Editor’s Verdict

STARTRADER offers 14 liquidity providers that ensure traders have access to deep liquidity pools, which results in tight spreads, lower trading fees, and higher profits for traders. Besides the MT4/MT5 trading platforms, a proprietary copy trading service exists, suggesting it is a core segment for STARTRADER. I reviewed this broker to evaluate the competitiveness of its trading environment. This broker review will cover the international subsidiary. Is STARTRADER as good as advertised?

Overview

I like the deep liquidity at STARTRADER, which is excellent for scalpers and algorithmic traders. Copy traders get a proprietary copy trading service, which they can use alongside the embedded MT4/MT5 options. My first impression of STARTRADER is solid.

Headquarters | Seychelles |

|---|---|

Regulators | ASIC, FSA, FSCA, SCA |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2012 |

Execution Type(s) | ECN/STP |

Minimum Deposit | 50$ |

Negative Balance Protection | |

Trading Platform(s) | MetaTrader 4, MetaTrader 5 |

Average Trading Cost EUR/USD | 1.3 pips ($13.00) |

Average Trading Cost GBP/USD | 1.3 pips ($13.00) |

Average Trading Cost WTI Crude Oil | $0.036 |

Average Trading Cost Gold | $0.17 |

Retail Loss Rate | Undisclosed |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 1.3 pips |

Minimum Commission for Forex | $6/lot |

Funding Methods | 9 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

I like the deep liquidity at STARTRADER, which is excellent for scalpers and algorithmic traders. Copy traders get a proprietary copy trading service, which they can use alongside the embedded MT4/MT5 options. I would appreciate more clarity about minimum deposit requirements and trading commissions for its ECN account. Still, my first impression of STARTRADER is solid.

STARTRADER Regulation & Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders check for regulation and verify it with the regulator by checking the provided license with their database. STARTRADER has two regulated subsidiaries with a clean track record and two unregulated but duly registered ones.

Startrader has been the subject of a warning issued by Spain's CNMV, the regulatory authority, responsible for overseeing financial activities in Spain. The CMNV has raised concerns about StarTrader's operations alleging that StarTrader is operating without necessary authorization. In response, Startrader claims that it is working actively to resolve the CNMV’s concerns and obtain the requisite authorization to operate in Spain. Therefore, Spanish resident traders should investigate the situation and carefully consider the matter when deciding whether to open an account with Startrader while this situation persists.

Country of the Regulator | United Arab Emirates, Australia, Seychelles, South Africa |

|---|---|

Name of the Regulator | ASIC, FSA, FSCA, SCA |

Regulatory License Number | 52464, 421210, SD049, 20200000241 |

Regulatory Tier | 1, 2, 4, 2 |

Is STARTRADER Legit and Safe?

STARTRADER, founded in 2012, is a Seychelles-headquartered broker with a well-regulated trading environment. It segregates client deposits from corporate funds, offers negative balance protection to retail traders, and is a Financial Commission member. Besides meeting strict financial capital ratios and audits, traders get a compensation fund of up to €20,000 per claim, ensuring a safe and secure trading environment.

It operates four regulated subsidiaries,one in United Arab Emirates, one in South Africa, one in Australia, and one in the Seychelles; and an unregulated but duly registered one in St. Vincent and the Grenadines.

My review did not find any misconduct or malpractice by this broker. I can confidently recommend STARTRADER and its clean track record, as it is a legitimate and safe broker.

