Editor’s Verdict

T4Trade offers commission-free costs and fixed and floating spread accounts on the MT4 trading platform. Traders get flexible leverage up to 1:1000, three account base currencies, generous bonuses, and a balanced choice of liquid trading instruments. I reviewed this broker to determine how competitive the trading environment is. Should you consider T4Trade as your next broker?

Overview

A transparent MT4 broker with a balanced asset selection and quality education.

Headquarters | Seychelles |

|---|---|

Regulators | FSA |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Execution Type(s) | Market Maker |

Minimum Deposit | $50 |

Trading Platform(s) | MetaTrader 4, Proprietary platform, Web-based |

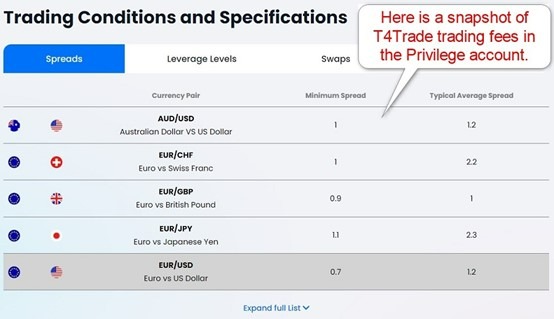

Average Trading Cost EUR/USD | 1.2 pips |

Average Trading Cost GBP/USD | 1.3 pips |

Average Trading Cost WTI Crude Oil | $0.04 |

Average Trading Cost Gold | $0.15 |

Retail Loss Rate | Undisclosed |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | 0.7 pips |

Minimum Commission for Forex | Commission-free |

Funding Methods | 9 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

I like the educational content for beginners at T4Trade, which also maintains a balanced asset selection. The flexible leverage and customizable demo accounts are also excellent, offering traders two core trading tools.

T4Trade Regulation & Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders check for regulation and verify it with the regulator by checking the provided license with their database. T4Trade presents clients with one regulated entity and maintains a secure trading environment.

Country of the Regulator | Seychelles |

|---|---|

Name of the Regulator | FSA |

Regulatory License Number | SD029 |

Regulatory Tier | 4 |

Is T4Trade Legit and Safe?

T4Trade, operated by Tradeco Limited, segregates client deposits from corporate accounts and offers negative balance protection. Founded in 2021, it lacks the longer operational history of many competitors, but my review found no misconduct on behalf of T4Trade, which maintains a clean regulatory track record.

Fees

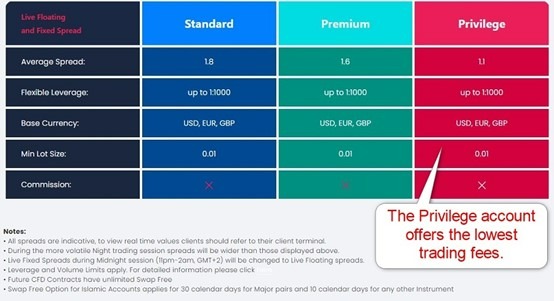

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability. T4Trade maintains a commission-free cost structure, and trading fees on the EUR/USD currency pair show an average spread of 1.1 pips or $11.00 per 1.0 standard round lot for the EUR/USD in the Privilege account, which is the one I recommend, as the trading fees in Standard and Premium are higher.

Average Trading Cost EUR/USD | 1.2 pips |

|---|---|

Average Trading Cost GBP/USD | 1.3 pips |

Average Trading Cost WTI Crude Oil | $0.04 |

Average Trading Cost Gold | $0.15 |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | 0.7 pips |

Minimum Commission for Forex | Commission-free |

Deposit Fee | |

Withdrawal Fee |

The minimum trading costs for the EUR/USD at T4Trade are:

Average Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

|---|---|---|

1.8 pips (Standard & Cent) | $0.00 | $18.00 |

1.6 pips (Premium) | $0.00 | $16.00 |

1.2 pips (Privilege) | $0.00 | $12.00 |

Here is a snapshot of T4Trade trading fees:

The most ignored trading costs are swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

MT4 traders can access swap rates from their platform by following these steps:

1. Right-click the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights in the commission-free Privilege account.

Taking a 1.0 standard lot buy/sell position, in the EUR/USD, at the average spread and holding it for one night will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

|---|---|---|---|---|

1.2 pips | $0.00 | -$11.75 | X | $23.75 |

1.2 pips | $0.00 | X | $2.01 | $9.99 |

Taking a 1.0 standard lot buy/sell position, in the EUR/USD, at the average spread and holding it for seven nights will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

|---|---|---|---|---|

1.2 pips | $0.00 | -$82.25 | X | $94.25 |

1.2 pips | $0.00 | X | $14.07 | -$2.07 |

Noteworthy:

- T4Trade offers positive swap rates in qualifying assets, meaning traders get paid for holding leveraged overnight positions, like in the example above on EUR/USD short positions.

