USD/CAD fell hard during the Thursday session to coincide with the "risk on" rally that we saw throughout the financial markets. The pair of course will follow the oil markets, so it is worth noting that oil had a relatively benign rally for the session. This of course will affect the Canadian dollar in general, and as such one has to wonder exactly how strong the Loonie will be going forward.

The trickiest thing about this particular currency pair is that oil is involved. With the problems in the Middle East, we could see sudden spikes or falls depending on the most recent headlines. Not only will you have to understand which direction oil is going, but why it is going in that direction. For example, if oil was going higher based upon fear, that actually could work in the Dollar's favor. On the other hand, if oil is going up due to demand, then of course the Canadian dollar will gain.

Move could be deceptive

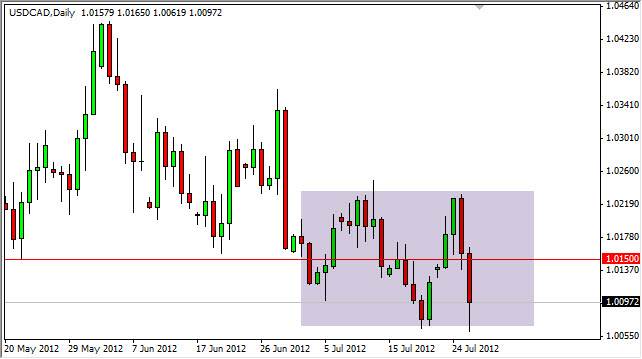

What I don't like about the downfall in this pair was the fact that it gave up as soon as it hit serious support. The 1.0050 level was the first support area below, and that is exactly where we stopped. On top of that, we gave back about 50 pips at the end of the session, which of course shows that very few were willing to hold this position through the night. This doesn't exactly inspire confidence for shorting this market.

Below the current area I see the parity level as serious support as well. In fact, I'm not really interested in selling this market until we are well below parity. If we can close below that number, I suspect we will run to the 0.97 level before it's all said and done. In the meantime, this looks like a very choppy pair, and I believe that we are actually going enter some form a consolidation.

The consolidative area I see is between the 1.0250 level and the 1.0050 area. I think we will more than likely gained from here, based upon the weakness I saw in the Canadian dollar at the end of the session. Nonetheless, short-term trades can be found in this little bit of a rectangle.