. It reduces the practice of pushing buttons on a mobile phone, a misleading approach that can result in retail traders losing money. Robinhood does not introduce the basics of options trading and replaces a proper introduction with a few marketing-driven expressions in an unacceptable manner to lure inexperienced traders. Since Robinhood Securities, its clearing broker, maintains numerous relationships with market makers, the primary objective of Robinhood is to generate volume. It also sells its order book to high-frequency traders.

A closer look at everything Robinhood provides, including Robinhood Options, reveals a careless portfolio to encourage reckless trading. It merely notes the risk of options trading in the website footer and a link to a more detailed risk disclosure. Options trading is highly complicated and can result in a total loss. Yet Robinhood treats it as something millennial traders without experience and the absence of a trading platform should get exposure to without being upfront about the risks. Masking high-risk trading strategies in a commission-free trading environment from a mobile trading app is dangerous. We urge new traders to conduct their due diligence about options trading, get educated, and then evaluate if it suits their trading needs and risk profile. Robinhood Options grants swift access but lacks the infrastructure to provide this service to clients.

Account Types

Traders can choose between two account types; the first is a self-administered trading account at Robinhood Financial, the second is a cryptocurrency account at Robinhood Crypto. The former features three options, the Robinhood Instant, Robinhood Gold, or Robinhood Cash account. According to the website, only the Robinhood Cash account grants commission-free trading, but without margin; the other two are margin accounts but without commission-free trading noted. The Robinhood Gold account carries a monthly fee.

Three account choices are available at Robinhood Financial.

Trading Platforms

Robinhood makes no mention of its trading platform; all that is known is that a webtrader and a mobile version exists, with the majority of clients favoring the latter. There is no excuse not to introduce the trading platform, and no information is available regarding tools for research and analysis. Asking potential new traders to open an account in order to view the core trading environment and features is unacceptable.

Robinhood App

The Robinhood App was officially launched in March 2015 but introduced during the 2014 LA Hacks. Robinhood designed it for mobile trading, which remains popular among millennial traders. 80% of traders at Robinhood belong to the group of millennials, and the average age of clients is 26 years. 50% report that they use the Robinhood App daily, while 90% use it at least once per week. With more than 13,000,000 traders, the success of the Robinhood app is without question. It is only available to US traders, as regulators prohibit Robinhood from catering to international clients. The US domestic financial market is a closed system, and competition among brokers remains limited to just a handful competing for traders. Among them, Robinhood carved out a dominant leadership position after introducing commission-free trades and fractional share trading. It offers smaller traders to create a well-diversified portfolio and allows purchases with as little as $1. New traders can benefit from it, making the Robinhood App increasingly popular among first-time traders.

The Robinhood App has a 4.3 rating in the Google App Store, with most complaints about poor customer service in resolving issues, including authentication problems. The Robinhood App has more than 10,000,000 installations, but before traders download it, they must consider that no mobile trading app is suitable for trading purposes. While most smartphones have more than enough computing power, the screen size is the primary reason professional traders do not use mobile phones for trading. Since millennial traders care less about conducting research and more about buying shares that remain popular in social media, the Robinhood App delivers. Unfortunately, Robinhood provides no information about the features of its Robinhood App. It confirms that the trading functions fulfill a secondary role. While it remains popular among millennials, it fails to provide committed traders a proper trading environment.

Unique Features

While fractional share trading remains attractive and noteworthy, the unique feature that dominates at Robinhood is the absence of essential information about the core trading environment. It may suffice to attract new millennial traders without any experience to trade, but more seasoned traders will find the lack of information a significant and worrisome red flag. Simply put, Robinhood makes no effort to introduce its trading platform, mention research and analytics tools, or openly discuss its execution model. Given its growing client base, it appears the next generation of investors does not care about these issues, and are willing to substitute proper research capabilities for following trends on social media. Interestingly, Robinhood fails to capture this trend and does not support social trading. Robinhood does not even incorporate sentiment indicators from client-based positions, while automated trading is not possible.

Robinhood has a waiting list for its pending Cash Management unit, which intends to offer checking and savings accounts. Initially, Robinhood had advertised a 3.00% annual interest rate, with the service to be launched in 2019. At that time, its nearest competitor offered a rate of 2.36%. The company had also falsely claimed SIPC insurance; after the SIPC denied those claims, Robinhood rebranded the service into Cash Management but removed the sign-up for the waiting list in January 2019. The relaunch in October 2019 stating that the Cash Management accounts would come with Federal Deposit Insurance Corporation (FDIC) insurance; moreover, the marketed interest rate was reduced to 2.05% via numerous partner banks. Before the official start of the service, Robinhood again cut the rate. Currently, per its website, Robinhood asserts that, once launched, Cash Management accounts will bear an interest rate of 0.30%. The waiting list is once again available online, but the entire process displays a clear lack of experience by the management team.

