The European Central Bank announced today its decisions to maintain current levels of interest rates and stimulus, while announcing no change to its 2021 Eurozone growth forecast of 3.9% of GDP. A painfully slow coronavirus vaccine rollout and more virulent mutations may derail this vision and see the euro drop further against other European currencies.

Only a few weeks ago, vaccine euphoria struck the policymakers of the richer OECD nations as it became clear that regulators were ready to begin approving several new coronavirus vaccines. Governments had been faced with a seemingly intractable problem since March 2020: how to deal with the spread of a novel virus which could kill or hospitalize 10% of the elderly population without paralyzing economic activity in the absence of effective preventative or palliative medicine. At a stroke, a seemingly safe and effective vaccine offered a way out of a painful, economically, and socially destructive nine-month period of COVID in Europe.

The Challenge of COVID in Europe

The Eurozone is both relatively densely populated, highly mobile, and old – all factors which worsened the impact of the novel coronavirus. It has seen high rates of infection and death, and desperately needs a widescale and rapid vaccination program. The problem may have become more urgent as new mutations of the virus emerge, notably in the U.K., South Africa, and Brazil, which may (or may not) be resistant to the first generation of vaccines currently being rolled out, mostly within wealthier nations. A further worry is whether a slow and geographically patchy rollout of the vaccines might create conditions ideal for the incubation of more aggressive or resistant strains of the virus.

It has become clear by now that the level of mitigatory efforts that wealthier western nations are prepared to implement are only able to temporarily dampen the spread, while causing a high level of collateral damage. Policy-wise, the vaccine is the only real exit strategy available to deal with COVID in Europe.

It is considerations like these which cause unease when considering the pronouncements of Eurozone leaders on the vaccination program. The stated goal of the European Union: vaccination of 70% of the Eurozone population by the end of August 2021. Several questions remain. Will 70% be sufficient to ensure an effective “herd immunity”? Will the vaccine be effective for a period longer than 6 months, or will the whole program have to begin again in September just as it ends with a vaccine 2.0? Will it be possible or epidemiologically desirable to vaccinate every Eurozone nation at the same rate?

Race to Herd Immunity

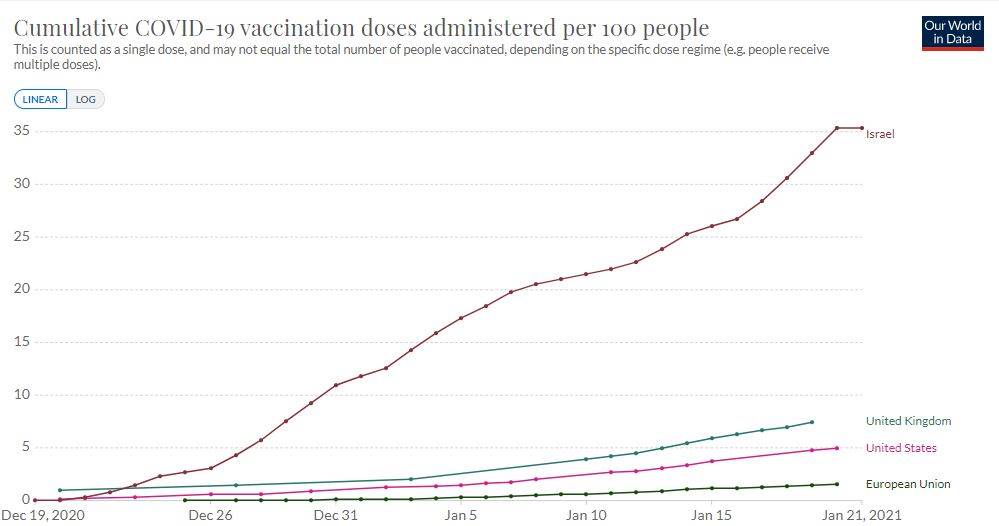

Here is how the European Union and a few other countries are progressing towards vaccinating their respective populations:

Although Israel’s big lead in this “race” is an outlier, it is obvious that the E.U. has been relatively slow off the mark. Admittedly, the data represents people given only one vaccine, while all vaccinations require two shots administered at least three weeks apart to reach peak statistical effectiveness. The United Kingdom, which recently left the E.U., has been able to proceed considerably more quickly – although the U.K. is delaying second shots for 3 months, while most E.U. member states are not, which may distort the data to some extent.

Will COVID Affect the Euro?

If the ECB really expects to see a 3.9% increase in GDP over 2021 and stimulus adequate at current rates, it had better get some good answers to the hard questions surrounding the coronavirus pandemic and vaccination program. Recent declines in the value of the euro against other European currencies suggest that the market might be asking the same questions and finding them lacking convincing answers, rendering the euro a good candidate as a currency to be short of on current trends.