By: Bastian Rubben

The US stock markets closed the trading day with sharp declines of more than 1%. The "excuse" for the declines was the mixed economic data, but the true reason is that the stocks are overbought and even if the markets continue rising, we will see more and more bearish days along the way, until the stocks surrender and start a significant correction of a least 5%.

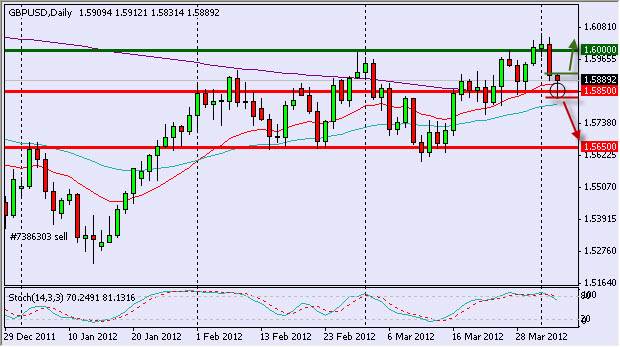

The negative momentum in Wall Street supported the USD against most of the major currencies, although the pound was one of the currencies that managed to block this strengthening. The pair GBP/USD fell to the support at 1.585 after it made a false-break at 1.60. The false-break was quite expected since buying in such extreme levels gives the professional the opportunity to take profits on the sake of the amateurs that open positions at the top of the trend. Yesterday's candlestick closed in long-tail hammer pattern, which increases the chances for risings.

However, today is published the interest rate in Britain and the MPC rate statement will determine today's trend. Therefore, if the pound rises above yesterday's high and manages to stay above this level, it might continue to 1.60 again. On the other hand, a negative influence by the central bank might take the pound under 1.58.