Following numerous missteps, the Cash Management unit at Robinhood once again accepts interested participants via a waiting list, as the service is still not operational.

Research and Education

Robinhood does not offer research, nor does it disclose how traders can conduct their own research on the trading platform. The firm also fails to connect its traders with third-party research, which would have been an acceptable alternative to the absence of in-house analytics. It does maintain a three-minute newsletter with market commentary, called Robinhood Snacks. Initially, the newsletter was called MarketSnacks, essentially a media company's attempt to use humor as a tool to make financial news understandable, or at least palatable, for those without any financial market background or knowledge. Given that Robinhood's target market audience is known for its short attention span, the newsletter remains an excellent service, albeit one without real value to clients, at least from a trading perspective.

Robinhood does not provide any research, neither in-house nor via third-parties, but substituted it with a humorous, relatively worthless, take on market commentary.

Education is where Robinhood delivers an unexpectedly quality service to new traders. The content is far more in-depth, and explains the basics of investing in equity markets while also providing insights into current events. Unfortunately, it does not feature a detailed search function or filter; only a simple search bar is available, making navigation through the growing list of content difficult. A separation of educational topics from market-related ones would create a more structured approach. New traders do not have a well-executed educational section that follows a lesson plan to guide them through their “financial journey.” Investing Basics consists of four articles, followed by four in The Markets category. The rest, placed under The Lingo, consists of a seemingly endless down scroll of content. It resembles a collection of admittedly quality articles thrown together without forethought; despite its flaws, this section represents the best asset available at Robinhood.

The educational section requires more structure but does represent the most valuable asset at Robinhood.