Range of Assets

T4Trade offers a choice of 300+ trading instruments, Forex, commodities, indices, shares, and futures. I like the selection of 84 currency pairs, which ensures that Forex traders have a broad choice of trading instruments, complemented by 30 commodities, 150 stocks, 30 futures contracts, and 30 equity indices. Equity traders get a selection of blue-chip stocks listed in the US, the UK, and the Eurozone, where Czech companies pleasantly surprised me. I am missing ETFs and cryptocurrencies, but the range of assets at T4Trade suits most retail traders and is excellent for Forex traders. The Fractional share dealing offer is ideal for smaller portfolios.

Asset List Overview

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Futures | |

Synthetics |

T4Trade Leverage

T4Trade maintains a highly competitive and flexible five-tier leverage system where Forex traders get between 1:100 and 1:1000. The higher the trading volume or equity of an account, the lower the leverage, which is an ideal risk management approach for traders and T4Trade. Commodity traders max out at 1:200, index traders at 1:100, and equity traders at 1:20. The T4Trade leverage ensures a competitive trading environment, but traders should deploy proper risk management to avoid magnified trading losses. Negative balance protection exists, meaning traders can never lose more than their deposits.

Noteworthy:

- Equity markets open and close each trading session, unlike Forex, and commodities, which essentially trade 24/5.

Account Types

Traders may choose from three account types, where the only visible difference is a difference in trading fees. The minimum deposit is $50. A Cent account is also available, which I recommend to beginners to learn how to trade in live trading conditions. Available account base currencies are USD, EUR, and GBP.

MAM/PAMM accounts are also available.

T4Trade Demo Account

T4Trade offers customizable demo accounts, and I did not find a time restriction, which is good, and how demo accounts should function. I recommend traders select demo account settings similar to their planned live deposits to create the most realistic demo trading experience.

I want to caution beginner traders when using demo trading as an educational tool, and they should consider the limitations. Demo trading does not grant exposure to trading psychology and can create unrealistic trading expectations. Therefore, the Cent account with a small deposit may be a better option for learning how to trade.

Accounts may be opened in either the USD, EUR, or GBP currencies.

Trading Platforms

T4Trade presents its proprietary web-based trading platform, accessible from the client portal, a mobile app, and the MT4 trading platform, which remains the undisputed industry leader, plus MT5. Mt4 fully supports algorithmic trading from its desktop client and has an embedded copy trading service. Regrettably, T4Trade does not offer third-party plugins for MT4. Traders can browse the 25,000+ custom indicators, plugins, and EAs available for MT4, but the quality upgrades are not free. I am missing an introduction to the proprietary options, as T4Trade does not list any features and only notes how to access or obtain them.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Unique Features

T4Trade focuses on its core trading environment, and my review did not uncover unique features, but I do applaud the pricing transparency.

Research & Education

T4Trade does not provide research to clients, but its live TV, available Monday to Friday from 0900 to 1100 (GMT), provides market coverage. I do not consider the absence of research by a broker as a negative, but it can create a service gap with more established competitors.

Beginner traders get three eBooks, numerous webinars, and a video library with short but well-constructed content. It includes three videos on trading psychology, which are excellent, as it remains the primary topic beginners must master.

I recommend beginners start with the T4Trade video lessons before funding a T4Trade account. I also urge beginners to seek in-depth education from third parties to deepen their foundation and avoid paid-for courses.

Customer Support

Customer Support Methods |  |

|---|---|

Support Hours | 24/5 |

Website Languages |            |

T4Trade notes 24/5 customer support in 30+ languages, but I only came across e-mail support during my review. The FAQ section left me unsatisfied and searching for answers elsewhere. Live chat is supposed to exist, but I could not find it.

Bonuses and Promotions

Traders can get three non-withdrawable bonuses, the 100% Supercharger bonus, the 40% Takeoff bonus limited to $4,000, and the 20% Welcome bonus capped at $2,000. Terms and conditions apply, and I highly recommend traders read and understand them before accepting any incentive.

