5-Year U.S Bond Yield Overtakes the 10-Year Yield

The U.S bond market has seen an inversion in the 5 and 10-year bond yields. This situation is not normal, and it will likely affect the financial assets that speculators trade. Typically the yield of a 10 year U.S Treasury is higher than the 5 year Treasury bond yield. This is because under normal economic circumstances, the greater amount of time a bond is held, it is expected to pay a bigger ‘reward’ in terms of its interest rate.

A higher coupon rate – interest paid, inflation perspectives, combined with the notion of agreeing to hold a bond for a longer amount of time – duration typically results in a higher yield for a 10-year Treasury compared to a 5-year Treasury. There are many complex parts involved with bond trading, but the notion that you can buy a bond with a higher yield over the short term compared to the long term is not a standard norm historically in the U.S bond market.

Intriguing Bond Market Developments and Opportunities Due to Inflation Risks

Due to the high level of inflation in the U.S. right now, investors have gotten nervous and have also been reacting to the rhetoric from the U.S Federal Reserve regarding rising interest rates. The high inflation rate is having an impact. Investors are nervous about short term and mid-term growth because of rising prices, and this is causing a reaction in the bond markets and volatility in equity indices is being exhibited.

When inverted yield curves like this have happened in the past, there is a rather good track record which shows this is a solid indicator that a recession is about to happen in the U.S. Investors with a long-term trading horizon, however, may find that the inverted yield curves of 5 and 10-year bonds is an opportunity. This because some financial investors may feel that inflation currently is approaching a potential apex and will soon start to decline. The U.S and global economies have been hit by coronavirus over the past two years, supply chain problems which led to shortages, and now the war in Ukraine. The large amount of bad ‘news’ and has certainly generated fragile economic results and outlooks.

5-Year US Treasury Yield March-April 2022

Possibility for Optimistic Outlook

Speculators who have positive outlooks and do not believe the world will end tomorrow, and expect that prices will start to decrease, may believe we will soon see inflation numbers start to lower. If commodity prices in grains, industrial metals and energy can stabilize and start to come down over the mid-term this will affect supply and demand. Reserves of resources should be monitored by traders. Prices could begin to lower and inflation would then decrease. If this happens then the outlook for the 5 and 10 year bonds over the mid-term is likely to reverse back to a normal yield curve because inflation will eventually lower.

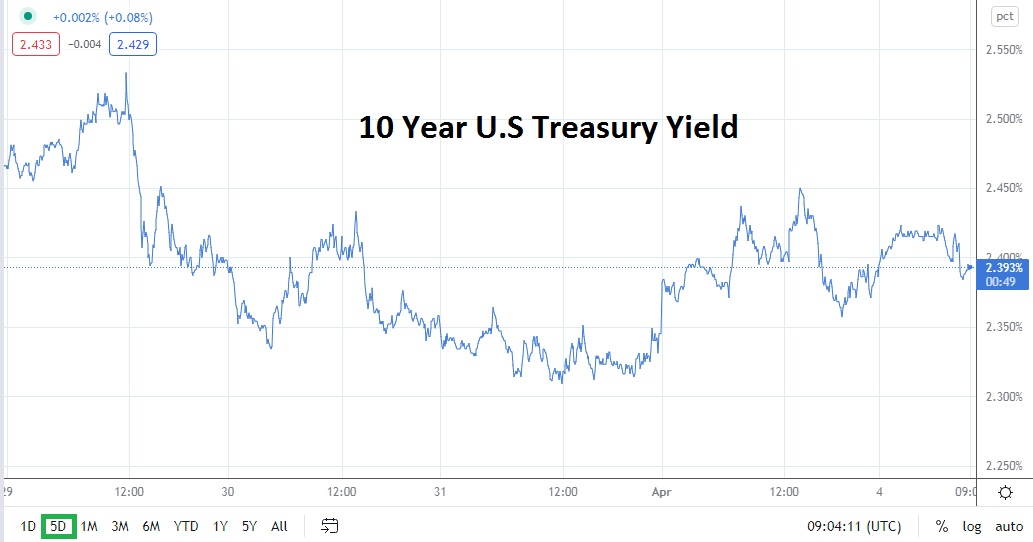

10-Year US Treasury Yield March-April 2022

What Does This Mean for Traders?

It is difficult to time the exact moment an economic turnaround will happen, just like it is hard to time the exact high and lows of a financial asset. However, if the world can get past this difficult phase and coronavirus ultimately subsides and become more manageable, if logistic problems ease and commodities including food resources, metals and energy supplies improve, this could lead to a better economic outlook. If financial institutions begin to feel more optimistic days are ahead, then bond yields in the 5 year U.S Treasuries will decrease, and 10 year notes will return to their higher returns once again. However, over the short term, timing the exact moment this will happen remains difficult and because of this U.S equity indices will likely remain challenging to trade in the near term. Trend trading bond yields may be a better defensive bet in the short-term.