Windsor Brokers Editor’s Verdict

Windsor Brokers began its journey in 1988 and has since been able to withstand the test of time. This broker compares itself to an olive tree and the positive characteristics it believes it to resemble, while citing its purpose as to place its clients first. The model continues to work well, and Windsor Brokers enjoys the trust of its growing client base, including a distinct focus on the Middle East. Traders have two account types. Regrettably, only the core MT4 trading platform is available; while the MT4 is, indeed, a market favorite, offering only the out-of-the-box version places traders at a disadvantage. The asset selection remains limited but are sufficient for new retail traders and those traders with smaller portfolios.

Overview

Windsor Brokers maintains a quality in-house research team, and new traders can benefit from a competitive educational section.

Headquarters | Cyprus |

|---|---|

Regulators | CySEC, FSC Belize |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 1988 |

Execution Type(s) | ECN/STP, Market Maker |

Minimum Deposit | $100 |

Trading Platform(s) | MetaTrader 4 |

Average Trading Cost EUR/USD | 0.2 pips ($2.00) |

Average Trading Cost GBP/USD | 0.6 pips ($6.00) |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.13 |

Average Trading Cost Bitcoin | $20.00 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Regulation and Security

The Belize International Financial Services Commission (IFSC) regulates Windsor Brokers (BZ), which caters to international traders. This subsidiary also offers the best trading conditions. Increasing the protection of client deposits is a €5,000,000 insurance policy. Windsor Brokers displays its understanding of a business-friendly regulator that grants traders a competitive trading environment and the importance of providing additional protection. Seldon Investments Limited/Jordan is the Windsor Brokers subsidiary, authorized by the Jordan Securities Commission (JSC). This subsidiary caters to clients based in the Middle East. Windsor Brokers is a rare international broker with oversight in Jordan.

Traders based in the EU must trade with Windsor Brokers Ltd, a Cypriot Investment Firm (CIF), licensed by the Cyprus Securities and Exchange Commission (CySEC). The disadvantage to EU-based brokers is one of the most uncompetitive trading environments due to the ESMA changes. Unfortunately, EU traders have no other option, as the IFSC unit does not cater to them. Client funds remain segregated at all three subsidiaries. Overall, the Windsor Brokers management team demonstrates an understanding of the ever-changing global regulatory environment and executes it with a market leader mindset.

Windsor Brokers has a clean regulatory track record with all three of its regulators.

Traders at the IFSC subsidiary get extra protection with a €5,000,000 insurance policy.

Fees

Average Trading Cost EUR/USD | 0.2 pips ($2.00) |

|---|---|

Average Trading Cost GBP/USD | 0.6 pips ($6.00) |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.13 |

Average Trading Cost Bitcoin | $20.00 |

Windsor Brokers offers one commission-based account where the minimum mark-up starts from 1.0 pips or $10 per 1.0 standard lots. It is higher than at most competitive brokers but lower than at the most expensive ones. The commission-based alternative lists a minimum spread of 0.0 pips for a cost of $8 per round lot, placing it just above the $7 per round lot threshold for competitive brokers. Traders will pay swap rates on leveraged overnight positions, and third-party payment processor fees exist. The terms and conditions do not list any additional costs.

MT4 traders can easily access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Symbols.

2. Select the desired currency and then click on Properties located on the right side.

3. Scroll down until you see Swap Long and Swap Short.

What Can I Trade?

Forex traders have access to only 44 currency pairs, a below-average selection by any metric. Unfortunately, there are no cryptocurrency pairs but there are 18 commodities, 50 equity CFDs, 14 index CFDs, and four bond CFDs from which to choose. The asset selection remains limited and incomplete. While it is enough for new traders, Windsor Brokers fails to cater to the needs of more advanced traders. It is one of the primary core trading aspects that the management of Windsor Brokers should address and improve.

Only 130 assets are available for trade at Windsor Brokers.

