Editor’s Verdict

Overview

Headquarters | United States |

|---|---|

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 1982 |

Execution Type(s) | ECN/STP, Market Maker |

Trading Platform(s) | Proprietary platform |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

TradeStation is a US-based broker founded in 1982 as Omega Research. In 1987, the company released its first product, System Writer, which allowed traders to back-test their trading strategies using historical data. The release of System Write Plus in 1989 followed before its flagship product, TradeStation, was launched in 1991. It quickly gained popularity, and Omega Research signed an exclusive deal with Dow Jones Telerate to offer TradeStation to institutional clients globally. The success allowed the company to complete an initial public offering (IPO) in 1997, listing on the NASDAQ National Market. In 2000, TradeStation 6 entered the online brokerage market, followed by a 2001 restructuring of the firm to distinct between the brokerage and technology divisions. In 2011, Japan-based financial conglomerate Monex Group acquired TradeStation. Today, it remains a dominant online broker in the US retail market, where it continues to deploy cutting-edge technologies to grant its clients a competitive edge.

Regulation and Security

TradeStation does not maintain a dedicated section about regulation and limits that information to the bottom of each web page, in small print. Why a market leader and respected entity is not more upfront about its regulatory environment may result from its US-only approach. It is a member of the Financial Industry Regulatory Authority (FINRA). FINRA is a private corporation acting as a self-regulatory organization (SRO), and the successor of the National Association of Securities Dealers (NASD). The ultimate regulator is the US Securities and Exchange Commission (SEC).

TradeStation is also a member of the New York Stock Exchange (NYSE) and the Chicago Mercantile Exchange (CME). The Securities Investor Protection Corporation (SIPC) protects the cash held for securities in equities and equity option contracts and underlying assets. TradeStation also maintains a list of essential documents on its website and stresses the importance of traders to understand with which of its subsidiaries it deals.

TradeStation is disappointingly quiet about its regulatory environment, merely noting it in small print at the bottom of each web page.