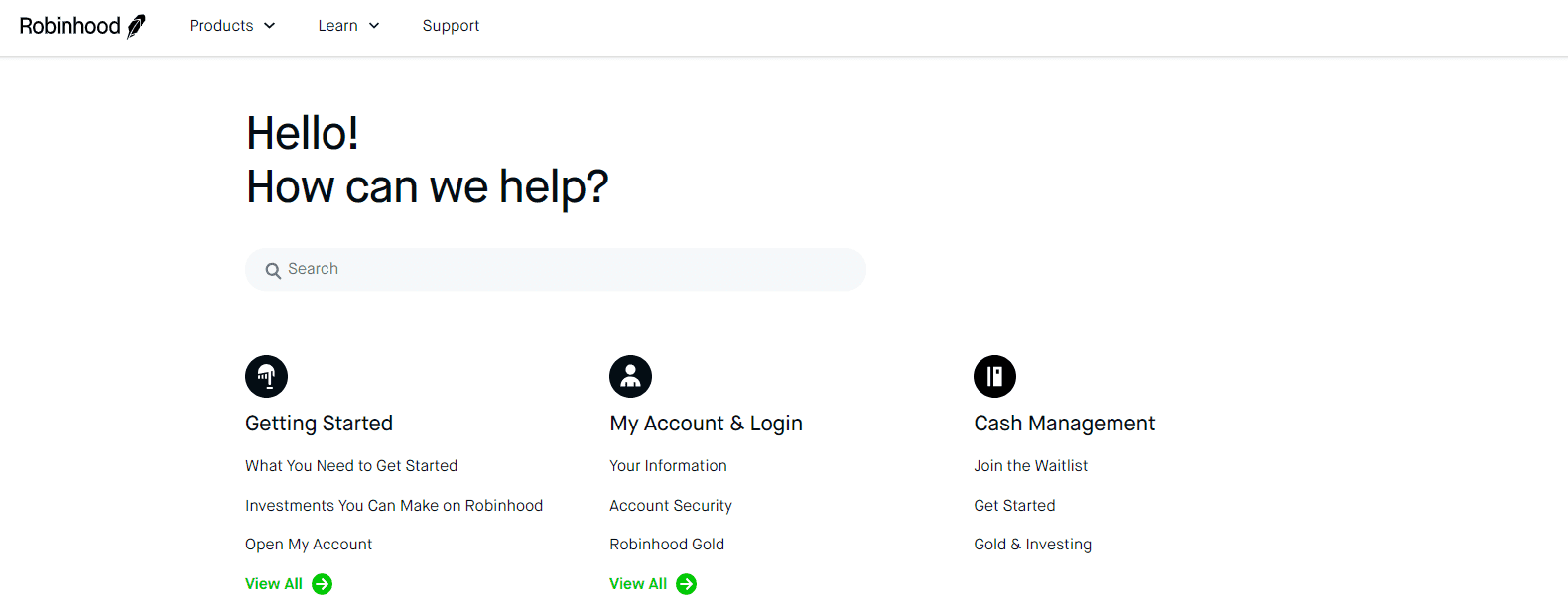

Customer Support

Support Hours | Undisclosed |

|---|---|

Website Languages |  |

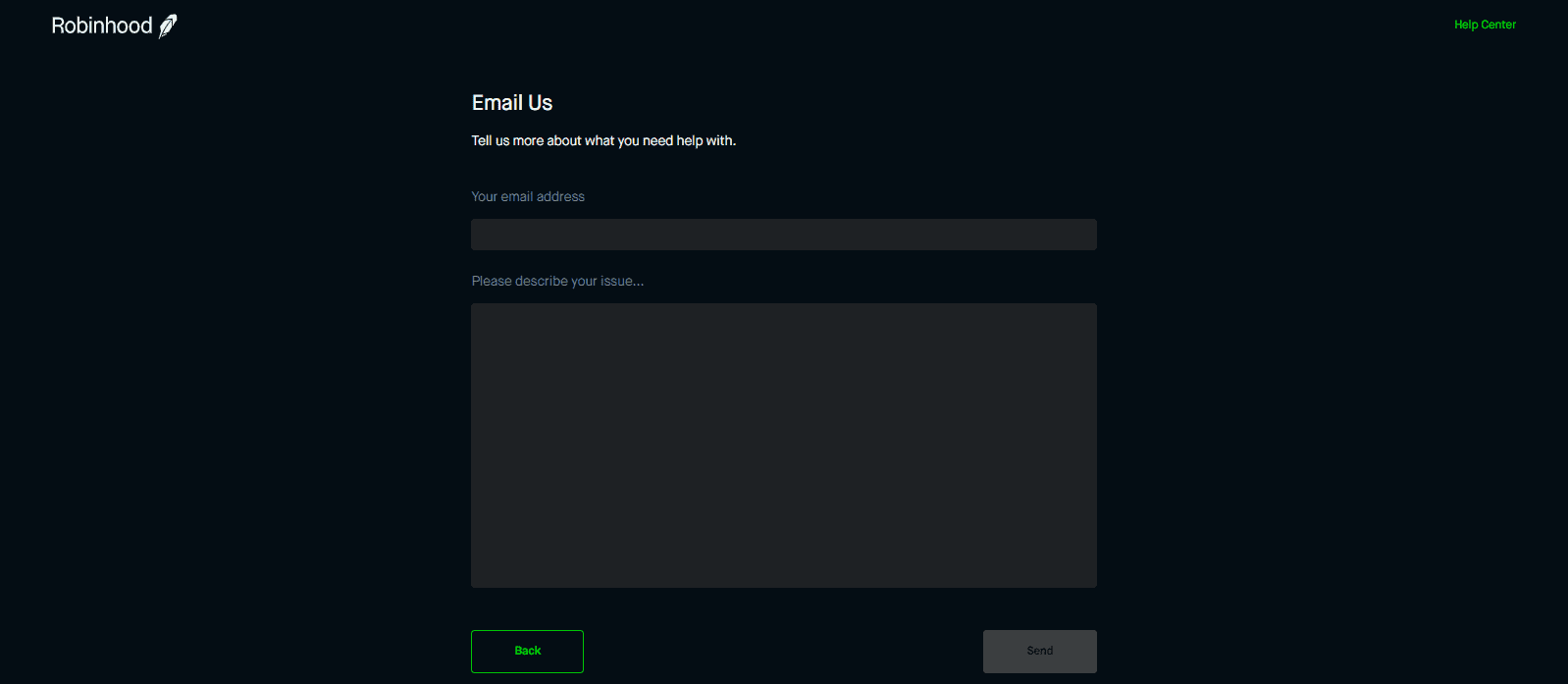

The Robinhood Help Center provides support in the form of an FAQ section. Clients can also reach out via a webform after going through a few questions aimed at directing them back to the FAQ section. Robinhood neither lists customer support hours nor a phone number. Therefore, traders are without assistance in case of emergencies, which is not acceptable. It adds to the list of management oversights or carelessness or, worse, a combination of both.