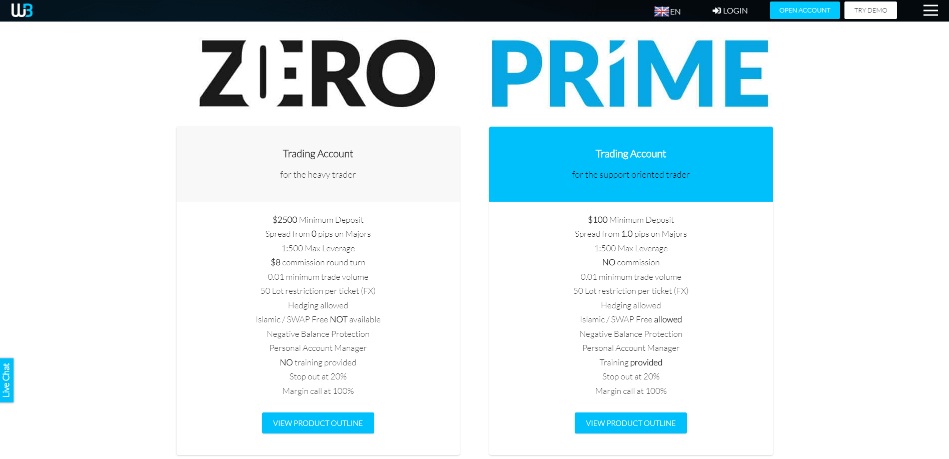

Account Types

Traders may opt for the commission-free Prime account for a minimum deposit of $100 or the commission-based Zero account, which requires a minimum balance of $2,500; the maximum leverage is 1:500 at both. While the former offers a swap-free Islamic account, the latter supports a VIP upgrade, where the trading costs are lower. All other account features remain similar, but the VIP Zero account provides active traders with several distinct benefits, which includes a dedicated personal account manager, cost-efficient pricing and one-on-one sessions with Windsor's technical analysts.

Windsor Brokers offers two account options, one commission-based and one commission-free.

The VIP Zero account features the most cost-efficient pricing environment.

Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Only the out-of-the-box MT4 trading platform is available at Windsor Brokers. It remains the most notable disadvantage at this broker, as the core MT4 requires third-party upgrades to provide a cutting edge trading environment. Without access to the upgrades, traders manage their portfolios from an uncompetitive trading environment. The MT4 is the most versatile trading platform and supports massive upgrades via more than 20,000 plugins. Windsor Brokers has been in operation since 1988 and, as a well-respected broker, must provide more than just the core MT4 trading platform.

Traders at Windsor Brokers only have access to the core MT4 trading platform; they should expect upgrades from a broker that has been in existence for more than three decades.

Unique Features

Our review did not uncover any unique features. Traders should make note of the operating history of Windsor Brokers, which dates back to 1988. While the broker offers an excellent core, Windsor management should consider providing an upgraded MT4 trading platform and an expanded asset selection.

