Editor’s Verdict

TrioMarkets is an ECN/STP broker promising deep liquidity and fast order execution from its upgraded MT4 trading platform. It also features a social trading platform, VPS hosting, FIX API trading, and the MAM/PAMM module for account management. I reviewed this broker to determine if retail traders get the advertised tight spreads. Should you trust and trade with TrioMarkets?

Overview

A CySEC-Regulated Broker with Expensive and Restrictive Retail Trading Conditions

Headquarters | Cyprus |

|---|---|

Regulators | ACPR, BaFin, CNMV, CONSOB, CySEC, FSA |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2014 |

Execution Type(s) | ECN/STP |

Minimum Deposit | $250 |

Negative Balance Protection | |

Trading Platform(s) | MetaTrader 4 |

Average Trading Cost EUR/USD | 100 |

Average Trading Cost GBP/USD | 100 |

Average Trading Cost WTI Crude Oil | 100 |

Average Trading Cost Gold | 100 |

Average Trading Cost Bitcoin | 100 |

Retail Loss Rate | 100 |

Minimum Raw Spreads | 100 |

Minimum Standard Spreads | 100 |

Minimum Commission for Forex | 100 |

Funding Methods | 100 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts | |

Profit-share | Test |

Daily Loss Limit | Test Test Test Test Test |

Maximum Trailing Drawdown | Test |

Funded Account Options | Test Test Test Test Test Test v Test Test Test |

Minimum Funded Account | Test |

Maximum Funded Account | Test |

I like the MAM/PAMM modules and social trading service at TrioMarkets, primarily a Forex broker with 60+ currency pairs, where it maintains the broadest market coverage. Traders get an introductory selection of cryptocurrency and equity CFDs, catering to its social trading service, where many prefer trending assets on social media. Regrettably, the trading costs rank among the highest in the industry.

Retail Loss Rate | 78.23% |

Regulation | Yes |

Minimum Raw Spreads | 0.0pips |

Minimum Standard Spreads | 2.4 pips |

Minimum Commission for Forex | $8.00 per round lot |

Commission for CFDs / DMA | Commission-free |

Cashback Rebates | No |

Minimum Deposit | $250 |

Inactivity Fee | $30 monthly after three months |

Deposit Fee | Third-Party |

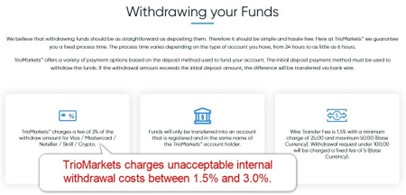

Withdrawal Fee | 1.5% - 3.0% + Third-Party |

Funding Methods | 5 |

TrioMarkets Regulation & Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders to check for regulation and verify it with the regulator by checking the provided license with their database. TrioMarkets presents clients with one regulated entity and six cross-border licenses. It also maintains an overall secure trading environment.

Country of the Regulator | Name of the Regulator | Regulatory License Number |

Cyprus | Cyprus Securities and Exchange Commission | 268/15 |

UK | Financial Conduct Authority | 702759 |

Germany | Bundesanstalt fur Finanzdienstleistungsaufsicht | 143165 |

Spain | Comisión Nacional del Mercado de Valores | 3946 |

Portugal | Comissão do Mercado de Valores Mobiliários | No license number but verified |

France | Banque De France | 60724 |

Italy | Commissione Nazionale per le Società e la Borsa | 4175 |

Is TrioMarkets Legit and Safe?

TrioMarkets is a legit and safe broker, segregating client deposits from corporate funds and offering negative balance protection. It complies with the Financial Instruments Directive 2014/65/EU or MiFID II and the EU 5th Anti-Money Laundering Directive. An investor compensation fund, per EU Directive 2014/49/EU, protects 90% of client deposits up to a limit of €20,000.

The remaining six licenses are cross-border ones as part of the EU single market. TrioMarkets obtained the UK license before Brexit and is currently under the post-Brexit temporary permissions regime. TrioMarkets remains one broker, headquartered and operational in Cyprus. It licensed its international operations to BENOR Capital Ltd, operating from Mauritius, with a regulatory license from the Financial Services Commission (license number C118023678).