The FAQ section offers the only direct support to clients.

After a few questions, a web form becomes available.

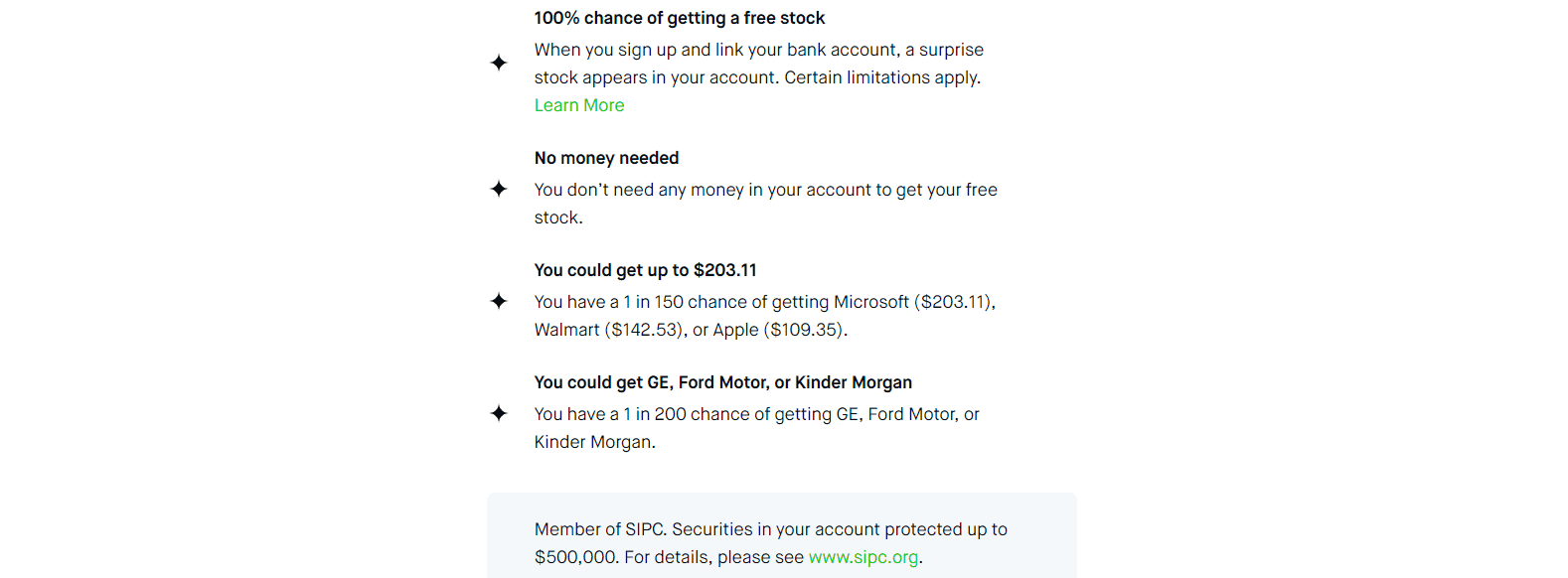

Bonuses and Promotions

Robinhood offers all new accounts one free bonus share from a group of randomly selected equities. The same applies if you refer a friend. Both are an excellent way to welcome new clients.

Robinhood's new account and refer a friend bonus program offers one free share of stock.

