Editor’s Verdict

VT Markets caters to 400K+ traders from 160+ countries who place 30M+ trades worth 300B+ in monthly trading volumes. Founded in 2015, headquartered in Australia, and compliant with three regulators, VT Markets presents a competitive STP trading environment with a balanced asset selection. I rank VT Markets among the best Forex brokers for demanding traders that rely on fast order execution from a trusted source. I conducted an in-depth analysis of the VT Markets trading environment. Is VT Markets the best Forex broker for your trading requirements?

Overview

VT Markets offers traders fast order execution in a genuine STP trading environment.

Headquarters | Australia |

|---|---|

Regulators | ASIC, FSC Mauritius, FSCA |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2015 |

Execution Type(s) | ECN/STP |

Minimum Deposit | 100$ |

Negative Balance Protection | |

Trading Platform(s) | Other, MetaTrader 4, MetaTrader 5, Trading View |

Average Trading Cost EUR/USD | $8.00 |

Average Trading Cost GBP/USD | $8.00 |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.07 |

Average Trading Cost Bitcoin | Not applicable |

Retail Loss Rate | Undisclosed |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 1.2 pips |

Minimum Commission for Forex | $6.00 per 1.0 standard round lot |

Funding Methods | 10 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

VT Markets Five Core Takeaways:

- Competitive trading fees, including low swap rates

- User-friendly mobile app

- Active Trader Program paying up to 13% annually on eligible funds

- Up to $50 monthly VPS refunds for active traders

- No cryptocurrency trading, deposits, and withdrawals

VT Markets Regulation & Security

Country of the Regulator | Australia, Mauritius, South Africa |

|---|---|

Name of the Regulator | ASIC, FSC Mauritius, FSCA |

Regulatory License Number | 516246, 50865, GB23202269 |

Regulatory Tier | 1, 2, 4 |

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend that traders check regulations and verify them with the regulator by double-checking the provided license with their database. VT Markets has three regulated entities with a clean track record.

Is VT Markets Legit and Safe?

My VT Markets review found no verifiable misconduct or malpractice by this broker, founded in 2015. Therefore, I recommend VT Markets as a legitimate and safe broker.

VT Markets regulation and security components:

- Regulated by the Australian Securities & Investments Commission (ASIC), the South African Financial Sector Conduct Authority (FSCA), and the Financial Services Commission of Mauritius (FSC).

- Founded in 2015

- Segregation of client deposits from corporate funds

- Negative balance protection

- Independent audits by the Hong Kong-based Financial Commission and an investor compensation fund of up to €20,000 per trader

- $1M liability insurance per trader arranged by Willis Towers Watson and underwritten by syndicates at Lloyd’s of London

What would I like VT Markets to add?

VT Markets ticks all the boxes from a security perspective. The only item that needs to be added is more transparency about its core management team.

Fees

Average Trading Cost EUR/USD | $8.00 |

|---|---|

Average Trading Cost GBP/USD | $8.00 |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.07 |

Average Trading Cost Bitcoin | Not applicable |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 1.2 pips |

Minimum Commission for Forex | $6.00 per 1.0 standard round lot |

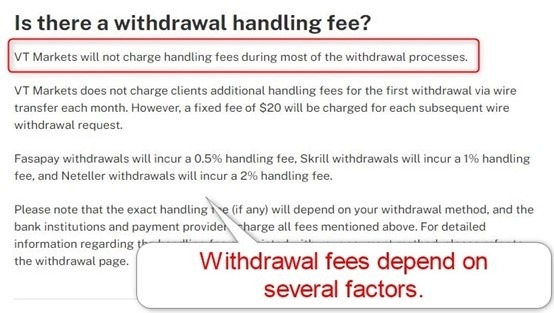

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | No |

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability. Traders can choose from an expensive commission-free account with minimum spreads of 1.2 pips or $12.00 per 1.0 standard round lot or the competitively priced commission-based alternative featuring raw spreads from 0.0 pips for a $6.00 commission per 1.0 standard round lot, a 50% reduction in minimum trading fees.

VT Markets does not levy inactivity, deposit, or withdrawal fees; third-party processing costs may apply. During my VT Markets review, I found no mention of currency conversion fees, other than several sources noting that VT Markets will take the currency exchange rate of its liquidity providers.

The minimum trading costs for the EUR/USD at VT Markets are:

Minimum Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

1.2 pips (Standard) | $0.00 | $12.00 |

0.0 pips (Raw) | $6.00 | $6.00 |

Here is a snapshot of VT Markets’ spreads during the London-New York crossover session, when traders usually will get the tightest spreads:

Swap rates on leveraged overnight positions are the most ignored trading costs. Depending on the trading strategy, they may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights in the commission-free VT Markets account.