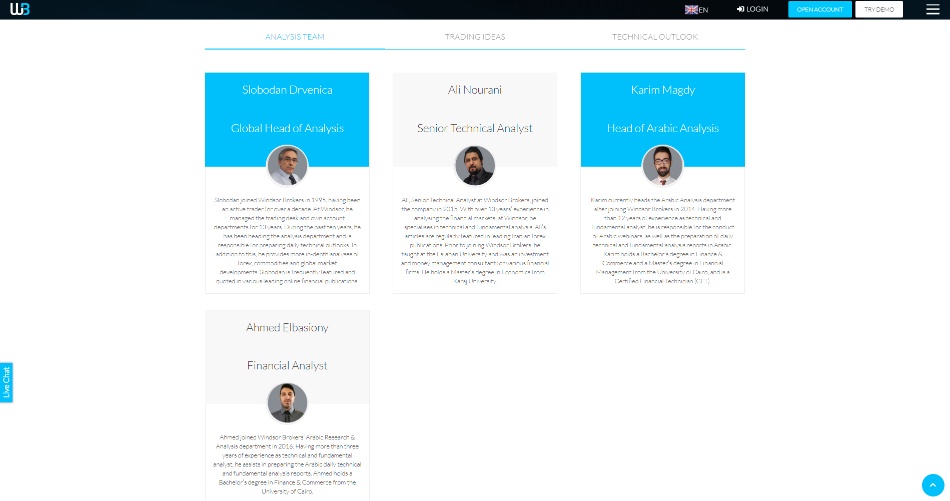

Research and Education

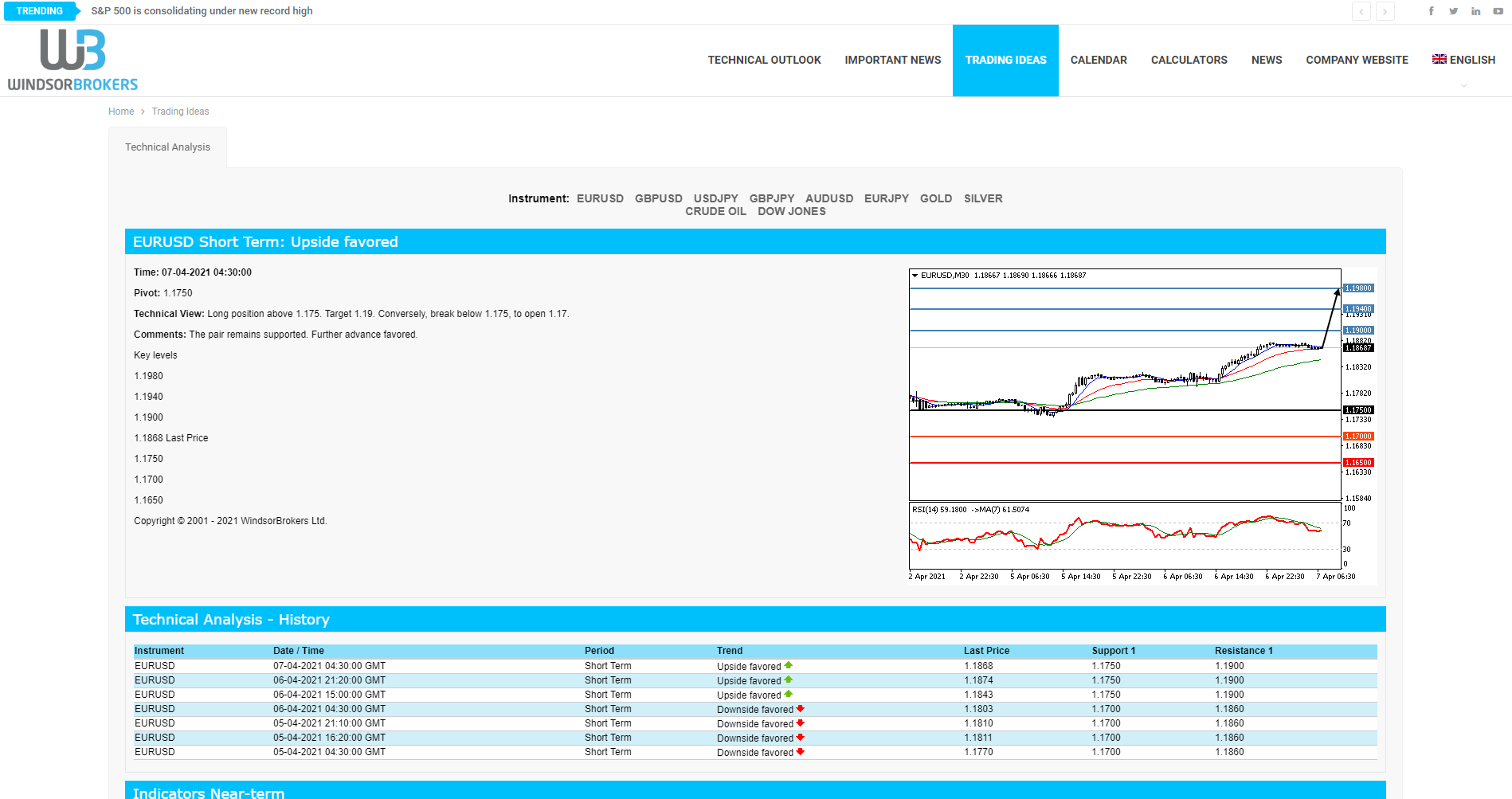

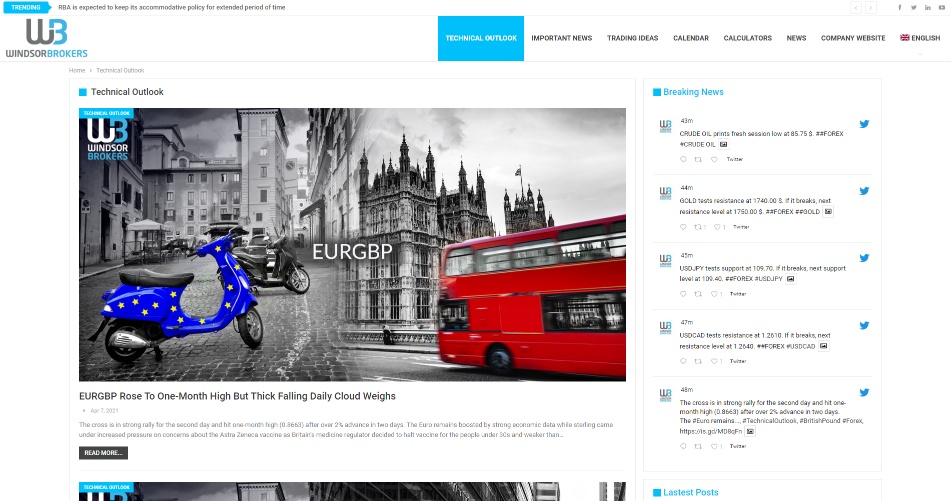

Research is where Windsor Brokers shines and delivers a valuable service. The team of four analysts generates quality trading ideas and technical outlooks each trading day. They are accessible to all traders and not just Windsor clients. The research features a chart and brief market commentary with all data necessary for a trader to understand the trading idea and to take a position, if desired. The presentation is clean and professional, while the blog provides additional content relevant to traders. Windsor Brokers executes this section well and can compete with the world's best brokers on this level.

Windsor Brokers has four analysts delivering high-quality research.

The Trading Ideas present technical analysis for ten assets.

More trading recommendations are available under Technical Outlook.

The Windsor Brokers blog completes an excellent research section.