Fees

I rank trading costs among the most defining aspects when evaluating an exchange, as they directly impact profitability. TrioMarkets is one of the most expensive brokers, with minimum Forex costs ranging between $24 per lot for most retail traders to $8 for portfolios above $50,000. Swap rates on leveraged overnight positions remain competitive but not enough to counter the massive mark-ups n its commission-free account and high commissions elsewhere.

Average Trading Cost EUR/USD | 100 |

|---|---|

Average Trading Cost GBP/USD | 100 |

Average Trading Cost WTI Crude Oil | 100 |

Average Trading Cost Gold | 100 |

Average Trading Cost Bitcoin | 100 |

Minimum Raw Spreads | 100 |

Minimum Standard Spreads | 100 |

Minimum Commission for Forex | 100 |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | 100 |

Maximum Evaluation Fee | 100 |

Profit-share | Test |

TrioMarkets advertises 0.0 pips raw spreads, but they are available only for deposits above $25,000 with an $11.00 commission per round lot, decreased to $8.00 for $50,000+ accounts, making it one of the most expensive cost structures for portfolios of that size that I have reviewed. Average spreads are 0.4 pips, adding $4.00 to total costs.

The pricing environment increases for everyone else, with commission-free spreads of 2.4 pips or $24.00 per round lot for most retail traders, decreased to 1.4 pips or $14.00 for deposits above $5,000. Average trading costs are higher, making TrioMarkets one of the most expensive brokers today.

The minimum trading costs for the EUR/USD in the various account types at TrioMarkets:

Minimum Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

2.4 pips (Basic) | $0.00 | $24.00 |

1.4 pips (Standard) | $0.00 | $14.00 |

0.0 pips (Advanced) | $11.00 | $11.00 |

0.0 pips (Premium) | $8.00 | $8.00 |

Here is a screenshot of the TrioMarkets quotes during the London-New York overlap session, the most liquid one, where traders usually get the lowest spreads.

One of the most ignored trading costs is swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

Noteworthy:

- TrioMarkets offers a positive swap on qualifying short positions, where traders get paid money to hold trades overnight

MT4 traders can access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights, in the Basic account for deposits below $5,000.

Taking a 1.0 standard lot buy/sell position, in the EUR/USD, at the minimum spread and holding it for one night will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

2.4 pips | $0.00 | -$5.18 | X | $29.18 |

2.4 pips | $0.00 | X | $0.63 | $23.37 |

Taking a 1.0 standard lot buy/sell position, in the EUR/USD, at the minimum spread and holding it for seven nights will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

2.4 pips | $0.00 | -$36.26 | X | $60.26 |

2.4 pips | $0.00 | X | $4.41 | $19.59 |

Range of Assets

TrioMarkets maintains a relatively limited asset selection of 140+ trading instruments, where 61 Forex currency pairs provide the broadest sector coverage. The commodity, cryptocurrency, and index selection remain minimal, while equity traders get a few dozen trending names listed in the US. TrioMarkets is primarily a Forex broker, while other sectors offer enough assets for beginners to get acquainted.

Asset List Overview

Currency Pairs | ||

|---|---|---|

Cryptocurrencies | ||

Crude Oil | ||

Gold | 5 | |

Metals | ||

Equity Indices | ||

Stocks | ||

Stocks (non-CFDs) | Test | |

ETFs | ||

Options | ||

Futures | ||

Synthetics |

TrioMarkets Leverage

The maximum TrioMarkets leverage for Forex retail traders is 1:30, per CySEC regulations, but negative balance protection exists. Equity traders get 1:5, and cryptocurrency CFDs 1:2. Professional Forex traders qualify for 1:300. Traders can compare it to maximum leverage in non-CySEC jurisdictions for retail traders, who get the industry standard of 1:500.

TrioMarkets Trading Hours (GMT +2)

Asset Class | From | To |

Cryptocurrencies | Monday 00:00 | Friday 24:00 |

Forex | Monday 00:00 | Friday 24:00 |

Commodities | Monday 01:00 | Friday 24:00 |

European Equities | Not applicable | Not applicable |

US Equities | Monday 16:30 | Friday 23:00 |

Noteworthy:

- Equity markets open and close each trading session, unlike Forex, cryptocurrencies, and commodities, which trade non-stop

- TrioMarkets does not offer 24/7 cryptocurrency trading, exposing traders to potentially massive price gaps each Monday

I recommend the following step for MT4 traders to access trading hours:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Sessions.