Taking a 1.0 standard lot buy/sell position in the EUR/USD, at the minimum spread and holding it for one night in the commission-based VT Markets Raw account will cost the following:

Order type | Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

Buy | 0.0 pips | -$6.00 | -$5.48 | X | -$11.48 |

Sell | 0.0 pips | -$6.00 | X | $2.48 | -$3.52 |

Taking a 1.0 standard lot buy/sell position in the EUR/USD, at the minimum spread and holding it for seven nights in the commission-based VT Markets Raw account will cost the following:

Order type | Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

Buy | 0.0 pips | -$6.00 | -$38.36 | X | -$44.36 |

Sell | 0.0 pips | -$6.00 | X | $17.38 | $11.38 |

Noteworthy:

- VT Markets can offer positive swap rates on qualifying assets, allowing traders to earn money.

Range of Assets

VT Markets offers 1,000+ assets for MT5 and 400+ for MT4. The asset selection covers Forex, commodities, indices, equity CFDs, ETFs, and bonds. I like the overall asset selection, but there is no cryptocurrency trading.

VT Markets offers the following assets:

- 40+ Forex pairs

- 23 energies, precious metals, and soft commodities

- 26 indices

- 800+ equity CFDs listed in the US, UK, EU, and Hong Kong

- 50+ ETFs

- 7 bonds

Asset List Overview

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

VT Markets Leverage

Maximum Retail Leverage | 1:500 |

Maximum Pro Leverage | 1:500 |

What should traders know about VT Markets’s maximum leverage?

- Maximum retail Forex and index leverage is 1:500

- Energies max out at 1:500

- Precious metals, soft commodities, and bonds have a maximum leverage of 1:100

- ETF traders max out at 1:33

- Equity traders receive 1:20

- Not all assets within a sector qualify for the maximum leverage

- Negative balance protection exists, ensuring traders cannot lose more than their deposit

- Traders should always use appropriate risk management with leveraged trading to avoid magnified trading losses

Trading Hours

Asset Class | From | To |

|---|---|---|

Currency Pairs | Monday 00:01 | Friday 23:57 |

Commodities | Monday 01:00 | Friday 24:00 |

Crude Oil | Monday 01:00 | Friday 24:00 |

Gold | Monday 01:01 | Friday 23:57 |

Metals | Monday 01:01 | Friday 23:57 |

Equity Indices | Monday 01:00 | Friday 24:00 |

Stocks | Monday 10:05 | Friday 23:00 |

Bonds | Monday 01:00 | Friday 24:00 |

ETFs | Monday 16:30 | Friday 23:00 |

Futures | Monday 01:00 | Friday 24:00 |

Account Types

Traders can choose between a more expensive commission-free and a more competitively priced commission-based account. VT Markets also offers a Cent account, a demo account, and a swap-free Islamic account.

My observations concerning the VT Markets account type are:

- A $100 minimum deposit requirement

- Maximum retail leverage of 1:500

- The account base currencies are USD, EUR, GBP, AUD, CAD, and HKD

- Up to 100GB/s of bandwidth network

- STP order execution

- Raw spread trading from 0.0 pips

- Deep liquidity pools

- A minimum transaction size of 0.01 lots

- $6.00 per 1.0 standard round lot commissions for Forex traders

- 13% annual interest earnings at 0.25% weekly for active traders

VT Markets Demo Account

Demo trading does not grant exposure to trading psychology and can create unrealistic trading expectations. Therefore, I want to caution beginner traders when using demo trading as an educational tool, and they should consider its limitations.

What stands out about the VT Markets demo account?

- VT Markets offers demo accounts.

- An expiry after 90 days

- Customizable MT4/MT5 demo accounts

- A demo account requires registration but not account verification

Trading Platforms

VT Markets offers a full suite of MT4/MT5 trading platforms, TradingView for social traders, and its proprietary VT Markets App for mobile traders. MT4/MT5 are available as powerful desktop clients, lightweight web-based alternatives, and popular mobile apps.

I recommend the desktop client, as they offer all the functions, including algorithmic trading. Traders can upgrade MT4 via 25,000+ custom indicators, templates, and EAs, while MT5 features 10,000+. VT Markets also upgrades MT4 with the Trading Central plugin if traders deposit a minimum of $200.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Unique Features

During my VT Markets review, the MAM/PAMM accounts for multi-account management and traditional account management services stood out. I also want to note the in-house copy trading service. It offers followers 100+ signal providers, and signal providers can unlock an additional revenue stream.

Research & Education

VT Markets relies on Trading Central for most of its research. All traders can access it from their dashboard under Pro Trader tools, while MT4 traders get the plugin. Traders also receive a well-written daily analysis with actionable trading signals and a weekly market forecast. I rank research at VT Markets among the best-quality ones in the industry.

What about education at VT Markets?

Beginners get a well-structured educational course split into beginner and intermediate lessons. It also features a dedicated Forex trading educational section and an MT4/MT5 guide. It is an excellent source of information.

My conclusion:

- I advise first-time traders to consider the high-quality educational content published by VT Markets.

- Beginners should also seek in-depth education from third parties focusing on trading psychology and the relationship between leverage and risk management.

- Avoid paid-for courses and mentors.

Customer Support

Traders get 24/7 customer service via live chat. Alternatively, they can e-mail VT Markets, which states that the average response time is between one and three business days. The help centre answers many questions organized into nine categories, and I recommend it as a first point of contact.