Fees

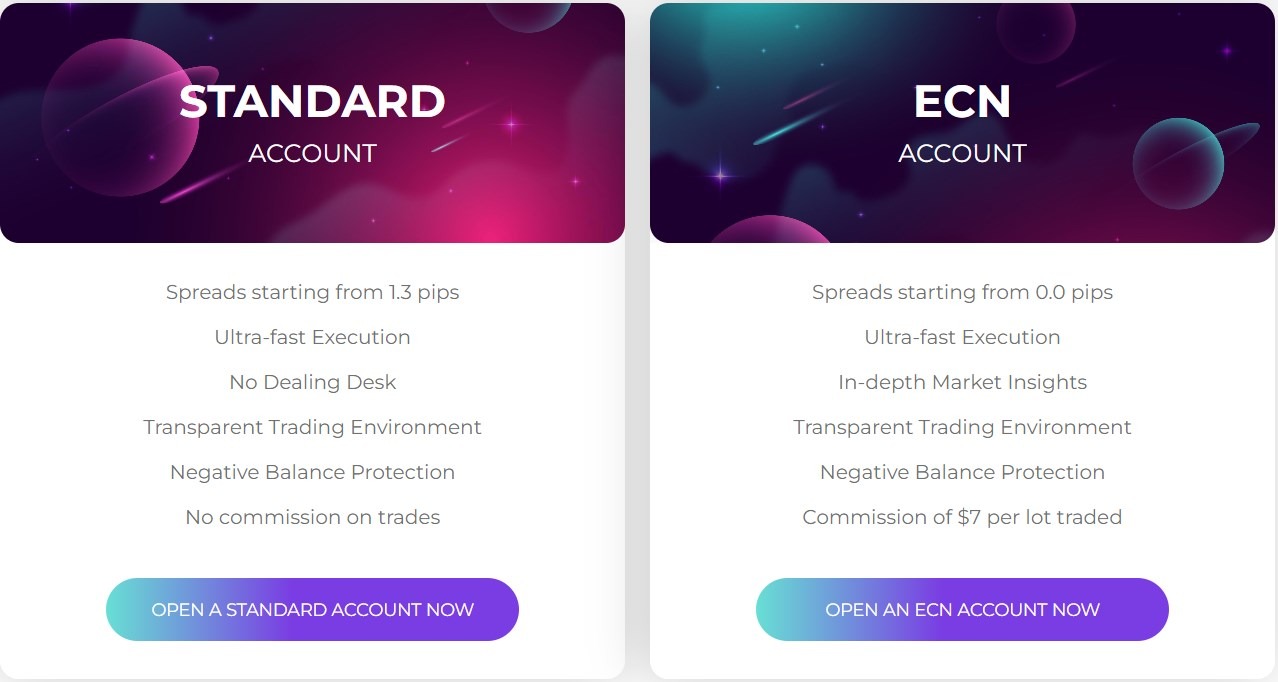

STARTRADER provides two cost structures, a commission-free and a commission-based one.

The commission-free Standard account has Forex spreads from 1.3 pips or $13.00 per 1.0 lot. Traders in the ECN alternative get raw spreads from 0.0 pips for a commission of $6.00 per 1.0 standard round lot, making it up to 46%+ cheaper than the commission-free account type.

STARTRADER does not levy internal deposit fees or an inactivity fee, but bank wire withdrawals incur a $20 charge.

Here is a snapshot of STARTRADER spreads:

Average Trading Cost EUR/USD | 1.3 pips ($13.00) |

|---|---|

Average Trading Cost GBP/USD | 1.3 pips ($13.00) |

Average Trading Cost WTI Crude Oil | $0.036 |

Average Trading Cost Gold | $0.17 |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 1.3 pips |

Minimum Commission for Forex | $6/lot |

Deposit Fee | |

Withdrawal Fee |

The most ignored trading costs are swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

MT4/MT5 traders can access swap rates from their platform by following these steps:

- Right-click the desired symbol in the Market Watch window and select Specification.

- Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights in the commission-free Standard account.