Fees

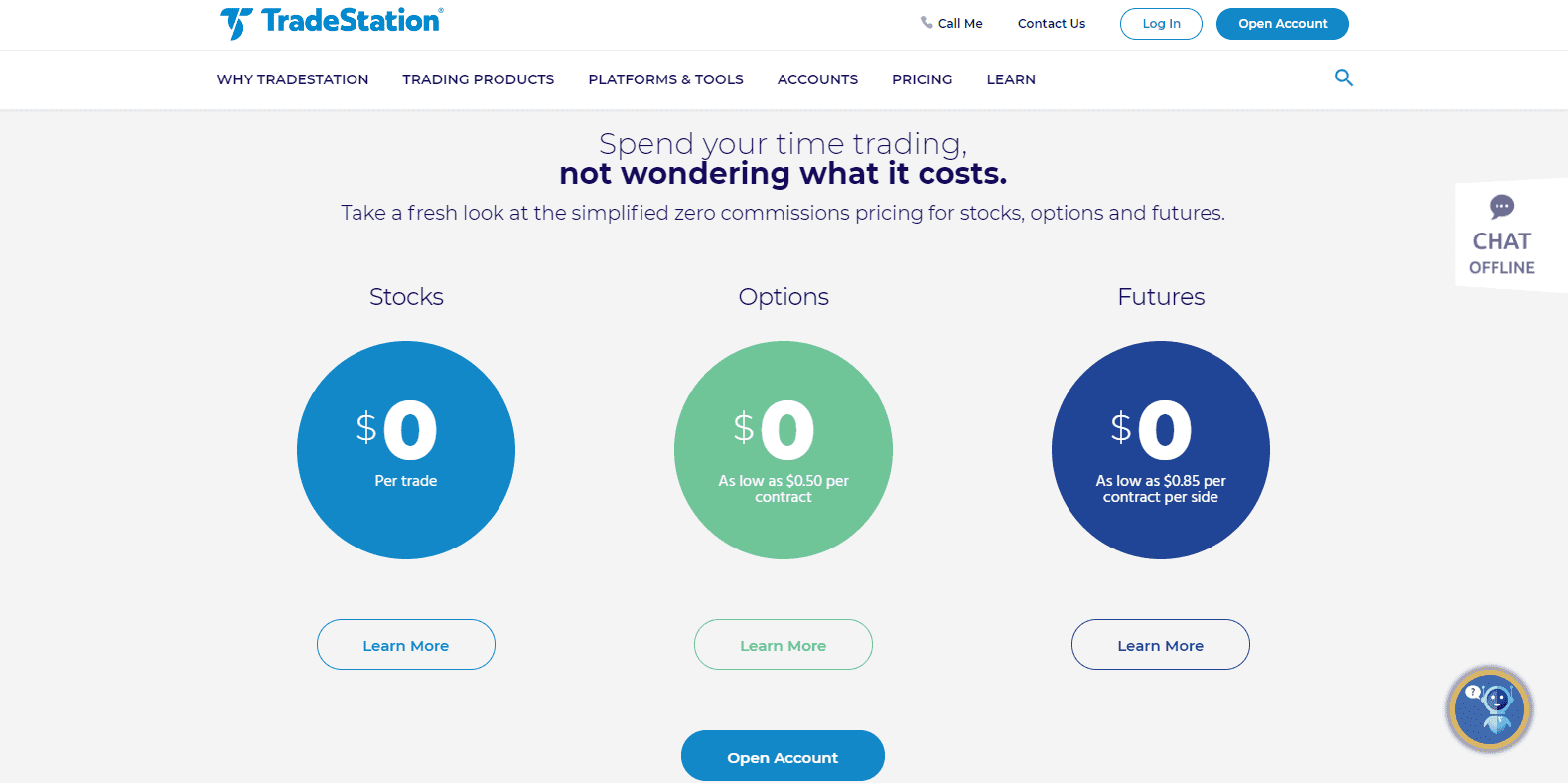

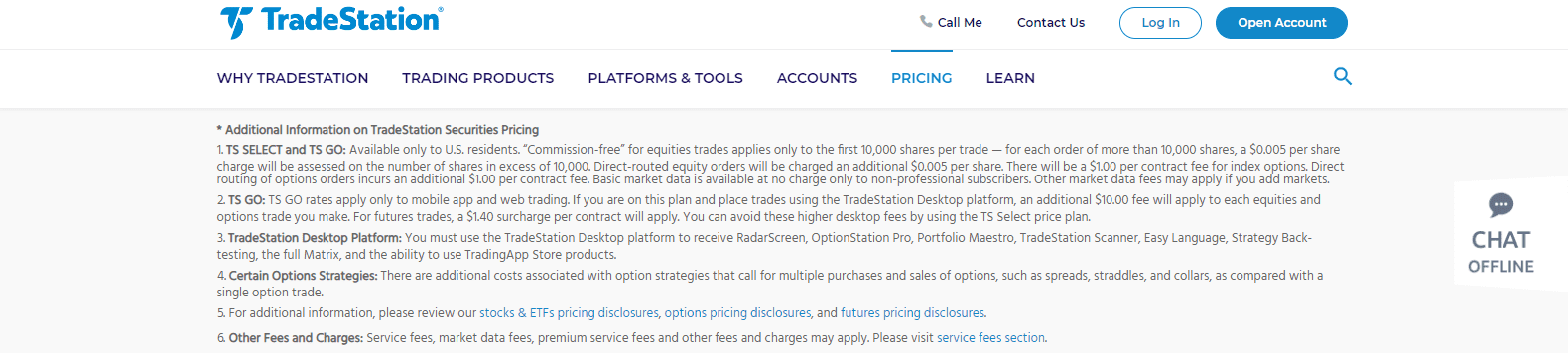

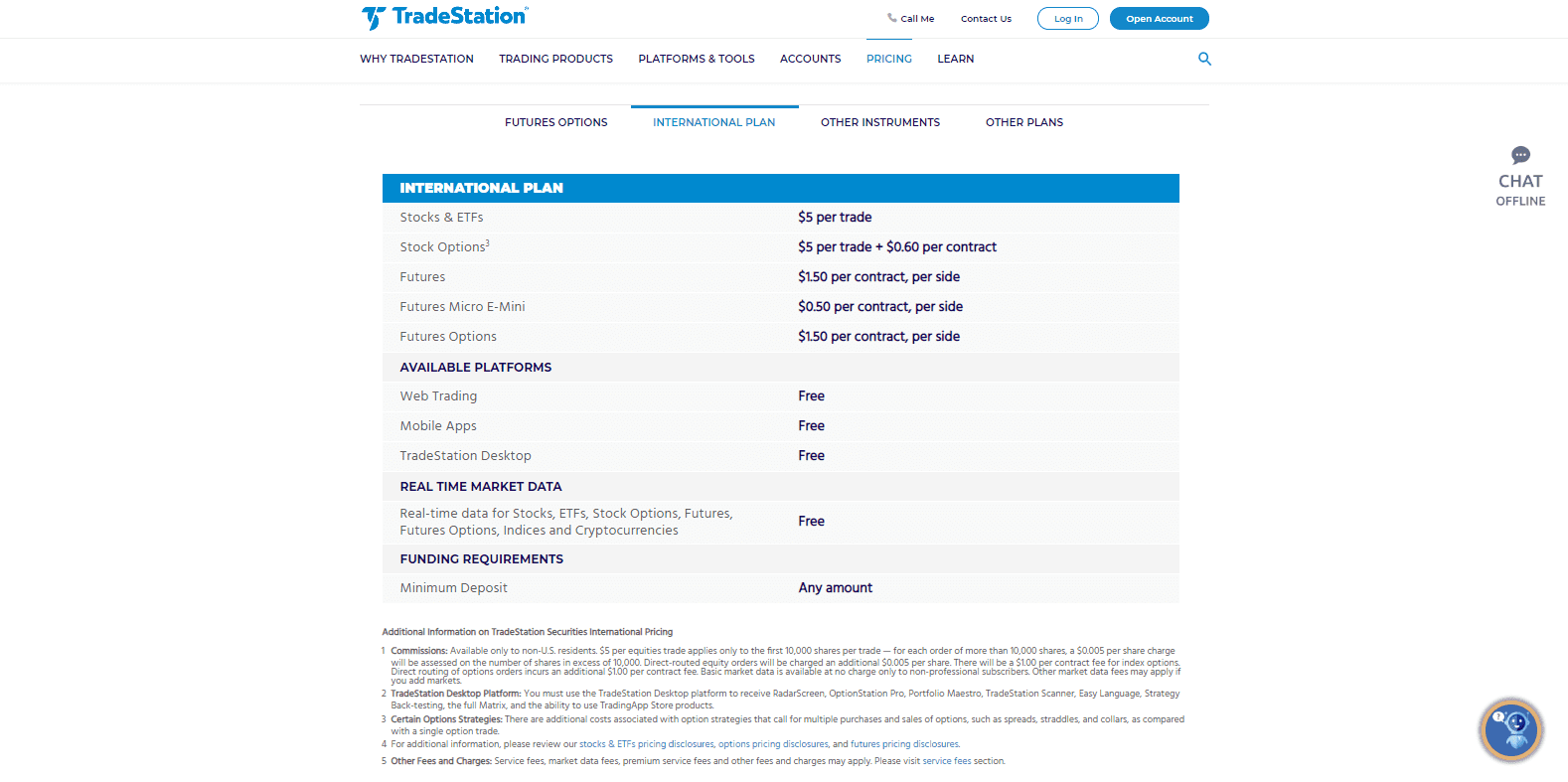

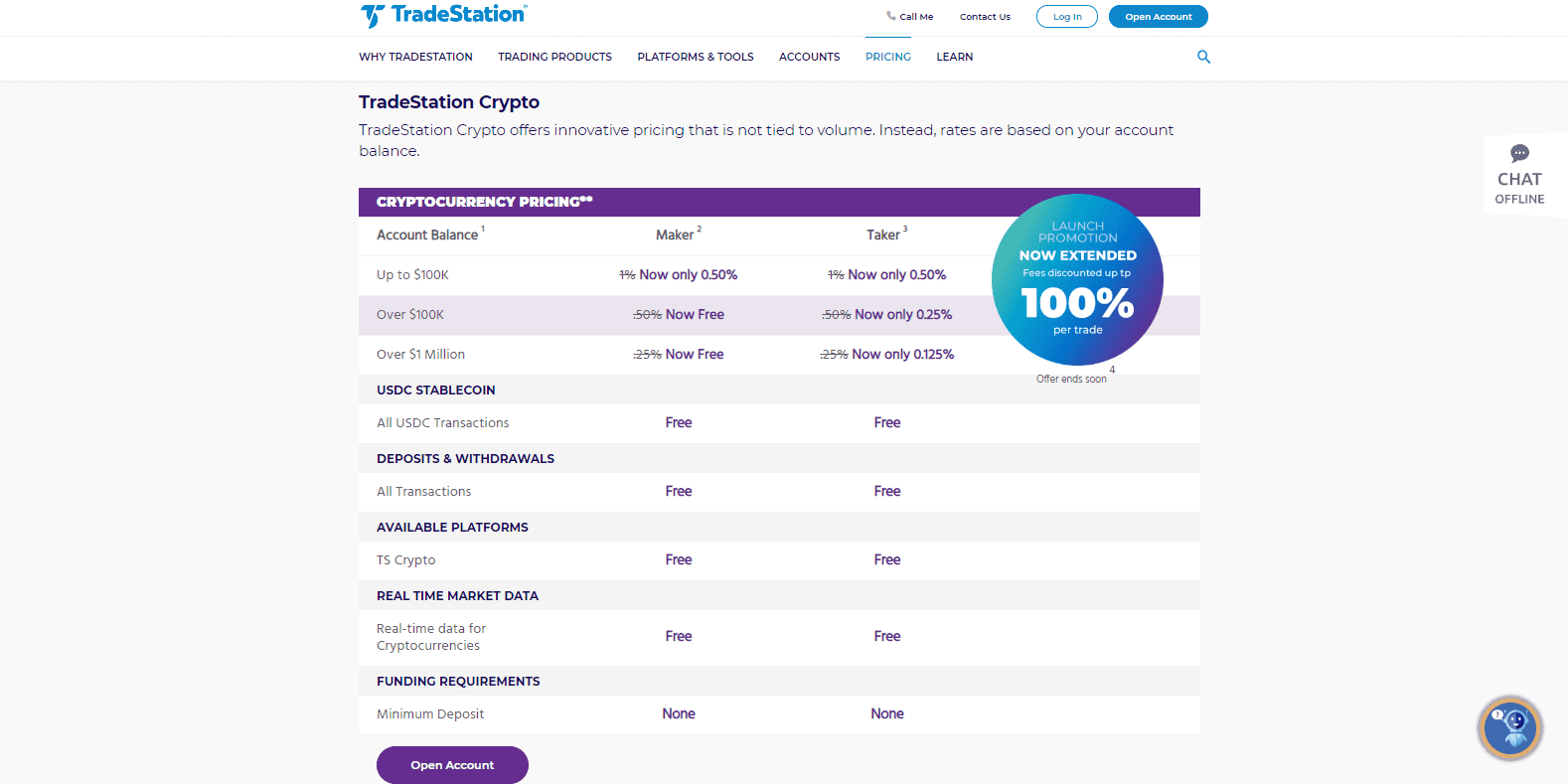

While TradeStation advertises limited commission-free equity trading, it does not disclose spreads. Stock options and futures contracts, also marketed as commission-free, face additional costs. After 10,000 shares, a fee of $0.005 per share exists, and another $0.005 for direct-routed orders. Extra fees can be as high as $10 per order, depending on the account type and trading platform. Cryptocurrency trading faces a commission as high as 1.00% per side, and margin trading carries a minimum interest rate of 3.50%. Third-party deposit and withdrawal costs apply.