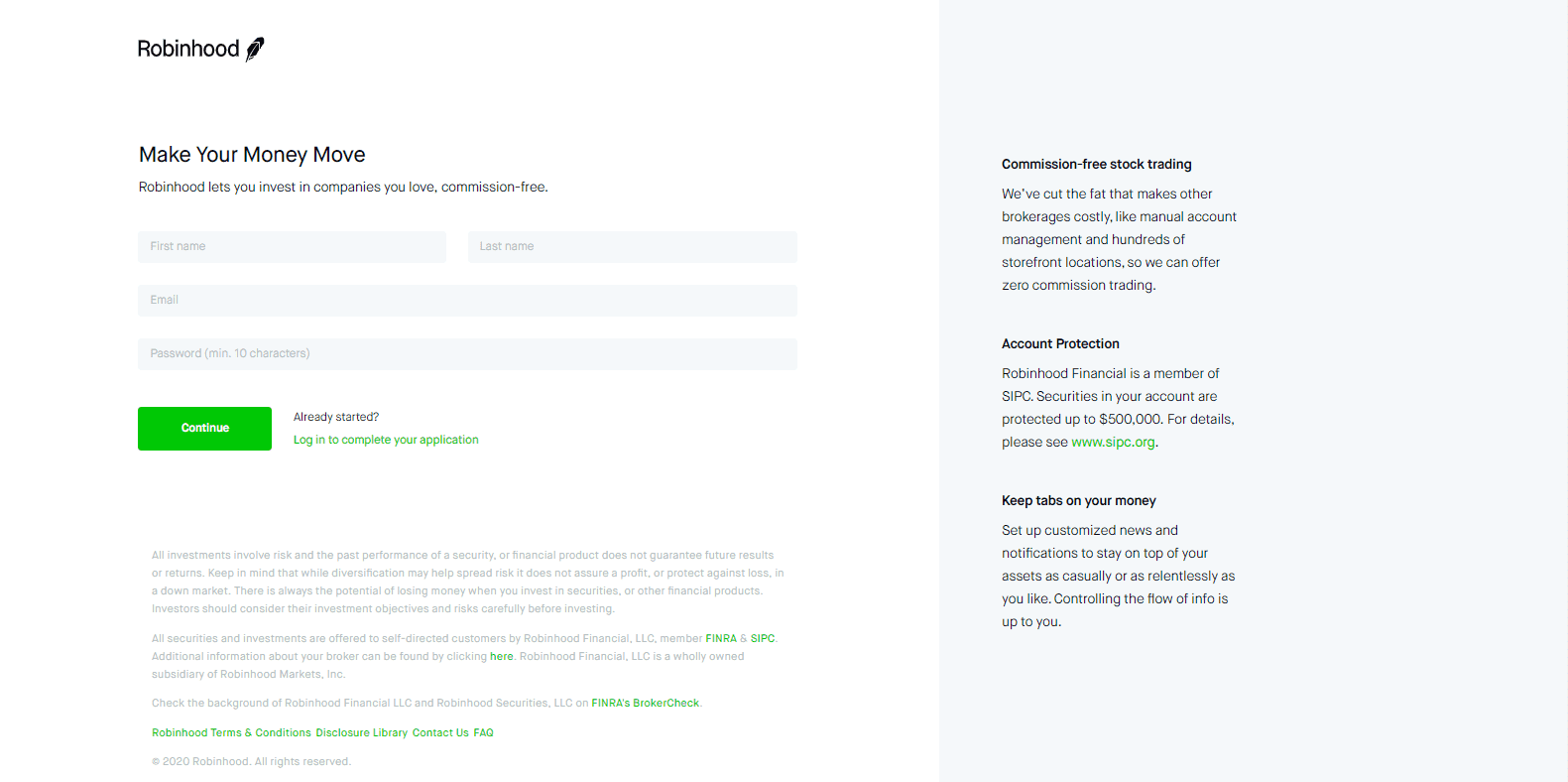

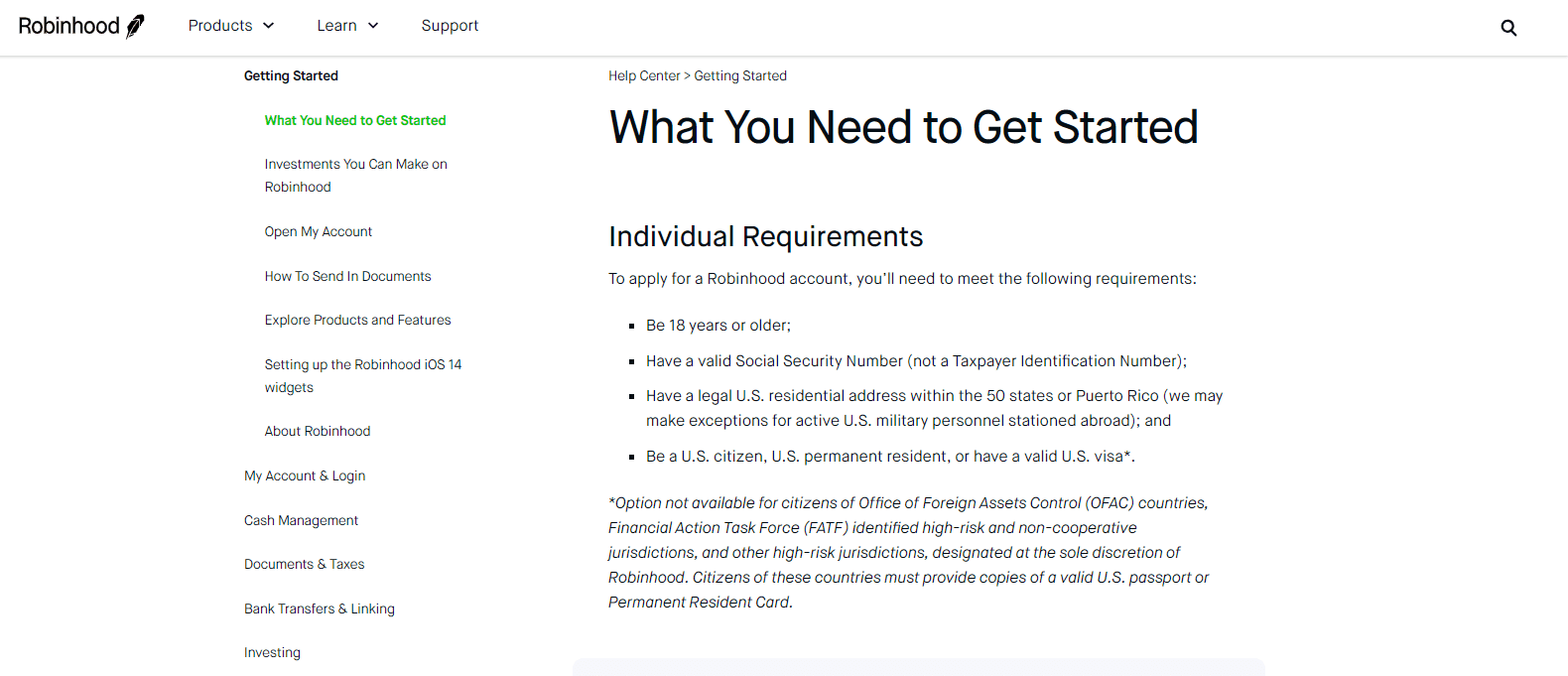

Opening an Account

An online application form handles new accounts, and the first step is merely for a name, e-mail, and password. New clients will complete the second step once logged into the back-office. A valid Social Security number (SSN), and proof of residency document is a requirement. Robinhood only caters to US citizens, permanent residents, and those with a valid visa.

New traders can quickly open a new account online.

Additional documents are required to complete the process.

Trading Platform

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Summary

Robinhood states it wants to make financial markets accessible to all traders, not only wealthy clients. Unfortunately, in opposition to that assertion, it sells retail trade data to high-frequency trading (HFT) outlets so that they can front-run Robinhood client orders. Essentially, that allows the wealthy to profit from retail traders, countering Robinhood's mission statement. Despite this, millennial retail traders, many of whom are without sound knowledge of trading principles and financial markets in general, tend to flock to Robinhood, as it initially sounds appealing. This broker masks its practices with commission-free trading, which appears available only in the margin-free account type, unless the explanation on the account page is incomplete.

