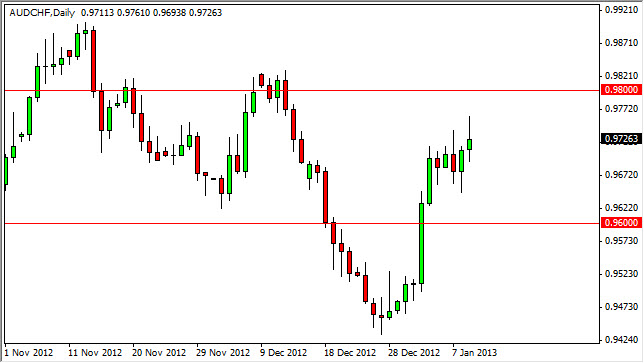

The AUD/CHF had a bullish session on Wednesday, popping higher and piercing the 0.9750 level. This chart is one of my fair wants to follow, even though I don't traded very often. The reason being is that we have a classic "risk on, risk off" type of marketplace. The Australian dollar is very "risk on", and when the world feels very good about the economic situation they tend to buy this currency and over fist. On the other side of the coin, you have the Swiss franc which is very "risk off." Alternately, when times are tough, the Franc tends to do quite well.

So by following this currency pair, you can a lot of times get a feel for what the market psychology is for the day or week or whenever time frame your involved in. What I found so interesting about the Wednesday candle is that we initially look very bullish, but pullback in order to form a shooting star. I don't necessarily think that selling the shooting star is the way to go, especially considering we have so much consolidation over the last five sessions.

Can be used in other places

So why would I bring up a shooting star in this currency pair I don't plan on trading it? The reason is that I will watch this market in order to see what I should be doing about the Australian dollar in general. Also, it tends to be a gauge as to how futures markets do in general. If I see this pair start to pullback and selloff rather strongly, I would more than likely begin to look for shorting opportunities in markets like silver and oil.

Alternately, if we managed to break the top of this range, I think that the 0.98 level will offer a bit of resistance. If we can get past that, I think we will be a very bullish market that point time in the stock market indices should all be doing well. Most people don't think of Forex like this, but the truth is that it can be quite a barometer of what's going on around the world if you know where to look.