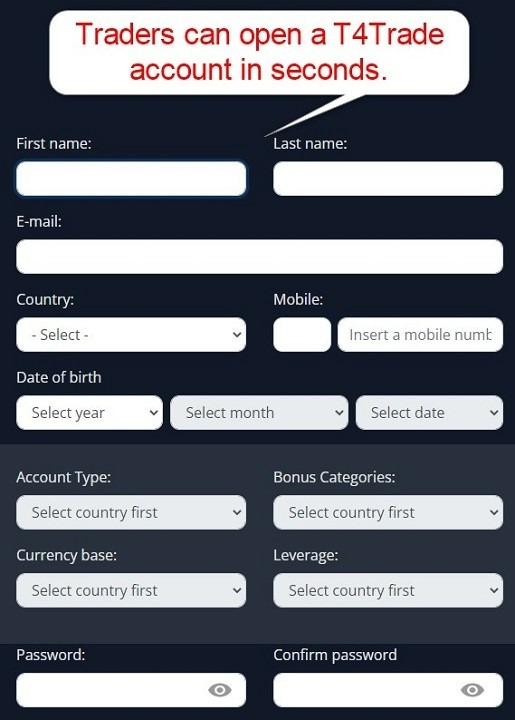

Opening an Account

T4Trade has a swift online application form. Traders must submit their name, e-mail, country of residence, mobile number, and date of birth. It also includes the account selection process, which I find convenient.

Account verification is mandatory, as T4Trade is a regulated broker with FSA oversight and must comply with strict AML/KYC requirements. Most traders will pass account verification by sending a copy of their government-issued ID and one proof of residency document. T4Trade might ask for additional information on a case-by-case basis.

Minimum Deposit

The minimum deposit at T4Trade is $50 but may be higher for the more sophisticated account types. Since the trading fees decrease significantly, traders may have to deposit more to access cheaper costs.

Payment Methods

Withdrawal options |       |

|---|---|

Deposit options |       |

Accepted Countries

T4Trade accepts traders resident in many countries, however it is not targeted at residents of the EU where it is not licensed. T4Trade does not offer its services to residents of certain jurisdictions such as USA, Iran, Cuba, Sudan, Syria, and North Korea.

Deposits and Withdrawals

The secure T4Trade client portal handles all financial transactions for verified clients.

T4Trade does not list minimum deposit or withdrawal requirements and does not levy internal fees. Traders may face third-party processing costs or currency conversion fees. Supported transaction currencies are USD, EUR, GBP, AUD, JPY, CHF, PLN, RUB, and HUF. T4Trade converts deposits and withdrawals in other currencies to the account base currency at market rates.

Withdrawal methods available are:

- Credit & debit Cards

- China Union Pay

- Digital Assets

- Perfect Money

- Bank Transfer

Payment methods available are:

- Bank wire transfer – maximum deposit varies among banks

- Credit & debit cards - Maximum deposit $50,000

- Skrill - Maximum deposit $50,000

- Neteller – Maximum deposit $50,000

- FasaPay – Maximum deposit $5,000

- Local Bank Transfer Solution – Maximum deposit varies based on country and solution

- Digital Assets – No Maximum

Internal processing times are within 24 hours, but the final transaction time depends on the payment processor and the geographical location of traders. Most non-banking payment processors have geographic restrictions, and the T4Trade client portal will only list the ones available to traders.

Only verified trading accounts can deposit and withdraw, and the name on the payment processor must match the T4Trade account name.

Is T4Trade a good broker?

I like the trading environment at T4Trade for its pricing transparency and balanced asset selection. T4Trade offers beginners a quality introduction to trading via its video course, and the minimum deposit of $50 ensures T4Trade is accessible to traders with smaller portfolios. Forex traders get an excellent asset selection, and I like the availability of fractional share dealing, making T4Trade a solid broker for beginners.

FAQs

How do I withdraw money from T4Trade?

You can withdraw their deposit amount to the payment processor used for the deposit but must withdraw profits via bank wire.

Is T4Trade good for beginners?

Yes, T4Trade has a low minimum deposit requirement, allows micro-lot trading and fractional share dealing, has a Cent account, and has quality educational content, making it a good choice for beginners.

What is the T4Trade minimum deposit requirement?

The T4Trade minimum deposit requirement is $50.

Is T4Trade a safe broker?

T4Trade has regulatory oversight from the FSA in Seychelles, segregates client deposits from corporate accounts, offers negative balance protection, and has a clean track record. Therefore, traders should consider it a safe broker.