Customer Support Methods |   |

|---|---|

Support Hours | 24/7 |

Website Languages |         |

Bonuses and Promotions

During my VT Markets review, six bonuses and promotions could benefit traders. Terms and conditions apply, and I recommend traders read and understand them before accepting incentives.

Here are the VT Markets bonuses and promotions:

- The VT Markets ClubBleu loyalty program rewards Trade Points to every trade that traders can redeem for 10+ exclusive offers, including cash redemptions and prizes

- A $200 refer-a-friend program that requires referees to trade 5.0 standard round lots within 60 days

- A 50% welcome bonus for all account types and deposit sizes

- A 20% deposit bonus for deposits above $1,000 up to a maximum bonus of $10,000

- An active trader program that pays up to 13% annually on eligible funds at a rate of 0.25% weekly, payable monthly

- A VPS refund for depositors above $1,000 with refunds of $25 or $50, dependent on monthly trading volume

Awards

VT Markets has dozens of industry awards. Three of the most recent ones include the Best STP Broker for Beginners 2024 award by FX Empire, The Most Accessible Trading Brokerage 2024 award by Acquisition International, and the Fastest Growing Multi-Asset Broker Europe 2024 award by the Cosmopolitan Daily Business Awards.

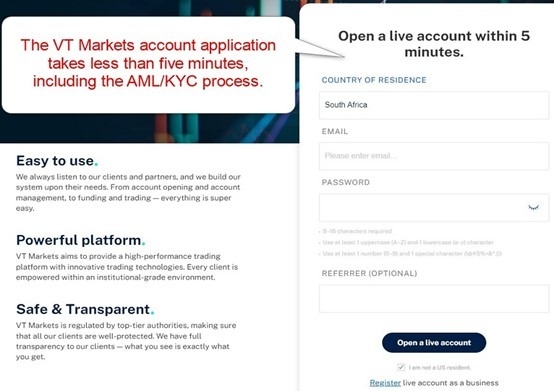

Opening an Account

The online VT Markets account application states a 5-minute process. Traders can start by submitting their country of residence, e-mail, and desired password, which grants access to the dashboard. The rest is the KYC procedure without data mining.

What should traders know about the VT Markets account opening process?

- VT Markets complies with global AML/KYC requirements

- Account verification is mandatory

- Most traders can pass verification by uploading a copy of a government-issued ID and one proof of residency document.

- VT Markets may ask for additional information on a case-by-case basis.

Minimum Deposit

The minimum deposit at VT Markets is $100 ($50 for the Cent account).

Payment Methods

Withdrawal options |         |

|---|---|

Deposit options |         |

VT Markets supports bank wires, credit/debit cards, UnionPay, Mobile Pay, Skrill, Neteller, FasaPay, Vietnam instant bank wire transfer (only for clients from Vietnam), EU bank transfer (only for clients from the EU), and Thailand instant bank transfer (only for clients from Thailand).

Accepted Countries

VT Markets accepts traders who are residents of most countries, except the United States, Canada, Singapore, and Russia, as well as jurisdictions listed on the FATF and global sanctions lists.

Deposits and Withdrawals

The secure VT Markets dashboard handles all financial transactions for verified clients.

What are the key takeaways from the deposit and withdrawal process at VT Markets?

- The minimum deposit is $100, except for the Cent account, which requires a $50 minimum deposit.

- VT Markets does not levy internal deposit fees.

- The withdrawal fee depends on the payment processor, but some withdrawals are free of charge.

- External processing times and fees depend on the payment processor, but VT Markets offers near-instant processing time for e-wallets and three to seven business days for bank wires and credit/debit cards.

- In compliance with AML regulations, the name of the trading account and payment processor must be identical.

- VT Markets will send the deposit amount back to the funding method.

Is VT Markets a good broker?

I like the trading environment at VT Markets for its deep liquidity, STP trading environment, and competitive trading fees. The asset selection is good, except for the absence of cryptocurrencies. VT Markets offers excellent beginner research and education and upgrades MT4 with the Trading Central plugin. The rewards for active traders are superb and decrease final trading costs. I highly recommend VT Markets to beginners and seasoned traders, as it is a well-managed brokerage with a clean track record and industry-leading client protection.

FAQs

Is VT Markets legit in Canada?

VT Markets does not accept Canadian-resident traders.

What is the minimum deposit for VT Markets?

The VT Markets minimum deposit is $100, except for the $50 requirement for Cent accounts.

Can you withdraw money from VT Markets?

Traders can withdraw money via bank wires, credit/debit cards, UnionPay, Mobile Pay, Skrill, Neteller, FasaPay, Vietnam instant bank wire transfer (only for clients from Vietnam), EU bank transfer (only for clients from the EU), and Thailand instant bank transfer (only for clients from Thailand).

Is VT Markets a regulated broker?

Yes, the Australian Securities & Investments Commission (ASIC), the South African Financial Sector Conduct Authority (FSCA), and the Financial Services Commission of Mauritius (FSC) regulate VT Markets.