By: Christopher Lewis

AUD/USD has been acting as if the laws of gravity don’t apply to it anymore. The Federal Reserve recently announced that the ultra low interest rates in the United States are going to continue until the end of 2014, and this will push money into riskier assets, commodities included.

The Aussie always gets a boost when commodities do well in general, and as long as the central banks in the European Union, England, and Japan are going to be ultra easy in monetary policy, it is very likely that the commodity sectors could get a boost. The easy money seems to be in the picture for the foreseeable future, so going forward the Aussie should benefit.

The Chinese are looking at a soft landing as well, so the pullback in China shouldn’t be as strong as feared. This means that the Chinese will be buying a lot of “stuff” from the Aussies going forward, and because of this, there will be a natural bid for the Aussie dollar as the Chinese continue to build up their infrastructure.

Becoming a bit toppy

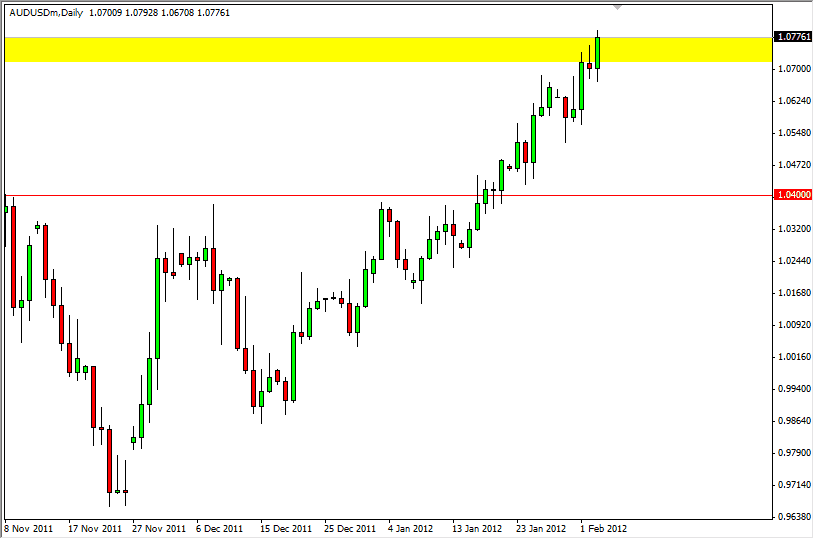

The AUD/USD pair however, does look a little bit on the toppy side. The 1.08 level has been very resistive in the past, and I believe that it will continue to be. The pair should face a lot of bearish pressure in the near future, but I like the pair overall. This leads me to believe that the pullback will simply be a buying opportunity.

The charts show several places where the pair may find support on a pullback. The pair did break through the top of the shooting star on Thursday, and this is a bullish sign. Because of this, there is a possibility of a breakout anyway. The pair certainly has gone fairly parabolic, and while it is difficult to think about buying the pair at the moment, the fact is that a daily close above 1.08 would clear the way to 1.10 going forward. The supportive areas that I see below are 1.06, 1.05, and of course the massive one at the 1.04 handle. I will be looking for a pullback to one of those levels, and supportive candlestick action to go long. Selling isn’t an option for me until we close sub-1.04 on the daily chart.