EUR/USD rose during the session on Thursday after the head of the European Central Bank announced that he was willing to do "whatever it takes" to save the Euro. For some out there, this seems to have been a major revelation. The truth is however, that there was no explicit statement in his statement. He simply did not state what was possible, or what the central bank was willing to do. In other words, it was another announcement with absolutely no substance.

It is because of this that I feel that the move from Thursday will be faded yet again. The fact is that the market has been fooled by the Europeans far too many times, and eventually participants will give up on them. One thing they cannot be disputed is the fact that every time this is happening, we have seen the move reversed in short order.

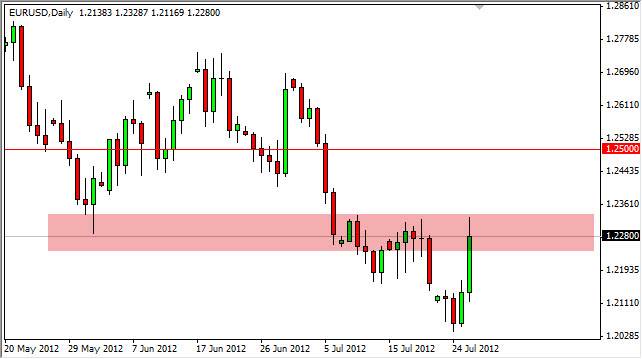

1.23 holds

I cannot help but notice that the 1.23 level held as resistance. In fact, the pair managed to rise directly to the next major resistance area, and simply couldn't get above it. This leads me to believe that this was more of a short covering rally than any type of new buying frenzy. Looking at this area, it is obvious that it once was serious support as seen on the hammer from the end of May, and the massively resistive as seen from just two weeks ago.

In a world where headlines continue to dominate the Forex market, I cannot believe that all of the negative news is over with. Because of this, I am simply looking for another sell signal in this pair. I will fade negative candles on the daily, four hour, and even one hour charts. Looking forward, I could seriously no reason to buy the Euro, and will continue to sell it only.

In a world where there is nothing but economic weakness, and general fear and anxiety when it comes to all things economic, it is very difficult to bet against the US dollar. This is going to be especially true when it comes to anything coming out of Europe, including the currency.