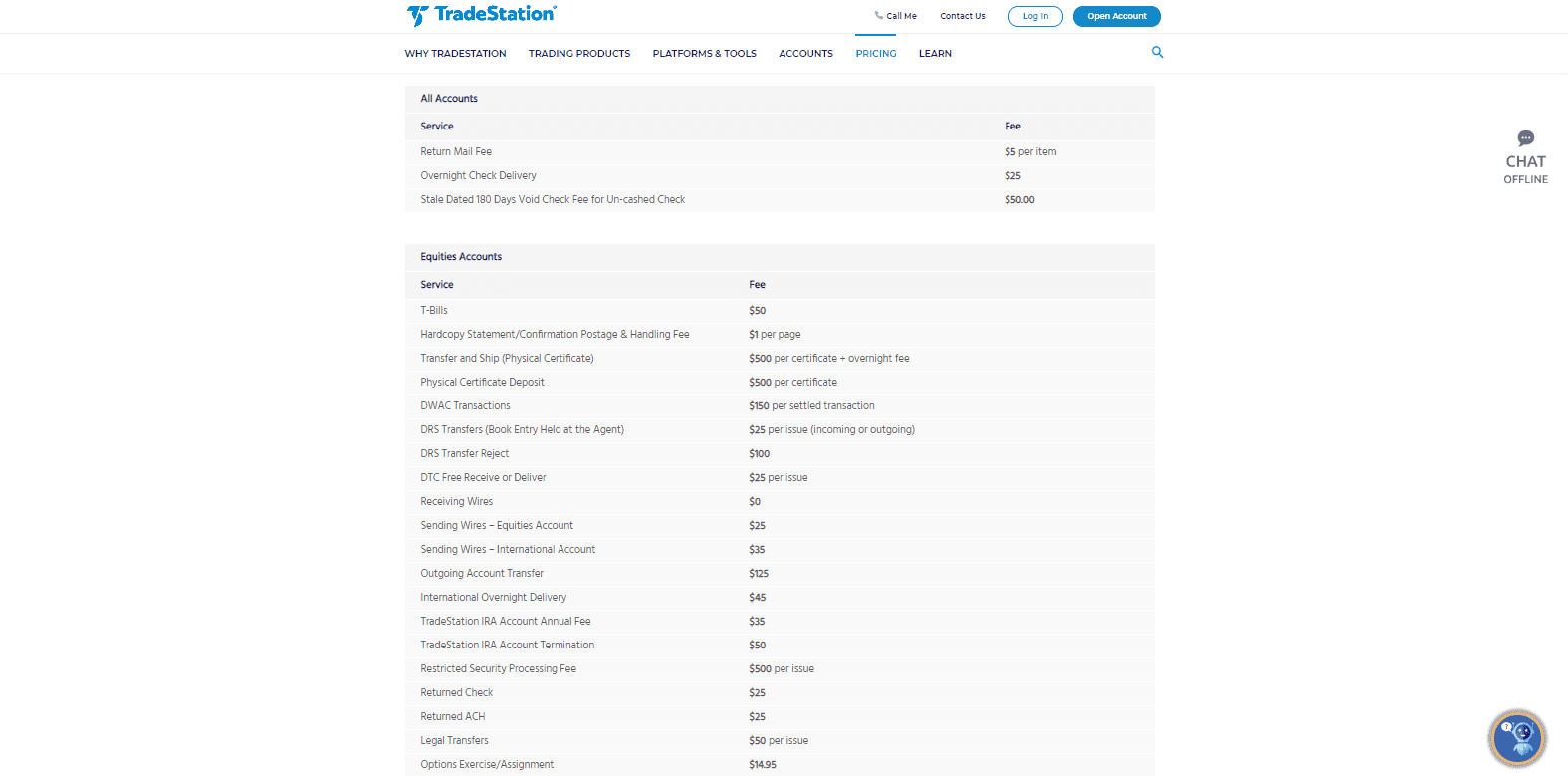

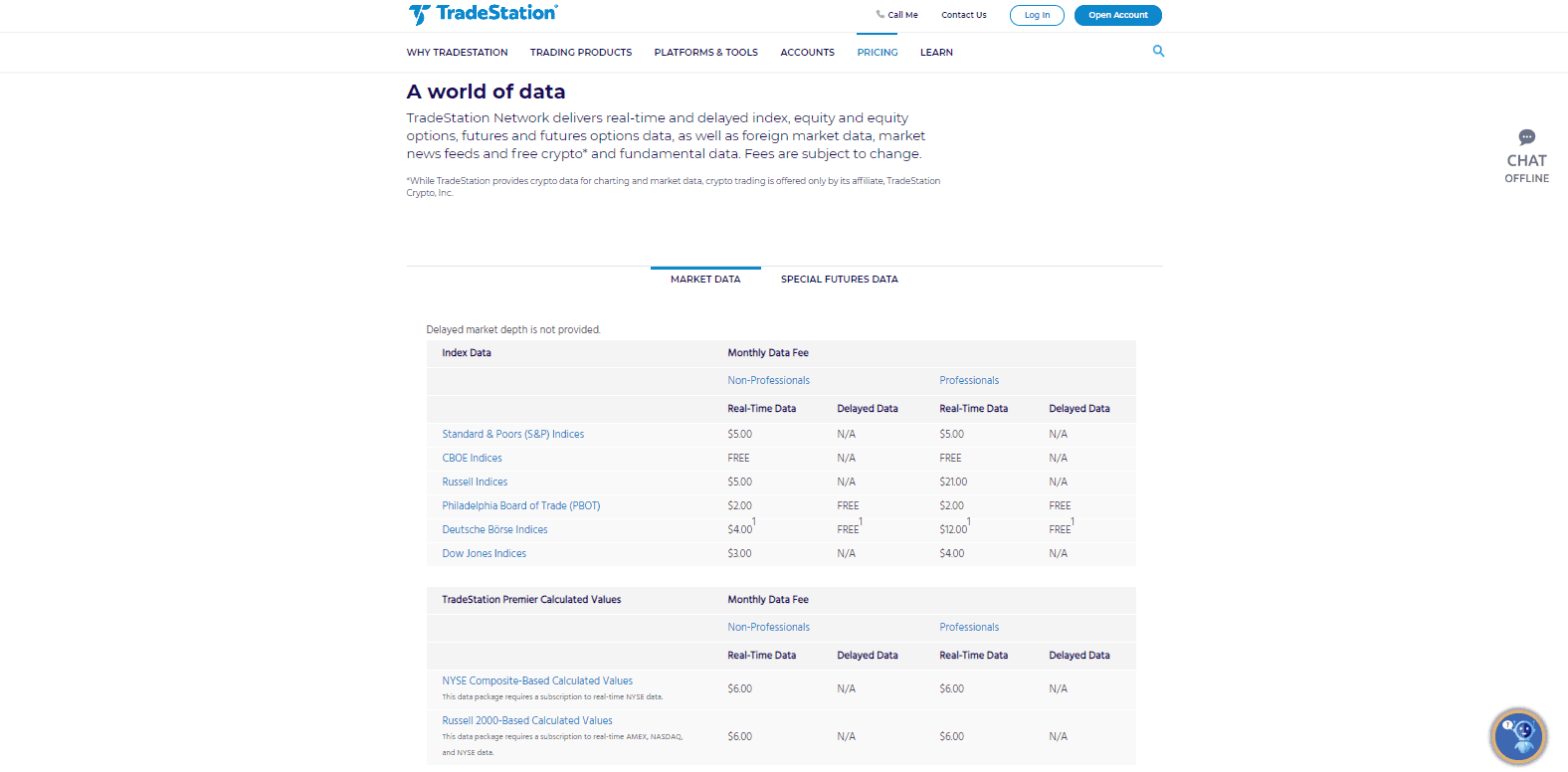

Besides the core trading costs, there are over 100 additional service surcharges and market data feeds, which will apply depending on the specific needs of a trader. TradeStation prides itself on pricing transparency, where it distinctively lags international competitors and is filled with additional costs, well-beyond commissions per trade. Before a trader can start trading, it may cost between $50 and well over $1,000 per month for access to the infrastructure and price feeds, an unacceptably high overall pricing environment.

TradeStation prides itself on pricing transparency but remains notably behind that of its international competition.

At first sight, it appears to be an attractive low-cost trading environment.

It is always crucial that potential traders read the broker's fine print, especially at TradeStation, where this broker notes additional costs.

The additional costs can add-up, especially if a trader requires more and more services.

Cryptocurrencies remain attractively priced.

Service fees at TradeStation are unacceptably elevated (there are three pages of fees listed).

Market data costs deliver the final blow to traders, from a pricing perspective (there are six pages of fees listed).

TradeStation Trading Hours

Asset Class | From | To |

|---|---|---|

Stocks (non-CFDs) | Monday 08:00 | Friday 20:00 |

ETFs | Monday 08:00 | Friday 20:00 |

Options | Monday 08:00 | Friday 20:00 |

Futures | Sunday 17:00 | Friday 17:00 |

What Can I Trade

TradeStation does not maintain a complete asset list, but several thousand are available across nine categories. Given the tremendous costs associated, most, if not all, assets listed on US exchanges are available for trading. It allows US traders one of the most comprehensive asset selections, primarily geared towards equity traders, mutual funds, and passive strategies which favor ETFs. This broker also covers the OTC market, where over ten thousand penny stocks trade, catering to one of the most intriguing sectors of the US financial market, and one of the most beneficial assets at TradeStation. The addition of cryptocurrencies adds to diversification opportunities, but the extreme costs to gain access to high-quality data must be considered.

TradeStation offers thousands of assets, though they are not comprehensively listed.

