Erdogan Announces Lira Guarantee

The President of Turkey yesterday announced measures which would protect Turkish savers and salary owners from any further catastrophic declines in the value of the Turkish Lira relative to major foreign currencies such as the U.S. Dollar. The Turkish Lira lost half its value relative to the US Dollar since September this year just a few months ago and had lost more than 75% of its value since May 2018. This catastrophic decline in the value of the Lira has hit the Turkish population extremely hard, not only due to the increasing cost of imports relative to salaries which are paid in Lira, but also from the increasing dollarisation of all prices which has been occurring in Turkey due to the Lira’s failure as a store of value.

President Erdogan announced in a speech that Lira savings and salaries will henceforth be protected by a new guarantee plan, in which Lira deposit holders will be reimbursed by the Turkish government if the Lira depreciates by more than the Lira interest rate. President Erdogan is hoping that this will erase the pressures sending Turkey racing towards dollarisation and give ordinary Turks relief from their recent currency-related sufferings. Turkish workers have been rushing to exchange their salaries for foreign currency upon receipt. This guarantee scheme can potentially restore faith in the Lira and give ordinary Turks the confidence to hold savings denominated in their national currency.

President Erdogan gave an additional promise to exporters, announcing that export business can now receive FX forward rates from the Turkish central bank to dampen exchange rate risks to their businesses. He also raised the state’s contribution to private pensions in Turkey by 5% to 30%.

Market Reaction to President Erdogan’s Lira Package

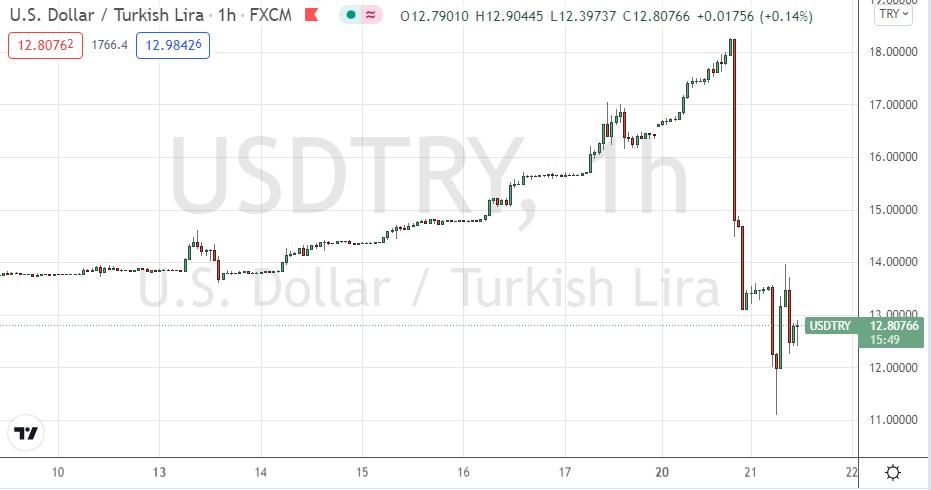

As soon as the plan was announced, the relative value of the Turkish Lira skyrocketed. Within only one hour of the announcement, the USD/TRY currency pair fell by just under 19%, an enormous move for such a short period. The USD/TRY continued to fall, reaching a low of 11.10 just a few hours ago, representing an extraordinary fall of 39% in only 12 hours after its all-time high was reached yesterday at 18.26.

At the time of writing, as we approach the start of the New York session, USD/TRY is trading at 12.63 and its price action is looking slightly more likely to forecast a further decline in price than a rise.

USD/TRY Hourly Price Chart

What Does This Mean for Traders?

Most retail Forex brokers offering exotic currency pairs are quoting prices for USD/TRY, so it remains possible to trade it. However, spreads are averaging more than 1.6%, which is a hefty cost of trading, and overnight swap rates, especially on the long side, are enormous. This means that retail traders determined to trade the Turkish Lira must do so under a strong handicap.

Volatility has been enormous since President Erdogan’s announcement. While this remarkably high volatility is likely to decrease over the coming hours and days, it will probably stay relatively high over the short term.

It is not clear that the price will fall by much more, although the current price action over the short term is a little bearish. It is also not clear that the price will bounce back and begin rising strongly again. However, this is a possibility, so we could be in a “sell the rally scenario” for anyone who really wants to trade the Turkish Lira despite the risks I have already outlined. The best approach may be to wait for a consolidation pattern to form, and then trade the breakout.