Taking a 1.0 standard lot buy/sell position in the EUR/USD, at the average spread and holding it for one night in the Standard account will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

|---|---|---|---|---|

1.3 pips | $0.00 | -$6.31 | X | $19.31 |

1.3 pips | $0.00 | X | $2.46 | $10.54 |

Taking a 1.0 standard lot buy/sell position in the EUR/USD, at the average spread and holding it for seven nights in the Standard account will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

|---|---|---|---|---|

1.3 pips | $0.00 | -$44.17 | X | $57.17 |

1.3 pips | $0.00 | X | $17.22 | -$4.22 |

Noteworthy:

- STARTRADER offers positive swap rates on qualifying assets, allowing traders to earn money for holding leveraged overnight positions, like in the example above.

Range of Assets

STARTRADER notes 200+ assets and offers Forex, commodities, indices, and equity CFDs. I like the choice of 61 currency pairs. In addition, introductory cross-asset diversification exists via 24 commodities, 26 indices, and 68 highly liquid blue-chip equity CFDs. I like the overall asset selection, as it suits most traders.

STARTRADER Leverage

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

STARTRADER offers a maximum Forex leverage of 1:500, which extends to all other asset classes except for equity CFDs, which max out at 1:20. It is a unique offer and creates a competitive edge for skilled traders, for as most brokers increase margin requirements for non-Forex assets.

Negative balance protection ensures traders cannot lose more than their deposits. Traders must always use appropriate risk management with leveraged trading to avoid magnified trading losses.

STARTRADER Trading Hours

Asset Class | From | To |

|---|---|---|

Currency Pairs | Monday 00:00 | Friday 24:00 |

Commodities | Monday 00:00 | Friday 23:00 |

Crude Oil | Monday 00:00 | Friday 23:00 |

Gold | Monday 00:00 | Friday 23:00 |

Metals | Monday 00:00 | Friday 23:00 |

Equity Indices | Monday 00:00 | Friday 23:00 |

Stocks | Monday 15:30 | Friday 22:00 |

Futures | Monday 00:00 | Friday 23:00 |

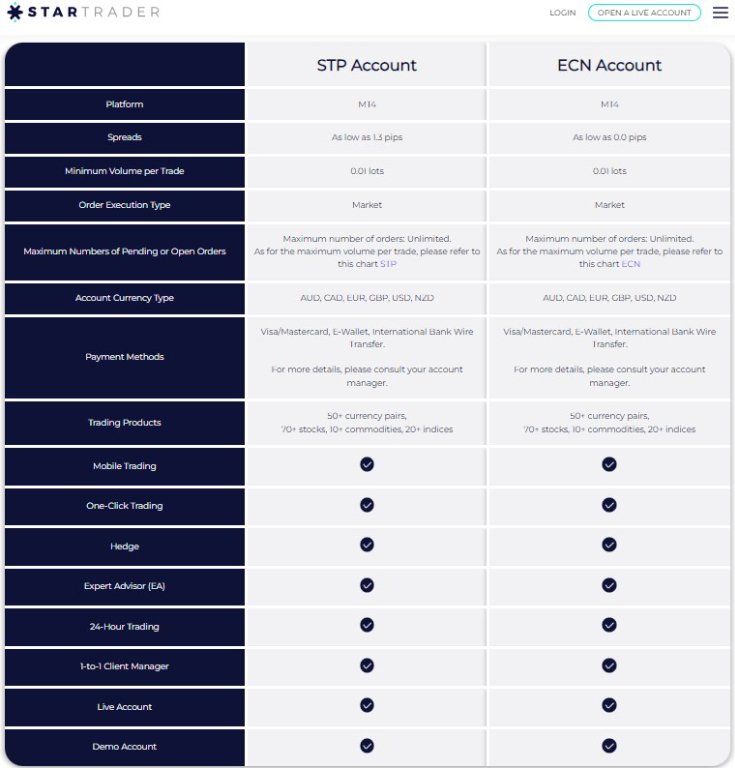

Account Types

Traders can opt for the expensive commission-free Standard account or the commission-based ECN alternative, which is almost 50% cheaper.

STARTRADER’s MT4 trading platform introduction mentions a $50 minimum. STARTRADER offers AUD, CAD, EUR, GBP, USD, and NZD accounts, but swap-free Islamic options are not offered.