Account Types

Traders get two commission-free trading accounts, Basic and Standard, and two commission-based alternatives, Advanced and Premium. All four maintain uncompetitive trading conditions, especially for retail traders, related to low leverage and high trading costs. Deposits below $5,000 must accept minimum spreads of 2.4 pips or $24 per round lot, four times higher versus competitive prized brokers without minimum deposit requirements. The absence of a volume-based rebate program is notable, as TrioMarkets levies between $8.00 and $11.00 per trade. While TrioMarkets has no restrictions on trading strategies, the trading conditions make most uncompetitive or impossible.

TrioMarkets Demo Account

TrioMarkets offers a demo account, and traders may select their desired demo account balance from their profile. Unfortunately, a three-month time limit exists, which is not ideal for testing strategies and algorithmic trading solutions.

I recommend choosing a demo account balance similar to the planned live deposit amount. I also want to caution beginner traders against using a demo account as an educational tool. It creates unrealistic trading expectations, and the absence of trading psychology negates much of the educational value.

Trading Platforms

TrioMarkets offers the out-of-the-box MT4 trading platform as a desktop client, a lightweight web-based alternative, or a mobile app. It supports algorithmic trading and has an embedded copy trading service. While TrioMarkets fails to provide any third-party plugins necessary to transform the sub-standard core MT4 into an innovative version, it features its in-house upgrade TrioXtend. It promises innovative management tools, advanced trade execution, sentiment trading, sophisticated alarms, and news and market data. Account registration is necessary for more details.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

Unique Features

TrioMarkets offers the MAM/PAMM module for account management services, using the widely deployed equity allocation method, with full support for algorithmic account management. It further supports algorithmic traders with VPS hosting in partnership with ForexVPS or HokoCloud. The FIX API caters to demanding trades with proprietary, innovative trading solutions. TrioMarkets also offers what appears as a proprietary social trading service alongside the embedded MT4 copy trading function.

Research & Education

TrioMarkets neither publishes in-house research nor provides third-party alternatives. Given the abundance of online services available, I do not consider the absence of research a negative, but it creates a services gap versus full-service brokerages. TrioMarkets writes market commentary and publishes it on Instagram.

Education for beginner traders is unavailable, a notable absence but not uncommon in brokers with asset management and copy trading services. I recommend traders source third-party educational material before considering an account with TrioMarkets.

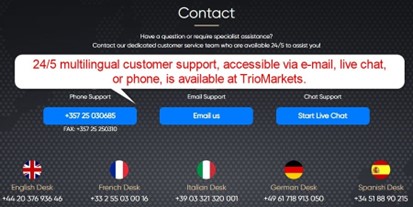

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |      |

TrioMarkets offers 24/5 multilingual customer support, accessible via e-mail, live chat, or phone. The FAQ section remains limited, failing to answer many questions, and some TrioMarkets products require more explanations.

A direct line to the finance department where most issues may arise is missing, but phone support exists. Live chat is ideal for non-urgent matters.

Bonuses and Promotions

TrioMarkets, due to CySEC restrictions, neither offers bonuses nor promotions. Its partnerships section caters to affiliate marketers and introducing brokers.

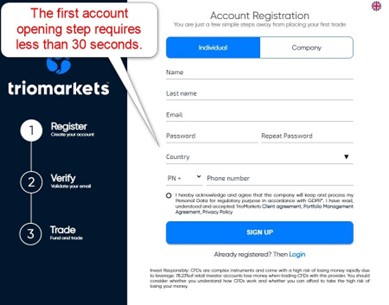

Opening an Account

An online application handles new account openings, asking for name, e-mail, desired password, country, and valid mobile phone number. There is no verification of responses necessary, and traders may answer at will.

Account verification is a mandatory step, and most traders will satisfy it by sending a copy of their ID and one proof of residency document.

Minimum Deposit

The minimum deposit at TrioMarkets is $250, higher than the industry average.

Payment Methods

TrioMarkets accepts bank wires, credit/debit cards, Skrill, Neteller, and cryptocurrencies.

Accepted Countries

TrioMarkets caters to many international traders, but will not accept residents of the US, Israel, Iran, Indonesia, North Korea, or Belgium.

Deposits and Withdrawals

The secure TrioMarkets back office manages all financial transactions.