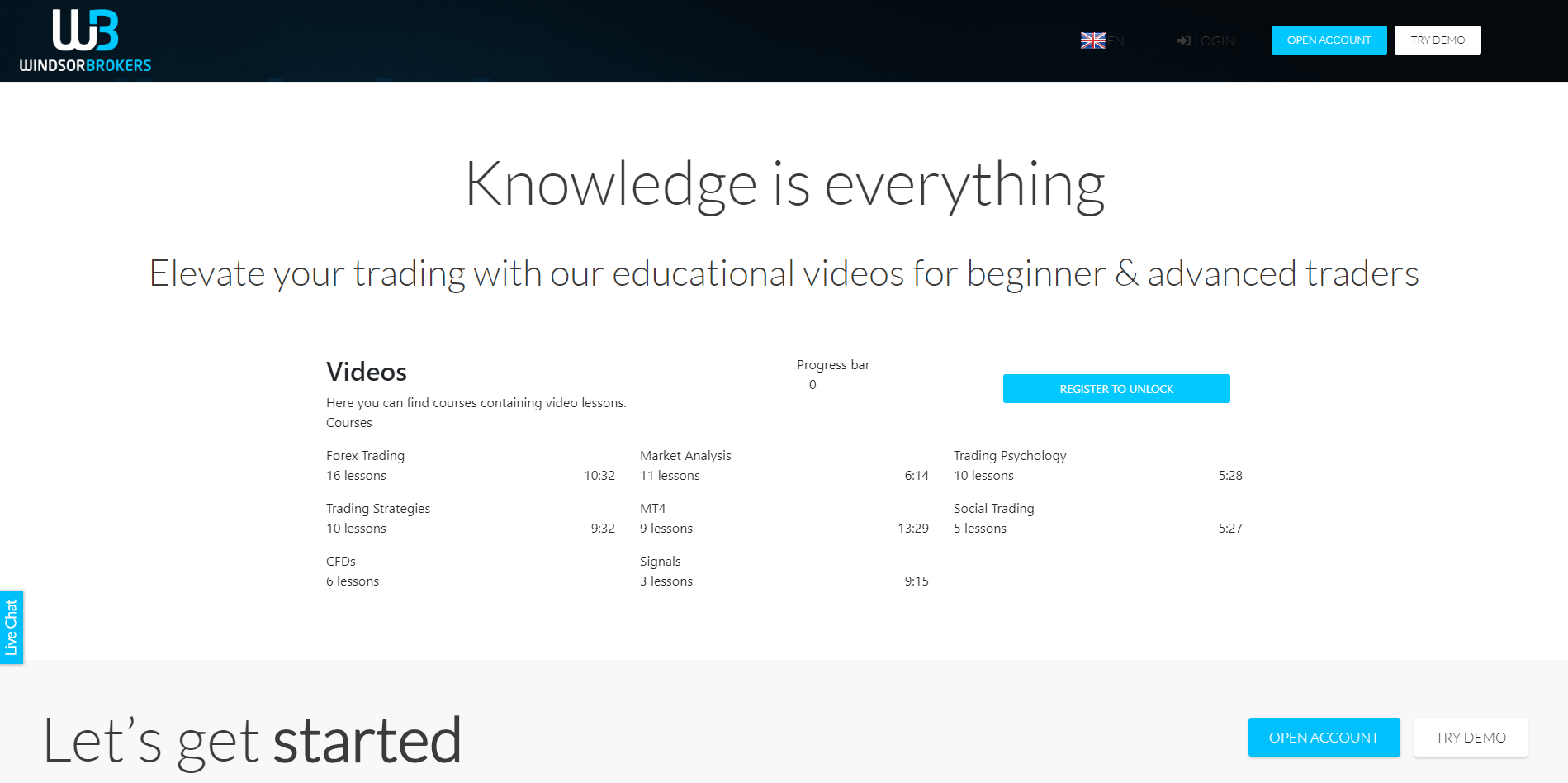

While Windsor Brokers provides education for new traders, it does not follow the same high-quality standards as its research. Live webinars grant the best value but have limited availability. A video library offers short videos, which resonates well with millennial clients but fails to deliver in-depth education. Three eBooks are also available. Registration is required to access additional details for both the video content and the eBooks. Windsor Brokers introduces the basics, while the overall quality remains significantly behind brokers with a market-leading approach to educating new clients.

Live webinars provide the best educational value at Windsor Brokers.

The video library requires registration and remains limited to ultra-short videos that fail to provide quality educational content.

Three eBooks are available for registered users.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | Unspecified |

Website Languages |          |

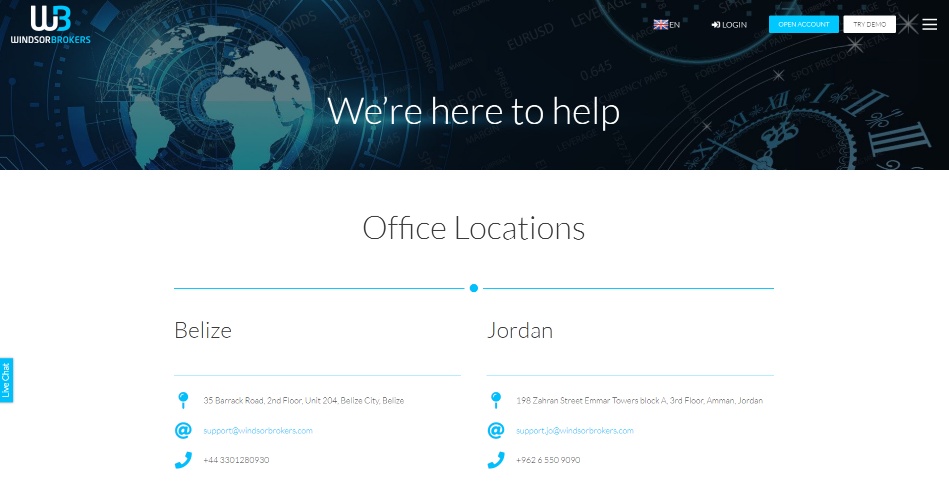

Clients may quickly reach customer support via live chat, the most convenient contact method. Windsor Brokers also provides an e-mail and a phone number. A broad FAQ section is notably missing, although one does exist for the loyalty program. Regrettably, Windsor Brokers does not list the operating hours of its support staff.

Customer Support is best accessed via Windsor Broker's live chat feature.