STARTRADER Demo Account

Traders can open MT4/MT5 demo accounts at STARTRADER via a quick sign-up or get access to the web-based trading platforms and a $100,000 demo account without registration. The default demo account balance is excessive, but MT4/MT5 have fully customizable options. I advise traders to select parameters similar to planned live portfolios for a more realistic demo trading experience. My review found no time restrictions on demo accounts.

I want to caution beginner traders when using demo trading as an educational tool, and they should consider the limitations. Demo trading does not grant exposure to trading psychology and can create unrealistic trading expectations.

Trading Platforms

STARTRADER offers out-of-the-box MT4/MT5 trading platforms as a desktop client, a web-based alternative, and a mobile app. Algorithmic trading is possible in both, where MT4 remains the industry leader and MT4/MT5 has embedded copy trading services. A proprietary mobile app is equally available but has just over 100 downloads on the Google Play Store.

Unfortunately, STARTRADER offers no plugins or upgrades, but traders can upgrade MT4 via 25,000+ custom indicators, templates, and EAs or 5,000+ for MT5. Please note that quality upgrades or functioning EAs cost money.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Unique Features

I want to note the 14 liquidity providers at STARTRADER, making it an excellent broker for scalpers and algorithmic traders. VPS hosting for low-latency 24/5 trading is available. STARTRADER has a two-tier reimbursement program for traders starting from a minimum account balance of $3,000+ and monthly trading volumes exceeding 5.0 lots.

The proprietary copy trading service for MT4 is also noteworthy, as this sector presents a core segment for STARTRADER, which it serves excellently. Followers pay a fee only if the strategy generates profits. MAM/PAMM accounts are available for traditional account management under its partnership program.

Another unique feature at STARTRADER is its CEO, Peter Karsten, who has led this broker over the past four years on an exciting growth path. He is a physicist and innovator with fifteen patents in his name. He previously held prominent roles at Citibank and Nokia.

Research & Education

STARTRADER publishes short videos and written analytics covering various assets. The latter includes a chart, pivot points, and three support and resistance levels. While it does not generate specific buy or sell recommendations, traders can use the trading idea and create their set-up with the available data.

Beginners get quality educational content via 15 videos and two sections featuring 26 well-written articles covering numerous topics. A few Arabic-language webinars are also available on its website.

Therefore, I advise beginners to start their education at STARTRADER. I also recommend additional in-depth education covering trading psychology and the relationship between leverage and risk management while avoiding paid-for courses and mentors.

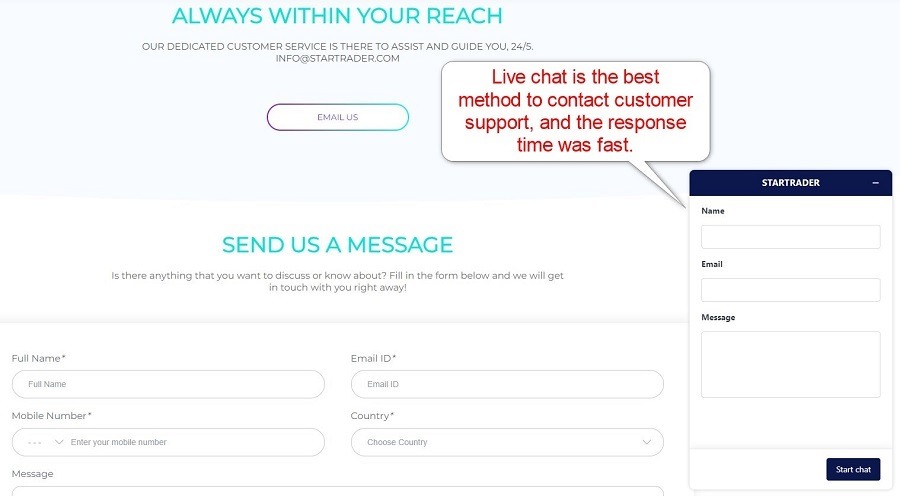

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |              |

STARTRADER customer support is available 24/5 via e-mail or live chat. I recommend the latter, as the response time was fast. Like most competitors that expand fast, STARTRADER could improve its customer support.