Account Types

The account structure at TradeStation is more comprehensive and confusing to new traders than at most domestic and international competitors. A thorough explanation of each type assists clients to select the one most suitable to them. Three distinct choices consist of Individual & Joint, Retirement, and Entity. Under Individual & Joint accounts, per the claim of TradeStation, the most popular selection, traders may select between Individual, Joint with Right of Survivorship, Joint Tenants in Common, and Custodial. Most retail traders will manage their portfolios for non-retirement purposes from the individual account, while retirement accounts fall under a separate category.

TradeStation maintains four retirement account options consisting of a Traditional Individual Retirement Account (IRA), a Roth IRA, a Simplified Employee Pension (SEP) IRA, and a SIMPLE (Savings Incentive Match Plan for Employees) IRA. It positions this broker as an excellent choice for all traders with a long-term outlook and desire to plan for their retirement. The choice of mutual funds and ETFs confirms a beneficial infrastructure and asset selection for retirement planning; the costs to gain access are significantly lower as compared to other assets.

Finally, there are six options for entities, geared towards Trusts, Corporations, General Partnerships, Limited Partnerships, Limited Liability Companies, and Sole Proprietorships. It increases the client-base for TradeStation to include all types of traders with solutions for their needs. A total of fourteen account types exist, eight for retail traders and retirement planning, with six account types intended for entities.

TradeStation offers fourteen account types, but most retail traders will manage their portfolios from the individual account.

Trading Platforms

Desktop 10 is the most recent version of the flagship TradeStation trading platform, offering traders the best trading environment available at this broker. The MT4 trading platform is not supported. Desktop 10 features RadarScreen, EasyLanguage, Strategy Back-Testing, Matrix, the TradingApps Store, OptionStration Pro, and Simulated Trading Mode. All are in-house developed tools, which aim to grant traders an edge. Support for automated trading support, seamless upgrades, fully customizable charts, and advanced order management complete the core features of Desktop 10.