There is no information about the core trading environment, no introduction of the trading platform, and no research and analytics tools. Rather than offering valuable services to traders, Robinhood relies on a humorous newsletter, which confirms the quality of traders attracted to this US-based online broker. The unorganized educational section actually represents the best value at this broker, while the asset selection remains above-average. Despite its popularity among new traders below the age of 30, Robinhood offers a visible low-quality trading environment. Genuine traders will find a more competitive offering elsewhere, also without paying a commission on trades.

Deposits and Withdrawals

FAQs

Is Robinhood legit?

Yes, the company operates under the oversight of the SEC, via FINRA membership, and the SIPC offers additional protection.

Is Robinhood a good way to invest?

It depends on the individual, but compared to other well-established brokers, it ranks significantly below in value. Commission-free trades do not cover the visible shortfall, but millennial retail traders tend to favor Robinhood.

What is the “catch” with Robinhood?

Robinhood sells your data to high-frequency trading firms, allowing them to profit from the retail order book before traders at Robinhood place trades. It counters their alleged mission to make financial markets available to all and not only the wealthy.

Can you actually make money on Robinhood?

Yes, by trading smart, you can make money. Regrettably, Robinhood does provide any valuable tools, aside from commission-free trading, to accomplish profitability.

Should I give Robinhood my SSN?

It is a legal requirement, so if you wish to trade there, you must provide your SSN.