Bonuses and Promotions

STARTRADER offers bonuses and promotions, and during my review, a withdrawable 20% deposit bonus with acceptable terms stood out. Terms and conditions apply, and I urge traders to read and understand them before accepting an incentive. An affiliate program is available for passive income seekers.

Opening an Account

Opening an account with STARTRADER only takes a few seconds. Traders must select a password and can either register via e-mail or mobile phone, and STARTRADER will send a confirmation code. STARTRADER also allows traders to use their Facebook or Google IDs to complete this step. I appreciate that STARTRADER does not insist on unnecessary questionnaires or data mining.

Demo Account | Yes |

|---|---|

Managed Account | Yes |

Islamic Account | Yes |

Other Account Types | No |

OCO Orders | No |

Interest on Margin | No |

Account verification is mandatory as STARTRADER complies with global AML/KYC requirements. Most traders will be able to satisfy it by uploading a copy of their government-issued ID and one proof of residency document. STARTRADER may ask for additional information on a case-by-case basis.

Minimum Deposit

The STARTRADER minimum deposit is $100.

Payment Methods

Withdrawal options |       |

|---|---|

Deposit options |       |

STARTRADER payment methods are bank wires, credit/debit cards, STICPAY, Perfect Money, Skrill, Neteller, Omini, SEPA, and EPay.

Accepted Countries

STARTRADER accepts clients from most countries. It prohibits registrations from residents of Afghanistan, Cuba, Eritrea, Iraq, the Islamic Republic of Iran, Israel, Liberia, Libya, Malaysia, Nicaragua, Pakistan, the Russian Federation, Somalia, the Syrian Arab Republic, Sudan, and the United States. It also adds that it does not cater to traders from “any other jurisdiction where such distribution, publication, availability or use would be contrary to applicable law or regulation.”

Deposits and Withdrawals

The secure STARTRADER back office handles all financial transactions for verified clients.

STARTRADER lacks a dedicated section outlining its deposit and withdrawal methods with minimum and maximum deposit amounts, fees, and processing times. It once references 200+ payment processors, but my review uncovered nine. There could be select regional options, so I prefer details and transparency.

STARTRADER notes that bank wires can take three to five business days and that it levies a $20 fee on international bank wires. It also processes all withdrawal requests on the same day if traders send them before 07:30 (GMT).

The name on the payment processor and STARTRADER trading account must match in compliance with AML regulations. Besides bank wires fees, STARTRADER does not levy internal deposit or withdrawal fees. Still, traders may face third-party processing costs, currency conversion fees, or follow-on charges.

Is STARTRADER a good broker?

I like the trading environment at STARTRADER for its deep liquidity pools. It makes it a competitive choice for scalpers and algorithmic traders, who can also qualify for free VPS hosting. Copy traders can use the embedded MT4/MT5 services or opt for the proprietary STARTRADER alternative.

I also want to note the quality CEO of STARTRADER, ensuring this broker is on the right path, as evident over the past four years. I need some transparency concerning its ECN account and detailed deposit or withdrawal methods. Still, I rate STARTRADER as a good overall choice and can recommend it to traders.

FAQs

Who is the CEO of STARTRADER?

The STARTRADER CEO is Peter Karsten.

What is the minimum deposit for STARTRADER?

The STARTRADER minimum deposit is 50.

Is STARTRADER regulated?

Yes, the Australian ASIC and the Seychelles FSA regulate STARTRADER.

Is STARTRADER a good broker?

STARTRADER is a good broker for scalper, algorithmic, and copy traders due to its deep liquidity, high leverage, negative balance protection, and strategy-focused trading tools.