The minimum deposit is $250, higher than most competitive brokers. Only verified accounts may request withdrawals, and the processing times are between 6 to 24 hours. It can take several business days for traders to get their funds, payment processor dependent. TrioMarkets charges an unacceptable 3.00% internal withdrawal fee plus third-party costs on all payment processors except for bank wires, where TrioMarkets charges 1.5%, with a $25 minimum and $50 maximum fee.

Is TrioMarkets a good broker?

I like the trading environment at TrioMarkets for its MAM/PAMM modules, social trading services, VPS hosting, and FIX API trading. Regrettably, I cannot ignore the unacceptable trading costs at TrioMarkets, up to 400% above competitors, and the internal withdrawal fee of 3.0%, which I consider punishment for withdrawing funds. TrioMarkets advertises well but has conflicting information on its website and maintains an overall uncompetitive trading environment. Despitesome excellent qualities, I cannot recommend this broker to anyone unless it addresses issues with its core offering, primarily trading costs and other fees.

Marius Regulation

Country of the Regulator | United Arab Emirates |

|---|---|

Name of the Regulator | ACPR, BaFin, CNMV, CONSOB, CySEC, FSA |

Regulatory License Number | 1234 |

Regulatory Tier | 1, 2, 3, 4 Test |

Marius Overview

Headquarters | Cyprus |

|---|---|

Regulators | ACPR, BaFin, CNMV, CONSOB, CySEC, FSA |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2014 |

Execution Type(s) | ECN/STP |

Minimum Deposit | $250 |

Negative Balance Protection | |

Trading Platform(s) | MetaTrader 4 |

Average Trading Cost EUR/USD | 100 |

Average Trading Cost GBP/USD | 100 |

Average Trading Cost WTI Crude Oil | 100 |

Average Trading Cost Gold | 100 |

Average Trading Cost Bitcoin | 100 |

Retail Loss Rate | 100 |

Minimum Raw Spreads | 100 |

Minimum Standard Spreads | 100 |

Minimum Commission for Forex | 100 |

Funding Methods | 100 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts | |

Profit-share | Test |

Daily Loss Limit | Test Test Test Test Test |

Maximum Trailing Drawdown | Test |

Funded Account Options | Test Test Test Test Test Test v Test Test Test |

Minimum Funded Account | Test |

Maximum Funded Account | Test |

Marius Assets instruments

Currency Pairs | ||

|---|---|---|

Cryptocurrencies | ||

Crude Oil | ||

Gold | 5 | |

Metals | ||

Equity Indices | ||

Stocks | ||

Stocks (non-CFDs) | Test | |

ETFs | ||

Options | ||

Futures | ||

Synthetics |

Marius Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

Marius Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |      |

Marius Trading Hours

Asset Class | From | To |

|---|---|---|

Gold | Sunday 22:00 | Friday 20:59 |

Equity Indices | Monday 01:01 | Friday 23:59 |

Stocks | Monday 01:01 | Friday 23:59 |

Marius Fees

Average Trading Cost EUR/USD | 100 |

|---|---|

Average Trading Cost GBP/USD | 100 |

Average Trading Cost WTI Crude Oil | 100 |

Average Trading Cost Gold | 100 |

Average Trading Cost Bitcoin | 100 |

Minimum Raw Spreads | 100 |

Minimum Standard Spreads | 100 |

Minimum Commission for Forex | 100 |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | 100 |

Maximum Evaluation Fee | 100 |

Profit-share | Test |

Marius Payments Methods

Withdrawal options |       |

|---|---|

Deposit options |       |

FAQs

What are the TrioMarkets account types?

TrioMarkets offers two commission-free and two commission-based accounts, but all feature high trading costs.

How to leave a review about TrioMarkets on the Traders Union website?

Traders may either sign-up to Traders Union or leave a review via Facebook.

Do reviews by traders influence the TrioMarkets rating?

Each review by traders can impact the overall trend online, but traders should approach them cautiously. Brokers with sub-standard products and services can pay for positive reviews or purchase awards. Competitors can pay for negative reviews, while traders who have lost money may leave negative reviews.

Is TrioMarkets safe?

TrioMarkets is a safe broker regulated in Cyprus with six cross-border licenses. It segregates client deposits from corporate funds, offers negative balance protection, and has an investor compensation fund.