By: Christopher Lewis

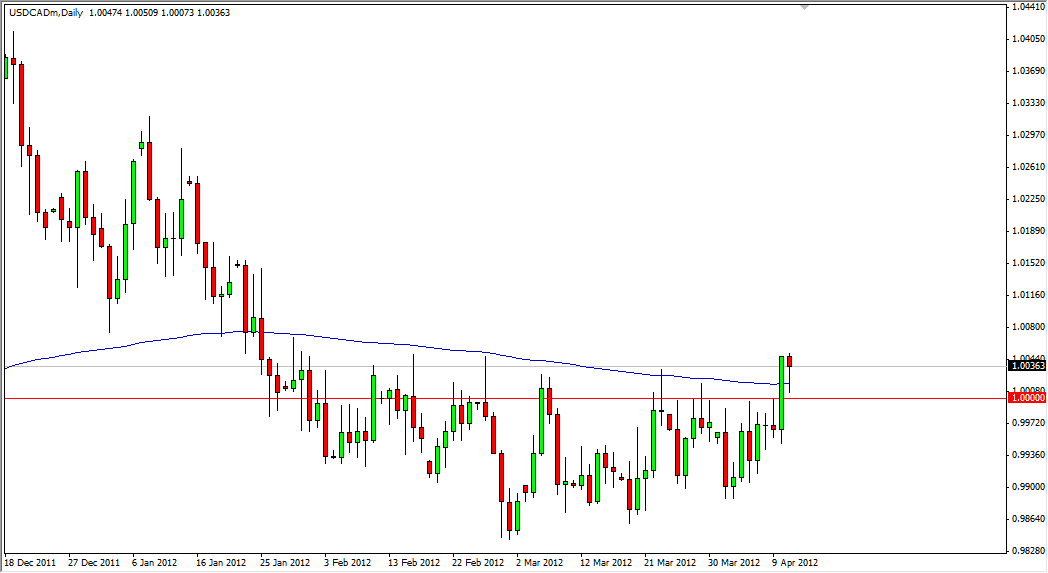

The USD/CAD pair has been a real grind over the last couple of months, and many of the people I know simply have been ignoring it. However, it looks as if the pair is trying to send serious signals to those who are willing to pay attention. The pair is notorious for grinding sideways, only to make a sudden move in one direction or another.

The recent sessions have seen bullishness, which is against the overall trend. The pair is still of course sensitive to the oil markets, and because of this we need to follow the Light Sweet Crude and Brent markets as well if we are to understand the “attitude” of the USD/CAD pair in general. Commodities in general can have an effect on this pair too, but oil is head and shoulders above the rest for this pair.

The pair has been slowly moving upwards, and I believe that the action on Wednesday may be the signal that a lot of technicians will be watching.

Hammer on Top

The hammer that formed on Wednesday was significant. (They almost always are.) This market fell for most of the session on Wednesday, only to bounce and form the hammer that we now see. The candle has formed on top of the parity level, an area that has been very resistive over the last few weeks. The fact that this resistance level has now shown itself to be supportive – as based upon the hammer – we could see a move higher.

Adding to the weight of the bullish argument is the fact that the 200 day EMA is just below the current price, and this should bring out the trend traders as well. I do however, have concerns about the 1.01 level above, so if you are more conservative – waiting for a daily close above that level to buy can’t be ruled out at the moment. In the meantime, I am willing to buy on a break above the highs from the session on Wednesday as this is a classic buy signal for technical analysts.