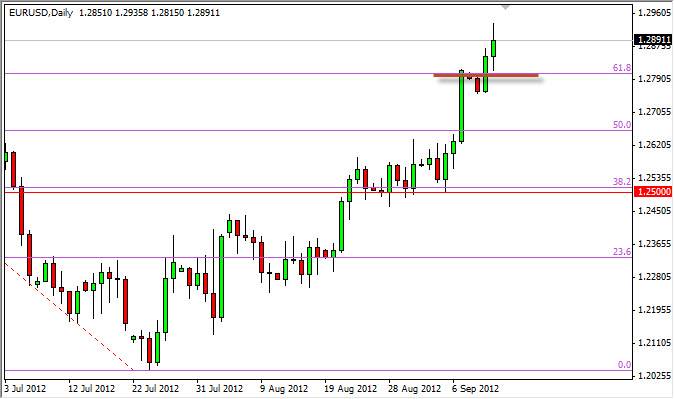

The EUR/USD pair continued to gain ground during the Wednesday session in preparation for the Federal Reserve and its announcement later today. There is an expectation of quantitative easing going forward, and as such this will work against the US dollar. Having said this, there is a strong likelihood that most of the market has priced in this expectation, and this could be a "sell on the news" type of event.

For me, the real challenge will be the 1.30 level. I do personally believe that we will attempt to make that level in the short term, and as such am actually bullish very short term. However, I think that the 1.30 level will in fact be massively resistive as it has been the bottom of a descending triangle that sent us to the 1.20 level in the first place.

With this being said, it should also be noted that the 200 day moving averages now well below current pricing, and longer-term traders could be stepping in. Personally, I believe that the Federal Reserve announcement later today will have a drastic effect on the future of the spare as the world goes from one central banks outlook to the other.

1.30

Although I'm willing to go long for the short period of time, I think that 1.30 will be where we start to see the market focus on things in Europe again. Obviously, we have kind of drifted from that but this is exactly a new thing as we have seen this pair to go back and forth over the last couple of years.

In fact, when I first started trading Forex I was told that this pair was the one you wanted to start with. After all "it was one of the most predictable" Forex pairs out there. It's funny to think about that now, as it is without a doubt one of the more volatile. Looking forward, I expect much more of the same as the market wants to be long of the Euro, but the underlying fundamentals are so poor. I think eventually we will see another leg down, but I need to see the resistant candle in which to sell from. I believe I will see it at the 1.30 level or just above, but in the meantime all we can do is be long small positions.