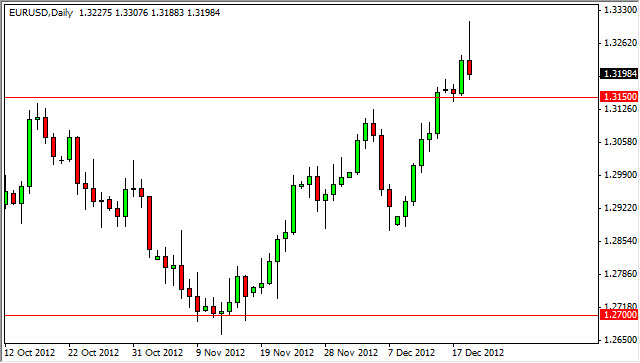

The EUR/USD pair initially started the Wednesday session or the first half of the day as it gained against pretty much everything in the market. Because of this price action, it looked like we were going to have another massively "risk on" type of trading session like we have seen over the last several days. However, by the end of the trading day we had retraced most of the gains, and actually end of the day negative.

The candle shape for the session ended up being a shooting star, which of course is very bearish. However, the 1.3150 level is just below, and it was massive resistance before. This should be support going forward, and as such I don't think that this pair will have that far to fall before we start seeing buyers stepped back into the marketplace.

Part of the problem with bombing riskier assets at this moment in time is the fact that the U.S. Congress and the President simply cannot come to an agreement in the so-called "fiscal cliff” talks. If the United States ends up going back into recession, this would be bad for the global economy, as the United States is one of the few bright spots right now.

Headline risks

I believe that this currency pair will be traded basically upon the latest headline going forward, and this will probably be the case until the end of the year. Volumes are starting to dry up, and I do believe that by the time we go into Friday, most traders simply will not be involved.

However, as long as the fiscal cliff debate rages on, there is going to be potential for serious movement in one direction or the other. Right now though, it appears that the Euro has rallied despite everything that has gone on. With that being said, it appears that this pair simply "doesn't want to go down", and as a result there's a reason to fight it. With that being said, I think that we should see some type of supportive action right around the 1.3150 level, and on a hammer or positive candle, I would be willing to start buying. Obviously, a break of the top of the shooting star is also very bullish as well.