Bonuses and Promotions

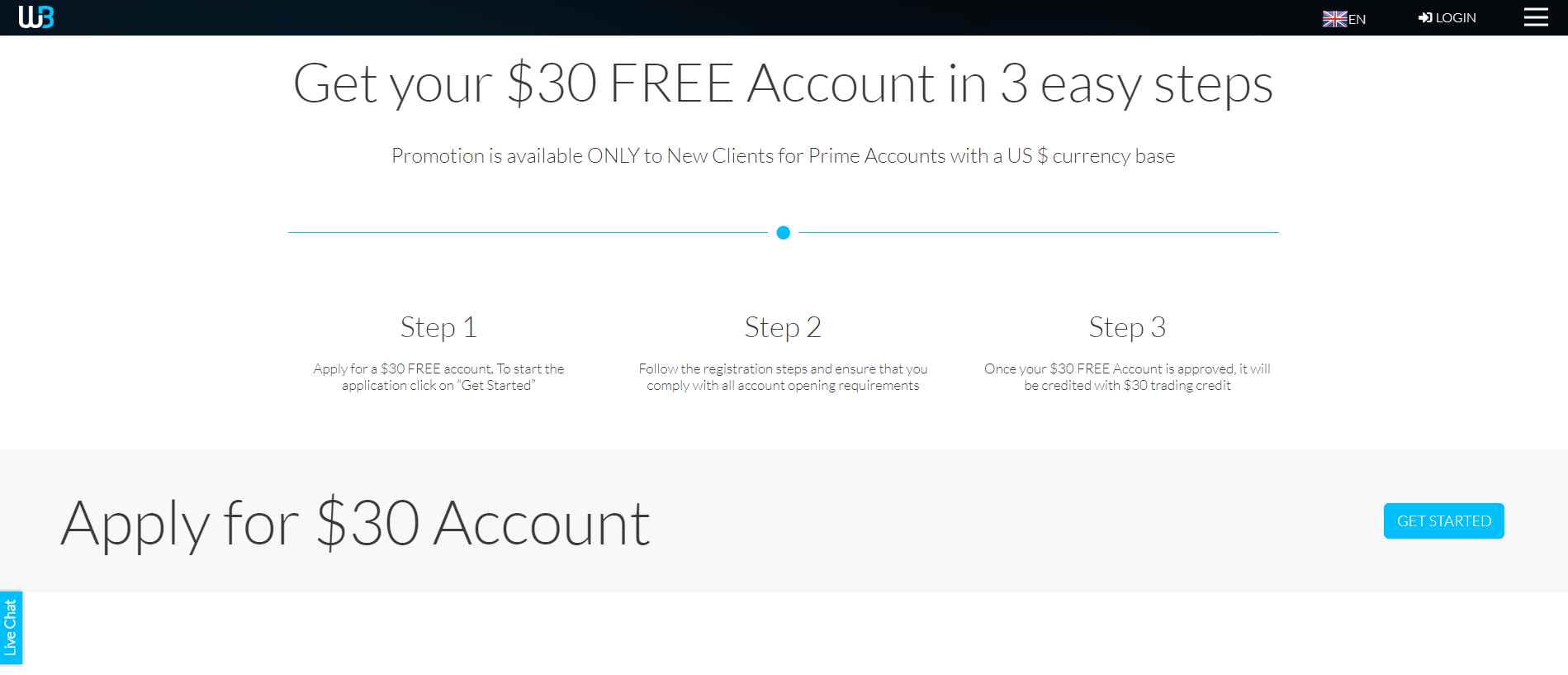

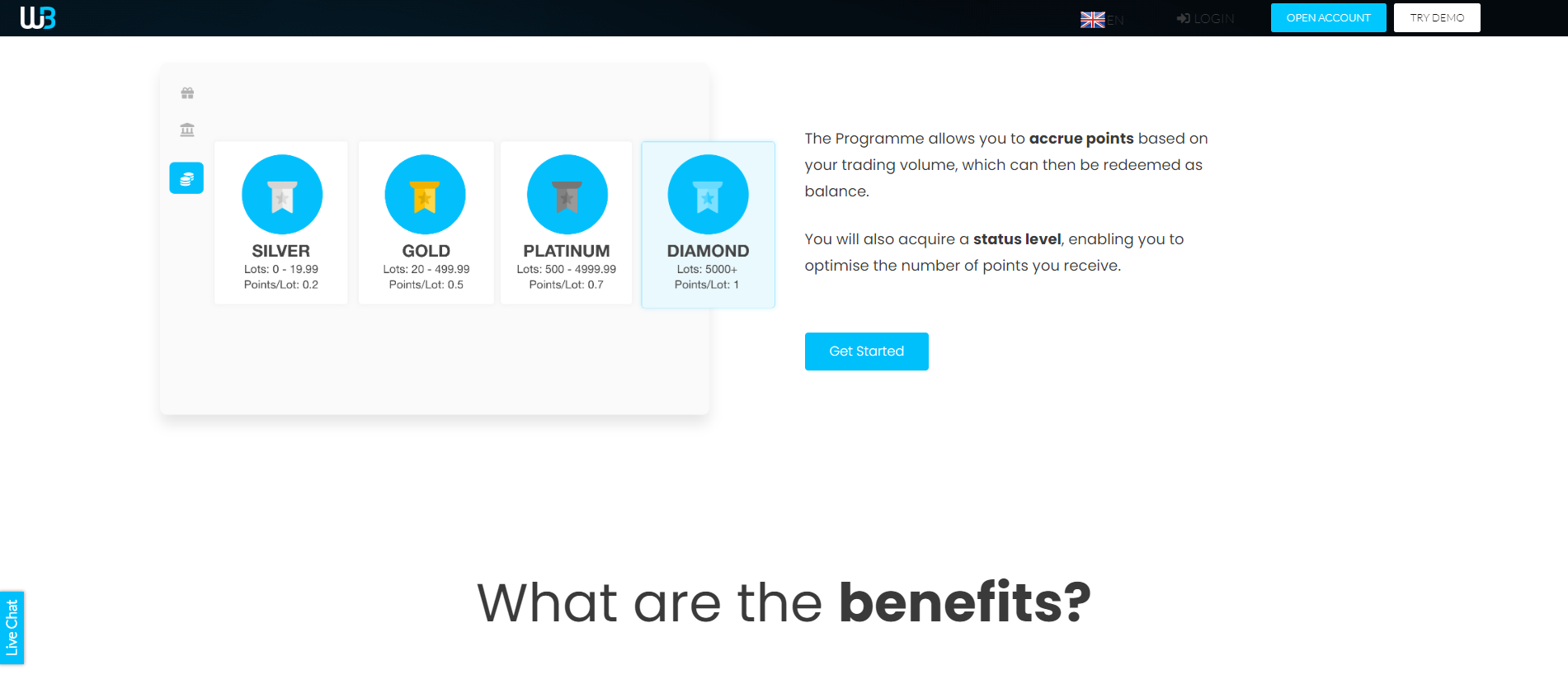

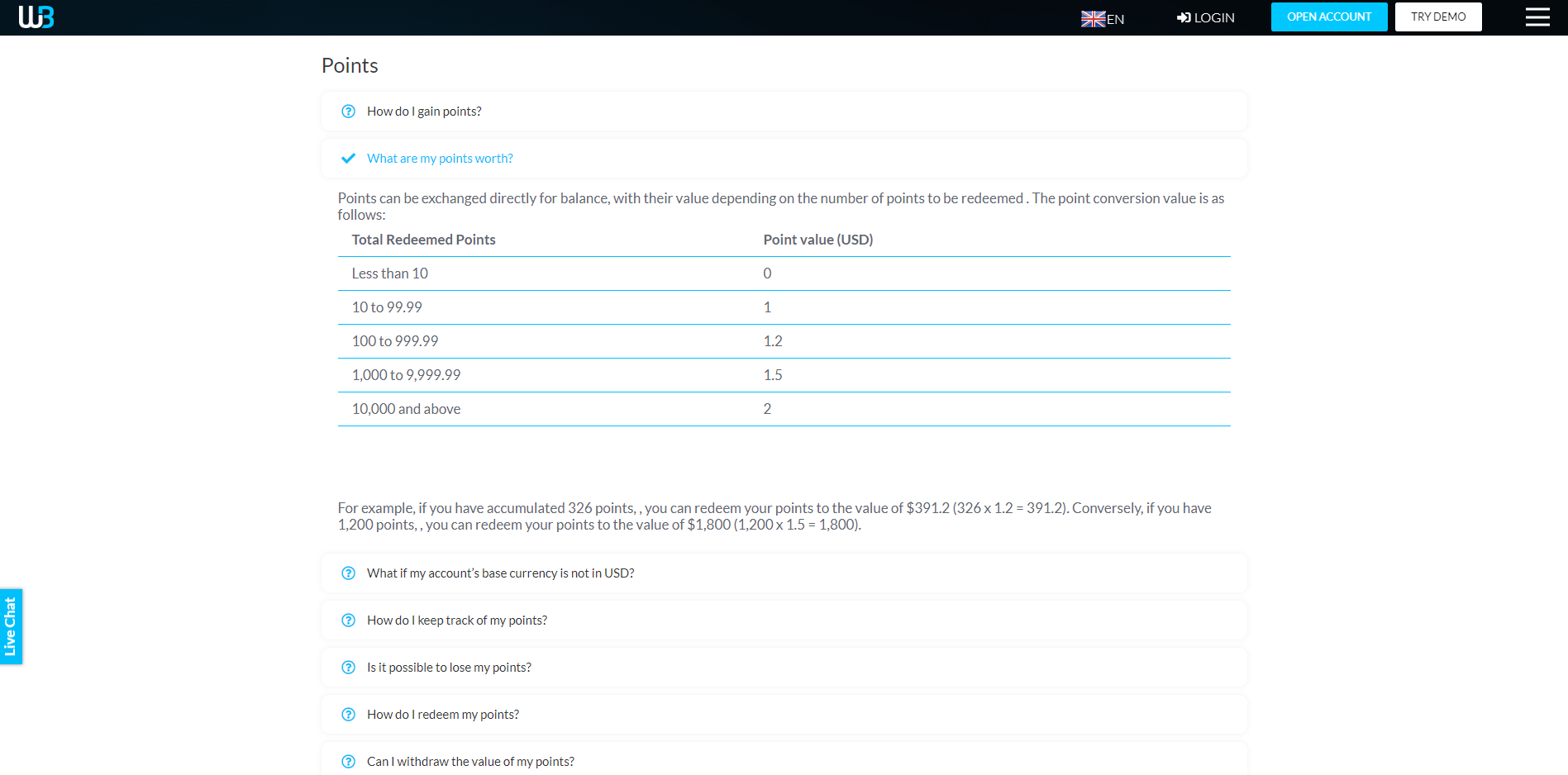

Windsor Brokers offers two bonuses and a loyalty program for active traders. The $30 no-deposit bonus is available for new clients with Prime accounts in US Dollars. It also grants a deposit bonus of up to $10,000. Terms and conditions apply, and traders must read them and fully understand the rules before requesting any incentive. The four-tier loyalty program allocates points per lot traded. Clients can convert their accumulated points into cash bonuses for their trading accounts. It appears that the program has no minimum lot size requirement, as Windsor Brokers awards points from the first 1.0 standard lot, per its description. Traders must have more than 10 points to qualify for a payout, and at 0.2 points per 1.0 lot, which is the lowest tier, that would require 50.0 lots.

New traders may test the Windsor Brokers trading environment with the $30 no-deposit bonus.

Windsor Brokers also maintains a deposit bonus, limited to $10,000.