TradeStation Web Trading is the web-based alternative available for traders who do not wish to download software. A mobile version caters to traders who want to monitor their portfolios on the go or trade from their mobile devices. TradeStation also launched a dedicated cryptocurrency trading platform, TradeStation Crypto, and developed TradeStation Futures Plus exclusively for futures options traders. All versions operate on the infrastructure maintained by this broker and feature its execution technology.

Desktop 10 is the flagship product of TradeStation.

A lighter version is available as a webtrader.

TradeStation also offers a mobile trading platform.

Two additional trading platforms, one for cryptocurrency traders and one for futures options traders, were recently launched.

Unique Features

One unique feature at TradeStation is the commitment to technology and the investment made into developing advanced solutions for various types of traders. This broker also maintains in-depth historical data, allowing for extensive back-testing of strategies through numerous well-defined historical market cycles and industry-changing events. Another fact to point out is the high-cost to receive access to products and services. While some core features are free of charge, there are more than a dozen pages of additional costs listed, a fact which cannot be ignored.

TradeStation commits ample resources to its technology infrastructure.

Research and Education

While TradeStation does not provide in-house research, TradeStation Analytics comes at a minimum cost of $99 per month, without the need to have a brokerage account. It offers traders access to the research capabilities of Desktop 10 and does not require trade execution through TradeStation. Market commentary and various financial topics are accessible at TradeStation Market Insights. The content is brief but covers the highlights without going into details. Interested traders can use the top menu for quick navigation across well-structured topics, but the overall value derived from it remains limited.

TradeStation Analytics is a subscription-based service for traders who seek access to the trading platform without a brokerage account.

TradeStation Market Insight offers brief market commentary with limited value.

An educational section contains introductory topics to trading, guides on how to use the trading platform, support forums, a FAQ category, one link to Market Insights, and another to its Trading App Store. All content is written-only, and there are just seventeen short articles for new traders to read. The approach to sincerely educating new traders does not appear genuine. TradeStation also promoted the use of trading coaches, a highly controversial topic where most new traders will pay for access to free education without obtaining valuable lessons.

Where TradeStation outperforms with technology, it fails with its approach to quality education.

The endorsement of trading coaches represents a dated and ill-advised recommendation. New traders should generally stay away from it.

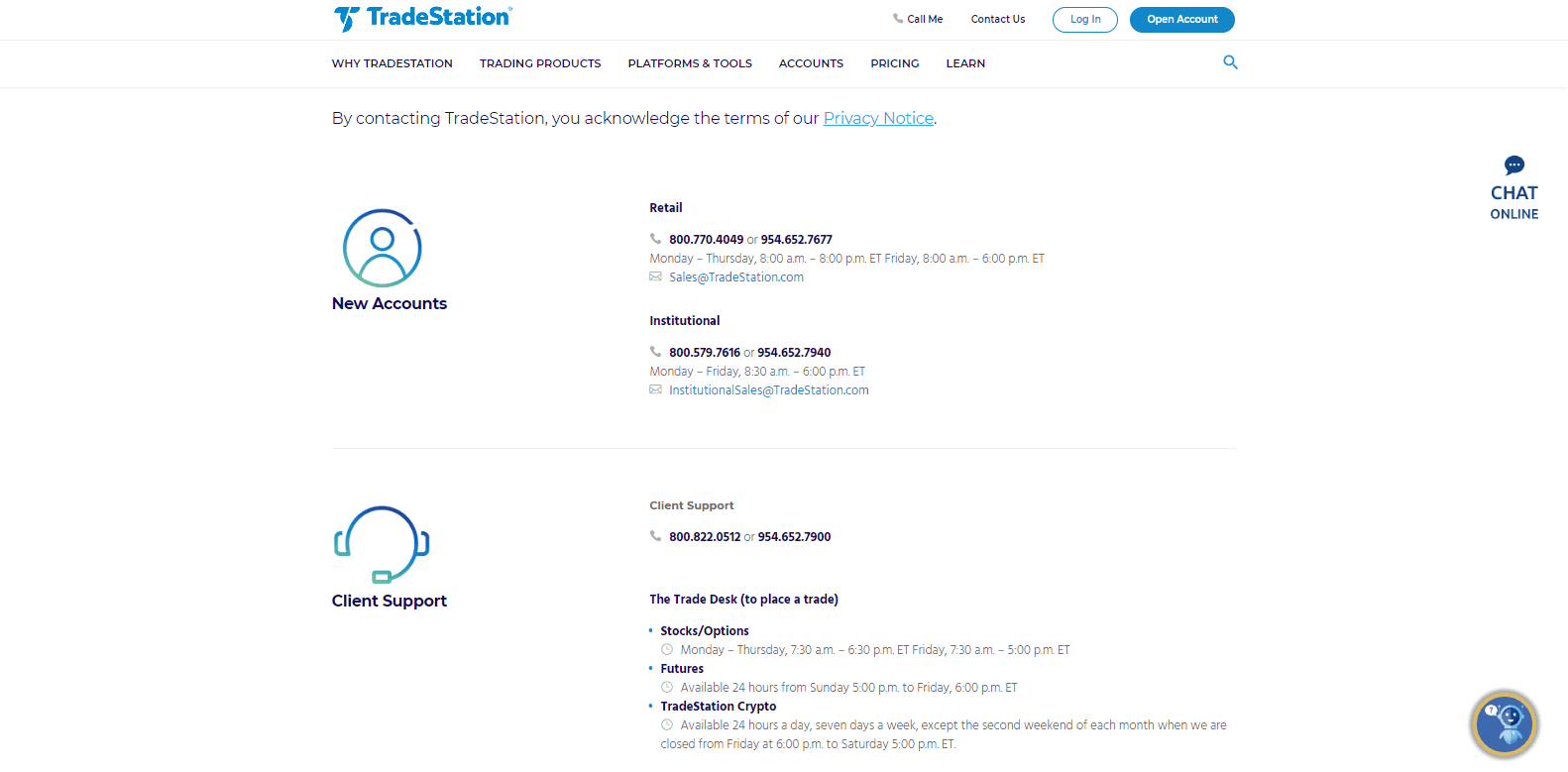

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | M - F, 0:800 am - 0:800 pm |

Website Languages |  |

TradeStation attempts to answer most questions via the FAQ section or through its support forums, which are accessible to clients only. Traders may send an e-mail, call, request a callback, or engage via live chat. Phone and live chat support are only available during regular business hours, Monday through Friday, between 8:00 am and 8:00 pm, while variations exist depending on the department and type of trader.

Traders can obtain customer support via various channels during regular business hours.

Bonuses and Promotions

TradeStation offers traders up to $5,000 to switch their accounts to them. It also maintains a stock lending program, unlocking an additional passive revenue stream on eligible positions. Terms and conditions apply, and interested traders must consider them carefully.

A $5,000 bonus program exists for traders who switch to TradeStation while a stock lending program may provide a passive revenue stream; traders should read the terms and conditions carefully.

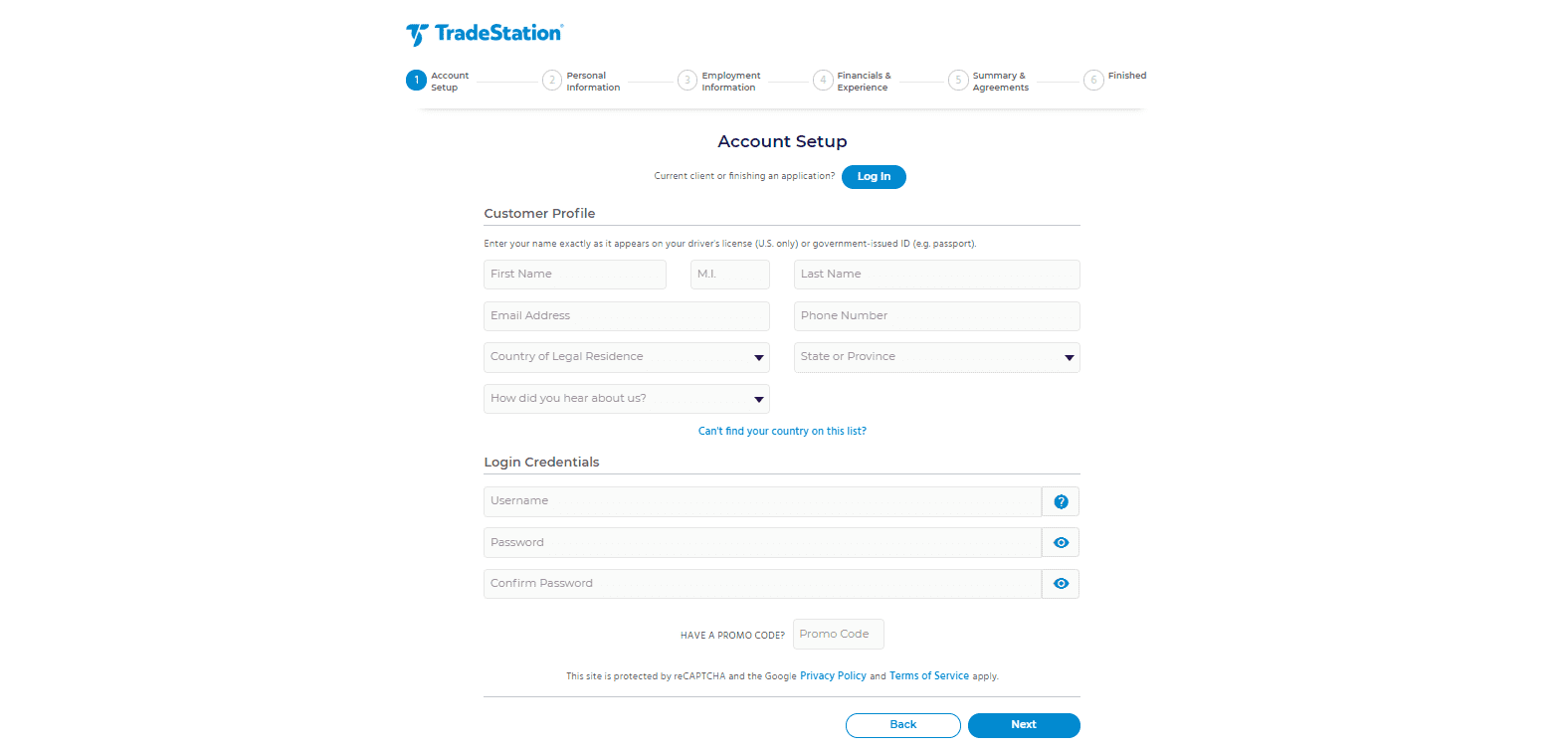

Opening an Account

A five-step online application processes new account applications, following established global industry standards. TradeStation does not list account verification requirements, but a copy of the trader's ID or driver's license should satisfy AML requirements. The chatbot had no answer to account verification and returned two-factor log-in verification.

The account opening process is standard for the industry.