Active traders may benefit from the volume-based loyalty program.

Accumulated points convert into cash, but the rates remain depressingly low.

Opening an Account

New clients may open a trading account via the swift online application, following well-established industry standards. A name, valid phone number, e-mail, password, preferred language of communication, and account type complete the sign-up process. Account verification remains a mandatory final step, usually satisfied after a trader sends a copy of their ID and one proof of residency document.

The Account Opening follows well-established industry standards including account verification.

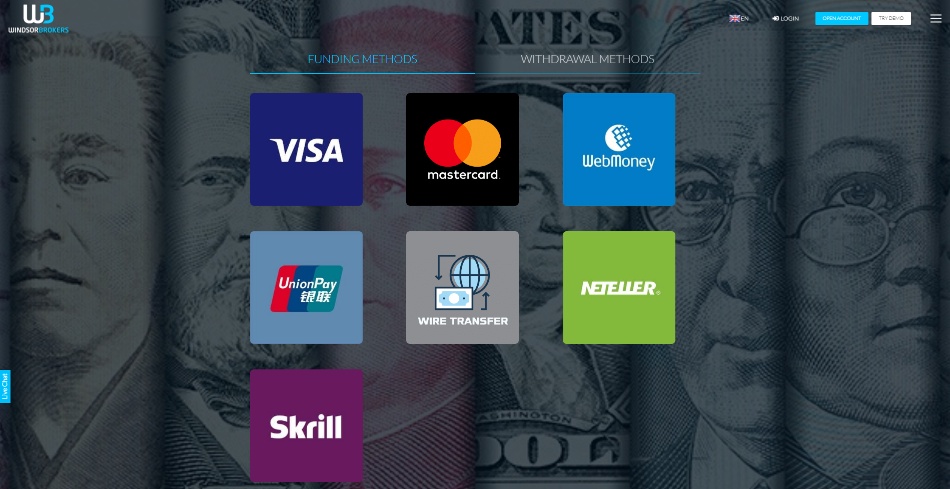

Deposits and Withdrawals

Windsor Brokers supports bank wires, credit/debit cards, WebMoney, UnionPay, Neteller, and Skrill as deposit and withdrawal methods. The latter two require a minimum deposit of $100, but the other options have no attached limit. Processing times and transaction fees depend on the payment processor. WebMoney and UnionPay present the most cost-efficient options. While Windsor Brokers could expand the choices, it maintains a suitable selection for most traders.

Windsor Brokers offers a suitable selection of payment processing options.

Summary

Windsor Brokers presents traders with a competitive trading environment from its Belize unit, which also provides a €5,000,000 insurance policy. The cost structure is acceptable but just out of the range of competitive. Unfortunately, the asset selection remains limited, and only the core MT4 trading platform is available. Windsor Brokers delivers a high-quality in-house research team, which represents the best feature at this broker. With the intelligent regulatory environment, maximum leverage of 1:500, and two well-thought-through account options, Windsor Brokers has a solid core. It can expand into a significantly superior broker by increasing its asset selection, offering a few MT4 plugins, and lowering the trading costs marginally. Overall, Windsor Brokers, in operation since 1988, remains a broker to monitor as it displays potential to expand its market share.