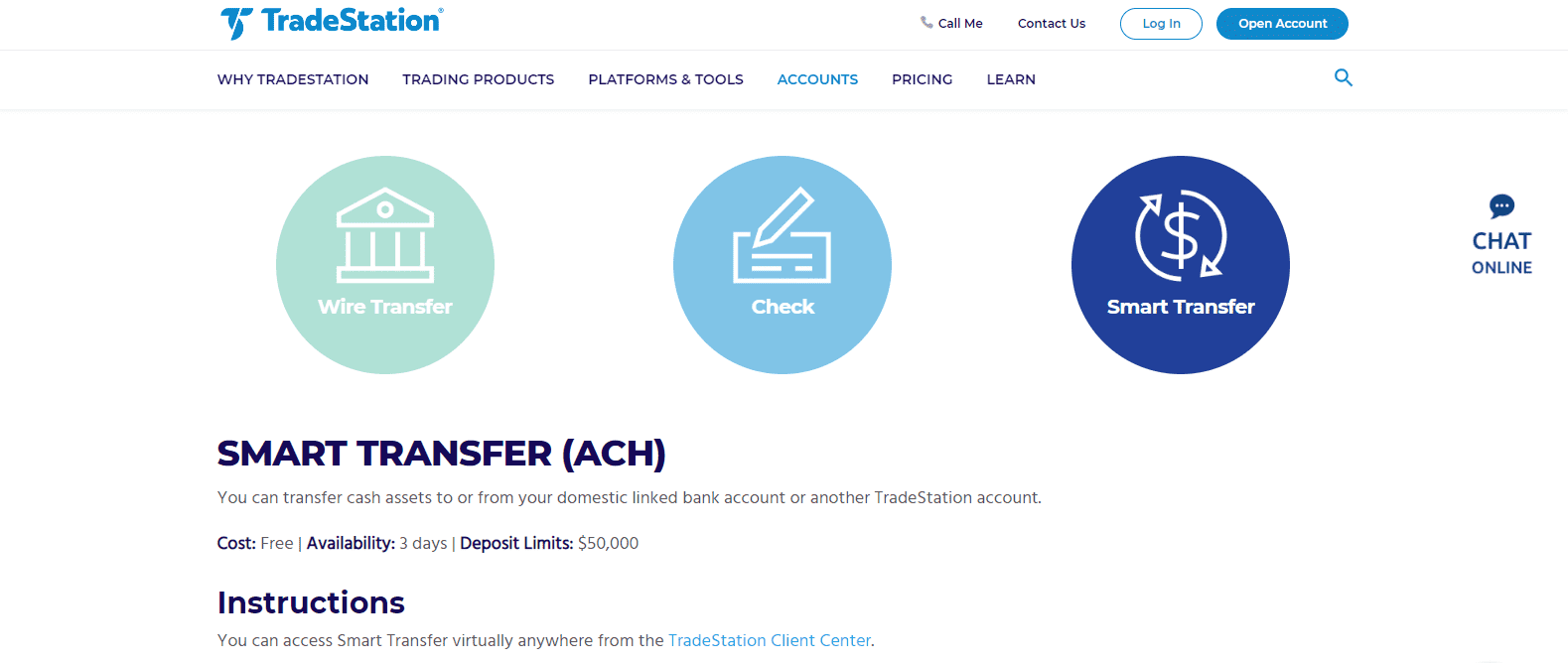

Deposits and Withdrawals

TradeStation only supports bank wires or by mailing a check. While US brokers do not allow more modern payment solutions, the choice at TradeStation is potentially the worst one available across all brokers, domestic and international. Despite the lack of options, TradeStation claims to offer a variety of ways, and points out that “time is money.” The processing times are between one and five business days, contradicting marketing efforts of efficiency. While no deposit fees apply, third-party costs may exist.

Traders have very few options for deposits and withdrawals at TradeStation.

Trading Platform

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Summary

TradeStation offers a competitive proprietary trading platform and excellent trading tools for professional traders and institutional clients. While the company foundation favored support for new traders, its present range of products and services, together with a high-cost structure, gears this broker more towards the high-end spectrum of the market. Non-clients may access the tools for a minimum of $99 per month, and clients have access to the core trading environment free of charge, but additional products and services incur a fee. The full suite can easily exceed over $1,000 per month, certain a cost to consider.

Equity, options, and futures traders remain the core client base, but the lackluster attempt to provide education confirms this broker's focus on established traders. The deployed technology infrastructure offers traders an edge, but deposit and withdrawal methods are a disappointment. The TradeStation Select account requires a minimum deposit of $2,000, placing it farther out of reach for new traders. While the TradeStation Go does not mandate a portfolio size, the cost structure is excessive. This broker is well-suited for day traders with deposits above $25,000. TradeStation remains a market leader in the US, but falls far behind well-established international competitors.

FAQs

How much does TradeStation cost per month?

It depends on the type of trader and the desired options. The core environment is available from $0 per month, but it can easily exceed $1,000 per month with added products and services.

Is TradeStation a good broker?

Advanced professional traders and institutional ones will benefit from the deployed technology and tradable assets. New retail traders with less than $25,000 in deposits will not be able to access the full range of products and services.

How much does it cost to open a TradeStation account?

The minimum deposit for TradeStation Select is $2,000. There is no minimum for TradeStation Go, but the trading fees are considerably higher.

Is the TradeStation platform free?

Clients have access to a free version, but professional tools and services come at an additional cost. Non-clients pay a minimum of $99 per month for TradeStation Analytics.

Is TradeStation safe?

Yes, this broker is safe, in part due to its corporate ownership by the Japanese financial conglomerate, Monex Group. It also has a long operating history and offers SIPC protection, where applicable.